Arlington Asset: Complex And Leveraged, Discount To Book Not Enough

Summary

- Arlington Asset Investment Corp. is a REIT investing in MBS, MSR and commercial real estate CLOs.

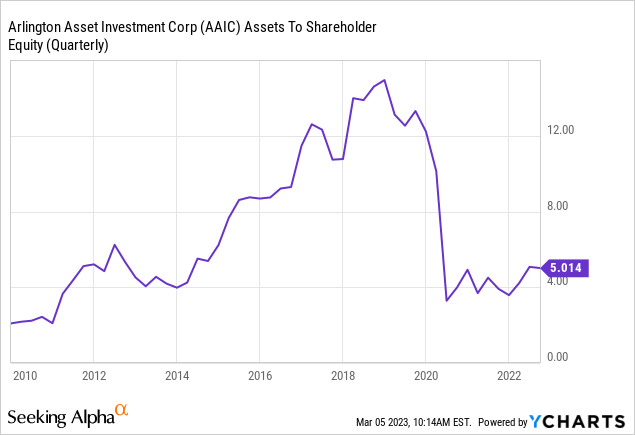

- The company leverages every one of its investments separately, which increases complexity. At the aggregate level, the company's leverage ratio is 5x.

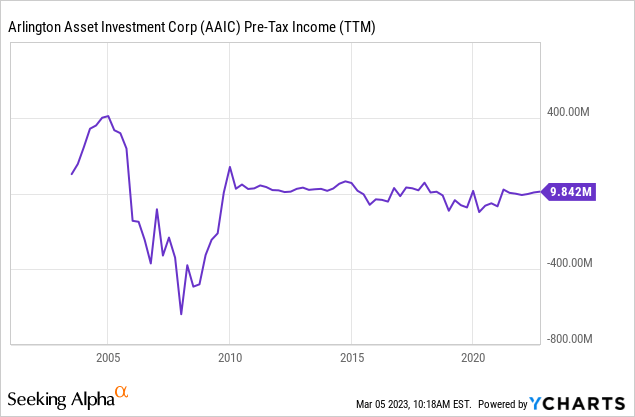

- AAIC has a history of generating enormous impairment losses because of taking too much risk by leveraging. The company lost hundreds of millions during the GFC.

- Today, AAIC trades at a deep discount of book value, but when leverage and complexity are considered, that discount does not provide a sufficient margin of safety.

- A 10% decrease in asset value would wipe out the company's discount on book value. Such a loss can materialize overnight in many scenarios because AAIC has complex leveraged exposures.

wichayada suwanachun

Arlington Asset Investment Corp. (NYSE:AAIC) is a mortgage REIT trading at a significant discount of tangible book value.

The discount is justified by a history of recurrent investment losses, a balance sheet heavily leveraged into risky assets, and a difficult macroeconomic context.

After analyzing the company's balance sheet, and historical income figures, I conclude that the company is not an opportunity at these prices.

Note: Unless otherwise stated, all information has been obtained from AAIC's filings with the SEC.

Business description

Mortgage investments: AAIC invests in three types of assets: agency mortgage-backed securities, non-qualified mortgages, and mortgage servicing rights. We will analyze each asset class below. Each has its own risk profile.

Leveraged book: The company is heavily leveraged at a ratio of 5 times assets to equity. This is the company's most important source of risk, particularly because most of the leverage comes from short-term repo financing (more on this below).

A high-risk proposition that has destroyed value: AAIC has historically generated enormous losses on its loan book and has not invested cautiously. The company generated losses during the GFC in the hundreds of millions.

During the decade after the GFC, characterized by falling interest rates and improving financial conditions, the company peppered some years of earnings with heavy impairment losses, netting a slight loss in average pre-tax income.

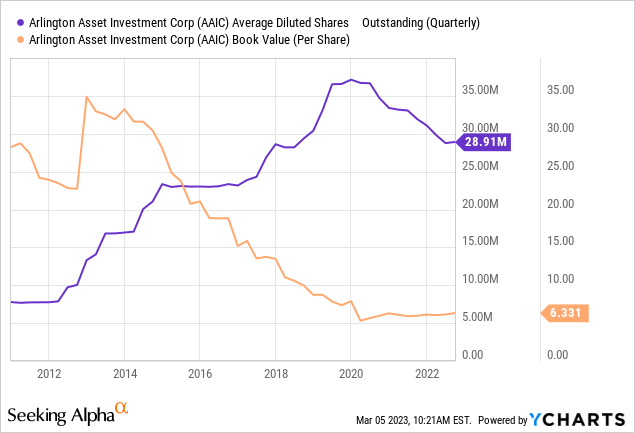

The losses were covered by issuing more shares and diluting previous shareholders. Still, the company consistently lost book value.

