GNT: Energy And Mining Equities With A 20% Leverage Ratio

Summary

- GAMCO Natural Resources Gold & Income Trust is an equities closed-end fund.

- As per its mandate, the fund is currently overweight mining companies and energy stocks, which comprise over 58% of the fund.

- The CEF has a low leverage ratio of 20% achieved via preferred shares and a large discount of -16%.

- This CEF represents a viable alternative to its sister fund GGN and can be obtained 10% cheaper.

- The structure has the ability to write covered calls but has used this option sparingly.

simoncarter

Thesis

GAMCO Natural Resources Gold & Income Trust (NYSE:GNT) is an equities closed end fund. As per its literature:

The Fund’s investment objective is to provide a high level of current income. The Fund’s secondary investment objective is to seek capital appreciation consistent with the Fund’s strategy and primary objective. Under normal market conditions, the Fund will attempt to achieve its objectives by investing 80% of its assets in equity securities of companies principally engaged in natural resource and gold industries, and by writing covered call options on the underlying equity securities.

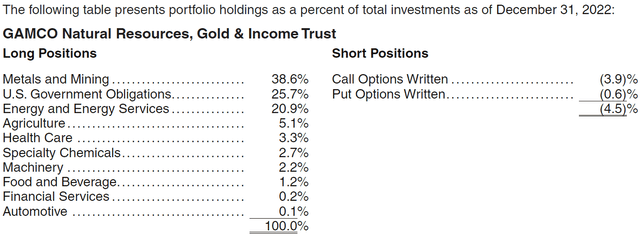

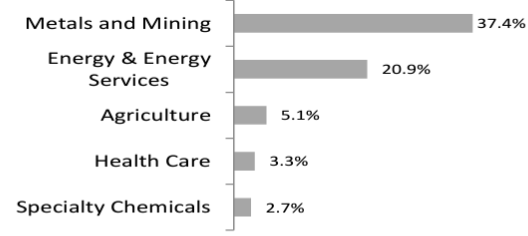

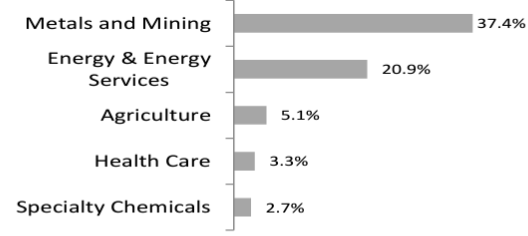

As per its mandate, the fund is currently overweight mining companies and energy stocks:

Sectors (Fund Fact Sheet)

We can see that the top two sectors account for over 58% of the fund currently. The fund has the ability to write options via cash covered puts or covered calls, but as of the latest available Annual Report, it uses this feature very sparingly:

We can see from the above table that as of December 2022 only 3.9% of the portfolio was overwritten with options while the fund had a 0.6% position in cash covered puts.

The fund is currently set-up very conservatively, with a 25% cash position. Usually large cash positions equated low returns, but in today's environment where a money manager can earn yields in excess of 4% on their cash balance, being set-up defensively is not a drag on performance.

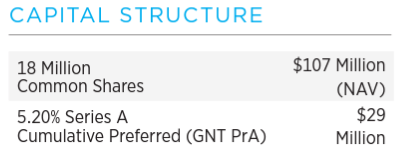

The fund has a low leverage ratio of 20% achieved via preferred shares placement:

Capital Structure (Fund Fact Sheet)

We like this set-up because it ensures a consistent cost of capital, especially in a rising rates environment like today's. We are currently seeing many CEFs, especially on the fixed income side, with a rising cost of capital on the back of short-dated repo facilities. Many of the CEFs with fixed cost of funds are well set-up in today's rising rates environment.

Analytics

- AUM: $0.1 billion.

- Sharpe Ratio: 0.5 (3Y).

- Std. Deviation: 22.7 (3Y).

- Yield: 7%

- Premium/Discount to NAV: -16%

- Z-Stat: -0.5

- Leverage Ratio: 20%

Holdings

The fund can be decomposed in two large asset classes:

- Mining Companies

- Energy Companies

Sectors (Fund Fact Sheet)

An investor needs to keep in mind that the fund does not take positions in the actual commodities, but in the equities of mining and energy producing enterprises. The differences between the returns of the underlying commodity and the equity of a company can be substantial at times, especially when balance sheet issues arise or environmental factors such as ESG factors come into play.

The current fund top holdings are:

Top Holdings (Fund Fact Sheet)

We can note that the list contains some of the largest global players in the mining industry such as Rio Tinto (RIO) and Freeport-McMoRan Inc. (FCX) alongside most of the global Oil & Gas majors.

