The Worst Lies Ahead Of Us: Part I-Euphoria's Last Stand

Summary

- The first quarter was far better than expected but I do not believe it will last, as the long lags to monetary policy persist.

- First quarter earnings season is likely to show the flow through of multiple items that will reduce earnings further.

- The Long-Term Treasury is giving investors an opportunity to preserve capital in an increasingly overvalued market.

- Since I called the top in rates in October of 2022, calling the long bond the best contrarian idea in the market today, the 30 year zero (ZROZ) has rallied 14.32%, beating the S&P 500 Index +8.09%, the Nasdaq +8.93%, and the Russell 2000 Index +9.26%, and I believe it remains a port in the coming storm.

CreativaImages

Euphoria's Last Stand

The first quarter of 2023 has been far better than anyone predicted so far. Investors headed right back to their previous speculative behavior, bidding up shares of the highly indebted, non-profitable stocks that characterized the meme stock craze we saw in 2020 and 2021. Part of this was the result of these same stocks getting hammered in 2022, resulting in retail investors thinking they are getting a bargain.

However, as Ben Graham taught us decades ago, in the short run, stocks act as a voting machine but in the long run they are a weighing machine. Research further has proven the viability of the conclusion that stocks ultimately price based on earnings, and thus, profitability drives long term stock returns.

This year, Nasdaq is up 13%, driven by unprofitable tech companies. The most shorted companies in the market are up 17% YTD. It is not fundamentals supporting this rally, it is short covering, and unprofitable tech being bought by retail investors. Bulls should be careful; they are standing on a house of cards. As retail piles in, the data is worsening in the real economy. With the speculative stocks that have no earnings leading so far this year, it is clear this is not a quality rally we are seeing. Rather this is the last stand in a bear market rally before the avalanche phase of the bear market takes over.

