Genesis Energy: Strongest Outlook In Years Of Covering The Company - Maintain Strong Buy

Summary

- Genesis Energy 4Q22 Segment Margin: beat versus the preliminary release back in January while Adjusted EBITDA was in line.

- Guidance Raised: From mid $700sM at the Q3 release to $780-$810M with such guidance assuming a worldwide recession.

- Reiterated offshore oil transport opportunity for next 2-4 years: On top of the 160k bpd contracted for early 2025, management is in discussions for an incremental 150k-200k bpd by 2026.

- Above average returns opportunity in our view: Even if we assume a 7.0x-8.0x EBITDA multiple (2 std dev below 5-year avg), GEL units could reach $14-$21/unit by the end of this year.

zorazhuang

One of the best outlooks for the company

Genesis Energy (NYSE:GEL) units fell nearly 4.7% in 2022 despite raising guidance multiple times and having one of the strongest outlooks I have ever seen since first picking up coverage as a sell-side analyst some 15 years ago. GEL management referenced the opportunities in their narrative as well saying the outlook is one of the strongest in their careers. In my view, investors should listen to this kind of commentary since the management team has historically skewed towards being non-promotional.

To reiterate the positives discussed in the release and on the earnings call:

- Raised guidance multiple times in 2022: from Adjusted EBITDA of $565-$585M at the release of 4Q21 earnings in Feb. 2022 to $700-$710M at the third quarter earnings release or +23% above the original guide at the mid-point. The company wound up beating that raised guidance with $717M in adjusted EBITDA for the full year or ~25% above the original guidance.

- Raised guidance for 2023 from the mid $700M range provided at the 3Q22 release to $780-$810M and which assumes a global recession.

- Reiterated ongoing commercial discussions for another 150,000-200,000 b/d to be realized the next 2-4 years on their offshore pipelines system.

- The King Quay platform being operated by Murphy Oil is producing 115,000 b/d vs the original assumption of ~80,000 b/d. The incremental barrels are contributing to the raised guidance for 2023.

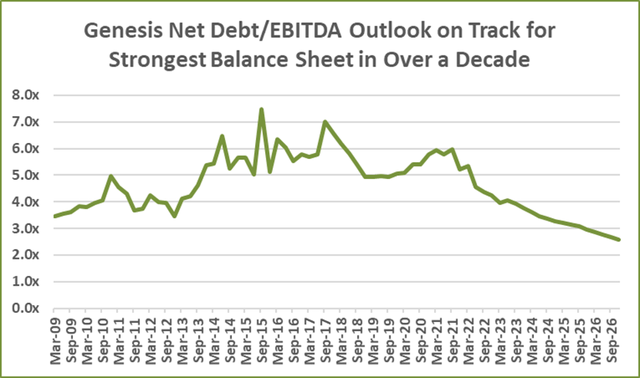

- Balance sheet leverage dropped to 4.2x at the end of 2022, the lowest leverage since 2Q2013. We expect leverage to drop even further in 2023 to below 4.0x which would mark GEL's strongest balance sheet in over a decade.

- Marine transportation is operating at near 100% utilization and at spot and contracted day rates last seen in 2014-2015. Kirby (KEX) had this to say on their 4Q22 earnings call:

We continue to expect refinery and petrochemical plant activity to remain high with an increase in customer volumes. Barge availability is constrained as there is minimal new barge construction expected in 2023. These positive factors are expected to contribute to our barge utilization running in the low- to mid-90% range for the foreseeable future. These favorable supply and demand dynamics are expected to drive further improvements in the spot market…"

