3 High-Yield Dividend Stocks For Dividend Income

Summary

- High-Yield dividend stocks are more for income focused investors.

- These three dividend stocks pay a high-yield and appear to be trading at a discount.

- Is High-Yield or Dividend Growth the right way to invest?

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

alfexe/iStock via Getty Images

There are various types of dividend stocks:

- Dividend Growth

- High-Yield Dividend

- Moderate Dividend

The biggest battle between investors is often between dividend growth and high-yield.

There is room to invest in both for an investor, but both are very different. Dividend growth stocks often, not always, come with lower yields that are growing at a strong clip.

High-yield dividend stocks are exactly that, high-yield, but the dividend growth is slow. These stocks are often more mature and slower growing companies.

Today, we will look at 3-High-Yield Dividend Stocks that look appealing in terms of valuation.

High-Yield Stock #1 - Altria Group (MO)

Altria Group has long been a staple in many dividend portfolios for many years, but since mid-2019, the stock has been trading in a range of $40-$55 for much of the past three and a half years.

Shares of Altria provide investors a high-yield of 8.0%. Not only does the company offer a high dividend yield, but they are also trading at a very compelling valuation.

Before we look at valuation, let’s first look at how the stock has performed over the past 12 months.

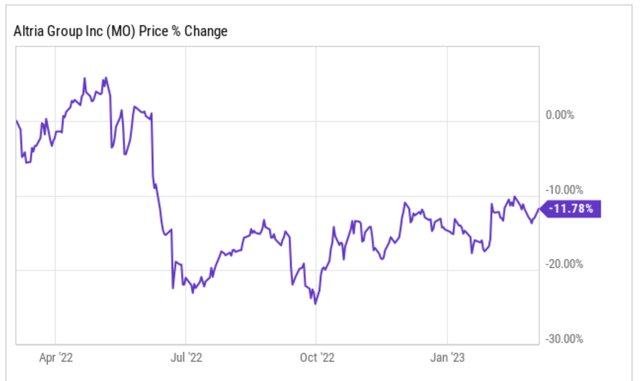

On the year, shares are up 3.5%, but over the past 12 months shares of MO have fallen roughly 12%, underperforming the greater S&P 500 (SPY).

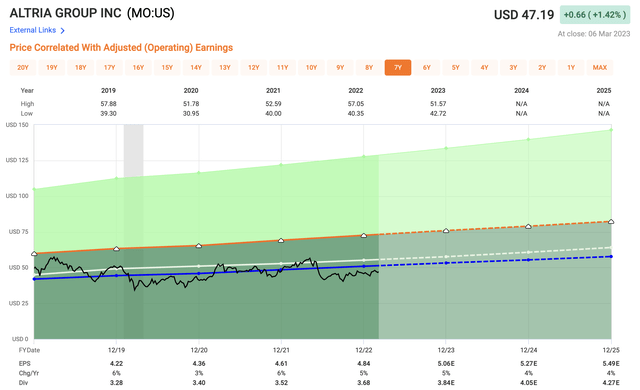

Now let’s have a look at valuation. Shares of Altria Group currently trade at just 9.3x 2023 earnings. Over the past five years, shares have traded closer to 10.5x, suggest shares are undervalued based on historical valuations.

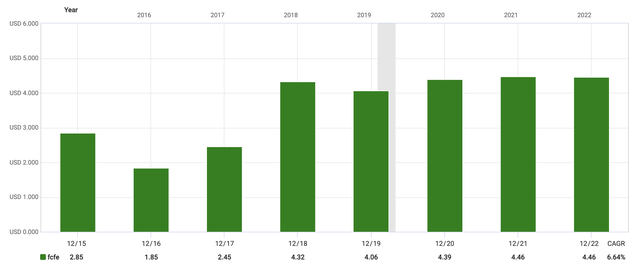

Altria is a company that has seen their top line revenue growth slow, which is not uncommon with high-yield mature companies. However, with high-yield dividend stocks it is less about revenues and more about cash flow.

