Teck Resources: Exciting Change, Focused On Energy Transition

Summary

- Teck Resources Limited is now streamlining its business to reposition itself for the great energy transition.

- Teck Resources is going to split its business in two, Teck Metals and Elk Valley Resources.

- In this manner, Teck Metals should be able to get a high multiple based on its copper business, while still receiving $7 billion in royalty payments.

- Looking for more investing ideas like this one? Get them exclusively at Deep Value Returns. Learn More »

tifonimages/iStock via Getty Images

Investment Thesis

Teck Resources Limited (NYSE:TECK) is spinning off its steelmaking coal business and positioning itself as a growth business seeking to service the energy transition, by producing copper and other base metals.

Since the announcement came out a few weeks ago, the Teck Resources Limited share price has tumbled slightly, even though the news was well received on the day.

As an investor that unquestionably buys into the thesis that there's a massive demand for copper required for the energy transition, I find it difficult not to be bullish on Teck.

The reasons for the spinoff are relatively straightforward, Teck's copper business and the EVR business could both get a higher multiple with time. The blemish to the spinoff is that this separation is expected to be dragged out over several years.

Teck Metals Well-Prepared for Strong Copper Demand

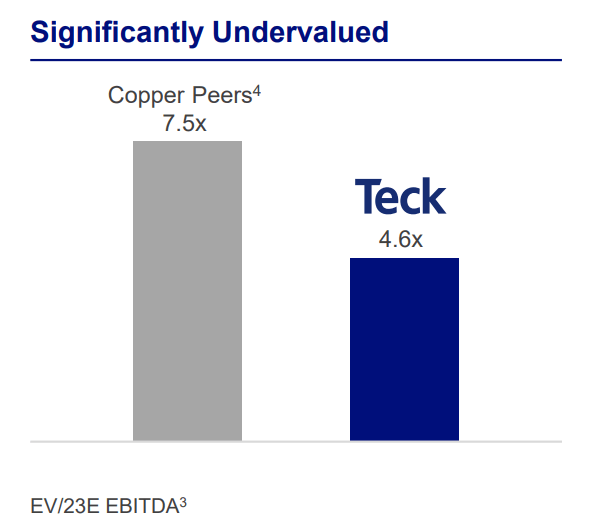

The graphic that follows gets to the core of the thesis for the company splitting in two, Teck Metals and Elk Valley Resources (''EVR'').

TECK Q4 2022

Essentially, having the steelmaking coal business together with the copper business was not allowing Teck to get rewarded with a multiple to EBITDA commensurate with its peers.

As you know, steelmaking coal is extremely cash flow generative but carries a significant stigma against it for two reasons: its environmental impact; and the erroneous misconception that it's not got a growth aspect to it. This will leave EVR as a publicly listed Canadian-based company.

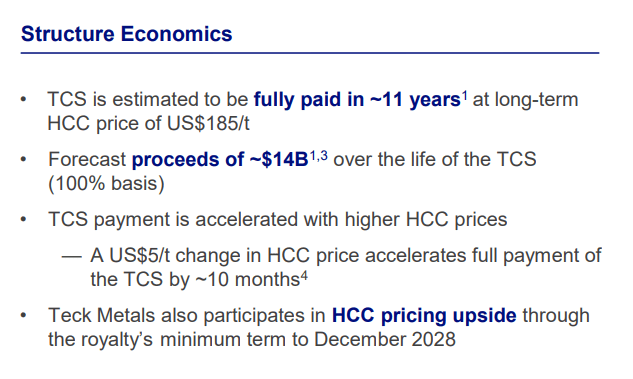

Nevertheless, the deal is struck so that over several years, there will be at least CAD$7 billion of cash returning to Teck Metals (the name of the ongoing Teck Resources business).

Teck Separation Presentation

Under different assumptions, there could be significantly more cash returning to Teck Metals.

Meanwhile, the bottom line is this, EVR's enterprise value is now valued at around CAD$11.5 billion. So, that means that what's left of Teck Metals is significantly undervalued.

The problem, as the graphic above illustrates, is that the proceeds will take a long time to return to shareholders of Teck Metals.

Teck's Balance Sheet is on Strong Footing

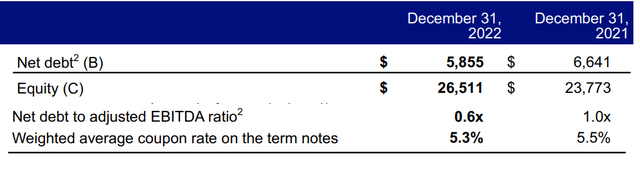

Moving on, Teck Resources stock made meaningful progress on its balance sheet in the trailing twelve months and ended Q4 2022 in much better shape. With a net debt to adjusted EBITDA ratio of 0.6x, Teck is now better-positioned to double down on its copper business.

This will allow EVR to be spun off as a debt-free enterprise, aside from its CAD$4.4 billion worth of preferred shares.

Looking ahead, I suspect that in the coming months, we'll hear from Teck about their commitment to meaningfully ramp up shareholder capital returns.

For now, this is what Teck's recently appointed CEO Jonathan Price said during the earnings call:

[Teck's] critical role in electrification and the energy transition will drive continued demand growth and premium valuation.

The thesis going forward is echoed in the quote above, that there's a massive demand for copper as part of the energy transition. And in this manner, Teck Metals will be well set up to participate in this growth opportunity.

The Bottom Line

Over the past several quarters, Teck Resources Limited has shed its energy business, and now it seeks to shed its steelmaking business.

I believe that, in time, investors will come to re-rate Teck Metals with a multiple that's significantly higher and more aligned with its copper peers.

Even though, in the very near term, the world's greatest consumer of copper and zinc, China, decided to set a moderate 5% economic growth target for 2023, which dimmed some of the excitement surrounding Teck's prospects as a streamlined copper and zinc business.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.