Broadcom Earnings Show It's Positioned For The AI Revolution

Summary

- Broadcom’s revenues and EPS grew by 15% and 23% in the quarter, respectively.

- The company is benefiting from strong corporate customer demand for networking, storage, and broadband products.

- Revenue growth is forecasted to slow down, but the company’s noncancellable order book is fully booked through year-end.

- Management believes the company’s acquisition of VMware is still on track to close in FY2023.

- The stock has popped on earnings, so we’d wait for a pullback to acquire shares as the short-term risk/rewards is slightly to the downside. We do believe the stock’s long-term return potential is 10% to 15% per annum.

- This idea was discussed in more depth with members of my private investing community, Cash Flow Compounders. Learn More »

Sundry Photography

Financial Results

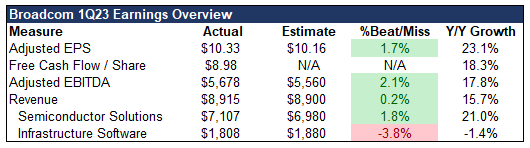

Broadcom (NASDAQ:AVGO) had another strong quarter. Revenues grew 15.7% y/y to $8.9 billion driven by 21% growth in the Semiconductor solutions segment, partially offset by a 2% decline in the Infrastructure Software segment. The revenue growth benefited Broadcom’s margins as the company has a high degree of operating leverage. Adjusted EBITDA margin expanded 120 basis points to 63.7%, which was 50 basis points higher than our estimate. EBITDA growth exceeded revenue growth, up 17.8% to $5.7 billion.

Earnings and free cash flow continued their strong track record of growth. A lower tax rate and share count as well as flat interest expense resulted on positive EPS and free cash flow per share leverage. Adjusted EPS grew 22% and free cash flow per share grew 23%.

Company Financials, Bloomberg

The quarter was another example of how well managed and positioned Broadcom is for the next generation of technological innovation. I have discussed in depth for subscribers to my marketplace how high performance computing is going to be the next driver of semiconductor growth this decade.

Outlook

Guidance for the second quarter implies a deceleration in revenues but continued margin expansion. Management forecasted revenues of $8.7 billion in the 2nd quarter, implying 7.4% y/y growth and the first sequential revenue decline for the company since 2020. EBITDA margins are expected to expand to ~64.5%, which would be the highest in the company’s history. We’re forecasting EPS growth of 8% in Q2.

On the call, Hok Tan outlined that he expects y/y revenue growth to slow over the next few quarters but will experience a soft landing. Slowdowns in the company’s handset business are expected to be offset by the strong demand for networking, storage, and broadband products.

For FY 2023, we’re forecasting revenues of $35.2 billion or growth of ~6%. We expect margins to hold up as Broadcom likely has more pricing power with customers of its networking, storage, and broadband products because there are more customers. This contrasts with the wireless business where Apple is the main customer, which gives Broadcom less negotiating power. Strong margins and further share repurchase result in EPS growth of ~18% to $45.32.

Return Forecast

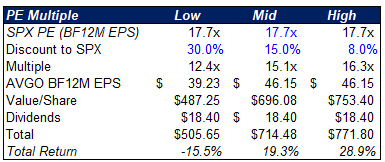

Applying our updated estimates and a 15% discount to the market’s current P/E of 17.7x (15.1x), Broadcom’s stock appears to have upside of ~10% to ~$700. If you include a year of dividends, that pushes the total shareholder return potential to ~15%.

The downside on the stock is probably ~$500, including a year of dividends, or approximately 19%.

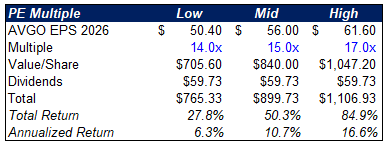

3-to-5-year total return upside could be 45% to 80% or ~10% to 15% upside.

Author's Spreadsheet Author's Spreadsheet

Conclusion

Broadcom is a high-quality Compounder. The company is well positioned to benefit from investments in artificial intelligence that are just in their infancy. The stock was up strongly on the report so we are waiting for a 5 to 10% pullback before we start thinking about acquiring more shares.

While the acquisition of VMware (VMW) was slightly delayed, the deal is still on track to close this year. This accretive acquisition should provide another $5+ billion of free cash flow for the company to return to shareholders or invest in future growth. VMW also reported their fourth quarter the same day as Broadcom and revenue and free cash flow growth were 5.2% and 48%, respectively.

Perhaps what is most attractive about Broadcom is the company’s strong focus on returning capital to shareholders. The BoD just raised the company’s dividend 15% to $4.60 per quarter. This equates to an ~3% dividend yield that should continue to grow in the mid to high single digits for several years.

Thanks for reading! Join our service Cash Flow Compounders: The Best Stocks in the World and build a durable, market beating portfolio. We have over 25+ years combined experience as institutional portfolio managers from mutual funds to hedge funds. Our high return on equity, high free cash flow stocks have a proven track record in compounding earnings over time. In our service we provide our BEST 2-4 ideas per month. Our picks going back to 2011 have produced just under 29% annual returns (TipRanks), roughly twice the market. Sign up for a free 2 week trial to get my latest ideas!

This article was written by

I contributed the 3rd most Top Ideas on Seeking Alpha in 2022.

I am a writer for Cash Flow Compounders where we seek to find the best companies in the world that will outperform the market.

Quality is the most important factor to me in stock picking. I believe that investing in companies with high free cash flow, low debt, and strong growth prospects will typically lead to market beating returns over the long term.

Valuation plays a critical role in my investment process. I rely on quantitative models to determine valuation and find good entry points for stocks.

follow me on twitter @njvalueinvestor as I'm looking to provide more of my daily musings there.

If you're looking for more in depth ideas, check out Cash Flow Compounders.

Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.