Ally Financial: A Strong Investment Opportunity In The Undervalued Financial Services Sector

Summary

- Ally Financial is a leading digital financial services company providing a wide range of financial products and services to consumers, businesses, and automotive dealers.

- Ally has a strong digital platform and a proven track record of innovation and customer satisfaction, with high net promoter scores and a growing customer base.

- With over 22,000 dealer relationships, Ally is the #1 prime auto lender in the US, with Consumer Auto Loans representing 65% of its finance receivables and loans portfolio.

William_Potter

Introduction

The banking and financial services sector has been undervalued for an extended period of time due to recency bias associated with the 2007/2008 financial crisis. Emerging market risk only reinforces these valuations, which results in many banks trading at mid to high single-digit earnings that do not reflect the lower discount rate deserved by stringent capital and liquidity regulatory requirements implemented subsequent to the crisis. Ironically, a recession may be the catalyst needed for high-quality banks to receive the multiple they deserve. Ally Financial is an easy-to-understand business that lends and insures the new and used auto industry, which it funds with low-cost sticky deposits.

Investment Thesis

Ally Financial (NYSE:ALLY) is a leading digital financial services company with over 100 years of experience. It serves a broad range of customers, including consumers, dealers, and corporate clients, offering various financial products and services such as auto financing, commercial finance, insurance, and online banking.

Ally Financial is an undervalued investment opportunity trading at 1x tangible book value. Management has guided to 16-18% normalized ROTCE, implying a mid-single-digit earnings multiple. Ally Financial has over-earned in recent quarters (mid-20% ROTCE), but management has incorporated a 30% point-to-point reduction in used vehicle values from the end of 2021 to 2023 in its normalized guidance. ~90% of ALLY's auto book is to Prime credit, and even in a scenario as bad as the Federal Reserve Severely Adverse Stress Scenario (worse than '08), ALLY's TBV would come down to $27.60 per share. This means that investors would be paying 1.2x today for a company that would due mid-teens ROTCE going forward, implying significant downside protection.

Ally Financial has been repurchasing shares, which has the effect of reducing book value per share, even if accretive to intrinsic value. Recent significant buybacks above reported book, coupled with MTM noise on its AFS book, have artificially suppressed tangible book value per share. These repurchases will likely drive ROTCE above management's guidance issued at higher TBVps values. Berkshire Hathaway owns 10% of the company, and Punch Card Management (Norbert Lou) owns ALLY as a core position. Buffett once said in an annual meeting that in banks he is looking for a company "characterized by very little risk on the asset side and very cheap money on the deposit side" which is the general thesis here.

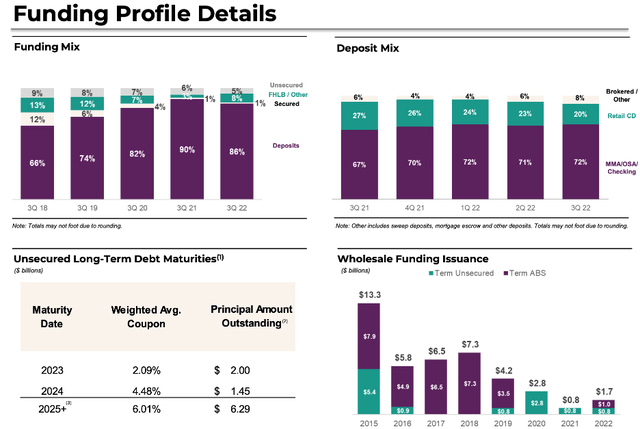

Ally Financial has a low-cost advantage, which allows it to implement a "scaled economies shared" model by taking its low-cost model and providing depositors higher interest rates than competing banks. Ally is an online-only bank that provides substantial cost savings relative to traditional brick-and-mortar banks. Combined with a strong financial value proposition, Ally consistently earns high NPS ratings and has grown deposits for 50+ quarters in a row. As of 2022Q2, Ally has $140bn in deposits (2.5mm customers), which represents 85% of its funding sources. This is up from 64% in the second quarter of 2018 as management has worked hard to replace secured and FHLB debt with retail deposits, which has structurally enhanced the balance sheet and will provide sustained improvement in net interest margins. In the short term, the rapid increase in rates will pressure margins as deposits initially reprice faster than assets, but over the medium term, Ally continues to see a strong NIM in the upper 3%.

Ally Financial is the #1 prime auto lender in the US with over 22k dealer relationships. The primary asset on Ally's balance sheet is Finance Receivables and Loans (~70% of assets), of which 65% relates to $82bn of Consumer Auto Loans. Given the concentration of risk aligned to Consumer Auto, the market is clearly focused on a normalization of credit losses and the performance of Ally's auto loan portfolio. The company has implemented several measures to mitigate risk, such as tightening underwriting standards, reducing exposure to subprime borrowers, and increasing diversification across different asset classes.

In addition to the macroeconomic factors, there are several company-specific catalysts that could further drive Ally's growth and increase its valuation. One of these catalysts is the company's continued focus on digital innovation and customer experience. Ally has invested heavily in its digital capabilities, including its mobile app and online banking platform, which have earned the company high customer satisfaction ratings. These investments have also allowed Ally to scale its operations more efficiently than traditional banks, which could further reduce its cost structure over time.

Another catalyst for Ally could be the potential for industry consolidation. As smaller banks struggle to keep up with the regulatory and technological demands of the industry, larger banks like Ally could have the opportunity to acquire smaller players and expand their market share. Ally has already made several strategic acquisitions in recent years, including the acquisition of CardWorks in 2020, which added credit card and merchant acquiring capabilities to the company's portfolio.

Conclusion

Overall, Ally Financial represents a compelling investment opportunity for investors looking for exposure to the banking and financial services sector. The company's low-cost business model, strong balance sheet, and focus on digital innovation and customer experience make it well-positioned to thrive in the current economic environment. With a valuation that does not fully reflect the company's growth potential and downside protection, Ally could be an attractive investment for long-term investors looking for a stable and growing company in the financial sector.

Risks

Credit Risk: Ally's primary business is providing financing for automotive purchases. As such, a significant portion of the company's assets are consumer auto loans. This concentration exposes Ally to credit risk, meaning that if borrowers are unable to repay their loans, Ally may suffer losses. Changes in economic conditions or consumer behavior can also impact Ally's credit risk.

Interest Rate Risk: Like most financial institutions, Ally's profitability depends on the difference between the interest rates it charges on loans and the rates it pays on deposits. Changes in interest rates can impact the profitability of Ally's business. If interest rates rise, the cost of funds for Ally may increase, reducing its net interest margin and profitability.

Regulatory Risk: As a financial institution, Ally is subject to a range of regulations, including those related to lending, consumer protection, and capital requirements. Changes in regulations or non-compliance with existing regulations can impact the company's operations and profitability. In addition, regulatory actions, such as fines or restrictions on business activities, can also affect Ally's financial performance.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ALLY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.