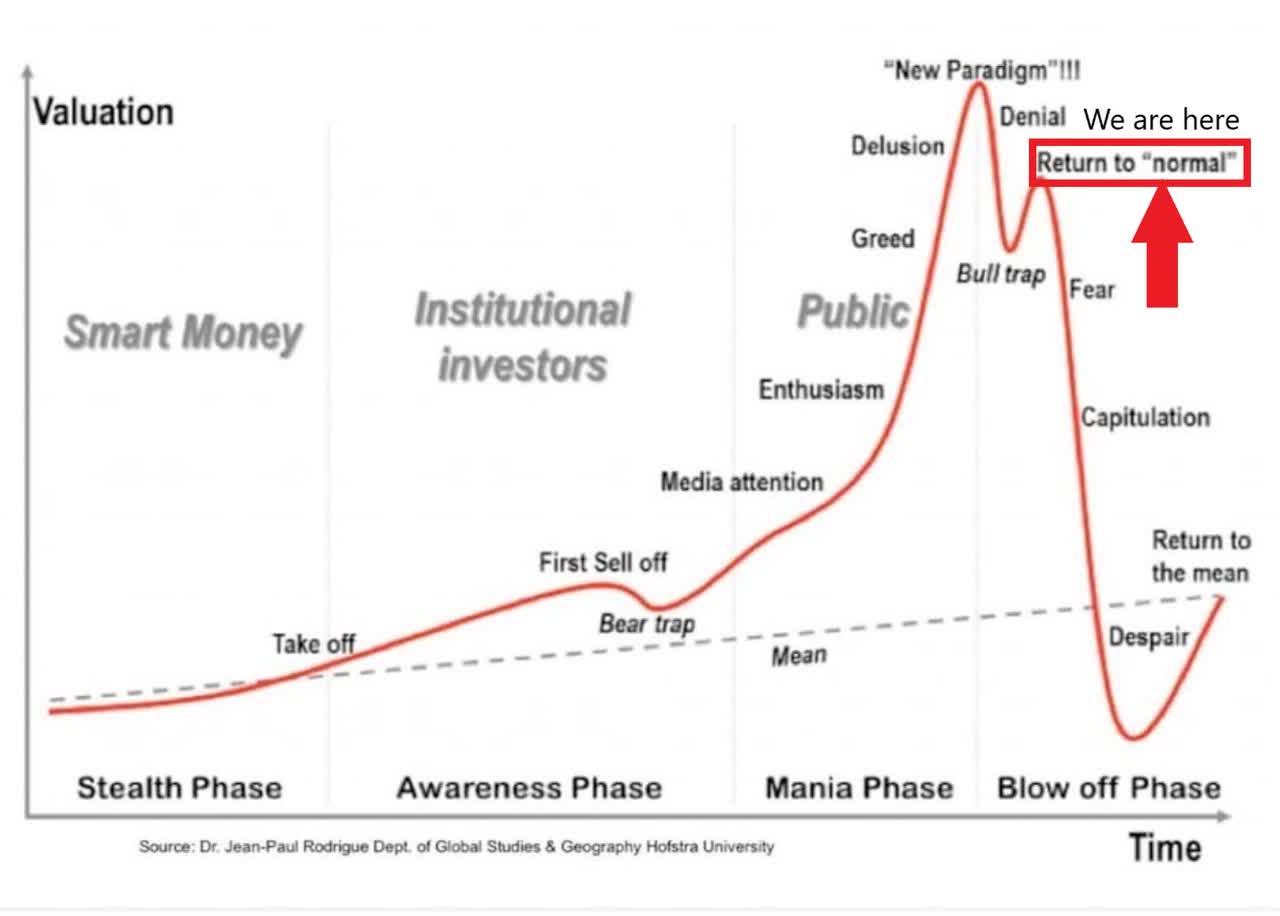

The Market Cycle of Investor Behavior (Dr. Jean-Paul Rodrigue Dept. of Global Studies & Geography, Hofstra University)

The Global Economy Continues to Weaken

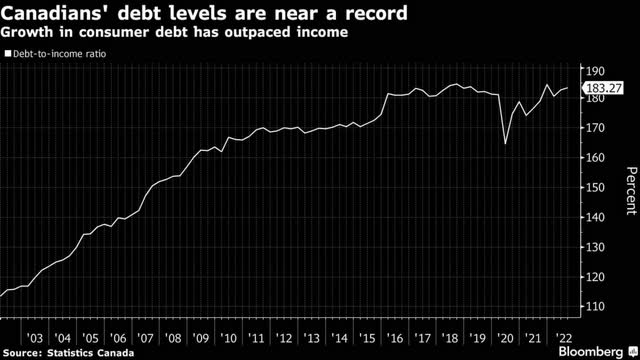

A recent article in Bloomberg summed up the state of the developed world, entitled "A Nation's Heavily Indebted Consumers Face a Painful Margin Call." The piece is about the Canadian consumer but could easily be written about most of the developed world, where consumers are over indebted. In some cases, buying lives they cannot afford with money they have not even earned yet. In other cases, consumers are trying to survive in a world of rampant inflation where real wages are declining, and many feel they are increasingly reliant on consumer credit to make ends meet at the end of the month.

Canadians' debt levels are near a record (Bloomberg)

Canadians for decades have been among the developed world’s most indebted people, and the low interest rates the central bank deployed to help the economy through the pandemic drove their borrowing to new heights. The country’s debt-to-income ratio reached a record 185% by the end of 2021, the highest in the Group of Seven countries. By comparison, the ratio is 101% in the US and 148% in the UK .

Consumers are starting to show signs of stress. The latest insolvencies data shows a 33% jump in January filings from the year before. The share of indebted households behind on their interest payments also climbed to 2.07% in the quarter ending September 2022, the latest reading, from 1.86% in the 2021 quarter.

The article goes on to describe the situation in Canada, where nearly 30% of homeowners have adjustable-rate mortgages. The continued rise in rates coupled with a cooling housing market has created a squeeze for consumers who overspent on housing in the previous speculative period. But the real take away from this piece is how indebted individuals really are in the developed world.

In the US, consumer debt hit a record of $16.9 trillion with delinquencies rising at the end of 2022. In the 4th quarter of 2022 household debt rose by $394B the largest increase in 20 years. The national debt also continues to grow at exponential rates, as both parties continue to spend beyond our revenue intake on personal pet projects and political priorities. The CBO now projects that by 2033 the national debt will eclipse $51Trillion. The US is rapidly approaching a point at which it pays more in debt interest payments than it does in national defense.

Stocks Have More Room to Fall

Until now we have not seen consumer spending materially harmed, I think that is the next phase of this bear market. As consumers have blown through their savings and are now in the process of using their credit lines, the slack in consumers ability to continue to spend is coming to an end, an end that will come suddenly, and then all at once. Couple this with what is likely to be a hard landing by the Fed, characterized with higher unemployment and you are going to be looking at an American consumer that is going to be severely crushed.

