SPIVA U.S. Scorecard 2022: Fewer Excuses

Summary

- According to the freshly published SPIVA U.S. Year-End 2022 Scorecard, the annual underperformance rate dropped to the slimmest of margins last year: just 51% of large-cap U.S. managers lagged the S&P 500 in 2022.

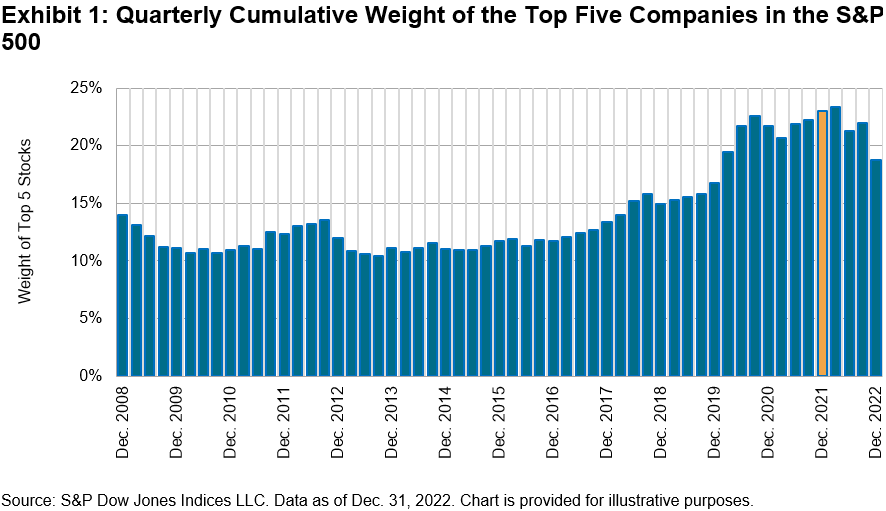

- In the summer of 2013, the largest five companies in the S&P 500 accounted for roughly 11% of the index’s weight.

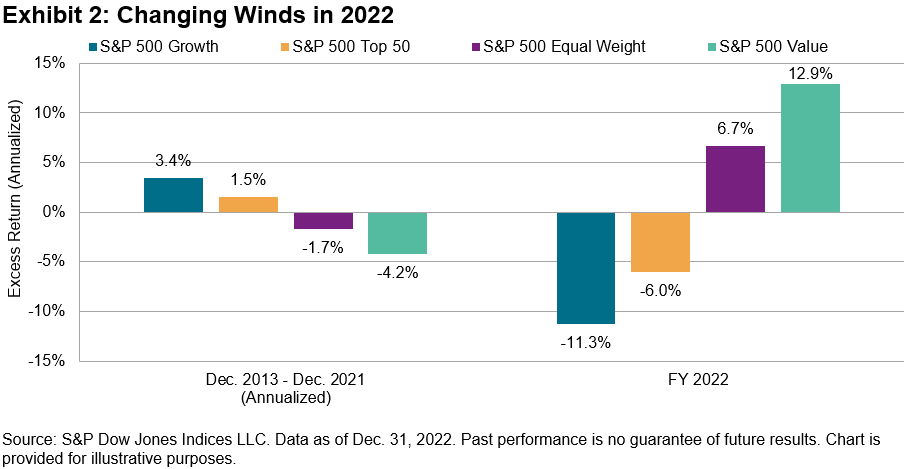

- As the U.S. dollar strengthened, smaller and more domestically oriented names were judged to have better prospects, while previously unfancied companies in the Materials and Energy sectors benefited from a steep rise in commodity prices.

Tippapatt

By Tim Edwards

For over a decade, our SPIVA® Scorecards have shown a majority of actively managed U.S. large-cap equity funds underperforming the S&P 500®. According to the freshly published SPIVA U.S. Year-End 2022 Scorecard, the annual underperformance rate dropped to the slimmest of margins last year: just 51% of large-cap U.S. managers lagged the S&P 500 in 2022.

Two key market trends associated with active performance provide context for this figure. One, explored by Anu Ganti in an earlier blog, was a sharp relative increase in the opportunity for outperformance across a range of global equity markets. Another, specific to large-cap U.S. equities, was a reversal in the trend of the strong performance of the largest stocks.

The latter point matters because one of the virtues often claimed for active management is its avoidance of perceived overconcentration in the largest stocks in the benchmark. Accordingly, active equity funds frequently underweight the index’s largest stocks (or at least some of them); if the largest companies outperform, then active funds are more likely to lag and, compounding the issue, the weight of the largest names will have also increased - so that the active funds will, all else equal, be even more underweight. Thus, as and if the largest stocks continue to outperform, active funds might underperform in ever-increasing degrees.

This is exactly what seems to have happened between 2013 and 2021. In the summer of 2013, the largest five companies in the S&P 500 accounted for roughly 11% of the index’s weight. As Exhibit 1 shows, this concentration more than doubled to over 23% by December 2021; not coincidentally, our SPIVA U.S. Year-End 2021 Scorecard reported a one-year underperformance rate of 85% for actively managed large-cap U.S. equity funds - close to a record high for any year of the scorecard’s 20-year history.

However, as can also be seen in Exhibit 1, concentration began to diminish in 2022. Previous market darlings, including Facebook (META), Amazon (AMZN), Alphabet (GOOG, GOOGL), Microsoft (MSFT), Tesla (TSLA), and Apple (AAPL), to name a few, underperformed materially. Meanwhile, as the U.S. dollar strengthened, smaller and more domestically oriented names were judged to have better prospects, while previously unfancied companies in the Materials and Energy sectors benefited from a steep rise in commodity prices. Exhibit 2 summarizes the changes in fortune that swept through markets last year, comparing the annualized excess returns (versus the S&P 500) for a range of large-cap indices in two periods: December 2013 to December 2021, and over the full-year 2022.

Will such tailwinds for active managers continue into 2023 and beyond? It is certainly possible. But it is also worth emphasizing that, even now, there is still plenty of ground for active managers to make up if they hope to change the long-term statistics; according to the year-end 2022 scorecard, 91% and 95% of all actively managed large-cap U.S. equity funds underperformed the S&P 500 over 10 years and 20 years, respectively.

If an underperformance rate close to a coin-flip is taken to be a “good” year for active managers, then 2022 was a “good” year. But there were also fewer excuses for underperformance, and the long-term record suggests that the swallow of 2022 performance does not an active summer make.

Disclosure: Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit Terms of Use.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by