Why Essential Utilities Faces 35%-50% Downside Risk

Summary

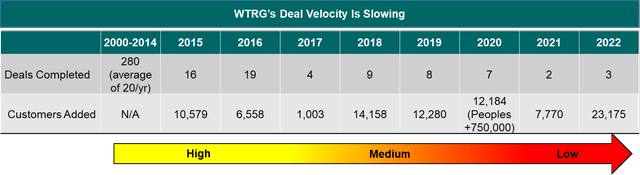

- WTRG is a roll-up of waste/water assets that we believe is facing severe growth headwinds due to challenges of completing new acquisitions among other things.

- We estimate WTRG needs to raise $1.7bn of capital in the next 12-18m, including $500m of equity being sold at market to cover capex, dividends and pending deals.

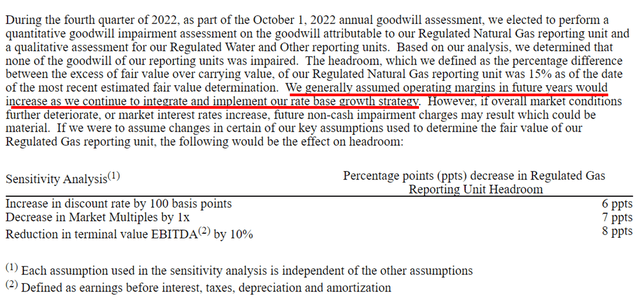

- WTRG's $4.3bn levered diversification bet into natural gas in 2020 is showing signs of failure. WTRG just included a warning of goodwill impairment in the new 10-K.

- WTRG just reduced its water organic rate base growth, and delays from closing DELCORA, rising interest costs and abnormally warm weather put 2023 estimates at risk of failure.

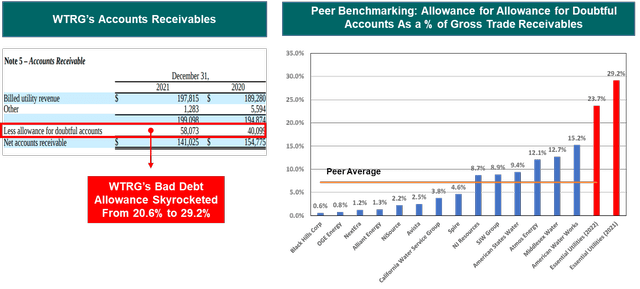

- WTRG's bad debts are significantly higher than peers, while cash flow margins have been falling every year since 2017. WTRG is pro forma levered >8x and has a premium valuation that we believe should contract. We see 35%-50% downside risk.

DKosig/iStock via Getty Images

Spruce Point Capital Management is also pleased to release a unique forensic research report on Essential Utilities, Inc. (NYSE: NYSE:WTRG) entitled "A Non-Essential Stock Holding". Below is a summary of some of our concerns and why we see 35%-50% downside risk. A link to the complete report is available at the bottom.

Essential positions itself as a utility/infrastructure investment which attracts investors due to the perception that it is a safe and insulated investment with an attractive dividend. However, we believe that perception is unwarranted, and that there are multiple signs of growing strains and risks being actualized with the investment story.

Since embarking on an aggressive roll-up acquisition strategy in the early 1990s of water and wastewater municipal assets, WTRG has made over 350 acquisitions spending approximately $4.5 billion in cash. Favorable regulation and the perception that infrastructure assets are safe, provide it an opportunity to borrow large amounts of money and implement higher prices to consumers while pushing the narrative that it is investing money to improve aging infrastructure to deliver reliable water services. However, like most roll-ups as they grow and mature, size ultimately becomes an inhibitor to continued growth. WTRG has already failed at multiple state and joint venture expansions, and we believe it is now at the declining phase of its growth story as its aggressive price increases and numerous snafus in billing, service and water quality have created an environment of public outrage against it. Meanwhile, growing pools of capital dedicated to infrastructure investing, the emergence of NextEra Energy as a major player in the space, and changes in legislation towards “fair market value” whereby municipalities can command more for their assets, has markedly increased WTRG’s competition in completing new acquisitions.

