SCHD: The Ultimate SWAN

Summary

- As you may know, we're soon launching our first REIT ETF Index and hopefully more to follow.

- As part of our research coverage, we have been increasing our flow of exchange-traded fund content.

- Today, we are focusing on Schwab U.S. Dividend Equity ETF, a bellwether ETF that can be described as the "ultimate sleep well at night" ETF.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

NicoElNino

A few days ago, I wrote an article titled "The Millionaire Mindset" in which I explained my fall from millionaire status and subsequent comeback story in which I rejoined the 7-figure club. As I explained:

"I no longer swing for the fences like I did in my 20s and 30s, instead I embrace rising stock dividends. There's a reason that millionaires are fond of dividends…"

To be clear, being fond of dividends is an understatement, because I actually love dividends. When it comes to dividend investing, it could be done primarily in one of two ways.

One could invest directly into individual stocks. This is the more exciting route for many, owning names like The Home Depot, Inc. (HD), The Coca-Cola Company (KO), or Johnson & Johnson (JNJ) to name a few. However, investing in individual names can also bring greater risk.

With greater risk also can bring greater reward, so it is a balance one has to decide when investing and the time horizon you have.

The other way, and more hands-off approach, is through investing in exchange-traded funds, or ETFs. When building a safe, reliable portfolio, it is always important to maintain a strong foundation. I consider ETFs to be foundational positions in a portfolio.

Investing does not have to be one or the other, in fact, I invest with both ETFs and individual stocks. It all comes down to one's risk appetite and how hands-on they want to be because with individual stocks it can require much more time and effort.

ETFs provide both stability and diversification for one's portfolio, and can be much less volatile than individual stocks, but not always depending on the ETF. However, today we are going to focus on what many consider to be the best dividend-focused ETF on the market today, and that is the Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD).

SCHD: The Best Dividend ETF

The Schwab U.S. Dividend Equity ETF is one of the most well-rounded dividend-focused ETFs on the market today.

- SCHD offers share price growth potential

- SCHD provides strong dividend growth

- SCHD offers a solid dividend yield

The ETF checks all three boxes. Let's look at those three boxes a little closer. Over the past 5 years, SCHD, from a total return perspective, has outperformed the S&P 500 to the tune of 76% vs 61%

Here is a look at the fund's performance over various periods:

- 1-year: +0.78% (S&P 500: -5.0%)

- 3-year: +60.5% (S&P 500: +42.6%)

- 5-year: +75.9% (S&P 500: +61.4%)

- 10-year: +230.4% (S&P 500: +215.2%)

As you can see, SCHD comes out on top over every period above.

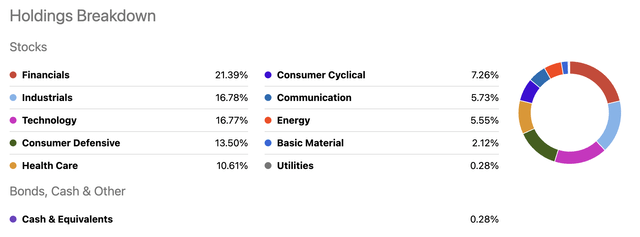

SCHD is an exchange traded fund launched and managed by Charles Schwab Investment Management, Inc. (SCHW). The fund invests in stocks of companies operating across various sectors. Here is a look at the fund's sector breakdown.

The fund focuses on dividend-paying stocks, and it seeks to track the performance of the Dow Jones U.S. Dividend 100 Index by using full replication technique. The fund was formed on October 20, 2011.

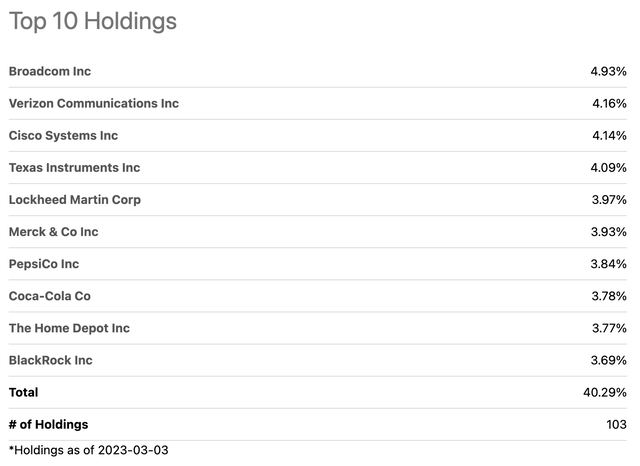

Next, let's take a look at the fund's top 10 positions and their weightings:

These top 10 positions make up 40% of the entire portfolio. In totality, the fund has 103 total positions. Let's take a look at valuation for each of the top 10 positions.

