Honeywell Remains A High-Quality Industrial Facing Temporary Headwinds

Summary

- Honeywell faces similar headwinds to many other companies in the industrial space.

- The company is very well-positioned for long-term growth across its business lines.

- Honeywell won't set the world on fire, but it remains one of my top picks in industrials, and is at around fair value today.

Sean Gallup/Getty Images News

I first wrote on Honeywell (NASDAQ:HON) in 2016 in a series of articles on some of the most stalwart industrial companies in America. The company has beaten the market since then, but not substantially. I'm always happy to beat the market in any investment, but around 11% in 7 years isn't something to write home about.

Honeywell has never been the type of company you'd brag about owning over Thanksgiving dinner. The company has been well-run, with a consistently shifting portfolio of strong business lines set for growth. Conglomerates can easily mask the bad with the good. Honeywell has strategically shed many businesses over the years, and maintained a pretty consistent streak of acquisitions to shift its portfolio. Key examples include the acquisition of Intelligrated and the joint venture in Quantinuum among others. This has pushed the company forward technologically, and is likely the most prudent way for this old-line industrial to set itself up for future decades of success.

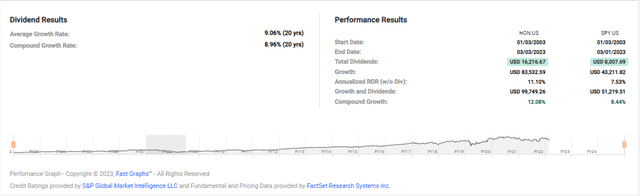

Over the past 20 years or so, the company has returned a 12% CAGR, with a dividend growth CAGR of 9%. An investment in the SPY would have yielded around 8.6%, so HON stock has done very well for investors over the long run.

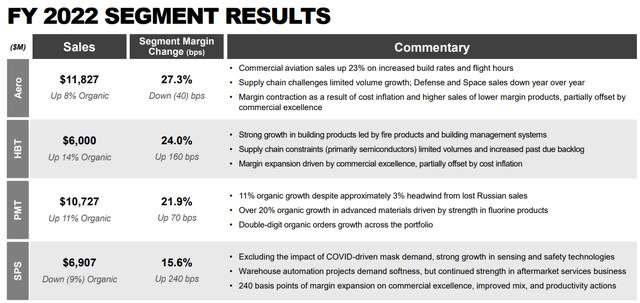

However, the company has definitely faced some headwinds of late. The exit from Russia impacted FY22 EPS by around $0.40. Sales in Safety and Productivity Solutions actually declined 9% this past year. Despite that, I actually see this as one of their most promising business lines. Margins in the segment expanded 940 bp's (in the fourth quarter), and 240 bp's on the year on strength in Intelligrated aftermarket, all offset by demand constraints in industrial automation. However, Allied Market Research projects a 15.4% CAGR in the industrial automation segment over the next decade to a $57.6B opportunity for companies in the space. Honeywell is not among the leaders currently, with companies like Amazon (NYSE:AMZN) headlining the list. A growth rebound here is projected by management in 2024, and this will be a key area to watch for Honeywell to take some market share. As initiatives push manufacturing back to America, automation and productivity in building solutions should be a boon for Honeywell. Additionally, defense is expected to return to growth this year as sales have been supply-constrained throughout 2022.

Within SPS, 20% growth in SaaS was a bright spot, with cyber, Sparta Systems, and connected building all up over 35%. The company continues to drive towards more and more recurring revenues, which should aid Honeywell in removing some of the cyclicality expected of an industrial company. Honeywell Forge, which includes its software offerings, drove strong growth in the face of headwinds elsewhere in the business, and remains a key reason I consider Honeywell to be favorably positioned among its industrial peers.

The company's Performance Materials and Technology segment provides exposure to the fickle oil and gas industry. However, Honeywell's products including absorbents and catalysts are efficiency and sustainability improvements for the industry which should remain in vogue as the industry shifts over to greener energy sources. Additionally, the company's Solstice molecule, the only EPA-approved replacement for legacy ozone-layer destroying flushing and cleaning products in the HVAC industry, is a duopoly with Chemours and should provide steady demand growth well into the future. In the most recent quarter, advance materials grew 20% on the back of fluorine demand. Honeywell's positioning has benefitted the company on the sustainability front, and government legislation should continue to push further into environmentally friendly subsidies and requirements.

