U.S. Wide-Moat Stocks On Sale - The March 2023 Heat Map

Summary

- Our 3-step process focuses on wide-moat stocks (as per Morningstar’s rating).

- We are only interested in those targets that are attractively valued in historical comparison.

- We share the heat map of the most investable candidates that may be worth your time for further analysis.

ValeryEgorov

Step One: Wide-moat stocks with 5-star and 4-star ratings

Historical evidence says that while quality alone is a poor indicator of outperformance, when combined with a decent valuation filter, Morningstar's moat rating proves to be more than useful. Based on the available data, stocks with a wide-moat rating that also fit into the 4- or 5-star category deserve to be the subject of further analysis. See the detailed explanation and the underlying evidence of our first step in this article.

We focus on those companies that are covered by a Morningstar analyst as assigning a wide-moat rating without thorough analysis is a questionable practice in our opinion. As of March 7, there were 143 U.S. wide-moat stocks meeting our criteria (down from 144 last month, as Dominion Energy (D) lost its wide-moat classification).

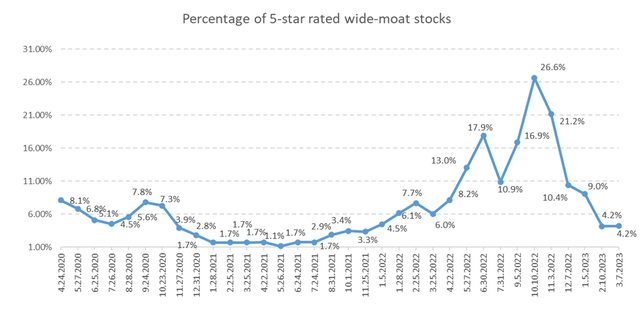

Only 4.2% (6 stocks) of this wide-moat group earned a 5-star (most attractive) valuation rating. Here are they:

Company Name | Ticker |

Comcast Corp Class A | |

Equifax Inc | |

Tyler Technologies Inc | |

International Flavors & Fragrances Inc | |

TransUnion | |

The Western Union Co |

We believe that the percentage of 5-star-rated wide-moat stocks is a good indicator of market sentiment. When this percentage is high, even the best companies are on sale. When the percentage is extremely low, market conditions may warrant caution. (Please note that this is not an indicator for market timing!)

Source: Data from Morningstar. Dataset after 12/2022 only contains U.S. stocks.

As these best of breed companies may be worth a closer look even when they are just slightly cheaper than their fair value but are not in the bargain bin, we also list the 4-star-rated wide-moat stocks as of March 7:

Company Name | Ticker |

Compass Minerals International Inc | |

Alphabet Inc Class A | |

Masco Corp | |

Meta Platforms Inc Class A | |

3M Co | |

Amazon.com Inc | |

Berkshire Hathaway Inc Class B | |

Cisco Systems Inc | |

CME Group Inc Class A | |

Constellation Brands Inc Class A | |

Domino's Pizza Inc | |

Ecolab Inc | |

Emerson Electric | |

Guidewire Software Inc | |

Honeywell International Inc | |

Intercontinental Exchange Inc | |

Intuit Inc | |

John Wiley & Sons Inc Class A | |

Kellogg Co | |

Lam Research Corp | |

Microsoft Corp | |

Polaris Inc | |

Roper Technologies Inc | |

Salesforce Inc | |

ServiceNow Inc | |

Teradyne Inc | |

The Walt Disney Co | |

U.S. Bancorp | |

Veeva Systems Inc Class A | |

Wells Fargo & Co | |

Workday Inc Class A | |

Zimmer Biomet Holdings Inc | |

Adobe Inc | |

Biogen | |

BlackRock Inc | |

Etsy Inc | |

Gilead Sciences Inc | |

Nike Inc Class B | |

Pfizer Inc | |

Tradeweb Markets Inc | |

VeriSign | |

Johnson & Johnson |

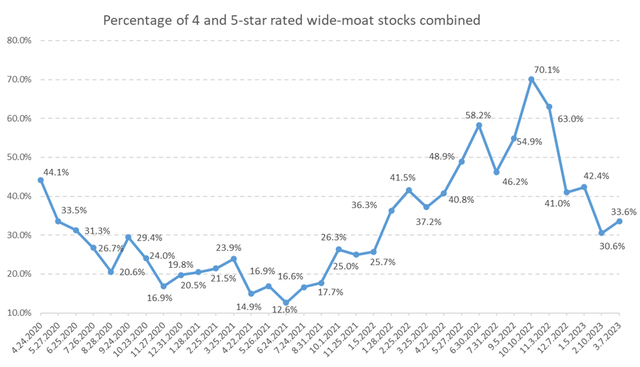

All in all, we have 48 firms that pass our very first criteria.

