'Everything Rally' Stalls As Hopes For Early Rate Relief Fade

Summary

- Stocks, bonds and key commodity prices broadly fell in February as investors revised up expectations for policy rate peaks amid surprisingly resilient inflation and global economic data.

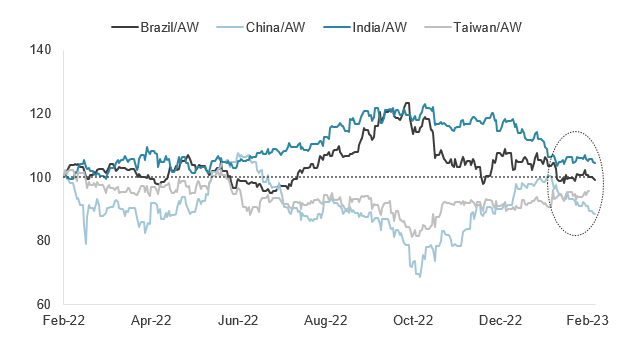

- Of the four largest emerging markets, only Taiwan continued to gain ground over the FTSE All-World in February. China’s February losses erased nearly all its advances versus the global index since late December.

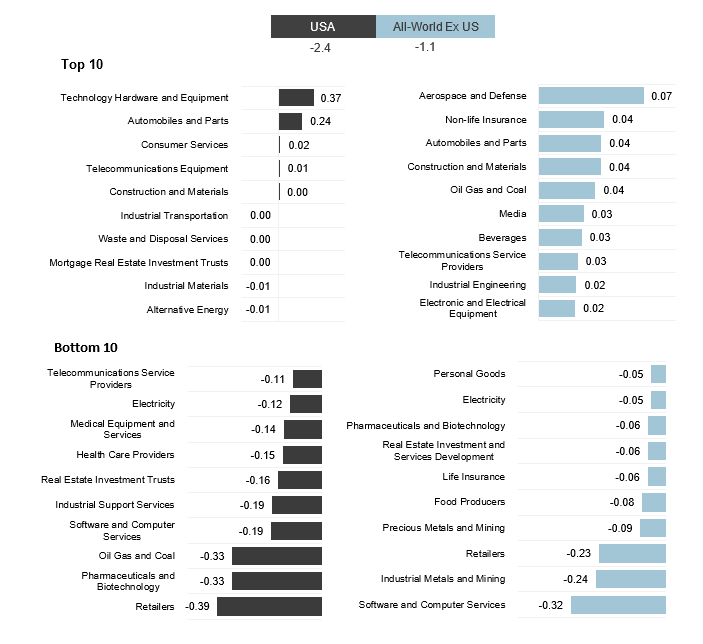

- US underperformance versus its overseas peers was broad-based, as seen in the February breakdown of the top and bottom 10 contributions to returns below.

Jonathan Kitchen

By Mark Barnes, PhD, and Christine Haggerty, Global Investment Research

Stocks, bonds and key commodity prices broadly fell in February as investors revised up expectations for policy rate peaks amid surprisingly resilient inflation and global economic data. As we cover in our latest Performance Insights report, the late-month resurgence in bond yields and US dollar underpinned big reversals in market and sector leadership from the previous month.

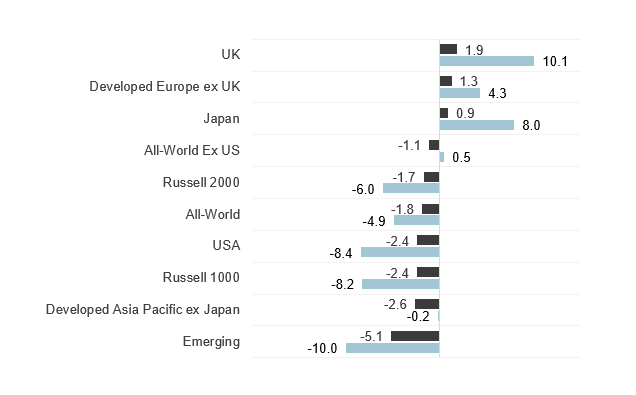

Amid a late-month uptick in volatility and risk aversion, equities in the UK, Europe and Japan ended February modestly higher in local currency terms, while developed peers in Asia Pacific and the US finished lower. In the US, small caps held up modestly better than the large-cap index. The Emerging index suffered even bigger losses than developed peers as many of its largest markets gave back some recent gains, notably China, Brazil and India (down 10%, 6.9% and 3.8%, respectively).