In Building Technologies, Honeywell is pushing an ecosystem of smart commercial products including energy metering, climate control, and security among others. This segment is tied to overall new construction, although aftermarket provides some regularity to the company's revenue stream. The value proposition is valid for its customers, however, as the company's sensors drive material improvements in facility operations. The company most recently drove 21% organic growth in building products on the back of supply chain improvements.

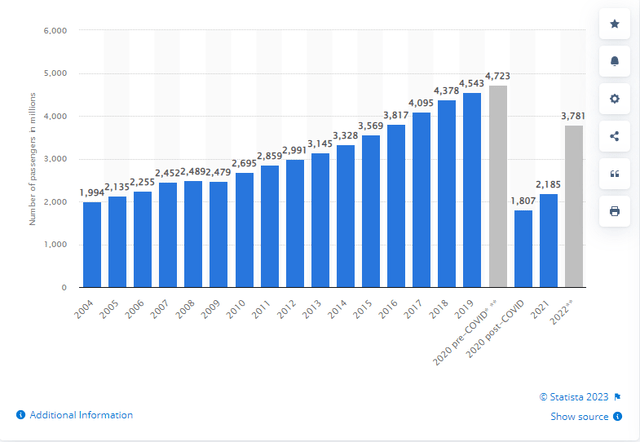

A bright spot from the quarter was in Aerospace. Honeywell's products have a massive footprint in the world's aircraft, and as I discussed in my Raytheon article, investors should expect strong tailwinds for the space from here. Grandview Research projects as low as a 4% CAGR in aerospace overall, but air traffic is still rebounding into this year from pandemic shocks, and the life cycle of these planes is incredibly long. Additionally, once a plane design is certified with a supplier's parts installed, they typically lock in service contracts for the life of the project and are loathe to swap suppliers for small price gains. Aerospace will likely remain a cornerstone of Honeywell's portfolio with strong, consistent demand over the long-term. The company drove 20% improvement in the backlog, and as supply chains normalize I'd anticipate meaningful production increases which will benefit the top line.

Pulling it all together, the company weathered 2022 well. There's room for improvement, but management reported $2B in top-line headwinds, and the company reported a 7% growth in the backlog to $29.7B, sales growth of 6%, or 10% without Russia, and EPS growth of 9% adjusted for a one-time charge. The company's Narco asbestos liabilities were settled, removing a future overhang. Additionally, two of the company's reporting segments drove double-digit sales growth.

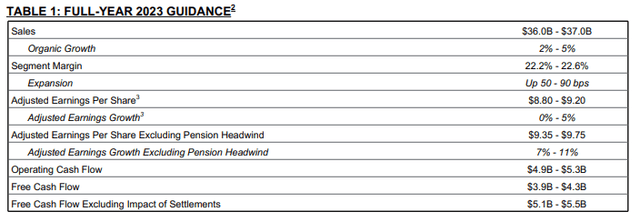

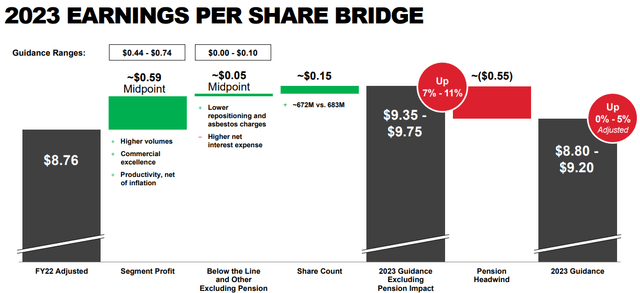

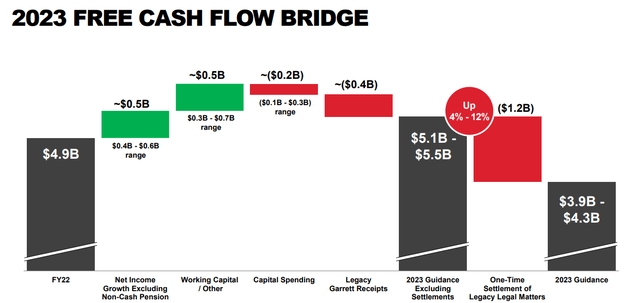

Looking at guidance, 2023 could be a tough year. However, take this with a grain of salt as Honeywell has a habit of underpromising and overdelivering on its projections. Projections have sales growth at 2-5% and EPS growth of flat to 5% or 7-11% adjusted for the anticipated pension headwind. The company discussed the headwind is related to higher interest rates, and the pension remains funded to 125%. Finally, free cash flow is expected to grow 4-12% adjusted for the Narco settlement discussed above.