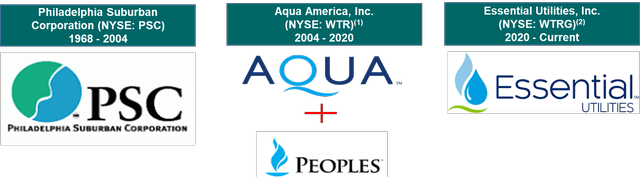

Spruce Point cautions investors to be wary of companies that go through frequent name changes and corporate “re-branding”. Essential Utilities, Inc. (formerly Philadelphia Suburban Corp and Aqua America, Inc.) was recently formed by the $4.3 billion levered acquisition of Peoples, which transitioned it from a water/wastewater to a water/wastewater and natural gas company. Our research indicates that the transaction is failing to meet expectations and being evaluated for goodwill impairment. With negative cash flow and record leverage at 7x Debt/EBITDA (8x pro forma for debt to be issued), we believe investors in WTRG will experience continued dilution and disappointment for the foreseeable future.

WTRG's Corporate Transformation (Company)

(1) “Philadelphia Suburban Corporation Changes Name to Aqua America, Inc. and Ticker To WTR; New Name Reflects U.S. Roots, Domestic Base”, Jan 16, 2004, Press Release

(2) “Aqua America Announces New Name and Executive Leadership Team Ahead of Peoples Closing”, Jan 16, 2020, Press Release

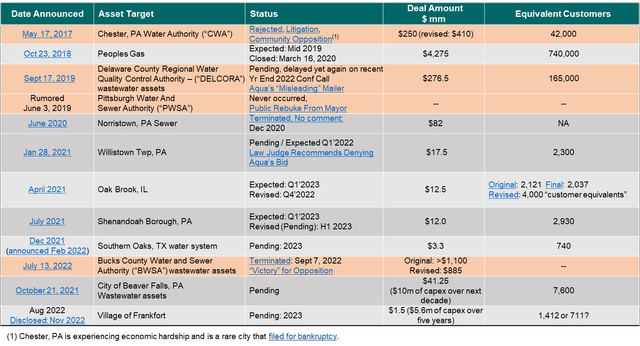

Spruce Point observes significant challenges in WTRG’s ability to close recent deals. Notably, four large transactions in WTRG’s home state of Pennsylvania have not materialized (BWSA, DELCORA, PWSA, CWA) and all received harsh resistance or blowback from community leaders. There have also been unexplained revisions in other recent pending and closed transactions.

Pending Deals (Spruce Point Research and Public News) Declining Deal Velocity (Spruce Point Research)

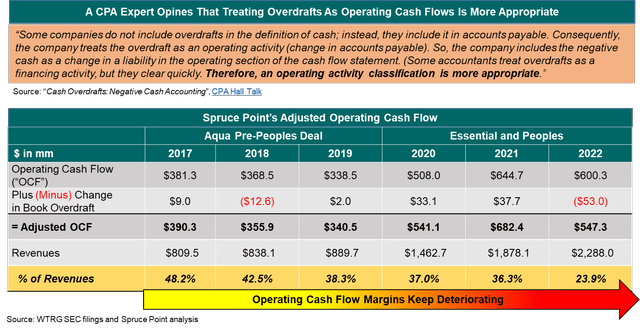

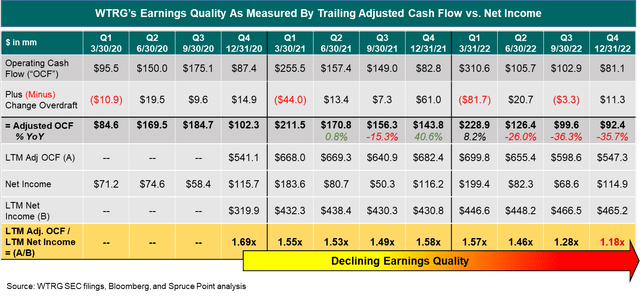

Spruce Point finds evidence that WTRG’s operating cash flow margin is in continued decline - having been 48.2% in 2017 to just 23.9% in 2022. Analytically, we reclassify changes in book overdrafts from financing to operating cash flows because they are classified as current liabilities and form part of working capital movements. Our analytical adjustment is supported by a CPA expert.

Adjusted Cash Flow (Spruce Point analysis and WTRG financials)

An indicator of the quality of WTRG’s customer base can be seen by analyzing its accounts receivable and allowance for doubtful accounts. Prior to the acquisition of Peoples in 2020, it averaged approximately 6.4% of gross receivables. We find that WTRG’s allowance as a percentage of gross receivables spiked to 29.2% in 2021 and is still highly elevated at 23.7% through year end 2022. Based upon a benchmarking analysis of its peers, we find that WTRG has by far the highest bad debt reserve.

