InMode: Key Takeaways From 2022 Full-Year Results

Summary

- With a 44% margin of safety, InMode Ltd. is a growth company trading at value prices.

- InMode's full-year 2022 results and earnings call did little to quell investor frustrations and concerns over future growth.

- Has the market concluded INMD stock is a one-trick pony with market saturation priced in?

monkeybusinessimages/iStock via Getty Images

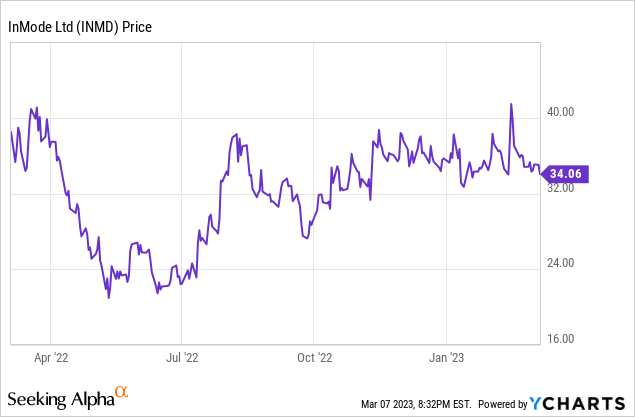

I've been a shareholder of InMode Ltd. (NASDAQ:INMD) on more than one occasion, having first discovered the company during the Covid crash of 2020. Like many of you, I use a stock screener to find potential investments. And InMode screens incredibly well on fundamentals, namely growth and profitability.

As of this writing, I again find myself to be a shareholder with a cost basis of $34.58 per share. I've owned shares for about a year and tend to keep a fairly close eye on my investments, namely operating results.

I recently listened to InMode's Q4 2022 and Full Year earnings call to glean a little more insight into company operations and, more importantly, future growth prospects. Here are a few of the key takeaways, some that leave me optimistic...and some not so much.

Too much cash

InMode's Q4 2022 earnings call isn't the only one I've listened to. I've listened to at least 6 or 7 others. A topic analysts frequently bring up during the Q&A session is the amount of cash on the balance sheet and what management intends to do with it.

Management's boiler-plate answer, regurgitated during each call, is three-fold:

- They're leaving the door open for share buybacks

- They may consider a special dividend

- They're looking at M&A opportunities.

Here's a quote from InMode Chief Financial Officer, Yair Malca, during the Q4 2022 call:

So, now all the options are absolutely on the table. We removed any restrictions or any tax -- additional tax requirement whatsoever. We are looking at all directions. The main thing we are looking right now, as Moshe mentioned, is some M&A opportunities. But buybacks or dividend or combination of buybacks with M&As, they are always an option.

And further supplemented by Moshe Mizrahy, InMode Chief Executive Officer, to squash all hope:

But we don't have any approved plan by the Board right now to do any of the buyback or dividend. This is just ideas that, in case we will not find any complement acquisition, we will consider it. But it's not on the table right now for 2023.

I swear, it's a copy & paste kind of response from call to call. I think all three options have merit if executed properly. At this point, I'm just ready for a decision to be made, and for management to get off the pot.

From Q4 2021 to Q4 2022, InMode's cash reserves increased by $110 million. I suppose having too much cash is a good problem. But if management isn't going to invest it back in the company for growth, I think they need to return it to shareholders.

Cash now unencumbered

InMode has been having a bit of a tax problem with the Israeli government. I don't know all the details, but the company recently reached an agreement with the Israeli Tax Authority which rendered all cash holdings unencumbered.

Here's an excerpt from CFO Yair Malca's prepared remarks:

With regard to taxes, InMode multiplied the provisions of the amendment to the investment law to its exempt profits accrued prior to 2020 and made a one-time payment of $12 million to the Israeli Tax Authority. In addition, the Company reached an agreement with the Israel Tax Authority under which the Company paid due in January approximately $14.3 million on its undistributed exempt income for the year ended December 31, 2021.

And further:

As a result, we expect to save up to $28.5 million in potential future tax payments, and our entire cash balance is now free and clear of any additional corporate tax requirements.

Has InMode been hoarding cash pending a resolution of its tax problems? I suppose time will tell, but it's definitely a win for the company and its shareholders.

Customer financing

Until recently, I hadn't considered that InMode's customers are most likely financing the purchase of devices. But with a price tag near $100,000, it makes sense. I know physicians earn a lot of money, but $100,000 is still a lot to cash flow.

