Newmont: Rising Real Yields Ding Gold, NEM Shares Near Fair Value

Summary

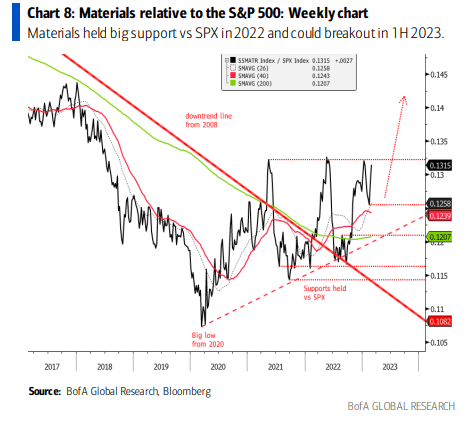

- The Materials sector has traded well in the last few years, and some technicians suggest there's more relative upside ahead.

- There are risks, though, and rising rates are generally a headwind for gold miners.

- Newmont has a fair valuation picture while the technicals suggest a trading range may be developing.

- I outline key price levels to watch.

LifeJourneys/E+ via Getty Images

The Materials sector has enjoyed some relative strength in recent years despite a volatile US Dollar. BofA suggests the technicals are somewhat bullish today. I am less sanguine about this cyclical and resource-dependent sector. Many commodities are simply rangebound and rising real interest rates hurt precious metals, all else equal. A two-month high in the greenback is a near-term headwind, too.

I see Newmont Mining near fair value, but a higher dividend yield today is an encouraging sign while the chart shows long-term support close to where the stock trades today.

Materials Sector: Eyeing A Breakout, Says BofA

BofA Global Research

According to Bank of America Global Research and Seeking Alpha, Newmont Corporation (NYSE:NEM) is the world's largest gold producer and a substantial producer of copper. It also explores copper, silver, zinc, and lead. The company has operations and/or assets in the United States, Canada, Mexico, Dominican Republic, Peru, Suriname, Argentina, Chile, Australia, and Ghana. As of December 31, 2022, it had proven and probable gold reserves of 96.1 million ounces and a land position of 61,500 square kilometers. Newmont management is focusing on free cash flow and returns to shareholders over production growth.

The Denver-based $35.1 billion market cap Metals & Mining industry company within the Materials sector does not have positive trailing 12-month GAAP earnings and pays a high 3.6% dividend yield, according to The Wall Street Journal.

Newmont issued a mixed Q4 earnings report late last month, but the long-term guide was soft. With a 2023 dividend set between $1.40 and $1.80, the stock now yields significantly more than its 5-year average 2.3% rate, so income investors have something to like here. Still, downside risks include the inability to secure low-cost financing amid higher interest rates and rising capital costs due to inflation.

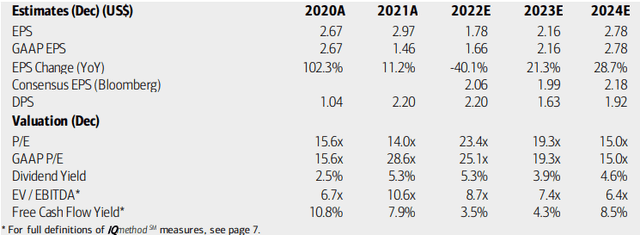

On valuation, analysts at BofA see earnings rising sharply in 2023 and 2024, but a recent dip in gold and metals prices could have downside risks to those estimates in my view. The Bloomberg consensus forecasts are more realistic to me. Thus, if we assume $2 of earnings and assign a generous 20 multiple, then the stock should be near $40.

NEM currently sells at a premium valuation to its sector while the forward PEG ratio is actually reasonable near 1.08. With a price-to-sales ratio at a 14% discount to the company's long-term average, shares look priced right in the low $40s to me.