In all, I think 2024 could be a solid year across the industrial space based on management discussions. Backlogs have grown, but supply chains remain constrained across the space. Patient investors could benefit from looking ahead just a little further to brighter days. While we wait, Honeywell has positioned itself across multiple growth industries to outperform and shift as much revenue as possible to more predictable and recurring streams. SPS will remain an overhang into this year, but I still maintain it's one of the better growth segments the company operates today.

Company Presentation

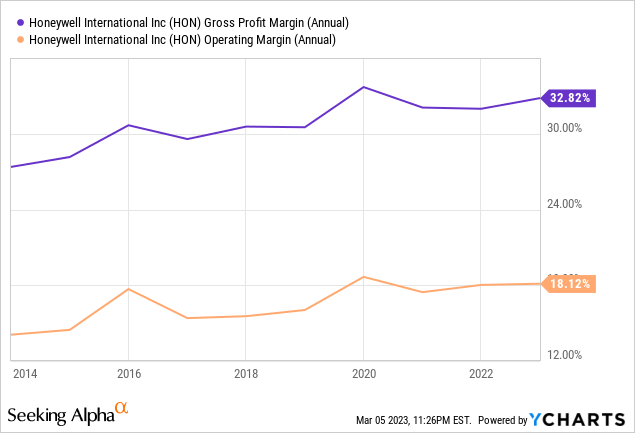

Operating margins have steadily risen over time as the company has instituted its productivity initiatives and shifted business lines. Gross margins have also increased, and 18% operating margins are a good spot to be.

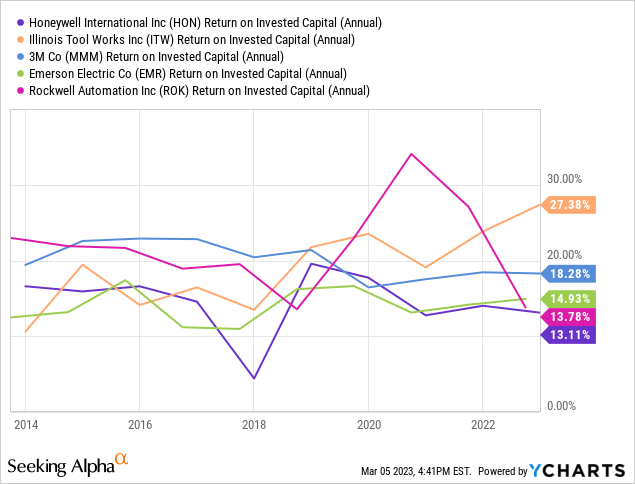

Returns on invested capital are not industry-leading at Honeywell, but they are relatively in-line with my peer selection and show shareholder value creation over time.

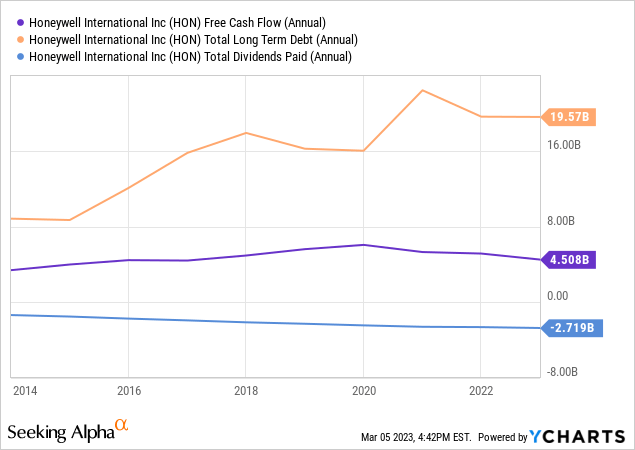

Looking at the balance sheet, free cash flow has not grown significantly, but long-term debt isn't in a bad spot, and the company is easily covering its dividend. The dividend has grown every year for 13 consecutive years, with the most recent increase at around 5% against a ~10% average over the past 10 years. Management has favored stock buybacks in some cases, which have resulted in bottom-line improvements. Overall, the capital allocation decisions have been appropriate based on the company's leverage, and Honeywell maintains the flexibility to continue acquisitions in higher growth areas.

