Magellan Midstream: 7.78% Yield, 21 Years Of Distribution Growth, On My Watchlist

Summary

- MMP has been an income investor's dream with a yield of 7.78% and 21 years of distribution growth which has led to a 1,400% increase in the quarterly distribution since inception.

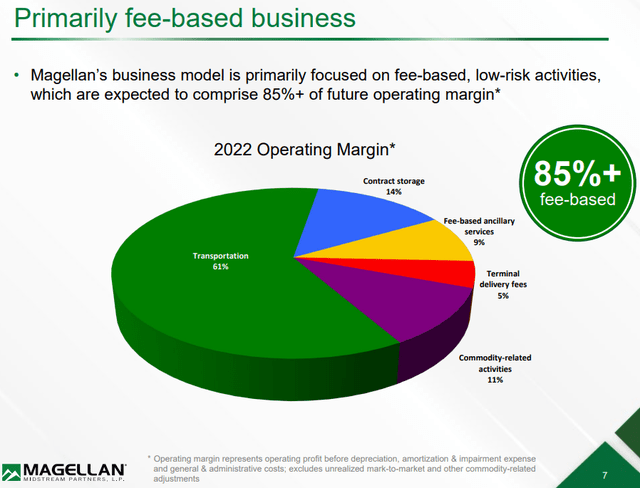

- 85% of MMP's revenue is backed by fee-based contracts, which help secure its Adjusted EBITDA, DCF, and distributions.

- I have added MMP to my watchlist, but I feel it's a bit expensive to pull the trigger here compared to where its peer group trades.

Sakorn Sukkasemsakorn

Magellan Midstream (NYSE:MMP) is very popular on Seeking Alpha, as readers have asked me several times to write a dedicated article on MMP. I love energy infrastructure companies and feel the sector is unloved and undervalued. I have covered many energy infrastructure companies such as Energy Transfer (ET), Enbridge (ENB), Enterprise Products Partners (EPD), and Kinder Morgan (KMI). Still, I have never written a dedicated article on MMP, even though I have added them to my peer group for metric comparisons. After doing my homework, there are many aspects I like regarding MMP. From a dividend standpoint, MMP has a fantastic yield and has delivered phenomenal dividend growth over the past 2 decades to its investors. MMP plays a critical role in transporting refined products throughout middle America, and a large percentage of its contracts are tied to fee-based contracts, a favorite of mine. After conducting my due diligence, MMP has made it on my watchlist, and if units sell off, I would be happy to add it to my portfolio. I think it's a bit overvalued compared to its peers, and I would consider EPD or ET a better opportunity for me based on the numbers today.