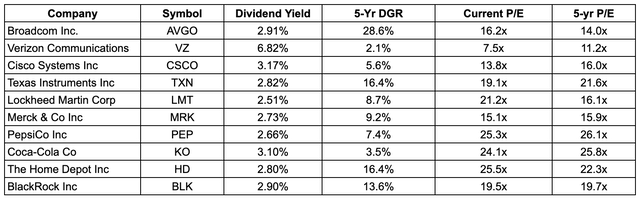

As you can see from the chart above, seven of the top 10 positions are trading at multiples that are below their historical 5-year average. All 10 dividend stocks are high-quality dividend stocks, which is something you want when investing in an ETF.

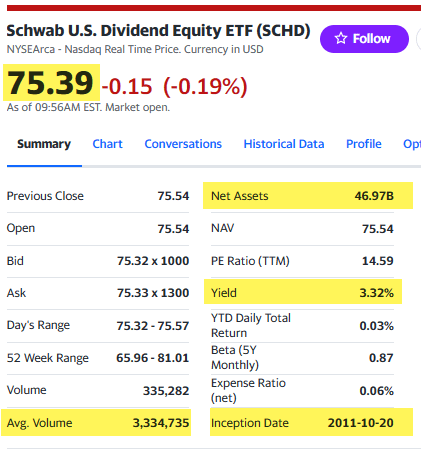

Now, let's take a closer look at SCHD's dividend. SCHD currently pays an annual forward dividend of $2.80, which equates to a forward dividend yield of 3.71%.

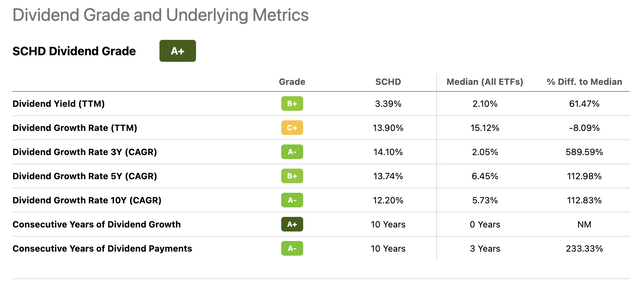

Seeking Alpha gives SCHD an A+ Dividend Grade, and here is why:

- Dividend yield: 3.71% which is higher than the median yield for all ETFs of 2.10% and SCHDs yield is more than double that of the S&P 500 which has a yield of 1.63%

- SCHD increased the dividend by nearly 14% over the past 12 months, and they have a 3yr DGR of 14% and a 5yr DGR of 13.74%, which is a very solid DGR

- SCHD has paid a growing dividend for 10 consecutive years

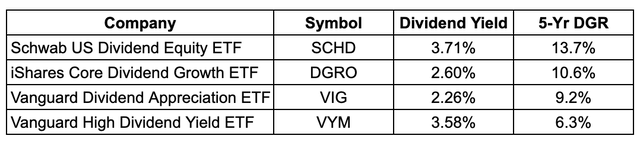

Let's compare SCHDs dividend yield and dividend growth to some other dividend-focused ETFs.

As you can see, SCHD has a higher yield and is also growing the dividend at a faster clip than all three of its peers.

SCHD outperforms in terms of yield and dividend growth, but that is not all: the fund also outperforms its peers in terms of total return over the past five years.

In Closing…

The Schwab U.S. Dividend Equity ETF is the king of Dividend ETFs. It checks off all the boxes as it relates to share price appreciation, dividend yield, and dividend growth.

Looking at the top 10 positions, which account for roughly 40% of SCHD, are all high-quality dividend stocks. The fund is well-diversified and can make for a great foundational position.

The icing on the cake is the fact that SCHD is a low-cost ETF with an expense ratio of just 0.06%.

Everything you want in a holding, especially during times of uncertainty like we are seeing right now in the U.S.

Yahoo Finance

As always, thank you for reading and Happy SWAN investing!

iREIT has been actively covering other ETFs such as...

- Pacer US Cash Cows 100 ETF (COWZ) 1.9% Yield

- Vanguard Real Estate ETF (VNQ) 3.8% Yield

- JPMorgan Equity Premium Income ETF (JEPI) 11.9% Yield

- InfraCap Equity Income Fund ETF (ICAP) 8.5% Yield

- iShares U.S. Real Estate ETF (IYR) 2.8% Yield

Get My New Book For Free!

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, and we recently added Prop Tech SPACs to the lineup. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 15,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 108,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Disclosure: I/we have a beneficial long position in the shares of HD, ICAP, JNJ, SCHD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.