Don't Let The Chart Fool You - Tractor Supply Company Is A Deal

Summary

- It's tough to find a retailer with customer base tailwinds as compelling as Tractor Supply Company.

- The company has a track record of free cash flow growth and dividend raises.

- We think Tractor Supply Company's prospects will only grow brighter from here.

TennesseePhotographer

Thesis

Any time investors come across a business that can capitalize on creating an exceptionally loyal community among a high-earning consumer base, they should pay attention. With over 2,300 retail storefronts, a smart expansion strategy, high-quality management, and a dividend to boot, it's our contention that Tractor Supply Company (NASDAQ:TSCO) is one of these companies.

More To The Name

Unfamiliar investors can be forgiven for assuming that Tractor Supply's business is exactly what its name implies (supplying heavy duty farm equipment), but they would be mistaken. The company, instead, is a bit of a general store with a target audience of the affluent rural. The company describes its target customer base perfectly in its 10-K: "Our target customers are home, land, pet, and livestock owners who generally have above average income and below average cost of living." More on the customer base later.

The company operates under a few names--Tractor Supply Company being one, and also Petsense By Tractor Supply. The company also acquired Orscheln Farm and Home stores in October 2022 and is in the process of re-branding those stores to Tractor Supply storefronts, which is expected to be complete by the end of 2023.

The company delivered $14.2 billion in sales in 2022, up more than 11% from 2021. Management expects sales to top $15 billion in 2023.

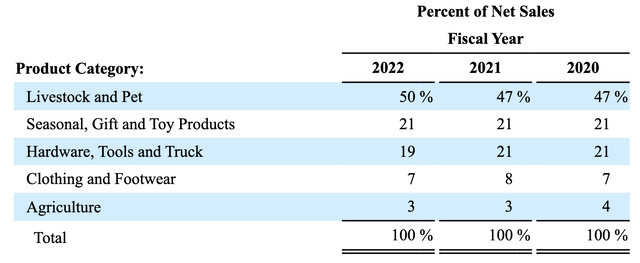

Rather than supplying tractors, a majority of Tractor Supply's business comes from its livestock & pet category, which focuses on food for household and farm pets and animals, but also includes fencing materials for containment (i.e., fencing), and healthcare products.

A Competitive Advantage

The company's primary niche here is supported by the fact that its livestock and pet business draws in customers that won't find the type of feed they require at, say, Walmart Inc. (WMT).

In fact, CEO Hal Lawton recently remarked at the Raymond James Annual Institutional Investor's Conference that the company is "the largest seller of bag animal feed in the United States, approximately a 25% market share." He also noted that the company is a top-five competitor in pet food generally.

This is critical, given Tractor Supply's customer base. Those in need of bag animal feed have somewhat limited options, and it only makes sense that if you buy bag feed somewhere that also sells standard pet food... well, then, you might as well load up.

Driving synergistic sales like this and smart merchandising are key components of the company's strategy. In 2022, the company introduced Field Activity Support Teams (known as "FAST"). These teams are responsible for ensuring that seasonal in-store displays are set up properly and exhibit world-class execution.

To those in the retail field, this may seem like a bit of overkill. Isn't that what you have regular store employees for, after all?

This is where we would disagree. With hourly worker satisfaction at all-time lows, and with consumers reporting customer service as falling to unacceptable levels across the board, we think it makes great sense for companies to invest in teams that specialize on proper merchandising. The company doesn't have to rely on less-than-reliable hourly workers to create uniform displays across multiple locations, and can routinely have more dependable employees in the store with eyes on the quality of store displays.

The Growth Story

Lawton intimated that the growth of Tractor Supply isn't simply limited by capturing stagnant market share--the market itself is growing. The company is poised to capitalize on a secular trend of exodus of residents from large cities to more rural locales. Lawton estimates that while millennials as a generation have largely delays a move from the urban landscape as compared to, say, Boomers or Gen-x'ers, the shift is fully underway now, and is underscored by a shift to hybrid and remote work and Millennials generally being tired of cities.