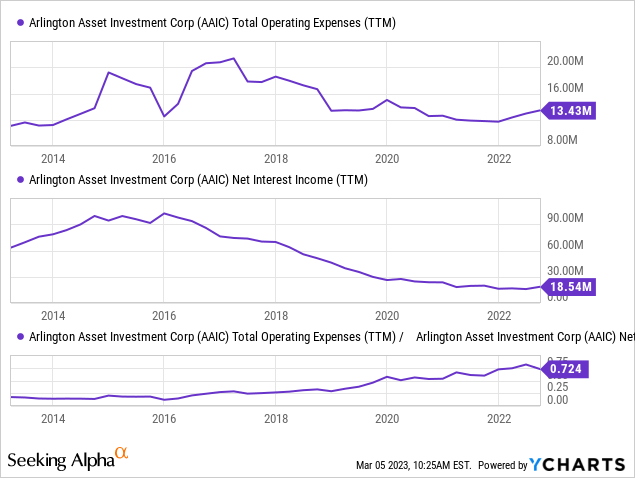

Low efficiency and high managerial compensation: The company's efficiency ratio before impairments (calculated as non-interest expenses over net interest income) is very high, meaning it consumes a significant portion of the interest generated on its own structure.

This situation was generated by decreasing net interest income without a corresponding decrease in operating expenses.

Particularly, managerial compensation is excessive. The company's CEO and CFO have averaged $4 million in aggregate compensation between 2019 and 2021, making more than a quarter of all operating expenses.

The book

This section covers the company's three lines of business/assets and how they are financed. The data corresponds to the third quarter of 2022, published in the company's 10-Q.

Qualified MBS: Agency MBS makes 45% of the company's assets at a fair value of $450 million. Agency MBS is the safest type of mortgage because the U.S. government guarantees the principal and interest of these securities. Further, only the best type of credit qualifies for an agency MBS.

Still, these assets carry interest rate risk and have suffered heavy capital losses in 2022 as interest rates climbed.

Unfortunately, it is difficult to understand the book characteristics of AAIC's MBSs because the company trades them constantly. Despite most MBS having very long maturities, usually well above 15 years, AAIC records sales and purchases of MBS above its whole MBS book every year. For example, in the 9M22 period, AAIC sold $650 million in MBS and purchased another $582 million. In the 9M21 period, the company sold $724 million and purchased $607 million.

Still, the company recognized fair value losses on its book for $60 million in the 9M22 period, as these low-yielding securities generated capital losses when interest rates skyrocketed.

These MBS are financed with short-term repurchase agreements (repos) for as much as $430 million in 3Q22, or 95% of fair value. Repos can become a nightmare during a financial panic because the lender can ask for the borrowed funds almost overnight, obligating the debtor (AAIC in this case) to fire-sale its assets when their valuations are at their lowest.

Off-balance sheet leveraged mortgage servicing rights (MSR): AAIC also holds $165 million in agency MSRs. An MSR is a right to receive basis points against the obligation to serve agency mortgages. The servicer makes payments to the agencies, finances the delinquent balances until the agencies guarantee them, and receives a portion of the payments (usually 25 basis points) in exchange.

A company needs a license to serve agency mortgages; AAIC does not have one. Therefore, the company has an agreement with a licensed servicer through which it finances the purchase of MSRs, and obtains the right to receive a spread above 12.5 basis points on that servicing, plus an excess over that spread and costs.

On top of that complexity, AAIC can indicate its servicing counterparty to pledge the financed MSRs and use the proceeds to purchase even more MSRs. The result is a structure that is leveraged 3:1, not consolidated in AAIC's books. However, AAIC has to provide the cash margin if its counterparty is margin-called on the leveraged MSRs.

MSRs require significant estimations to be valued because their value depends on prepayments and defaults of the underlying mortgages on which the rights are written.

Generally, the value of the MSRs goes up with higher interest rates because mortgage prepayments fall. This is positive in the current context, where higher rates are expected. However, fair value is obtained from models, not from liquid markets.

Servicing the MSRs can become burdensome because the servicer (and AAIC as the financer in this case) have to send the principal and interest payment of non-accrual mortgages to the agencies, waiting for them to guarantee them at a later time.