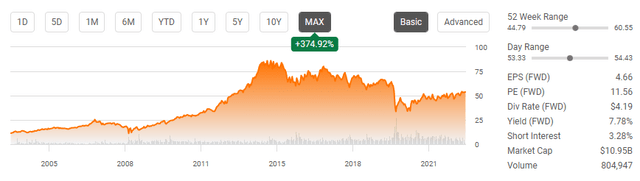

Seeking Alpha

Magellan Midstream is another midstream gem with critical energy infrastructure

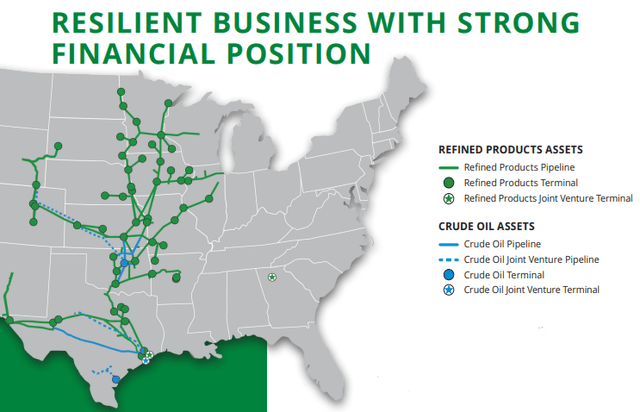

MMP transports, stores, and distributes refined petroleum products and crude. Since its inception, MMP purchased roughly 3,000 miles of refined product pipelines as well as terminals and storage capacity from Shell in 2004 and made additional acquisitions, such as the Longhorn Pipeline running from Houston to El Paso. MMP also acquired 100 miles of pipeline and 7.8 million barrels of storage from BP p.l.c. (BP), and in 2013 MMP acquired approximately 800 miles of refined petroleum products pipeline, four terminals, and 1.7 million barrels of storage from Plains All American Pipeline (PAA). MMP has grown into a premier midstream entity operating a 9,800-mile refined products pipeline system with 54 connected terminals, two marine storage terminals, and a crude segment consisting of 2,200 miles of crude oil pipelines, a condensate splitter and storage facilities with an aggregate storage capacity of about 39 million barrels.

Magellan Midstream

In 2022, MMP delivered $3.2 billion of revenue and drove $1.43 billion of Adjusted EBITDA and $1.43 billion of distributable cash flow (DCF) to the bottom line. MMP focuses on fee-based contracts to protect its business operations, which is a huge plus. When I research midstream operators, I look for their revenue to be protected by either fee-based or take-or-pay contracts. To my surprise, Fee-based services account for 85% of MMP's contract base. This is where a fixed rate is negotiated upfront between MMP and its customers. The revenue which is generated from fee-based contracts is based on volume, which passes through the system as the fee has already been set. Fee-based contracts are also a mitigation method to an uncertain commodity market as fees are agreed upon upfront, so whether commodity prices increase or decrease, MMP is generating a revenue amount that is attractive to their overall business. I also like take-or-pay contracts because they ensure that the midstream operator is paid the negotiated rate regardless of the number of fuels that pass through its system. When an entity enters into a take or pay contract, they are reserving future capacity based on its projections and have to pay for everything that is reserved regardless if it's used.

Magellan Midstream

Magellan Midstream has delivered tremendous value for its investors and I can see why so many long-term investors have nothing but smiles on their faces

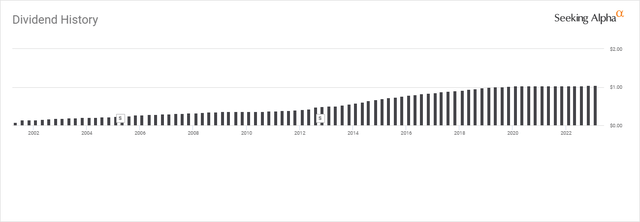

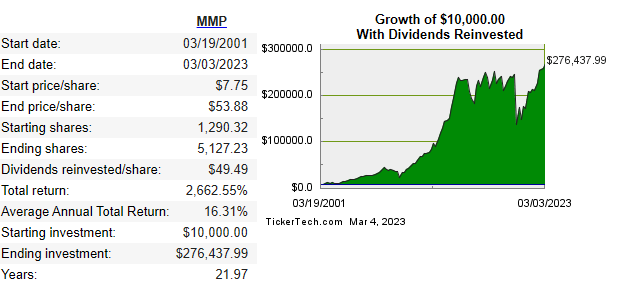

Investing is a long-term game, and anyone who has held units of MMP for the long haul has nothing to complain about. MMP has provided its unitholders with 21 consecutive years of dividend growth. Since its inception, MMP has increased its quarterly dividend by 1,400% as it's grown from $0.07 to $1.05. MMP has proven that its business model is resilient to different economic dynamics, which generates strong cash flow to consistently pay distributions through various business cycles. It's hard to argue with 21 years of uninterrupted annual distribution growth and almost $50 of distributions generated per share over the years.

Seeking Alpha

Since its IPO in 2001, MMP has undergone 2 splits, a 2-for-1 split on 4/12/05, and another 2-for-1 split on 10/14/12. MMP has also delivered $49.49 in distributable income per share since its inception. Since its IPO, if you had reinvested the distributions, a $10,000 investment would have seen a 2,662.55% return, as the value today would be worth $276,437.99. The initial unit count would have increased 297.36% (3,836.91 units) to 5,127.23 units. The amount of income generated per unit on a trailing twelve-month basis since inception also increased by $1,328% from $0.29 to $4.17. Anyone lucky enough to have stayed invested in MMP since its inception would have seen their forward projected income increase from $376.77 to $21,380.55, an increase of $21,003.78 or 5,574.64% on the initial $10,000 investment. Today, you would be making more than double your initial investment in pure distribution income annually.