Here is a look at cash flows over the years:

Over the past five years, Altria has been able to generate a free cash flow CAGR of more than 8%, allowing the company to not only pay a high-yield dividend, but a growing dividend at that. Altria has increased their dividend for 53 consecutive years and counting.

The negative with Altria has been their untimely and failed acquisitions. Investments in JUUL and Cronos Group were both disasters, but a more recent investment is the venture they are doing with JT Group focused on heated tobacco products. This has the potential to reignite some growth back into the business.

The most recent transaction is the company's $2.75 billion acquisition of NJOY Holdings. NJOY's key product is a smoke-free product, which is an area that Altria has been looking to grow. Altria's enhanced smoke-free portfolio will now include full global ownership of products and technologies across the three largest smoke-free categories and a joint venture with JT Group for the U.S. commercialization of heated tobacco stick products.

In a time when the US is expected to enter into a recession, Altria is worth a closer look for investors in 2023, offering a high-yield at a low valuation.

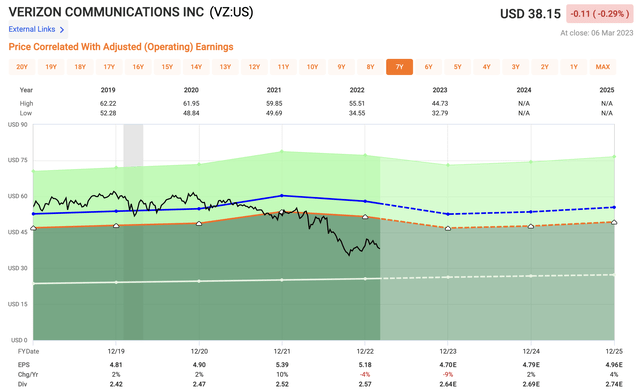

High-Yield Stock #2 - Verizon Communications (VZ)

The telecommunications sector has seen growing competition over the past few years between the likes of Verizon Communications, AT&T (T), and T-Mobile (TMUS).

T-Mobile has certainly been taking market share and growing at a strong clip over the past few years, but they do not pay a dividend at all, so they could not be viewed as an option for this piece. That leaves us with legacy competitors, Verizon and AT&T.

AT&T has had numerous hiccups that have put a lot of strain on the company along with mountains of debt. The management team has made numerous poor acquisitions that the company continues to pay for.

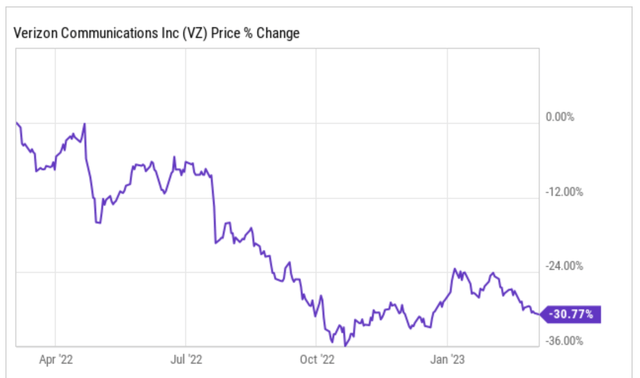

That leaves us with Verizon. Shares of VZ are down 30% on the year, lagging the S&P 500 by a wide margin over the same period.

Year-to-date, shares of VZ have fallen 5% as investors preferred more growth at the start of the year, but that could soon change given the uncertainty with the US market.

Again, assuming we are headed towards a recession at the end of 2023, VZ could be viewed as a safe investment option. In terms of financial health, Verizon is in a much better place than that of AT&T, and the company has a BBB+ credit rating. Things at AT&T were deteriorating, as such, the company decided to separate its telecommunication assets from its media/content business.

The stock price could hold up in an economic downturn and in addition the stock offers a very generous dividend yield at 6.8%. Over the past five years, VZ shares have had an average dividend yield of 4.6%.

Although the yield is high for the company, VZ still maintains a safe payout ratio of 50%, which is unique given the high dividend yield. The company has also increased the dividend for 18 consecutive years now.

Looking at valuation, VZ shares trade at just 8.1x 2023 earnings, compared to a historical average of 11.2x.