Allowance for Bad Debts Benchmarking (WTRG and Peer SEC filings)

Source: WTRG 2021 10-K

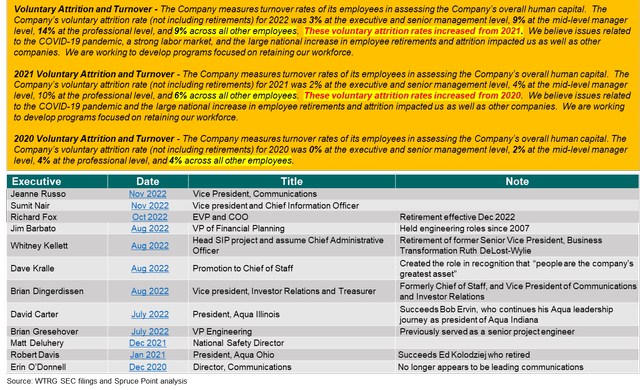

Voluntary attrition has more than doubled since 2020 from 4% to 9% and increased at all levels across the organization.

Voluntary Turnover (Spruce Point Research)

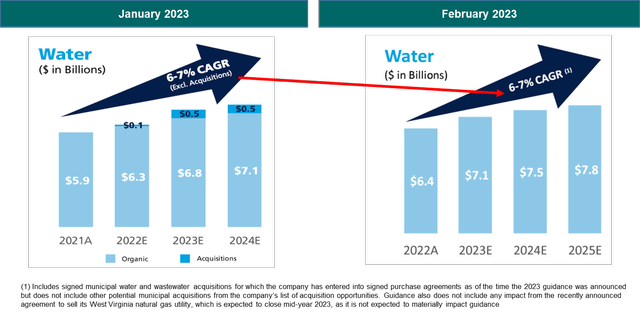

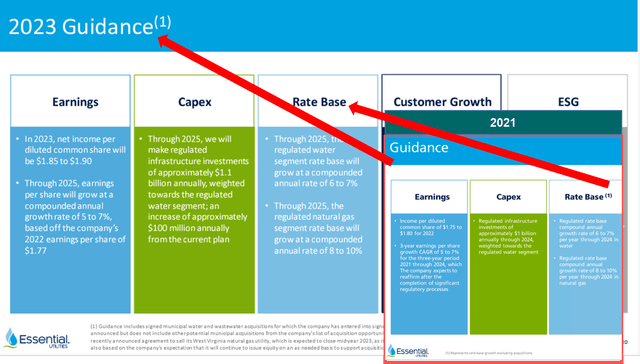

We believe that WTRG subtly cut its organic growth estimate for water rate base growth between January and February 2023. The latest investor presentation uploaded February 27, 2023 now includes acquisitions to achieve the targets 6-7% rate base CAGR growth.

Organic Rate Base Growth Declining (WTRG Presentation)

Source: Investor Presentations

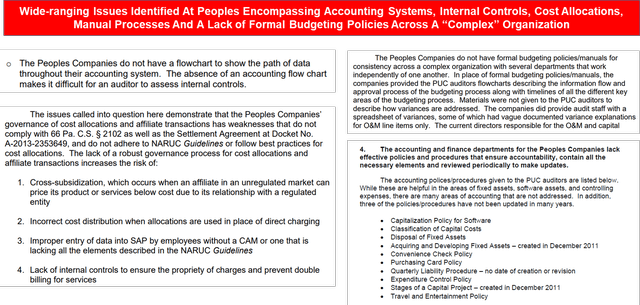

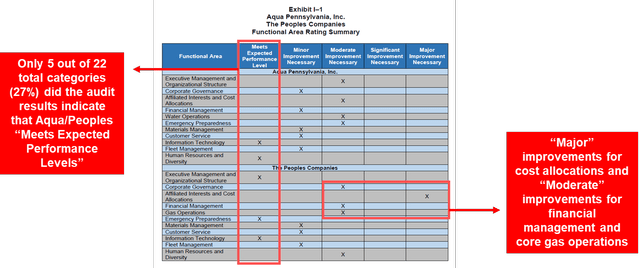

In October 2018, WTRG announced the acquisition of Peoples to expand into regulated natural gas. The Company paid $4.275 billion, assumed $1.1 billion of Peoples’ debt, and incurred $0.8 billion of incremental debt to finance the deal. The transaction valued Peoples at approximately 4.7x and 13.0x 2019 revenues and Adjusted EBITDA. WTRG claimed that the transaction would combine two companies with, “proven track records of operational efficiency, complementary service territories and strong regulatory compliance.”(1) Peoples was owned by SteelRiver Infrastructure Partners, who formed it through a roll-up, and whose marketing statements claimed, “a strong system of internal governance and controls,” and “a significant emphasis on value added through in-house asset management.”(2) According a recent audit by the Pennsylvania Utility Commission, Peoples needed moderate to major improvements in key areas of financial management, cost allocations, governance and core gas operations.(3)

