Adtran: Government Subsidies To Boost Growth Through 2026

Summary

- ADTN is experiencing strong demand and growth in bookings due to the adoption of its fiber access platforms.

- ADTN is among the group of companies that will benefit significantly from the rise in fiber broadband installations, which is expected to continue for the next decade.

- I expect a recovery in gross margin, supported by price increases, to begin in 2H23 and margins to return to previous levels in the low to mid-40s.

- ADTN shares are currently trading at a significant discount to its historical multiple as well as to its peers.

style-photography

Thesis

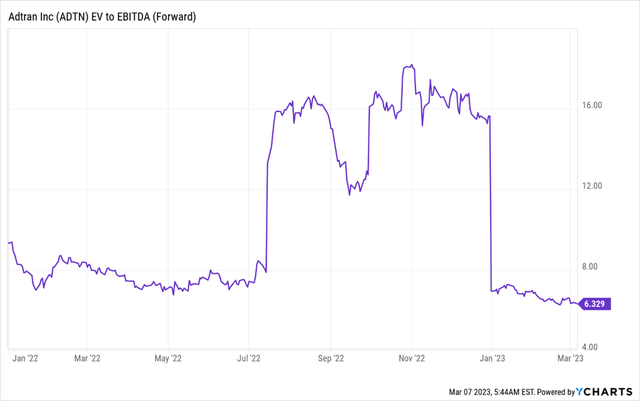

The COVID-19 pandemic has highlighted the importance of broadband service for households to function effectively, resulting in CSPs and over $135 billion in government subsidies to close the "digital divide" over the next decade. ADTRAN Holdings, Inc (NASDAQ:ADTN) is in a favorable position to benefit from new 10G fiber-to-the-home (FTTH) deployments. Key drivers of growth and margin expansion over the next few years include easing semiconductor supply chain constraints, several tier-1 contract wins, and the accretive acquisition of Adva with revenue and cost synergies. ADTN stock is currently trading at a discount to its own historical multiple as well as to its peers trading at forward EV/EBITDA of 6.3x. I keep an end-of-2023 price target of $28, based on an EV/EBITDA multiple of 8x.

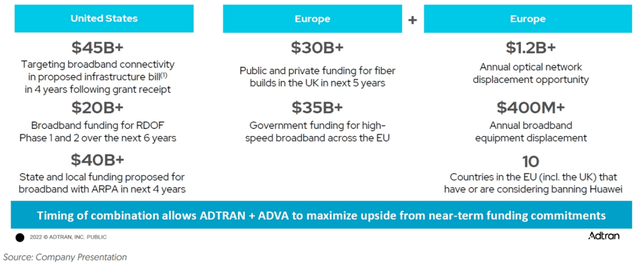

Government Funding to Drive Demand in the Next Few Years

ADTN is experiencing strong demand and growth in bookings due to the adoption of its fiber access platforms, in-home service delivery platforms, and SaaS applications by communication service providers (CSPS). Over the last two decades, there has been a slow shift from copper/DSL technologies to fiber-to-the-home (FTTH) in this market. The COVID-19 pandemic and the demand for work-from-anywhere (WFx) capabilities have further accelerated this shift towards fiber. Governments worldwide are providing substantial subsidies to support the deployment of fiber, which has been historically costly to deploy, particularly in rural areas. In the US, over $100 billion in subsidies is set to be distributed over the next 6+ years, primarily consisting of ARPA pandemic relief funds, Rural Digital Opportunity Fund, and the Broadband Equity Access and Deployment (BEAD) Program associated with the Bipartisan Infrastructure bill. In Europe, over $35 billion in government broadband stimulus has been approved.

Growth Catalysts for ADTN (Company Presentation)

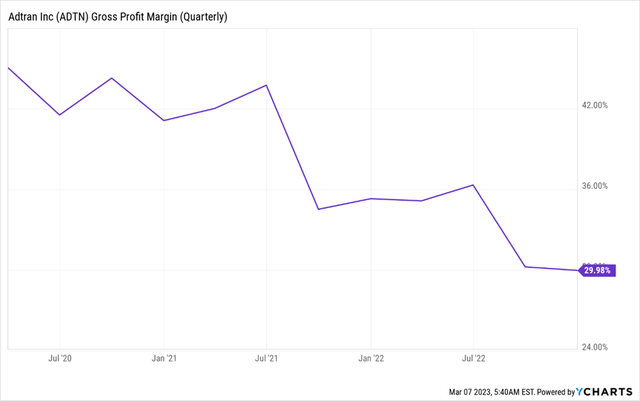

Reduction in supply chain constraints would ease pressure on the margins

ADTN has been facing issues in shipping its products due to supply chain problems. However, I anticipate a decline in freight overages and expedite fees, and an easing of semiconductor supply constraints in the next few quarters. This should improve ADTN's ability to ship its products as per its customers' desired timelines. I expect a recovery in gross margin, supported by price increases, to begin in 2H23 and margins to return to its previous levels in the low to mid-40s. With the company gaining market share in Europe and increased spending due to US federal subsidies, I believe there is potential for ADTN to exceed consensus revenue growth projections for the next two years.

ADTN Historical Gross Profit Margin (YCharts)

Valuation

ADTN shares are currently trading at a discount to its own historical multiple as well as to its peers trading at forward EV/EBITDA of 6.3x. Given ADTN's above average growth and expectation for the company to meaningfully outperform current 2023 sales estimates given the vast amounts of government subsidies flowing into the broadband access market, several Tier 1 wins in Europe set to achieve volume deployment at varying times over the next couple of years, and material improvements in the company's supply chain next year, I believe ADTN should trade at a higher multiple. I keep an end-of-2023 price target of $28, based on an EV/EBITDA multiple of 8x.

ADTN Forward EV to EBITDA Multiple (YCharts)

Delays in the rollout of government funds may impact revenue growth trajectory

I believe that ADTN's existing backlog is sufficient for the company to post high double-digit growth in the next few quarters, but the company is likely to face supply chain limitations throughout the year. In my view, ARPA subsidies issued by state and local governments are relatively less risky, while the FCC has been slower in approving long-form applications for RDOF, and any further challenges or delays in the distribution of these subsidies could result in project and shipment delays for ADTN's customers.

Final Thoughts

ADTN is among a select group of companies that will benefit significantly from the rise in fiber broadband installations, which is expected to continue for the next decade. With the move away from copper already completed and both private and corporate investments in fiber access increasing steadily in recent years, the US government has set aside around $100 billion, while European subsidies exceed $50 billion to ensure affordable broadband access for all. ADTN has a strong presence among US tier 2 and tier 3 segments, along with select tier 1 clients. In Europe, it is well-positioned as most CSPs are looking for a replacement for their former Chinese suppliers. The stock is currently trading at a discounted valuation compared to peers, and I believe ADTN should trade at a higher multiple as it continues to grow revenues at a high pace and improve margins as supply chain problems ease in the next few quarter. Therefore, I keep a Buy rating on the stock with an end-of-year price target of $28 on the stock.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.