H&E Equipment Services: Shares Aren't Done Rising Just Yet

Summary

- H&E Equipment Services has done incredibly well at growing both its top and bottom lines in recent quarters.

- Acquisitions and strong demand have been the key drivers here, and shares have done well in response.

- Add on how cheap shares are, and I believe that further upside is warranted from here.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

PJ66431470

During these uncertain times, it's great to come across a company that's performing exceptionally well. One really good example of this can be seen by looking at H&E Equipment Services (NASDAQ:HEES), an enterprise that operates as one of the largest rental equipment firms in the US. For the most part, it generates revenue from renting out equipment such as aerial work platforms, earth-moving equipment, air compressors, and more. Although the state of the economy may not actually seem conducive to these types of activities, the business continues to report strong sales, profit, and cash flow growth. In addition to that, HEES stock looks cheap enough to warrant some additional upside from here. Because of that, I've decided to keep the ‘buy’ rating I had on the stock, even though shares have risen so much in recent months.

Fantastic results so far

Back in early June of 2022, I decided to tackle H&E Equipment Services to see whether or not the company made for an appealing prospect for investors. In that article, I talked about how well the company had been doing after experiencing years of pain. Cash flow was robust and the outlook for the enterprise was encouraging. A continuation of that trend, in my opinion, would have resulted in some much-needed upside for shareholders. Because of how likely I felt that trend was to continue, I ended up rating the business a ‘buy’ to reflect my view that shares should generate upside that exceeds what the broader market should over a similar timeframe. Since then, the business has exceeded my own expectations. While the S&P 500 is down 3.6%, shares of H&E Equipment Services have seen upside of 52.7%.

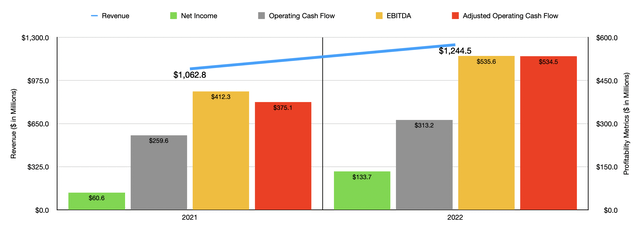

To understand exactly why the company continues to generate such strong performance, we should discuss how well it performed in 2022 as a whole. Revenue for the year came in at $1.24 billion. That's 17.1% higher than the $1.06 billion the company reported only one year earlier. Interestingly, during this time, the company did see a lot of pockets of weakness. For instance, used equipment sales for the firm plunged 32.8% from $135.2 million to $90.9 million. This decline was at least in part intentional on the company's side. In addition to benefiting from an increase in rental demand, the firm decided to capitalize on high equipment utilization during the year by selling less and renting more. Overall equipment rental revenue, as a result, surged 31% from $729.7 million to $956 million. Some of this sales increase can be attributed to strong demand from customers. However, it was also facilitated in large part by an increase in the company's fleet. At the end of the 2021 fiscal year, the firm's fleet consisted of 42,725 units. That number ballooned to 55,208 units by the end of 2022. Some of this growth was undoubtedly driven by acquisitions. In September of last year, for instance, the company acquired One Source Equipment Rentals in a deal valued at $130 million. That particular acquisition brought with it annual revenue of $59 million, largely stemming from aerial work platforms, material handling equipment, and other general equipment lines.

Net income during this period of time more than doubled from $60.6 million to $133.7 million. Operating cash flow expanded from $259.6 million to $313.2 million. If we adjust for changes in working capital, the improvement was even greater. Year over year, the metric shot up from $375.1 million to $534.6 million. Also on the rise was EBITDA. Based on the data provided, it rose from $412.3 million in 2021 to $535.6 million in 2022. Naturally, the rise in sales for the company was very helpful in this regard. But the company also benefited from a rise in its gross profit margin from 39.1% to 44.6%. Strong demand in what is traditionally a low-margin, asset-intensive space can result in significant bottom line improvements.

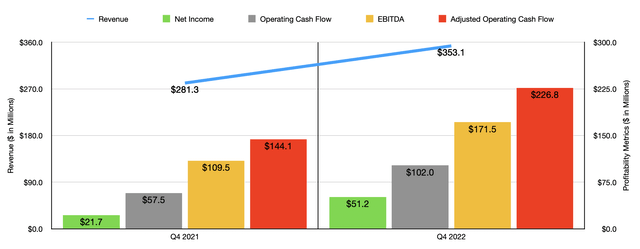

It's important to keep in mind that the economy can change rather quickly. That's why it's also important to keep a pulse of the most recent data provided by management. This data, however, also looks very positive. Revenue of $353.1 million generated in the final quarter of 2022 came in quite a bit higher than the $281.3 million reported in the final quarter of 2021. Net income more than doubled from $21.7 million to $51.2 million. Operating cash flow expanded from $57.5 million to $102 million, while the adjusted figure for this grew from $144.1 million to $226.8 million. And finally, EBITDA for the business expanded from $109.5 million to $171.5 million.

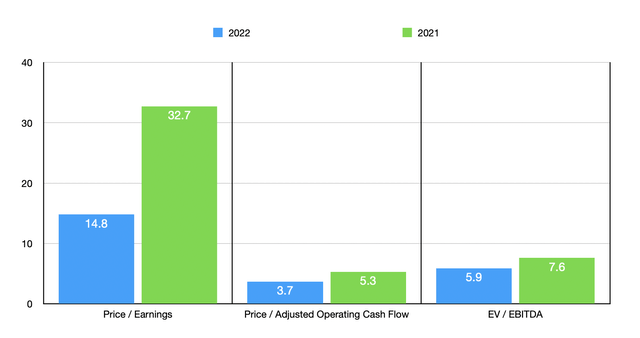

Using the data from 2022, the company is trading at a price-to-earnings multiple of 14.8. That's down from the 32.7 reading that we get using data from 2021. The price to adjusted operating cash flow multiple is considerably lower at 3.7. That compares to the 5.3 reading that we get using data from the year prior. Over the same window of time, the EV to EBITDA multiple for the business fell from 7.6 to 5.9. As part of my analysis, I also compared the company to some similar firms. In this case, I picked three similar enterprises. On a price-to-earnings basis, these companies ranged from a low of 16 to a high of 21.1. Using the price to operating cash flow approach, we get a range of between 7.5 and 12.5. And finally, when it comes to the EV to EBITDA approach, the range is from 6.7 to 10.3. In all three scenarios, H&E Equipment Services was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| H&E Equipment Services | 14.8 | 3.7 | 5.9 |

| McGrath RentCorp (MGRC) | 21.1 | 12.5 | 10.3 |

| U-Haul Holding Co (UHAL) | 18.0 | 7.5 | 6.7 |

| United Rentals (URI) | 16.0 | 7.6 | 8.1 |

Takeaway

Right now, I must say that I am very much impressed by how well H&E Equipment Services performed. Although I was bullish about the company, I did not think the stock would move up so much. But when you have an enterprise that's already cheap and that's growing at a nice clip, and you add into that favorable market conditions, it should come as no surprise when things turn out nicely. For more cautious investors, I could understand the decision to take some money off the table at this point. But given how cheap shares still are, even if the firm were to revert to the levels of profitability seen in 2021, I still believe that additional upside is warranted. Because of that, I have decided to keep the ‘buy’ rating I had on HEES stock previously.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.