Global equity returns (%) – One month and 12 months ended February 28, 2023

Source: FTSE Russell. Data as of February 28, 2023. Past performance is no guarantee to future results. Please see the end for important disclosures.

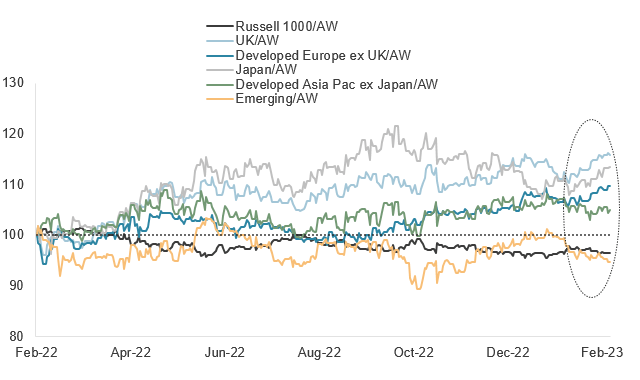

The February U-turn in equities reshuffled market leadership across regions. With their February gains, UK, Europe and Japan extended their 12M outperformance versus the FTSE All-World index, while the downturn in Asia Pacific reversed that market’s advances since last October. The Emerging and US indexes remained laggards for both periods.

Regional index returns relative to FTSE All-World (rebased, TR, local currency)

Source: FTSE Russell. Data through February 28, 2023. Past performance is no guarantee of future results. Please see the end for important legal disclosures.

Of the four largest emerging markets, only Taiwan continued to gain ground over the FTSE All-World in February. China’s February losses erased nearly all its advances versus the global index since late December.

Select FTSE Emerging Country returns relative to FTSE All-World (rebased, TR, local currency

Source: FTSE Russell. Data through February 28, 2023. Past performance is no guarantee of future results. Please see the end for important legal disclosures.

US underperformance versus its overseas peers was broad-based, as seen in the February breakdown of the top and bottom 10 contributions to returns below. Only two sectors contributed meaningful gains to the US index for the month, and its losses among the bottom 10 sectors were far bigger across the board.

Top and bottom 10 sector contributions to returns – One month ended February 28, 2023

Source: FTSE Russell. Based on Industry Classification Benchmark (ICB) data as of February 28, 2023. Past performance is no guarantee of future results. Please see the end for important legal disclosures.

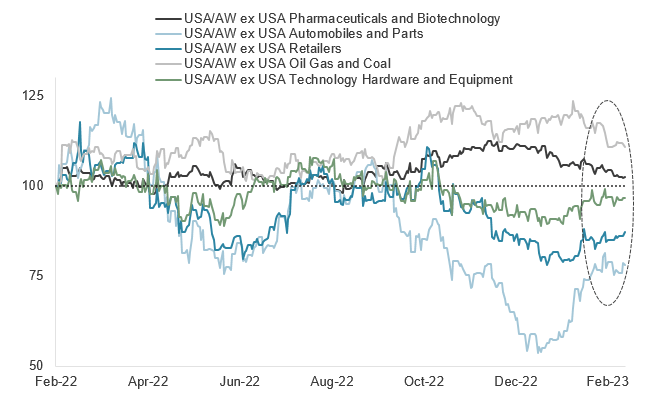

The chart below provides more detail on the give-and-take between the two markets: The bulk of the US’s lackluster relative performance came from lagging contributions in pharmaceutical & biotechnology, and bigger declines in retailers and oil & gas stocks. These setbacks more than offset the stronger contributions from US autos (light blue line) and its huge overweight in technology (green line), the only US stock group of the 11 FTSE Russell industry indices to post a gain in February.