The fund tends to have a gold miners tilt, via names such as Franco-Nevada (FNV) and Barrick Gold (GOLD).

Performance

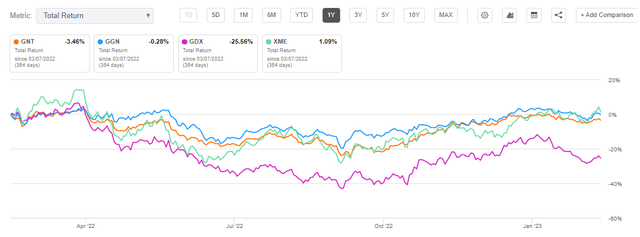

The fund has had a flat performance in the past year, mirroring the one exhibited by its much larger sister fund GAMCO Global Gold, Natural Resources & Income Trust (GGN):

We are comparing the CEF here with its sister fund GGN, with the VanEck Gold Miners ETF (GDX) and with the SPDR S&P Metals and Mining ETF (XME). We can see that the CEF's large allocation to gold miners has dragged its performance down. GDX is down substantially in the past year versus its comparison points.

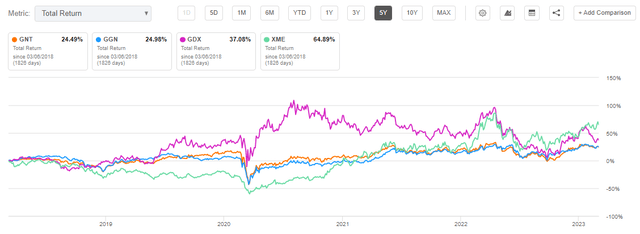

Long term the fund has a performance similar to GGN's, but overall modest returns:

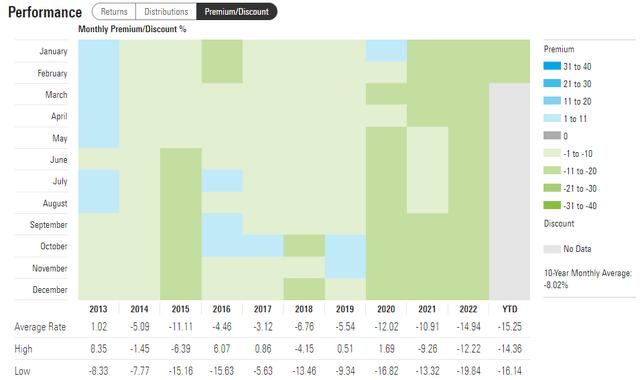

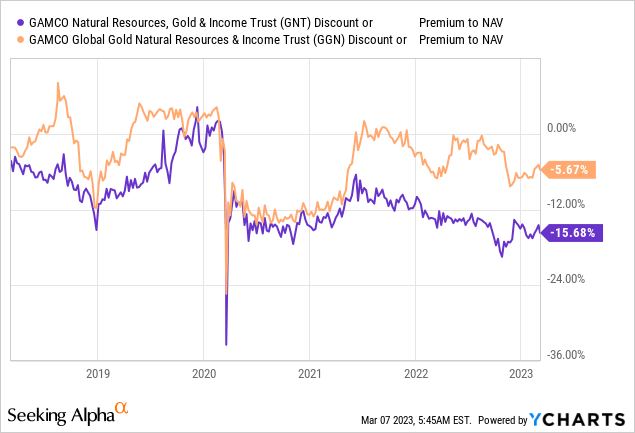

Premium/Discount to NAV

The CEF usually trades at a discount to net asset value:

Premium/Discount to NAV (Morningstar)

We can see how the CEF has traded at discounts to NAV of around -10% in the past few years. This feature is due to the fund's poor performance and its huge drawdown of almost -50% during the Covid crisis. If the CEF's performance does not improve markedly expect the steep discount to persist.

The fund has a similar performance to its sister fund GGN long term, but their premiums have diverged:

We can see how the two funds started trading with different premiums to NAV mid-2021. We do not think this is warranted given their similar total return performance.

Conclusion

GAMCO Natural Resources Gold & Income Trust is an equities closed end fund. The vehicle focuses on mining and energy companies and exposes a low leverage ratio of 20%. The CEF achieves its leverage via a stable funding source, namely preferred equity. The mining and energy sectors account for over 58% of the fund currently, while the fund is also conservatively set-up with a 25% cash position. The fund has the ability to write covered calls but uses this feature sparingly. GNT is very similar to its sister fund GAMCO Global Gold, Natural Resources & Income Trust, having an almost identical long term total return. Investors interested in GGN can pick up the same exposure with a -10% discount via GNT. We feel energy strength in 2023 is going to be offset by more weakness in gold miners, therefore we are on Hold with respect to GNT.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.