Newmont: Earnings, Valuation, Free Cash Flow Forecasts

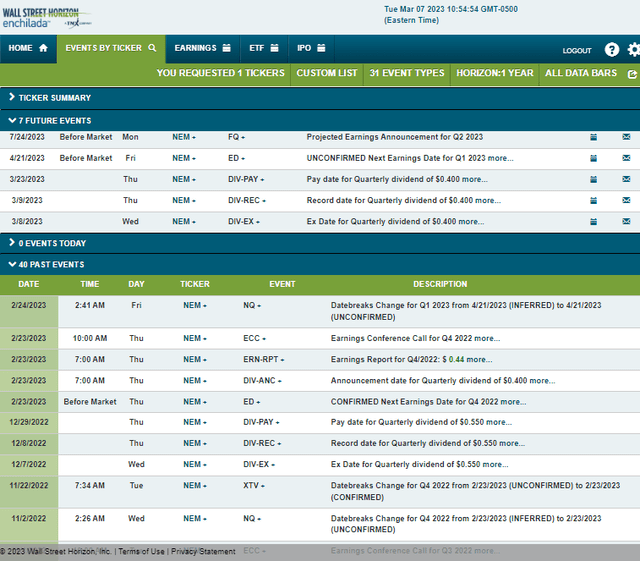

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q1 2023 earnings date of Friday, April 21. The stock trades ex-dividend on Wednesday, March 8.

Corporate Event Risk Calendar

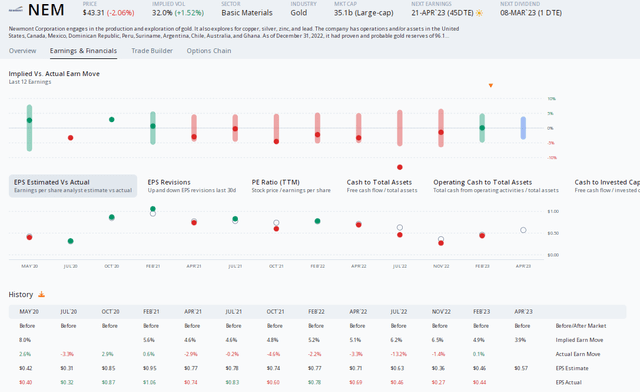

Digging into the upcoming earnings report, data from Option Research & Technology Services (ORATS) show a consensus EPS amount of $0.57 which would be a 17% decline from $0.69 of per-share profits earned in the same period a year ago. What's more, NEM has missed estimates in the previous four earnings events while the stock has traded lower post-earnings in seven of the eight releases - one of the worst earnings performers I have seen lately.

This go-around, options traders have priced in a small 3.9% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the April reporting date. That is a cheap amount of premium to pay given an uptick in gold miners' volatility lately. With two straight small moves after earnings, perhaps traders have been lulled to sleep slightly. I would be a buyer of that premium.

NEM: Bearish Earnings-Related Price History, Attractively Priced Straddle

The Technical Take

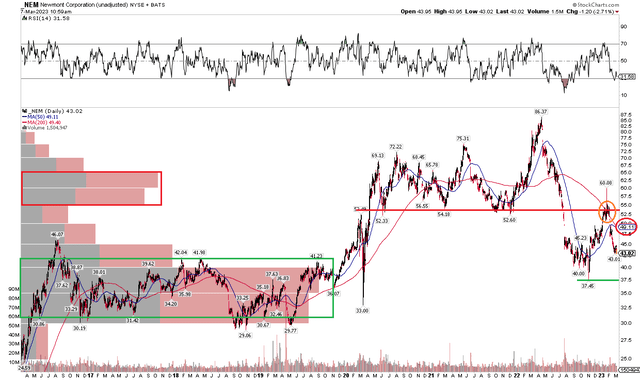

NEM ran into bearish overhead supply on its rally toward $60 earlier this year. Shares have dropped hard amid high real interest rates and a drop in gold prices. Technically, I see support starting near $42 due to high volume by price in the 2016 through 2019 range that peaked there. Moreover, NEM dipped under $38 late last year, so the stock could fall a bit further, but we are nearing a buy zone.

New congestion may have emerged in the low to mid-$50s, however, so I would take profits on any strength there. Overall, with a sharply downtrending long-term 200-day moving average, the broad trend is in favor of the bears at the moment.

NEM: Trading Range Developing

The Bottom Line

With elevated volatility and some earnings uncertainty, I see shares of Newmont near fair value in the low $40s. Technical support also comes into play there. The upside is that the stock has a robust yield today. I am a hold on Newmont.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of GDX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.