FTSE USA sector returns relative to FTSE All-World sector returns (rebased, TR, local currency)

Source: FTSE Russell. Based on Industry Classification data through February 28, 2023. Past performance is no guarantee of future results. Please see the end for important legal disclosures.

© 2023 London Stock Exchange Group plc and its applicable group undertakings (the “LSE Group”). The LSE Group includes (1) FTSE International Limited (“FTSE”), (2) Frank Russell Company (“Russell”), (3) FTSE Global Debt Capital Markets Inc. and FTSE Global Debt Capital Markets Limited (together, “FTSE Canada”), (4) FTSE Fixed Income Europe Limited (“FTSE FI Europe”), (5) FTSE Fixed Income LLC (“FTSE FI”), (6) The Yield Book Inc (“YB”) and (7) Beyond Ratings S.A.S. (“BR”). All rights reserved.

FTSE Russell® is a trading name of FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “FTSE4Good®”, “ICB®”, “The Yield Book®”, “Beyond Ratings®” and all other trademarks and service marks used herein (whether registered or unregistered) are trademarks and/or service marks owned or licensed by the applicable member of the LSE Group or their respective licensors and are owned, or used under licence, by FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB or BR. FTSE International Limited is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

All information is provided for information purposes only. All information and data contained in this publication is obtained by the LSE Group, from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data is provided "as is" without warranty of any kind. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of FTSE Russell products, including but not limited to indexes, data and analytics, or the fitness or suitability of the FTSE Russell products for any particular purpose to which they might be put. Any representation of historical data accessible through FTSE Russell products is provided for information purposes only and is not a reliable indicator of future performance.

No responsibility or liability can be accepted by any member of the LSE Group nor their respective directors, officers, employees, partners or licensors for (a) any loss or damage in whole or in part caused by, resulting from, or relating to any error (negligent or otherwise) or other circumstance involved in procuring, collecting, compiling, interpreting, analysing, editing, transcribing, transmitting, communicating or delivering any such information or data or from use of this document or links to this document or (b) any direct, indirect, special, consequential or incidental damages whatsoever, even if any member of the LSE Group is advised in advance of the possibility of such damages, resulting from the use of, or inability to use, such information.

No member of the LSE Group nor their respective directors, officers, employees, partners or licensors provide investment advice and nothing in this document should be taken as constituting financial or investment advice. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors make any representation regarding the advisability of investing in any asset or whether such investment creates any legal or compliance risks for the investor. A decision to invest in any such asset should not be made in reliance on any information herein. Indexes cannot be invested in directly. Inclusion of an asset in an index is not a recommendation to buy, sell or hold that asset nor confirmation that any particular investor may lawfully buy, sell or hold the asset or an index containing the asset. The general information contained in this publication should not be acted upon without obtaining specific legal, tax, and investment advice from a licensed professional.

Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes only. Index returns shown may not represent the results of the actual trading of investable assets. Certain returns shown may reflect back-tested performance. All performance presented prior to the index inception date is back-tested performance. Back-tested performance is not actual performance, but is hypothetical. The back-test calculations are based on the same methodology that was in effect when the index was officially launched. However, back-tested data may reflect the application of the index methodology with the benefit of hindsight, and the historic calculations of an index may change from month to month based on revisions to the underlying economic data used in the calculation of the index.

This document may contain forward-looking assessments. These are based upon a number of assumptions concerning future conditions that ultimately may prove to be inaccurate. Such forward-looking assessments are subject to risks and uncertainties and may be affected by various factors that may cause actual results to differ materially. No member of the LSE Group nor their licensors assume any duty to and do not undertake to update forward-looking assessments.

No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of the applicable member of the LSE Group. Use and distribution of the LSE Group data requires a licence from FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB, BR and/or their respective licensors.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by