Issued Noted By PUC With Peoples/Essential (PUC)

(1) Aqua America Deal Announcement

(2) SteelRiver Partners (website and press release). Peoples was created by acquiring TW Phillips (2011), Equitable (2013) and Delta Gas (2017)

(3) PUC, Management and Operations Audit, Aqua and Peoples, April 2021

Rate base growth potential is a key investor marketing pitch used by WTRG to show upside in its business. We find that Peoples is falling behind expectations for rate base growth and projections have quietly been cut by $100m per year.

Nat Gas Rate Base Growth Revision (Investor Presentation)

Source: Guidance Event, Jan 11, 2021

Source: Investor Presentation slide 47, IR Website, January 2023

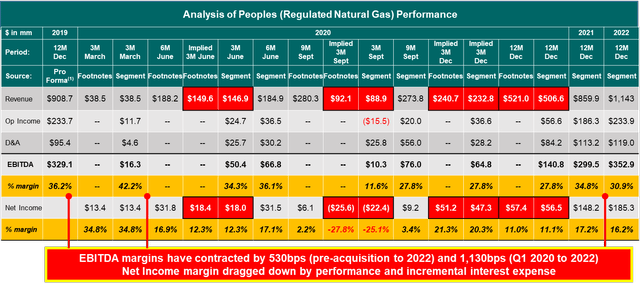

Spruce Point analyzed the performance of the transformational Peoples acquisition post-closing by WTRG on March 16, 2020. WTRG reports results in the Regulated Natural Gas Segment (below “Segment”). In addition, in the year post-closing, it reported revenue and net income contributed in the “Acquisitions” section (below: “Footnotes”) to the financial statements. Another observation we make is that EBITDA margins have contracted by approximately 530bps (pre-closing to 2022) and 1,130bps (Q1 2020 closing quarter to 2022).

Nat Gas Segment Performance (WTRG SEC Filings and SP Analysis)

Source: 2019 Pro Forma 8-K; 2020 Q1, Q2, Q3 10-Qs and 10-K; 2021 10-K; 2022 10-K

(1) Operating income adds back transaction expenses, removes sponsor management fees, and reclassifies certain expenses to conform to WTRG’s reporting

Approximately 93% of Peoples’ customers reside in Pennsylvania which is why we believe investors should have grave concerns about the recent state audit exam.

Source: PUC, Management and Operations Audit, Aqua and Peoples, April 2021

Spruce Point has never seen a company claim it needs to change its goodwill testing period for better alignment with long-term planning and forecasting, especially when its fiscal year reporting period did not change. As an additional concern, WTRG is now qualifying its testing and assuming margins will “generally” increase in the future, despite the fact they’ve now gone down consistently for three years post-acquisition. How general, or rather liberal, is WTRG being with its assumption?

"In 2022, we changed our annual goodwill impairment test date from July 31 to October 1, which is a change in accounting principle that management believes is preferable as the new test date better aligns with our long-term planning and forecasting process. The change did not delay, accelerate or avoid an impairment charge nor did it change our requirement to assess goodwill on an interim date between scheduled annual testing dates if triggering events are present. To ensure that no lapse in an assessment occurred since the prior period, we performed an impairment test as of July 31, 2022, during the third quarter of 2022 for all reporting units and noted no impairment."

Spruce Point frequently evaluates the ratio of operating cash flow to net income in assessing the “earnings quality” of a company’s financial reporting. In the case of WTRG, we see a clear trend that the ratio has been in decline post the closing of Peoples in Q1’2020. In the most recent Q4’2022 quarter, there was a substantial decline in the quality ratio.

Earnings Quality Deteriorating (WTRG SEC filigns and SP Analysis)

Evidence That Financial Targets Won't Be Achieved This Year

Notice that for the first time, WTRG added a large footnote on top of its guidance slide loaded with qualifications. In addition it removed a footnote over the rate base. Previously the rate base growth excluded acquisitions, but now it appears to include acquisitions. We believe this indicates that organic rate base growth is falling behind expectations.