Dividend Channel

I love Magellan Midscream's business and its track record, but would I invest today?

Today, I am paying the present value for all future cash flow, and while MMP has a rich history that resonates with what I want to see, I am investing for the future. The only way for me to determine if I am paying a good price today is to see how MMP is valued compared to its peers. I track the market cap, enterprise value, revenue, Adjusted EBITDA, distributable cash flow, and total debt so I can compare the following ratios, Adjusted EBITDA to market cap, EV to Adjusted EBITDA, DCF to Market Cap, Debt to Adjusted EBITDA, and Price to Sales. The energy infrastructure companies I will compare MMP against are:

- Enterprise Products Partners (EPD)

- Energy Transfer (ET)

- MPLX LP (MPLX)

- Kinder Morgan (KMI)

- Plains All American Pipeline (PAA)

- Williams Companies (WMB)

- Targa Resources (TRGP)

- ONEOK (OKE)

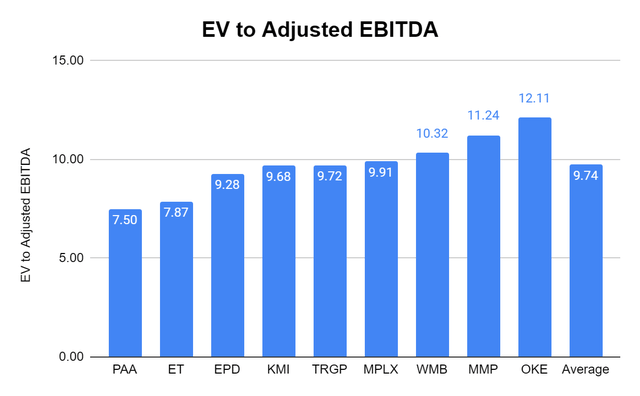

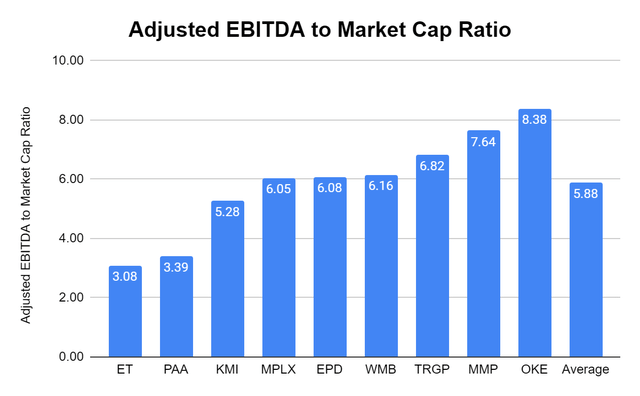

The EV to Adjusted EBITDA ratio is popular because it compares the value of a company, debt included, to the company's cash earnings less non-cash expenses. MMP has the 2nd largest EV to Adjusted EBITDA ratio at 11.24x, which is significantly larger than the peer group average of 9.74x. When I look at the Adjusted EBITDA to Market Cap Raito, MMP is still high at 7.64x compared to the peer group average of 5.88x. By these 2 valuation metrics, MMP looks expensive compared to some of its peers.