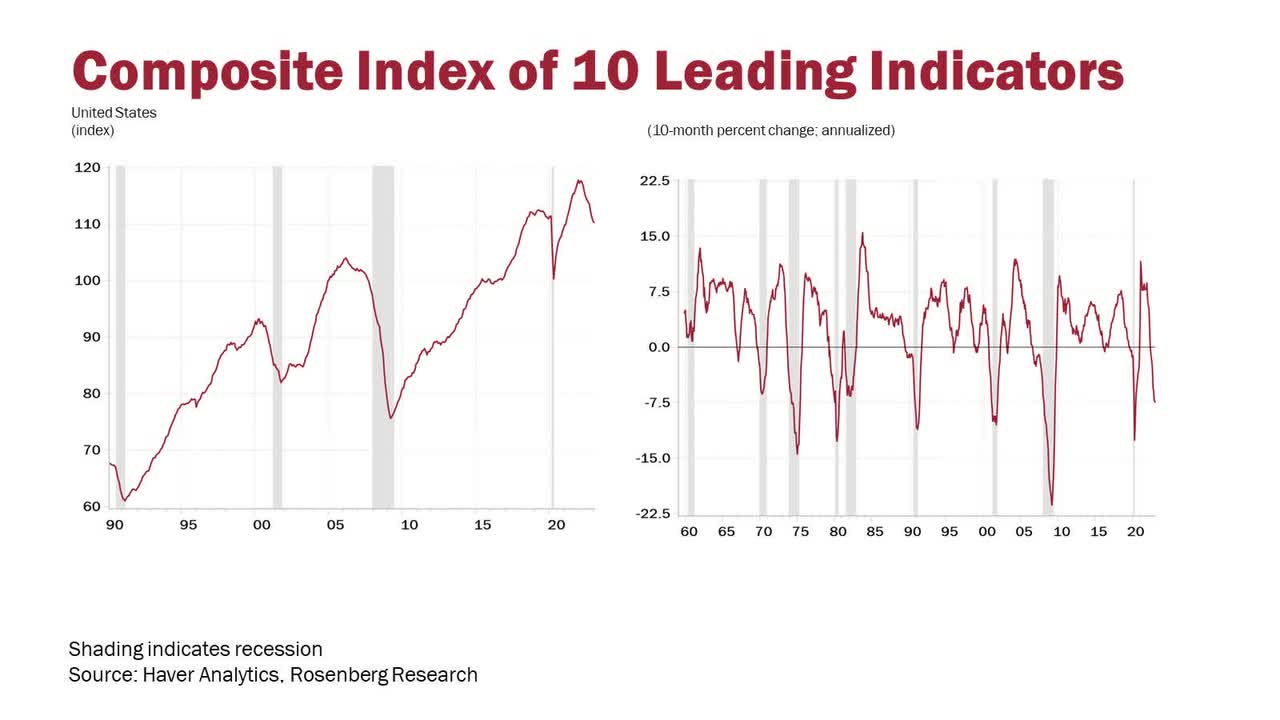

Composite Index of 10 Leading Indicators (Rosenberg Research, David Rosenberg, @EconguyRosie)

We are already seeing the economy contract with the 3 month seasonally adjusted levels in a number of data points all turning lower: building permits -46.6%; housing starts -20.8%; exports -11.2%; construction -7%; real retail sales -6%; IP -5.2%; real durable goods orders -3.9% & shipments -1.2%; Real consumer spending -0.3%. On an annual basis, ISM 47.7, down 18.6% over the past year. Finally, the index of leading indicators has dropped for 10 straight months, yet some believe a recession can be avoided, given the data we have coming out of the economy, I do not think this is possible.

In the same period, we have seen the Federal Reserve raise the benchmark interest rate by nearly 500 basis points, and yet stocks have fallen very little, relative to the rise in rates. This extensive lag in monetary policy will begin hitting the real economy in the coming months, and thus stock prices.