Leveraged non-qualified credit: AAIC increased its non-qualified credit book to $170 million from approximately $60 million one year ago. This book is, in turn, made up of two components.

First, $145 million in credit securities composed of non-agency MBS backed by commercial residential real estate mortgages. These are mortgages taken for business purposes, not by families planning to dwell on them. The risk of default on these mortgages is enormous, but this is already recognized in the assets' valuations, with expected default rates of 20%.

Another $25 million are represented by the net participation in the first-loss tranche of a VIE that invests in commercial real estate. Because the company owns the first-loss tranche, it has to consolidate the entity's assets ($205 million) and liabilities ($180 million). If the VIE's loans enter into default, AAIC is obliged to absorb those losses or to purchase the assets at their pre-default value to protect the other tranches from losses. This implies 8x leverage. That is, principal losses of 10% on the book, and AAIC's investment is wiped out.

Other assets and financing: The company also participates in derivatives, like mortgage futures (called TBAs) and naked short selling of Treasuries to hedge its MBS exposure.

On the liability side, on top of $430 million in MBS repos, and $180 million consolidated from the company's participation in the commercial real estate VIE, AAIC also owes $87 million in unsecured debt, $70 million of which pay 6.35% fixed (average of two issues) maturing in 2025 and 2026, and $15 million of which pay LIBOR + 2.5%, maturing between 2033 and 2035.

Finally, the company has two classes of cumulative preferred shares. The first class has a redeeming value of $9 million and pays 7%, and the second class has a redeeming value of $27 million and pays 8.25% until 2024, after which it pays variable LIBOR + 5.6%.

Valuation

AAIC currently trades at a market cap of approximately $85 million. We will approach its valuation through the income statements and the balance sheet. Both methods indicate that AAIC stock is overvalued.

The premium on complexity, leverage, and a bad record: AAIC has a very complex balance sheet, with leverage embedded in the securities, off-balance sheet agreements, and derivatives. Many of the company's assets do not have a liquid market to trade, and their fair value has to be estimated from models. Further, the company is extremely leveraged and has, in the past, generated enormous impairment losses because of complexity coupled with leverage.

Therefore, the investor should ask for a significant premium on earnings, and a significant discount on the company's book value per share, to accommodate for the enormous risk and complexity embedded in the company's operations.

Income-based valuation: As seen above, the company did not generate almost any income on average after the GFC because the income from some periods was later written down in impairment losses.

As of 9M22, the company is generating positive net income, but when dividends on preferred shares are accounted for, the result for common shareholders is still losses. Without selling its real estate renting business in 3Q22, the company would have generated a $10 million loss in that quarter alone, mostly from MBS capital losses.

On an income-based valuation, AAIC is overvalued.

Balance sheet based: As of 9M22, AAIC's equity stood at $215 million, of which approximately $185 million corresponded to common shareholders after removing the redeeming value of preferred shares.

This implies a price-to-book value per common share ratio of 0.5x, a significant discount. However, at a leverage ratio of 5x, a discount of 0.5x on book value implies only downside protection of 10%.

If (in the aggregate) the company's assets decrease 10% in value, the company's equity cushion is wiped out, and AAIC's book value will be $90 million.

This is without considering the specifics and complexities behind the different structures. For example, the company's agency MBS might do well regarding defaults, but further rate increases can precipitate margin calls and fire sales. Or conversely, an interest rate decrease can decrease the value of the company's MSRs, also tied to short-term repo financing.

Therefore, I believe that the 0.5x P/B ratio does not provide a sufficient margin of safety either and implies an overvaluation of the company's asset quality.

Conclusions

AAIC has a complex and leveraged balance sheet that carries enormous risks.

Because of leverage, the components that should have hedged each other (like long MBS and short Treasuries, or long MBS and long MSR) could very well backfire and generate (any one of them) losses big enough to completely wipe out AAIC's book value discount.

Complexity makes analyzing the different scenarios a harder task. In my opinion, complexity should pay a premium (conversely, a price discount on earnings or book), because even the best analyst is never sure every scenario has been understood correctly, with so many assets and liability types.

Further, if the company's track record is considered, the effects of taking so much risk and complexity are patent. The company lost millions during the GFC, and was unable to sustain earnings in the most accommodative financial context in recent history (the post-GFC decade).

For these reasons, I believe AAIC discount on book value is more than justified, and the company does not represent an opportunity at these prices.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.