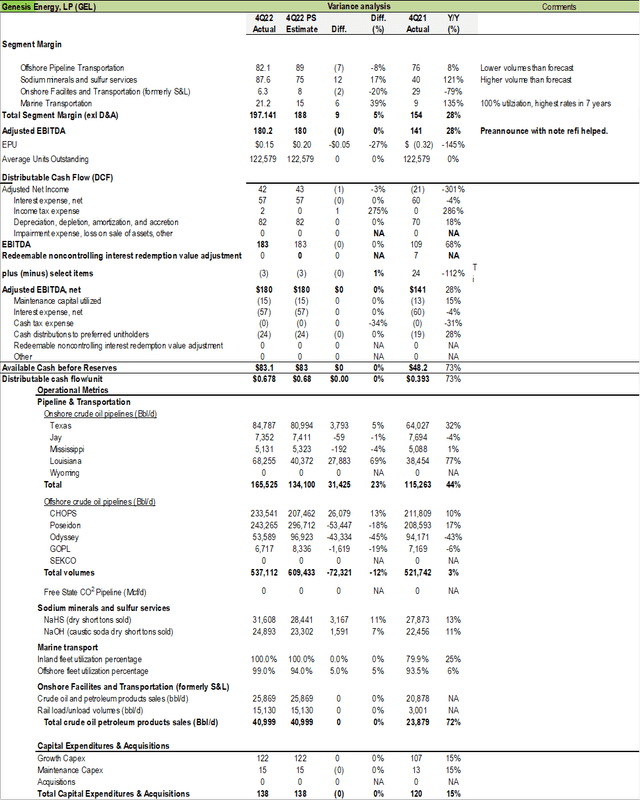

Our variance analysis for 4Q22 results shown below were largely in line with the January pre-announcement:

Source: Company filings, Principal Street estimates.

Outlook for 2023-2025

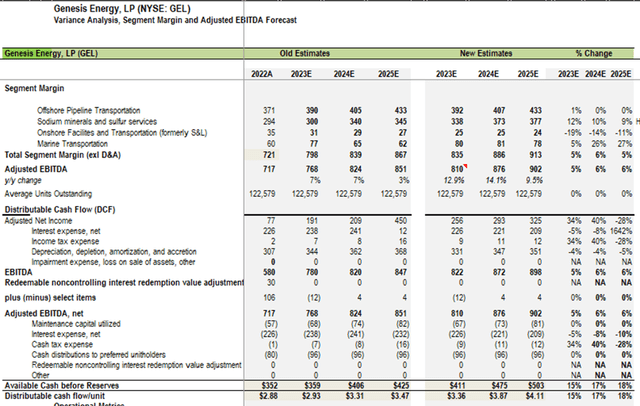

The outlook for 2023-2024 and beyond is the most positive outlook that I can recall in the ~15 years that I have been following the company. The positive outlook is in spite of management assuming a global recession in its guidance. Further, I had to be quite conservative in modeling the company to fit my forecast within the guidance provided in terms of volumes and pricing on the pipelines, soda ash pricing and volumes, as well as marine transport. None-the-less, based on the strong 4Q22 results and guidance, my forecast Adjusted EBITDA is up ~6% from my previous outlook for 2023-2025. We note that consensus EBITDA estimates for 2023-2025 stand well below guidance for 2023 at $762M vs $780-$810M guidance and our $810M estimate. 2024 consensus is at $807M versus our $866M and 2025 consensus is at $843M vs our $907M.

We believe that Street estimates are too low for the reasons we explain below.

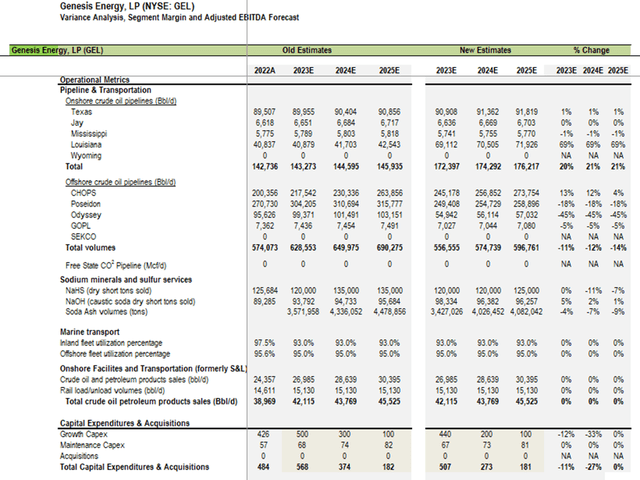

- Soda ash

- Volumes sold was 3.1M tons (3.5M tons production capacity) in 2022. We assume a 500k increase in soda ash sales while production capacity in 2023 is expected to increase 600-700k tons per management for the restart of the original Granger production facility on Jan. 1 and the completion of the Granger Optimization Project in the second half of 2023 which adds an incremental 750,000 tons of annual production capacity. Taking these two events together gets to the expected average increase of 600,000-700,000 tons of production in 2023 and which gets to management guidance of 4.2M tons of capacity by the end of 2023. However, to be conservative, we assume an increase of only ~400,000 tons in production in our 2023 forecast, to 3.47M tons. For 2024 and beyond, capacity is expected to reach approximately 4.7M-4.8M tons. Again, to be conservative, we assume production of ~4.1M tons in 2024 with a ~1% increase in production each year thereafter.