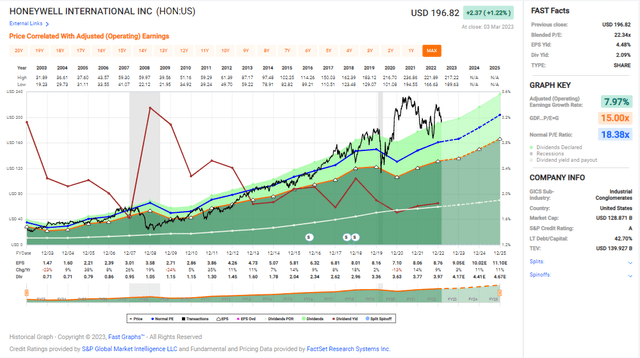

Company Presentation FAST Graphs

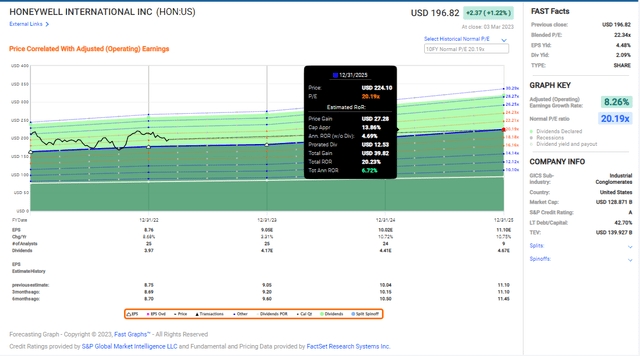

Looking at the company's earnings over time, growth has been steady at an 8% CAGR, with dips following the housing crisis and most recently following the pandemic. From here, earnings growth looks to resume strongly. The valuation doesn't put Honeywell at a value from a long-term lens, but at 23X earnings, it's likely close to its fair value not accounting for the earlier periods in the company's history.

Zooming the average valuation into the past decade, an investment today could yield around 7% annualized total returns. That's factoring in earnings growth of 3% this next year followed by a return to around 10% the following two years. I think this is very achievable for the company.

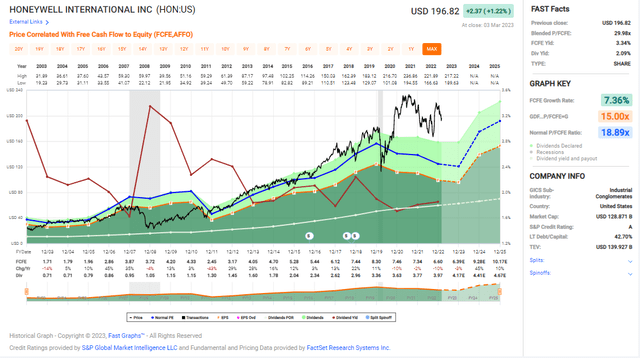

Free cash flow mimics earnings growth, at 7.3% annualized over time, with dips following the two recessions. It looks to snap back into 2024 as supply chains normalize and the company comes through recent headwinds. Looking to the future, free cash flow growth is expected to be closer to 12%.

Based on analyst estimates for free cash flow growth and a 25X multiple, an investment today could yield around 12% annualized total returns. Some multiple compression to 22X would be more in-line with the earnings projections at 7-8%.

Honeywell isn't going to set the world on fire with its growth. However, I think the company is very well positioned across its operating segments to continue rewarding shareholders. 2023 will likely continue to be somewhat below par for company growth, but as industrial automation and defense recover into next year, I think this will prove to have been a good time to buy the company. Two out of four operating segments posted double-digit sales gains this year, and Honeywell's balance sheet remains in a good spot. Honeywell is a buy on a long-term time horizon.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of HON either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.