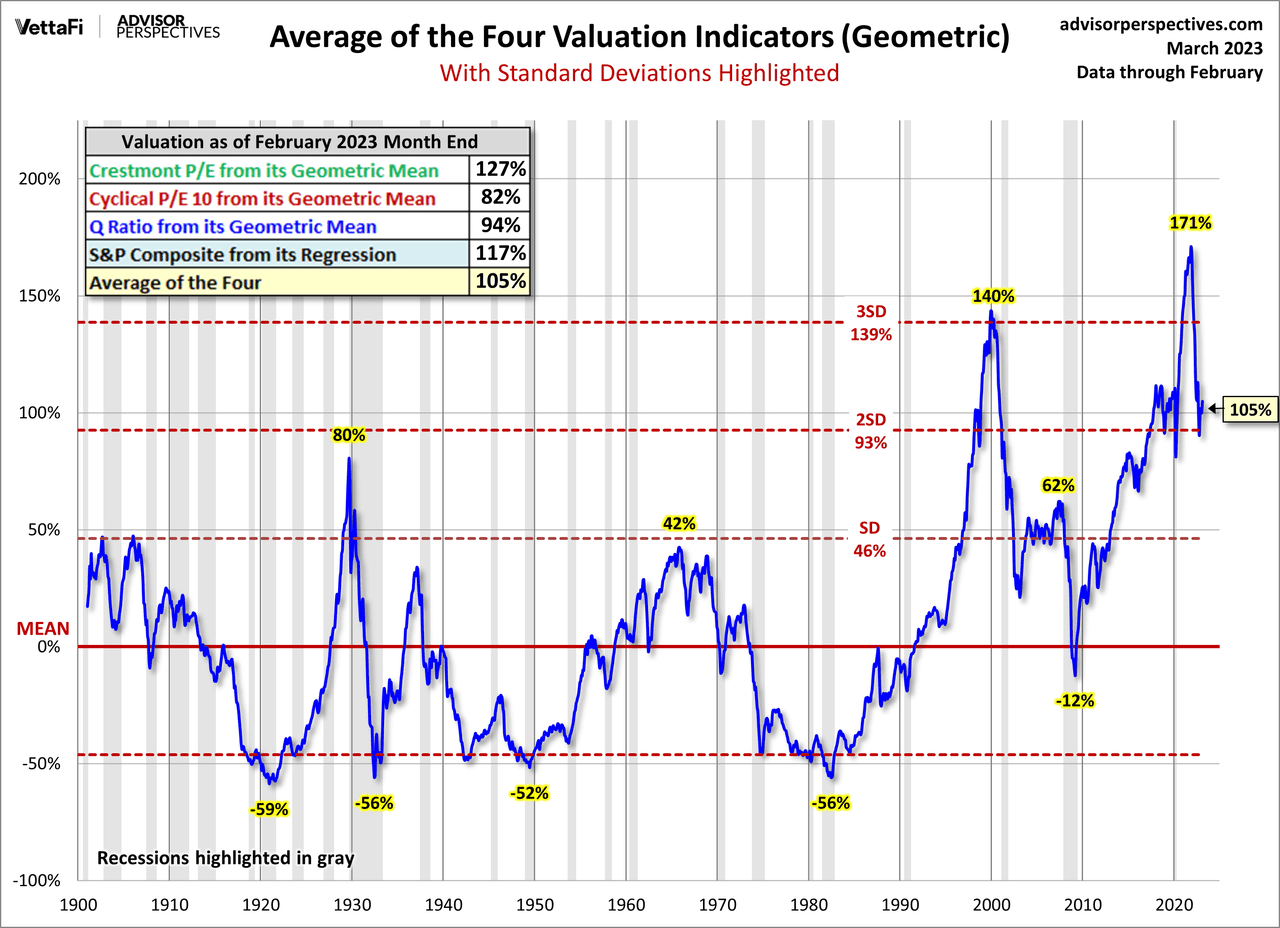

Average of the Four Valuation Indicators (Geometric) (AdvisorPerspectives)