Steven Fiorillo, Seeking Alpha

Steven Fiorillo, Seeking Alpha

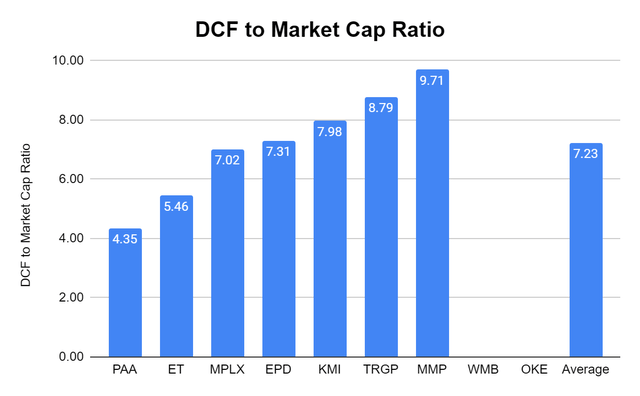

Next, I look at the DCF to market cap ratio as I want to pay a good price for the DCF a midstream operator produces. OKE and WMB do not report on a DCF basis so they are excluded from this metric. MMP has a 9.71x DCF to market cap ratio, which is much larger than the 7.23x peer group average. ET, which is my favorite in the group, trades at 4.35x DCF, and EPD, which is often regarded as the gold standard, trades at 7.31x. MMP looks expensive on this metric also.

Steven Fiorillo, Seeking Alpha

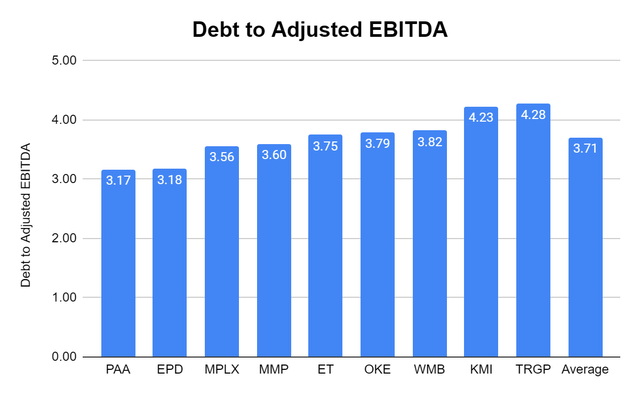

MMP looks to have a solid balance sheet. Companies discuss net debt to Adjusted EBITDA, but I look at total debt to be more conservative. MMP has a debt to Adjusted EBITDA ratio of 3.56, which is lower than the 3.71x peer group average. This is a check for MMP.

Steven Fiorillo, Seeking Alpha

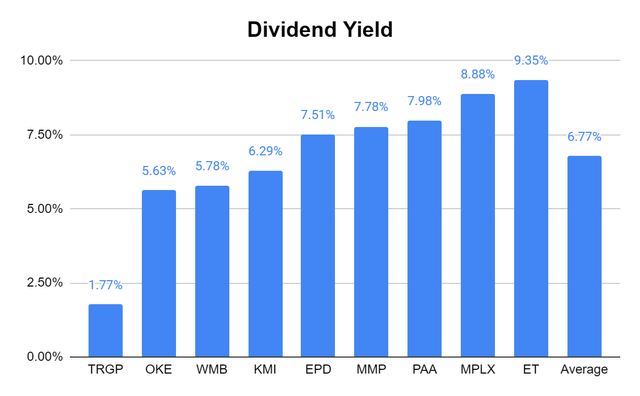

This should come as no surprise, but MMP is a distribution yield star. MMP yields 7.78% compared to the peer group average of 6.77%. From an income perspective, MMP is attractive.

Steven Fiorillo, Seeking Alpha

Conclusion

MMP's outstanding track record has created tremendous value since its IPO. With 21 years of consecutive distribution increases, 1,400% growth in its quarterly distribution since inception, and a current yield of 7.78%, it's clear why MMP is an income standout. I love the business model, and as the demand for energy grows, I feel that MMP's asset base will produce additional DCF, which will fuel future distribution increases and possibly make the business more valuable. I have added MMP to my watchlist, but I won't be investing today as it's a bit expensive compared to two of its peers that I am invested in, ET and EPD. ET has been discounted heavily, so I have to take that with a grain of salt, but compared to EPD, I would rather allocate more capital toward EPD today than start a position in MMP. If MMP sells off and units become more attractively valued, I would entertain starting a position.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of ET, EPD, BP, OKE, ENB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.