Source: Data from Morningstar. Dataset after 12/2022 only contains U.S. stocks.

Step Two: Historical Valuation in the EVA Framework

We believe that the most widely used valuation multiples are terribly flawed. See this article on why we consider the Future Growth Reliance metric the best-of-breed sentiment indicator that addresses accounting distortions, thus gives us a true picture of which wide-moat companies seem attractively valued in historical terms. We want to buy our top-quality targets when the baked-in expectations are low, since that is when surprising on the upside has the highest probability. As investment is a game of probabilities, all we can do is stack the odds in our favor as much as possible.

17 of the 48 stocks survived this second step. Here's the list:

Company Name | Ticker |

3M Co | |

Adobe Inc | |

Alphabet Inc Class A | |

CME Group Inc Class A | |

Comcast Corp Class A | |

Etsy Inc | |

Lam Research Corp | |

Meta Platforms Inc Class A | |

Pfizer Inc | |

Polaris Inc | |

ServiceNow Inc | |

Tradeweb Markets Inc | |

TransUnion | |

Veeva Systems Inc Class A | |

VeriSign | |

Wells Fargo & Co | |

The Western Union Co |

We are rather strict when it comes to historical valuation. There are stocks that unquestionably fail both our short- and long-term tests. There are some targets, however, that may look attractively valued if you only focus on the short-term (like the last 5 years), but the longer you zoom out, the more you lose your appetite. It comes down to personal preference where you draw the line. For us, only those stocks are allowed to appear on the heat map in our third step that seem attractively valued in both a short-term and long-term context. (We go back as far as 20 years, calculate averages and medians on different time frames and let our algorithm do the ruthless work.)

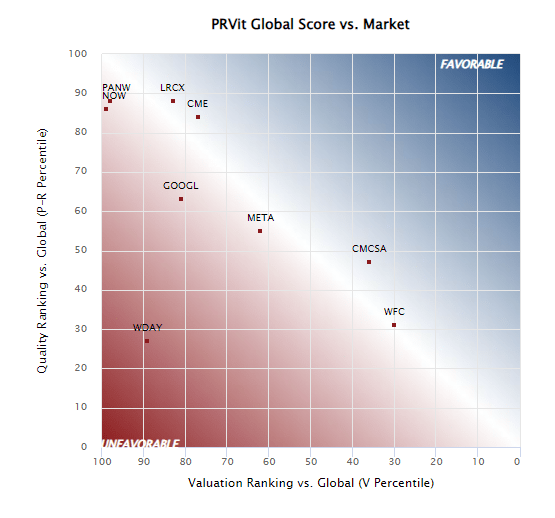

Step Three: The Heat Map of the most investable wide-moat stocks

Seeing the stocks of our shortlist on a heat map with a quality and valuation axis is something that can prove very useful when we need to make a decision on which candidates to analyze thoroughly. As explained in our previous article, we use the PRVit (Performance-Risk-Valuation investment technology) model of the EVA Dimensions team.

All in all, PRVit is a multifactor quantitative stock selection model based on EVA-centric measures of Performance, Risk, and Valuation. It first estimates the fundamental value of a company based on its risk-adjusted EVA performance (shown on the vertical axis) and then compares it to its actual valuation (shown on the horizontal axis). All factors in this model were chosen heuristically based on common sense, and not by data mining, yet strong and statistically significant backtests prove the soundness of the PRVit approach both in the U.S. and globally. (See the details here.)

Here is the heat map as of March 7:

Source: Institutional Shareholder Services Inc.

We also present the results in a table format to make your decision easier.

Source: Institutional Shareholder Services Inc., Morningstar

(Stocks highlighted in light blue are Morningstar's 5-star-rated U.S. wide-moat names that survived the second step of our process.)

In PRVit, the factors are grouped into three categories: Performance, Risk, and Valuation. Each company has a composite 0-100 score in each category, where higher is better for Performance and lower is better for Risk and Valuation. We believe that stocks in the upper quintile of the PRVit ranking (with a PRVit score above 80) are worth a closer look.

We plan to run this three-step process on a monthly basis and publish the shortlist of targets it produces.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of GOOGL, META, BLK, DIS, MSFT, DPZ, AMZN, DPZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.