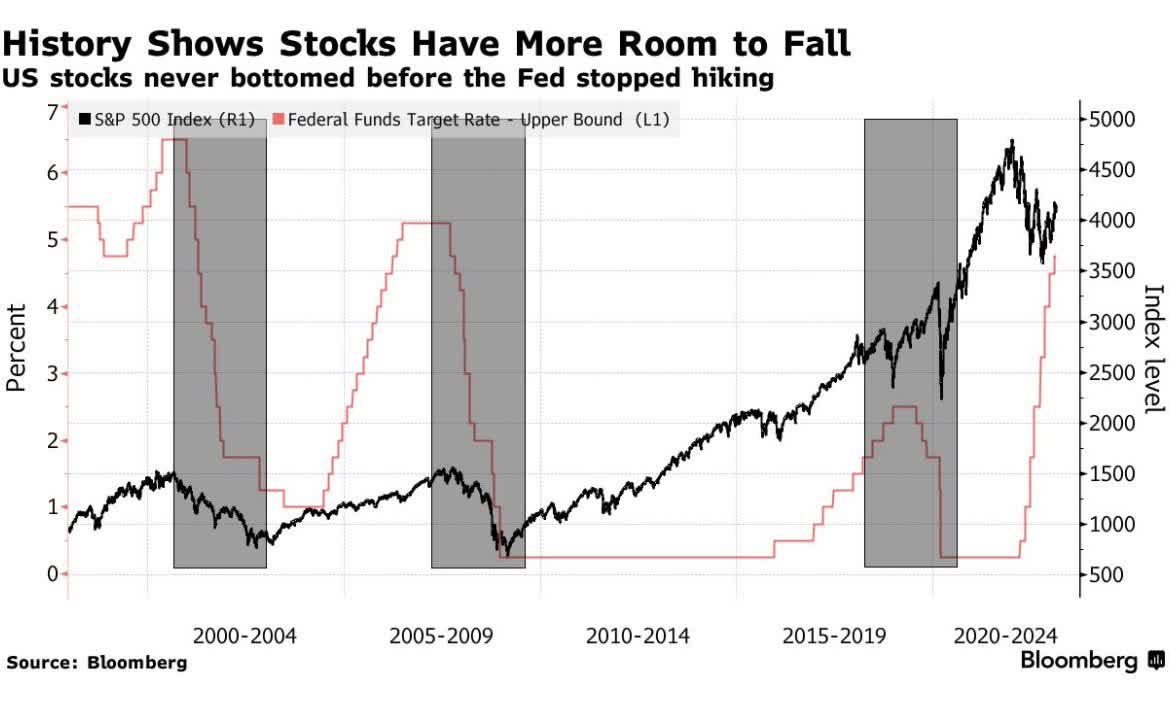

This leaves a great deal of room for stocks to fall, as the market remains overvalued today at over two standard deviations from the mean. In past cycles we have seen stocks bottom under one standard deviation from the mean, indicating we may have further to fall. Additionally, US stocks have never bottomed in a Fed hiking cycle before the Fed has stopped raising rates. I believe the Fed is likely to have to take rates over 5% to get inflation under control.

History Shows Stocks Have More Room to Fall (Bloomberg)

Many are waiting for a Fed pivot to go all in on equities, this is misguided. History has shown that Fed pivots tend to be negative for stocks. I believe this cycle is proving to be particularly stubborn, buoyed by consumer savings accumulated during the pandemic the market remains resilient... for now.

The zeitgeist of the moment has gone from very negative, with everyone convinced a recession was immanent, to now turning positive, even speculative, as the narrative that the US will avoid recession has permeated the mainstream, giving rise to the belief that the bear market is over. It is not. History proves this out, as the cycles of behavioral finance continue to play out in real time.

Conclusion

We are in an economy that has shown mixed results, with robust consumer spending largely being the catalyst for continued strength. But recent readings show that the consumer may be rolling over. Foreclosures are rising as are delinquencies on car loans and credit card balances are rising as well, indicating consumers are spending potential future income rather than savings on both needs and wants.

This is, no doubt, a result of continued inflationary pressures that has resulted in workers falling behind, despite increases in wages. I believe the worst of this cycle still lies ahead of us, and while the Fed continues to raise short term interest rates, the rate of long-term inflationary expectations remains well anchored.