2023 Guidance Changes (Investor Presentations)

Source: Investor Presentations

On the recent conference call, the CEO dropped hints that after consistently meeting targets, there were factors that could affect its ability to meet them this year. For example, DELCORA’s closing and revenue contribution being delayed to 2024 would result in 2023 revenue falling $44m below plan.(1)

CEO Franklin:

“Let's start out with some highlights from our 2022 year. Our focus on operational efficiency and infrastructure improvement and service-related priorities led us to another strong year, reporting earnings per share of $1.77, which is 6% better than last year and the midpoint of our 2022 guidance. It's also in line with our 5% to 7% long-term guidance, despite macro challenges of inflation and rising interest rates among other as you all know about. Importantly, in a context of that I want to point out that since I became CEO in 2015, my team and I have always met the guidance we provided to the street.”

And Later:

“As of this call, we have eight signed asset purchase agreements for nine systems across four states. All of these are in states where we currently do business. These acquisitions will add nearly 219,000 customers or customer equivalents and total nearly $380 million purchase price. Now, let's take a minute and talk about the status of DELCORA On our last call, you'll recall that we provided the PUC procedural schedule and our expectations of closing this acquisition in the first of 2023 based on the most recent legal and regulatory actions a mid-year closing is now unlikely, we now expect to close toward the end of this year.

All right, now before we walk through our 2023 guidance, I want to provide clarity on how we're thinking about the impacts of both weather and our acquisition program on the guidance we provided you last month. Dan mentioned earlier in the call, the colder than normal weather in 2022 had a favorable impact on revenues.

While it's very early in the year and we still have another month left in the first quarter. Year-to-date 2023 weather for the region where our natural gas segment is located has been approximately 20% warmer than normal. This will likely be a topic for our next earnings call for first quarter, but as a reminder the fourth quarter has a significant impact as usage as well. So, it's far too early to determine the weather impact on our results for the year.

Regarding our acquisition program, you may recall that DELCORA was included in the guidance we provided for 2023. I want to point out that we do not believe that the delay in the closing of DELCORA alone would cause us to fall outside our existing EPS guidance range for 2023. So, we'll continue to monitor the impact of weather and acquisitions but we remain confident. In 2023 guidance, we released last month.”

Source: FY 2022 Conference Call, Feb 27, 2023

(1) DELCORA 2023 Budget projects $88m of full year revenue; half-year revenue contribution estimated at $44m

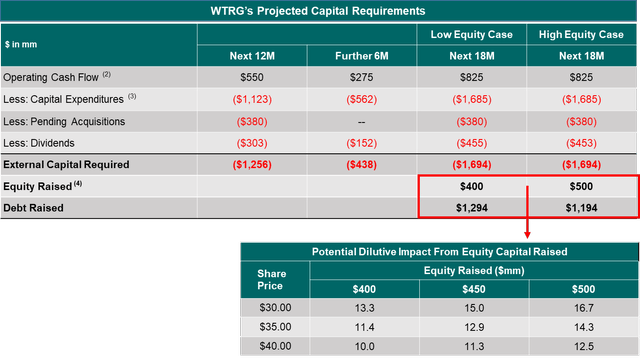

We believe investors should be discounting substantial dilution and more debt issuance into the forward valuation of WTRG’s equity share price. We estimate $1.7 billion of capital needs to be raised. Essential does not have a firm commitment to raise equity, but instead relies on a $500 million at-the-market (“ATM”) program whereby it can issue stock as it chooses.(1)

Estimated Capital Requirements (WTRG Filings, Statements and SP Analysis)

(1) ATM 8-K filing, October 14, 2022

(2) 2022 Adj. Operating Cash Flow is $547m, has been falling, and will likely trend further down in 2023 due to unusually warm weather. We conservatively estimate stable cash flow (see slide)

(3) 2023E Capex per 2022 10-K p. 54

(4) Equity raised per management 2022 year end conf call

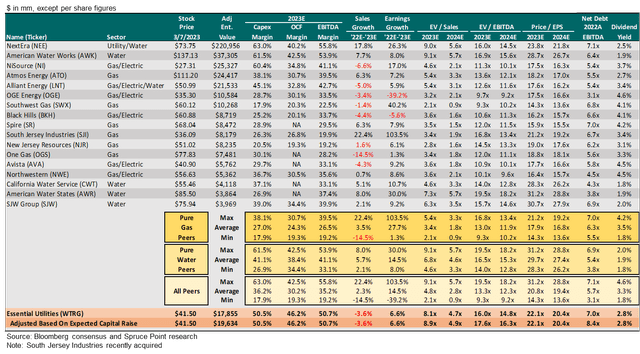

We believe WTRG trades at a rich multiple that makes little sense in relation to our evidence of its acquisition growth strategy facing challenges among other factors. A realistic valuation should consider that WTRG is both a water/wastewater utility and a regulated gas distribution business. Gas asset multiples trade at a discount to water assets based on our peer group selection below of: NEE, AWK, NI, ATO, LNT, OGE, CWT, AWR, SJW another others.