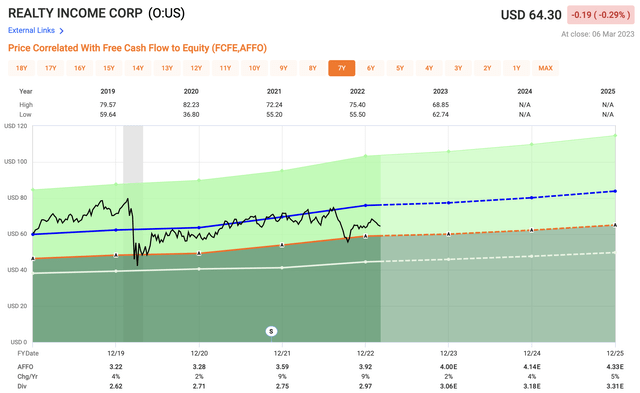

High-Yield Stock #3 - Realty Income (O)

The final high-yield stock we will look at hails from the REIT sector, and it happens to be the most popular REIT in Realty Income.

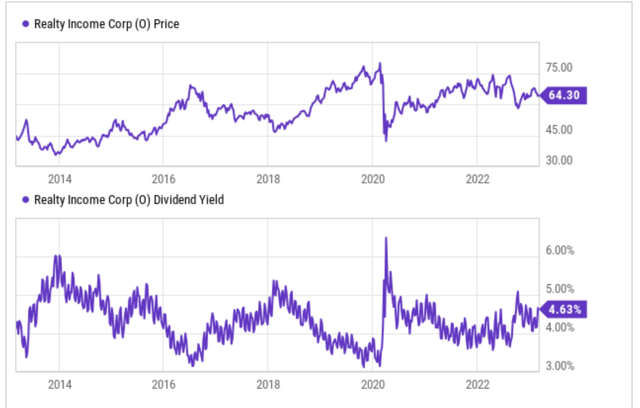

Realty Income has a dividend yield that has now reached 4.8%. Looking at the chart below, you can see that over the past decade, any time Realty Income’s dividend yield has reached 5%, it has been a great time to buy the stock. We are nearing those levels once again.

For those of you unaware, Realty Income is a net lease REIT, which simply means they own properties that are leased out to various tenants, and typical landlord costs are passed onto the tenant, which include:

- Property taxes

- Insurance

- Maintenance costs

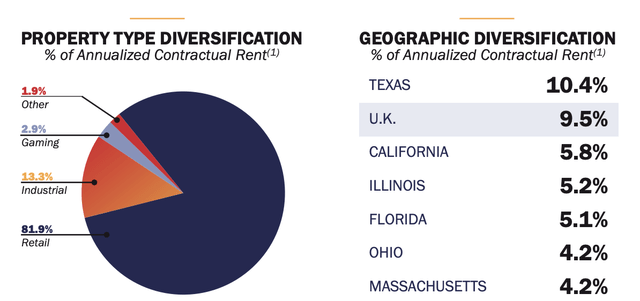

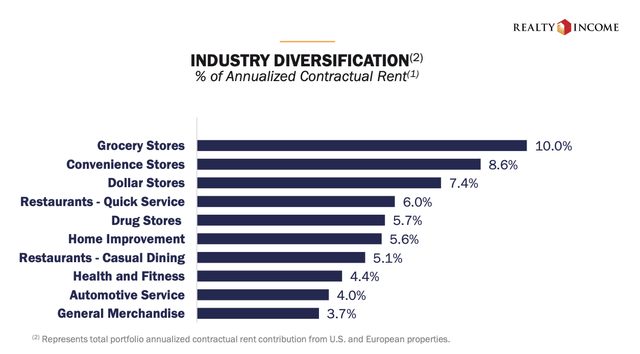

The company owns primarily buildings that are leased out to retail tenants. Roughly 82% of the company’s annual base rent, or ABR, comes from retail tenants, 13%, from industrial tenants, and the remaining 5% is other industries.