So, as Lawton says, of the:

"70% [of] revenue growth, about half of that, call it 35%, was market growth. The other half of that was market share gains. On the half that was market growth, about half of that, so call it 15% to 20%, was driven by this millennial cohort[.]"

On average, the company grows about 70-80 new store locations per year and is currently fully focused on domestic growth within the U.S. For that, the company has long-term plans to grow store count to roughly 6,800, which, as Lawton notes, is around "650 stores remaining to build."

When you factor in demand growth, customer base expansion, and store count growth--it all adds up to a powerful recipe in our minds.

Valuation

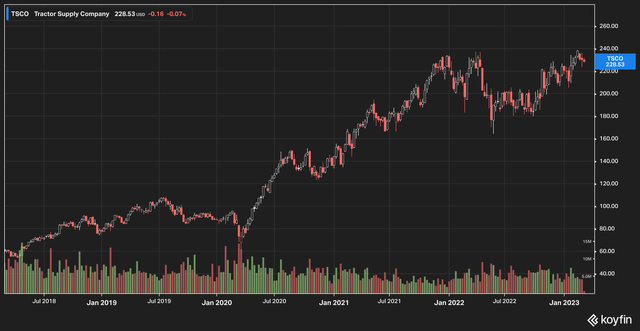

Based solely on the price chart, it would be easy to assume that Tractor Supply has run out ahead of its skis, with a quick run up in price from the $80 range to over $200 in just a few short years.

Valuations, however, tell a different story.

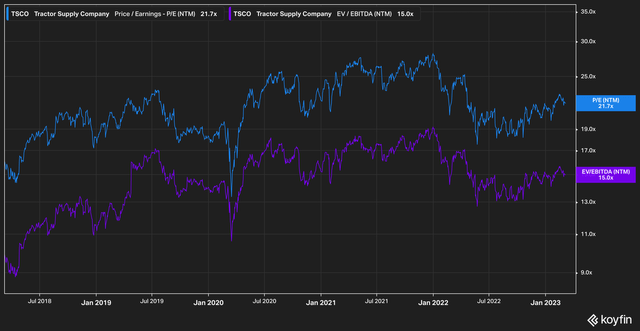

Forward PE & EV/EBITDA (Koyfin)

In a very atypical situation for stocks today, Tractor Supply's forward price to earnings and EV/EBITDA valuations have largely traded sideways while the price has climbed--which to us indicates that the market has not lost its mind in valuing the stock.

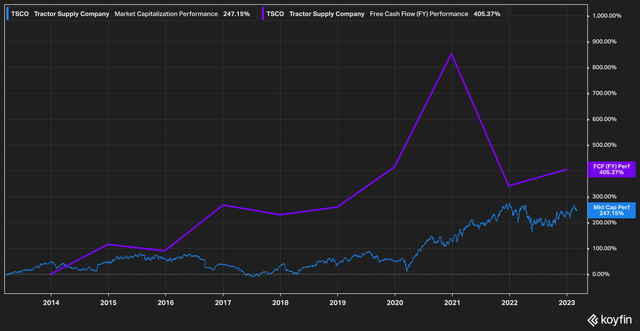

Indeed, in a sign that we at Ironside Research love to see (but rarely get to), free cash flow growth has actually outpaced market capitalization growth for the company over the last 10 years.

In the past 10 years, market capitalization has grown 240%, while free cash flow has grown 405%. This metric alone, in our opinion, makes the stock worth the price of admission.

Finally, management--in addition to paying and consistently raising a dividend that currently yields 1.8%--has been on a mission to repurchase shares. Over the past ten years, the share count has fallen from roughly 125 million shares to just over 110 million.

The Bottom Line

When it comes to a compelling retail growth story with strong management and great results, we think it's tough to beat Tractor Supply Company. With a focus on customer satisfaction, growing the dividend, repurchasing shares, and fast-growing free cash flow, we think that investors would do well to consider Tractor Supply Company when researching possible new positions for their portfolios.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.