- Price: The price of soda ash increased by 40% from 1Q2022 to 4Q2022 per discussion with the company. The higher price in 4Q2022 is what forms the basis of price negotiations for the upcoming year. Yet GEL management is only able to disclose that prices in 2023 will be higher on a weighted average basis than in 2022. If prices merely averaged the 4Q2022 for all of 2023, compared to 2022 the math tells us that the prices would be ~20% higher than in 2022. To be conservative and to account for the fact that certain contracts are locked in 2023 at 2022 prices, we have assumed only a 6% higher price in 2023 compared to 2022 and which implies is ~14-15% below the price charged in 4Q22. We believe that margin in the sodium, minerals and sulfur services segment has a high probability of beating our current estimate. Also, recall that Genesis is the global low cost producer of soda ash.

- NaHS:

- Pricing: We assume average margin/ton declines of 5.0%, 3.6%, 1.0% for 2023, 2024, 2025 respectively.

- Volume: We assume 0.50% tonnage decline per Q from a 4Q22 base for 2023 and 204 before growing at 0.25% per Q beginning in 2025.

- Offshore pipelines:

- Hurricane downtime: Guidance assumes 10 days of down time on the offshore pipeline system for hurricanes vs. the average down time for the offshore pipelines has typically been in the 5-7day range. Last year it was 0 days.

- No min payment in the guidance (nor in our forecast) until connection mid-year for the Argos project which has a 140,000 b/d contract to ship crude oil volumes on the GEL offshore pipeline system.

- Volume: While the original volume from King Quay assumed ~85,000 b/d, the original design capacity, the production platform is currently producing 115,000 b/d. Field tie backs are expected to contribute another 50,000 b/d but to be conservative, we have assumed no such incremental contribution. 160,000 b/d in late 2024 or early 2025 but we have assumed no contribution until 2025.

- Marine Shipping:

- Utilization: Total utilization is running at 100% per management commentary in the earnings release yet we assume inland barge utilization of 93%, offshore barges at 96%, and the American Phoenix at 96%.

- Pricing: Management said spot day rates are approaching levels last seen during the 2014-2015 time period. During 2015, the margin per barrel was above $9.00/barrel while we are conservatively assuming $7/bbl.

Bottom line is we have significant conservatism embedded in the outlook in terms of both volume and price and yet we are still significantly above Street estimates.

Source: Company filings, Principal Street estimates Source: Company filings, Principal Street estimates

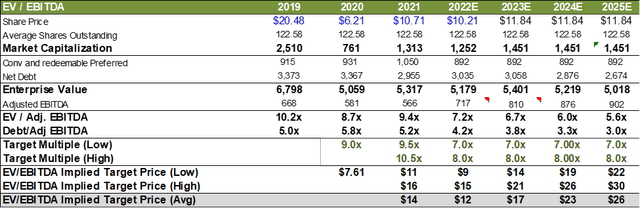

Valuation Outlook Continues to Suggest ~ a Double Over the Next Two Years

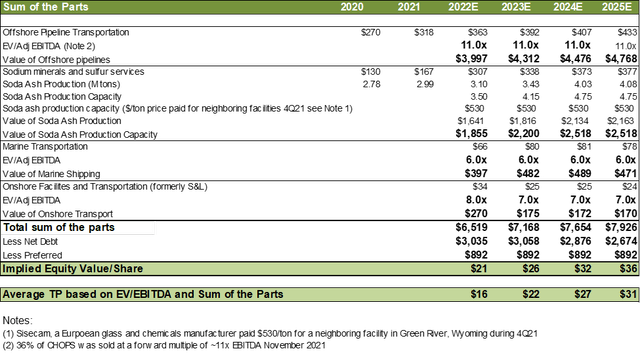

We arrive at a target price outlook (TP) of $17, $23, $26 by the end of 2023, 2024, and 2025 respectively on a multiple of 7-8x EV/EBITDA which is two turns below the five-year average multiple of 9.5x.

