(Representative image)

The tribe of women fund managers grows gradually year by year.

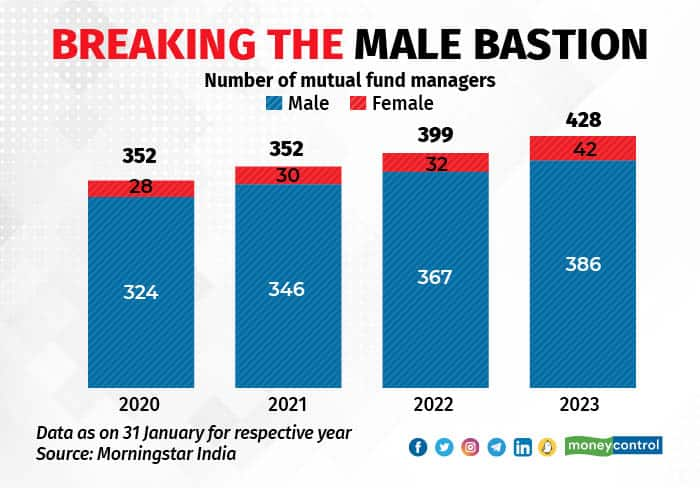

Compared to 38 lady fund managers last year in the Rs 40 trillion Indian mutual funds (MF) industry, there are 42 women fund managers in the industry as on January 31, 2023, according to Morningstar India.

To be sure, there is a long way to go. Just 9.81 percent of the fund managers in the industry are women and they manage 11.19 percent of the assets under management (AUM) of the MF industry.

On the occasion of Women’s Day, Moneycontrol caught up with the young women fund managers of India.

The emerging stars

The global financial crisis of 2009 and the slowdown that followed was a bad time for many companies. Many young graduates did not land jobs of their choice. Ennette Fernandes, 37, born into a family of bankers, was one such: a management graduate looking for a job in corporate finance.

She settled for a job in equity research. Fifteen years of tracking equity markets have made her the fund manager she is now.

Fernandes manages the Canara Robeco Consumer Trends Fund, and the Canara Robeco Equity Hybrid Fund at Canara Robeco, India’s 16th largest fund house with an AUM of Rs 62,000 crore.

Thirtytwo-year-old Nirali Bhansali is Fund Manager-Equity, at Samco AMC. She manages the Samco Flexi-cap Fund and the Samco ELSS Tax Saver Fund. Samco is one of India’s youngest fund houses.

At Taurus Mutual Fund, Neha Raichura, 33, an equity fund manager, took independent charge of Taurus Infrastructure Fund recently.

Thirtythree-year old Sneha Joshi, a Ph.D in economics, is Associate Fund Manager, Alternative Investments, at Quantum Mutual Fund, and manages the Quantum ESG Fund. Her colleague, 30-year-old Ghazal Jain, Fund Manager, Quantum Mutual Fund, looks after the Quantum Gold ETF.

What drew them to fund management

An engineering graduate, Bhansali developed an interest in stock markets when she used to go through her brother’s Chartered Accountancy exam study material. She decided to switch over to finance and did her MBA.

“The MBA made me seriously think about a career in money management. It is the holistic approach to money management that appeals to me. It is not just about buying stocks that are going up. I must also ensure risk management for the entire portfolio,” she said.

Though equity research was not the chosen path for Fernandes, things changed over a period of time. She says, “Firstly, Fundamental analysis – studying varied businesses, management strategies and their impact on businesses; and secondly, financial modelling – wherein all the qualitative aspects of understanding the business get translated into numbers, is all exciting.”

Fund management is a tough job, especially in a fund house like Canara Robeco, which is focused on active funds. It becomes tougher when the markets are in a volatile phase, such as the one we are in now.

“A job is never demanding as long as one loves what one does. And money management is something I love,” Fernandes adds.

Joshi views money management as a process that requires maximising returns with limited resources in order to achieve specific financial objectives. Explaining why she chose the profession, she says, “Money management requires ideation, planning, strategising and back-testing to ensure that the chosen strategy aligns with the set financial goals. It provides valuable insights into the investor's preferences and is intellectually stimulating.”

No more a male bastion

The profession of money management is changing.

Increasing awareness about stock market investing in general and mutual funds, in particular, have ensured that more women are taking up investing to achieve both personal (financial) and professional goals. The glass ceiling has already been shattered by many seasoned women fund managers in the mutual fund and insurance industry, and they have become role models for the new entrants.

Raichura looks up to Swati Kulkarni, former Executive Vice-President and Fund Manager, Equity, at UTI Mutual Fund, who was among the first women fund managers in the industry. “Though there are not many women fund managers, the situation is changing gradually, and that is encouraging. Today, women get equal opportunities when it comes to senior-level jobs. That’s one positive change that’s come about in the industry,” she adds.

Indeed, most women fund managers are optimistic about better times ahead for women in the industry.

Various stakeholders acknowledge the contribution of women. For example, speaking on condition of anonymity, a senior money manager, who has worked with Fernandes said, “Ennette has a deep understanding of consumer businesses. Many analysts develop a good understanding of businesses. But too much analysis paralyses their ability to decide if a stock should be added to a portfolio. She does not miss the big picture, though she keeps an eye on the smallest of details. That one attribute can help her make good investment decisions.”

“Over the past few years, we have been seeing a steady increase in the number of lady fund managers in the industry. While the assets managed by women fund managers (either as lead or co-managers) are negligible relative to the overall assets, what is certainly impressive is the performance of their funds. Funds managed or co-managed by women have shown remarkable consistency when it comes to outperforming the category average over various time periods,” says Nehal Meshram, Senior Analyst, Manager Research, Morningstar India.

Ravi Kumar TV, Founder of Bengaluru-based Gaining Ground Investment Services, says, “Irrespective of gender and educational qualifications, what matters is going through two-three market cycles. Over a period of time, we may see more women fund managers in the industry.”

“Be financially independent. Take an interest”

The aforementioned women fund managers are vocal about the need to educate the general public about investments.

Bhansali says, “More women should be financially literate, they should be financially independent. That will also help them to improve the money matters of their families.”

Many investors, especially women, are comfortable purchasing gold jewellery as a means of investing. However, experts point out that this may not be in their best interest.

“Investors need to distinguish between consumption and investment. Gold is a good asset for long-term investment, provided you take exposure to it through financial avenues such as gold ETFs, which has many advantages such as liquidity, absence of purity-related issues, low-ticket size, no storage-related issues, etc,” says Jain.

To create wealth, investors have to work in line with their financial goals and risk appetite. Diversifying across asset classes can help reduce portfolio risk.

Jain explains with an example. “We want a thali — dal, rice, roti, and sabzi. We will neither be happy nor healthy eating only one of these. Accordingly, build a portfolio across asset classes.”

Typically, Indian investors are less exposed to risky assets such as equities due to their volatile nature. But fund managers are emphatic that one needs to have exposure to equities in a staggered manner, in line with one’s asset allocation.

Raichura recommends a healthy mix of diversified and thematic equity funds for wealth creation. “While large and flexicap funds offer exposure to consistent compounders, thematic funds, such as infrastructure, can help generate higher-than-average returns during periods of sector upcycle,” she says.