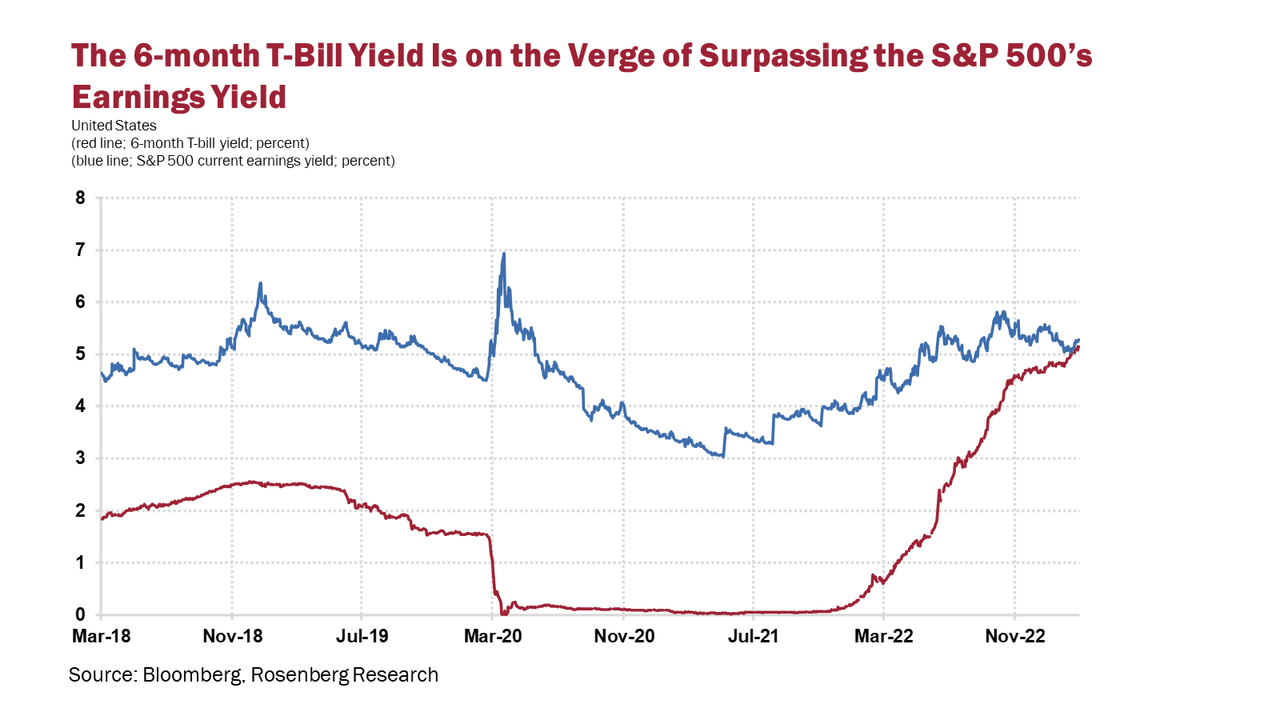

The 6 Month T Bill Yield on the Verge of Surpassing the S&P 500's (Rosenberg Research, David Rosenberg, @EconguyRosie)

While the rates on the long bond may rise in the short run, as the Fed continues to battle inflation, I continue to believe that the 30-year zero coupon US Treasury, is a desirable asset as we head into a period of immense uncertainty, where the risks for a major leg lower in equity prices remain elevated.

- Monetary Policy Risk-You have the long and variable lags of monetary policy which are a threat to the market, along with the reality that the Fed will have to raise rates much higher than is currently priced into equities, which will result in a repricing of risk.

- Earnings Risk-expenses accrued on the balance sheet of many of these companies in previous periods are going to start flowing through to the income statement, hurting earnings, and bringing prices of these stocks down as Q1 earnings season comes upon us.

- Political Risk-Then you have the debt ceiling debate, which is likely to roil markets in the summer months.

- Geopolitical Risk-The continued war in Ukraine, remains an imminent risk of turning into a more severe conflict.

- Valuation Risk-Your returns on equities are ultimately a result of the price you pay for them. Therefore, buying overvalued equities, will likely lead to sub-par long term returns. Today, the stock market is too expensive especially with an earnings yield that rivals that of the 6-month T-bill, and a complete collapse of the equity risk premium.

With these risks presented to investors, it is no wonder there has been intense interest in US Treasury bills, notes, and bonds across the curve, now providing investors with competitive yields. Since I called the top in rates in October of 2022, calling the long bond the best contrarian idea in the market today, the 30 year zero (NYSEARCA:ZROZ) has rallied 14.32%, beating the S&P 500 Index +8.09%, the Nasdaq +8.93%, and the Russell 2000 Index +9.26%, and I believe it remains a port in the coming storm. In Part II, I will further the case for the US Treasury, by looking at updated data, and dive deeper into the approaching next stage of this bear market.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of 30 YEAR TREASURY ZROZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is for informational purposes only and is not an offer to buy or sell any security. It is not intended to be financial advice, and it is not financial advice. Before acting on any information contained herein, be sure to consult your own financial advisor. This article does not constitute tax advice. Every investor should consult their tax advisor or CPA before acting on any information contained herein.