You can probably guess where I'm going with this, but if not I'll spoil it for you...interest rates. Yes, this is a short-term, macroeconomic concern, but it may help explain the dismal stock performance and cheap valuation.

Rising interest rates deter customers from financing large purchases. Management indicated they're not seeing any impact to demand or revenue at this time, but it's worth noting.

Shakil Lakhani, InMode President of North America, had this to say on the topic:

But it's - we've seen the U.S. market just as strong as it's ever been from our perspective, and the way we finished it was extremely good. We've had a good start to Q1 so far. So, we don't anticipate anything changing there. In terms of the funding environment or the financing environment, we haven't seen much of a slowdown. We've got some really great partners, and we have some really good programs that are put together to help some of the physicians kind of get through.

One-trick pony or pony with many tricks

Like it or not, InMode's main source of revenue and profit is selling various iterations of the same or similar products. Don't get me wrong, the company is doing an excellent job of it. They're innovating, and advancing RF treatment in new specialties, an example being ophthalmology. But at some point, I have to believe the market will be saturated; a previous author did a good job pointing this out.

So, my gut tells me InMode is a one-trick pony. The big question is, how long is it going to take to saturate the market? I'm a shareholder because I think there's still a lot of meat on the bone. But there are two things I would like to see from InMode: 1) a lot more recurring revenue; and 2) a pony with more tricks.

When asked how much further penetration may be left in North America given a current installed base of some 8,000 units, CEO Moshe Mizrahy had this to say:

I mean, I would like to add to what Shakil said, just for comparison, right now, there are more than 30,000-35,000 active laser equipment in the United States, or even more than that. So we are now in the range of 8,000. So just figure out that every doctor who are using laser for static future and eventually will use RF for static as well. So we have a long way to go.

Based on this estimate, management is thinking they could pretty easily double the installed base in North America. I'm hopeful as well.

Valuation

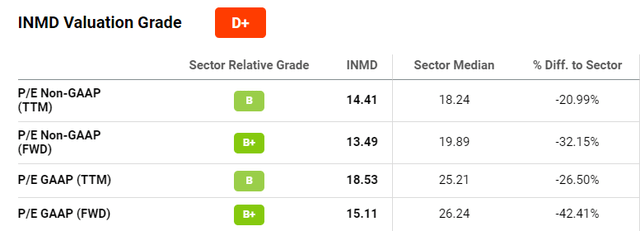

InMode looks cheap no matter how I slice it. Name another GAAP profitable company with >80% gross margins trading at a P/E in the low teens. I doubt you'll find one (admittedly, I didn't look). According to Seeking Alpha, InMode is trading at a >20% discount to the sector median.

INMD P/E Multiples (Seeking Alpha)

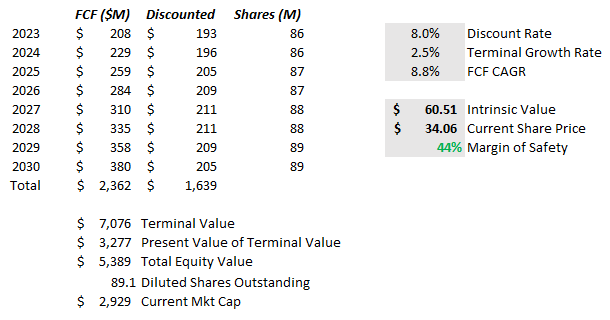

From a discounted cash flow ("DCF") perspective, I put an intrinsic value of $60 on InMode shares. This equates to a 44% margin of safety from the current share price of $34.

For the growth phase (7 years), I assumed a free cash flow ("FCF") CAGR of 8.8%, FCF margin of 38% (near historical average), and an 8% discount rate. I also assumed shares outstanding would increase by 0.5% annually, and a terminal growth rate of 2.5%.

INMD DCF Analysis (Author's data)

Conclusion

By all appearances, InMode looks to be an exceptional company generating tons of cash flow. It's why I'm a shareholder. But there are some growing frustrations and risks associated with holding shares.

With an estimated 44% margin of safety, I think the market's sentiment reflects my frustration. In addition to the concern InMode may be a one-trick pony.

However, I do believe there's still meat on the bone, and probable that InMode Ltd. reaches my intrinsic value of $60 within the next 5 years. If it does, I'll be a seller, and recommend you be the same...unless the company can learn some new tricks between now and then.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of INMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.