Source: Company filings, Principal Street estimates.

If we average EV/EBITDA multiples and sum of the parts TPs go to $22, $27, $31 for 2023, 2024, and 2025. Also note as we show in the chart further below that the average EV/EBITDA multiple over the last five years is 9.5x and GEL sold a 36% stake in its CHOPS pipeline for approximately 11x EBITDA. We point out that assuming a 7.5x EBITDA valuation is two standard deviations below the 5-year average and still implies upside of over 40% from the current price of GEL units.

Source: Company filings, Principal Street estimates. Genesis Energy EV/EBITDA History (Source: Factset, Principal Street estimates.)

Balance sheet outlook

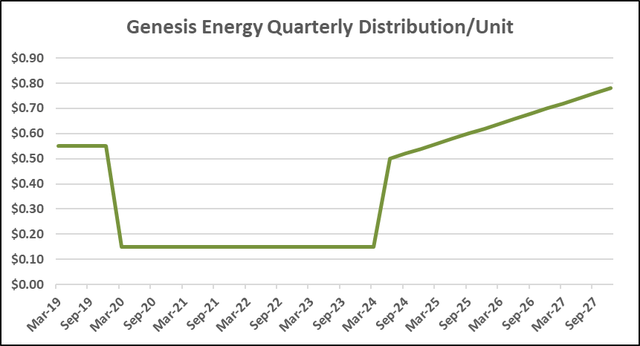

From updating our model, we provide an update on the outlook for the Genesis Energy balance sheet. For purposes of computing the Debt/EBITDA ratios we have included the Alkali notes even though they are excluded for purposes of complying with bank covenants for its credit facility. Note that GEL's prospects continue to mean that the balance sheet is likely to de-leverage rapidly. Note that leverage drops below 4.0x during the 2H23 and to approximately 3.0x by YE25. With high distribution coverage and a strong balance sheet we estimate that the distribution would rise from the current $0.15/unit/Q to $0.50/unit/Q with the declaration attributable to 2Q2024 (payable in 3Q2024). While we are seeing a 5.1% yield today, we believe that based on today's unit price, the yield would be over 16% in approximately 1 1/2 years and ~9.0% if our target price by the end of 2024 is achieved.

Net Debt to EBITDA history and outlook (Source: Factset, Principal Street estimates.)

Note in the chart below that given how strong the balance sheet is likely to be along with the high distribution coverage, the distribution is likely to be growing rapidly. We forecast $0.02/unit/Q increases in the distribution through 2028 and translates to mid-teens to low teens growth rate for ~three years. Based on an annualized distribution of $2.16 by the end of 2024 and $2.80 by the end of 2025 and applying a yield-based value of ~8.0% would translate into GEL unit valuation of ~$27/unit by the end of 2024 and ~$35/share by the end of 2025 or more than double the current value by the end of 2024 and nearly triple the current unit price by the end of 2025.

Distribution per unit history and outlook (Source: Company filings, Principal Street estimates. )

Conclusion

The 4Q22 results and guidance was the best we have seen from Genesis Energy in years and supports the thesis we have been writing about for over a year. Genesis struggled for a number of years but has turned the corner and the company's future is the best we have seen in at least five years.

While no company is perfect, we continue to believe that an investment in Genesis Energy units remains compelling and could deliver returns that outperform the broader market averages all while delivering attractive income to investors.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of KEX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our firm is long GEL and KEX across various strategies and/or separately managed accounts. This presentation is limited to the dissemination of general information pertaining to general economic market conditions. The information contained herein should not be construed as personalized investment advice and should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is no guarantee of future results, and there is no guarantee that the views and opinions expressed in this presentation will come to pass. Individual client needs, asset allocations, and investment strategies differ based on a variety of factors. Principal Street Partners, LLC (“Principal Street”) is an SEC-registered investment advisor with its principal place of business in the State of Tennessee. Principal Street and its representatives are complying with the current registration and notice filing requirements imposed upon registered investment advisors by those states in which Principal Street maintains clients. Principal Street may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by Principal Street with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.