Realty Income Q4 Investor Presentation

Considering we have been talking about a recession already, a retail landlord may not sound all that enticing. Let me clear that up for you. Realty Income is not your typical landlord, they are the gold standard when it comes to REITs, and the retail tenants they lease to are primarily service oriented or non-discretionary type retail.

Looking at the slide below, you can see that over a quarter of the company’s rent comes from grocery stores, convenience stores, and dollar stores, all areas that should hold up well in a recession.

Realty Income Q4 Investor Presentation

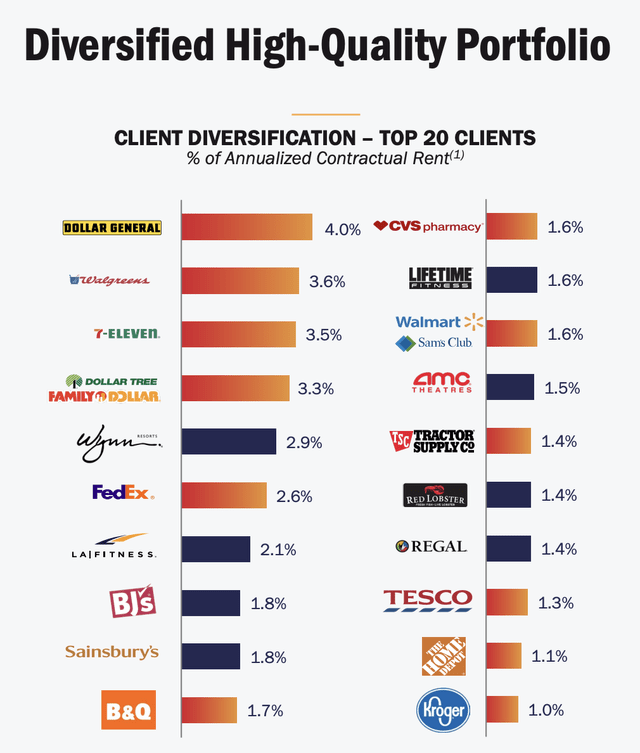

Here is a look at the company’s top 20 tenants:

Realty Income Q4 Investor Presentation

In all, the REIT has a portfolio that consists of over 12,200 properties, nearly 1,250 customers within 84 industries. The company has a well-diversified portfolio of high-demand properties in all 50 states.

Realty Income has a fortress A rated balance sheet, which gives them a major advantage when it comes to obtaining debt at a lower cost as they continue to expand.

In terms of valuation, REITs are valued based on funds from operations or adjusted funds from operations, rather than EPS. Realty Income currently trades at a forward AFFO multiple of 16.1x compared to a historical average of 19.4x over the past five years, suggesting shares are undervalued at current levels.

Investor Takeaway

All three of these stock pay safe, reliable, high-yield dividends. All three companies are high-quality and trading at reasonable valuations making all three worthy of a second look.

The dividend yields are high, but the dividend growth is slow, so make sure you understand that prior to investing.

Let me know in the comments section, which of these stocks you prefer.

Disclosure: This article is intended to provide information to interested parties. I have no knowledge of your individual goals as an investor, and I ask that you complete your own due diligence before purchasing any stocks mentioned or recommended.

No marketing to add

This article was written by

Mark Roussin is an active Certified Public Accountant (CPA) in the state of California. Mark has worked as a CPA, serving both public and private Real Estate corporations for over 10 years. Today, he provides his followers insights to both undervalued dividend stocks mixed with high-growth opportunities with a goal of them reaching financial freedom in the long-term. Mark tends to invest primarily in dividend stocks with a strong emphasis on Real Estate Investment Trusts (REITs).

Mark has partnered with "iREIT on Alpha”, which is the premiere marketplace service that provides the best daily in-depth REIT research. The service boasts a community of like minded investors that also receive complete access to our various portfolios that you can track in real-time. Come check out all the exclusive content today!

-----------

DISCLAIMER: Mark is not a Registered Investment Advisor or Financial Planner. The Information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. He asks that you perform your own due diligence or seek the advice of a qualified professional. You are responsible for your own investment decisions.

Disclosure: I/we have a beneficial long position in the shares of MO, O either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.