Relative Valuation of Peers (SP Analysis)

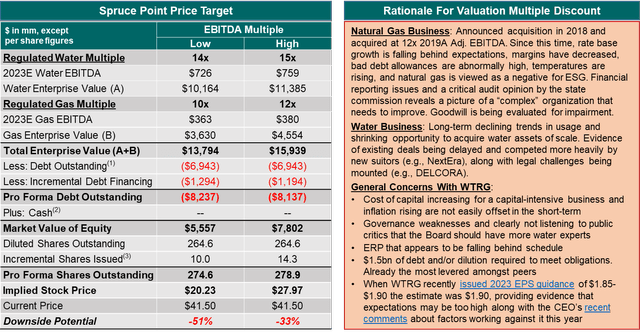

Spruce Point conducts a sum-of-the-parts valuation for WTRG’s water and gas businesses which are distinct and separately reported businesses. We estimate 35%-50% downside risk to WTRG's share price and list our reasons why below.

Valuation Range (Spruce Point and WTRG Data)

The complete report covering all of our concerns is available on our website.

Disclaimer: This research expresses our research opinions. You should assume that as of the publication date of any presentation, report or letter, Spruce Point Capital Management LLC (“SPCM”) (possibly along with or through our members, partners, affiliates, employees, contributors and/or consultants) along with our subscribers and clients has a short position in all stocks (and are long/short combinations of puts and calls on the stock) covered herein, including without limitation Essential Utilities, Inc. therefore stand to realize significant gains in the event that the price of either stock declines. Following publication of any presentation, report or letter, we intend to continue transacting in the securities covered therein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation. All expressions of opinion are subject to change without notice, and Spruce Point Capital Management does not undertake to update this report or any information contained herein. Spruce Point Capital Management, subscribers and/or consultants shall have no obligation to inform any investor or viewer of this report about their historical, current, and future trading activities.

This research expresses our research opinions, which we have based upon interpretation of certain facts and observations, all of which are based upon publicly available information, and all of which are set out in this research presentation. Any investment involves substantial risks, including complete loss of capital. There can be no assurance that any statement, information, projection, estimate, or assumption made reference to directly or indirectly in this presentation will be realized or accurate. Any forecasts, estimates, and examples are for illustrative purposes only and should not be taken as limitations of the minimum or maximum possible loss, gain, or outcome. Any information contained in this report may include forward looking statements, expectations, pro forma analyses, estimates, and projections. You should assume these types of statements, expectations, pro forma analyses, estimates, and projections may turn out to be incorrect for reasons beyond Spruce Point Capital Management LLC’s control. This is not investment or accounting advice nor should it be construed as such. Use of Spruce Point Capital Management LLC’s research is at your own risk. You should do your own research and due diligence, with assistance from professional financial, legal and tax experts, before making any investment decision with respect to securities covered herein. All figures assumed to be in Canadian Dollars, unless specified otherwise.

To the best of our ability and belief, as of the date hereof, all information contained herein is accurate and reliable and does not omit to state material facts necessary to make the statements herein not misleading, and all information has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer, or to any other person or entity that was breached by the transmission of information to Spruce Point Capital Management LLC. However, Spruce Point Capital Management LLC recognizes that there may be non-public information in the possession of WTRG or other insiders of WTRG that has not been publicly disclosed by WTRG. Therefore, such information contained herein is presented “as is,” without warranty of any kind – whether express or implied. Spruce Point Capital Management LLC makes no other representations, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use.

This report’s estimated fundamental value only represents a best efforts estimate of the potential fundamental valuation of a specific security, and is not expressed as, or implied as, assessments of the quality of a security, a summary of past performance, or an actionable investment strategy for an investor. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Spruce Point Capital Management LLC is registered with the SEC as an investment advisor. However, you should not assume that any discussion or information contained in this presentation serves as the receipt of personalized investment advice from Spruce Point Capital Management LLC. Spruce Point Capital Management LLC is not registered as a broker/dealer or accounting firm.

This article was written by

Disclosure: I/we have a beneficial short position in the shares of WTRG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.