Covenant Logistics: A Tough Road Ahead

Summary

- Covenant’s revenue and margins in 2023 should face headwinds due to inventory destocking across the majority of the end markets.

- The company is adding new tractors to its fleet which should help reduce operating, maintenance, and insurance casualty costs, partially offsetting the impacts on margins.

- Despite trading at discount, I have a hold rating on the stock.

bucky_za/E+ via Getty Images

Investment Thesis

Covenant Logistics' (NASDAQ:CVLG) revenue in 2023 should decline due to decreased volumes resulting from inventory destocking in its major end markets, such as retail, industrial, and paper & packaging. However, the company plans to capitalize on this situation by pursuing acquisitions that will help it gain market share, ultimately boosting its revenue in the medium to long term. As of December 2022, the company had a healthy balance sheet with a leverage ratio of 0.34x. The company is also making investments in its fleet to increase the average age of its fleet by purchasing new tractors. This move should lower operating, maintenance, and insurance casualty costs, ultimately improving profitability. While my DCF calculation and relative valuation suggest that the stock is currently trading at a discount, I recommend holding onto CVLG stock due to the challenges faced by revenues and margins in 2023.

CVLG’s Truckload Business

Covenant Logistics' revenue is largely dependent on its truckload business, which makes up approximately 67% of its total revenue. This business is further segmented into two categories: Expedited and Dedicated. The Expedited segment contributes 37% to the total revenue and caters to customers who require high service standards for freight and delivery. On the other hand, the Dedicated segment contributes 30% to the total revenue and provides committed truckload capacity over a contracted period to its customers.

CVLG’s' truckload business has been performing well over the past few quarters, primarily due to strong end markets such as food & beverage, industrial manufacturing, retail, healthcare, consumer goods, and paper & packaging. However, due to rising interest rates, the end markets in the second half of 2022 weakened, and the company saw a decline in its volumes. Despite this, the price hikes implemented in previous quarters helped the company maintain positive revenue growth during this period.

In Q4 FY22, the company's truckload business revenue, excluding fuel surcharge, showed a healthy growth of 11.2% year-over-year, reaching $158 million. The increase was primarily driven by a 14.5% year-over-year increase in average freight revenue per tractor, partially offset by a 3.3% year-over-year decrease in the average operating fleet size. Within the Expedited segment, revenue excluding fuel surcharge saw impressive growth of 26% year-over-year, reaching $90.4 million, primarily driven by Covenant Logistics' acquisition of AAT and a 16.5% year-over-year increase in average freight revenue per tractor per week. This increase was attributed to the company's significant contribution to the Federal Emergency Management Agency's (FEMA) hurricane Ian relief efforts in October. Meanwhile, within the Dedicated segment, revenue excluding fuel surcharge declined 5% year-over-year to $67.5 million, due to a 10% reduction in the average number of trucks. This decrease was part of the company's initiative to exit unprofitable businesses in 2022. However, this was partially offset by a 5% increase in revenue per truck, which helped partially mitigate the impact of the reduction in the truck count.

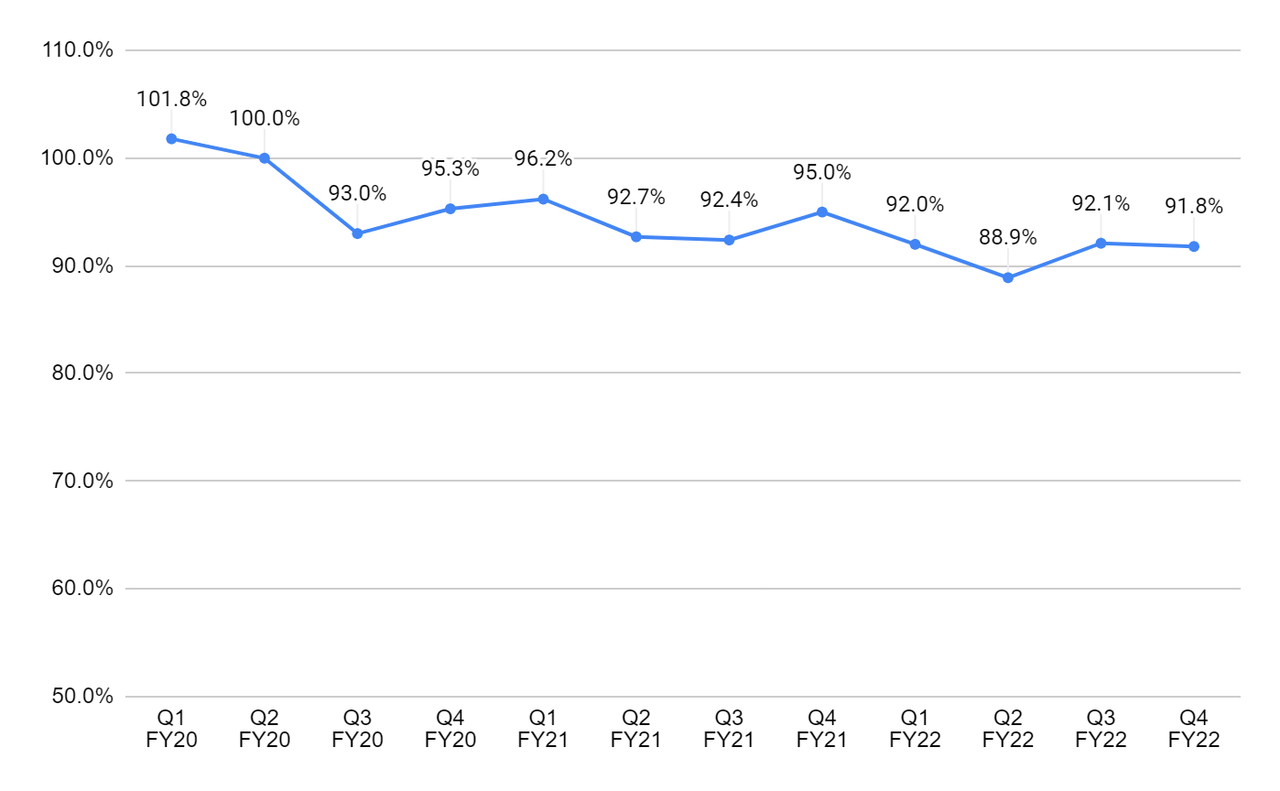

Truckload business’ adjusted operating ratio (Created by DzD Analysis by taking data from CVLG)

In Q4 FY22, the truckload business’ adjusted operating ratio improved by 320 bps Y/Y due to increased revenue per freight and the acquisition of AAT. However, the operating expenses in the quarter increased by 23% Y/Y due to costs related to equipment adjustment and an increase in fuel costs, salaries and wages, operations, and maintenance. The equipment adjustment or fleet reduction is due to two factors: Firstly, the company's initiative to exit unprofitable businesses and, secondly, the reduction in fleet counts with existing customers due to the weakened demand in end markets. As a part of its equipment adjustment plan, the company ordered new tractors in 2022 and received approximately half of them in the fourth quarter.

Looking ahead to 2023, I believe the revenue in the truckload business should be negative due to lower volumes from inventory destocking, partially offset by pricing actions and acquisitions. The company plans to take advantage of the weak macroeconomic environment by acquiring new companies to gain market share, leveraging its healthy balance sheet with a leverage ratio of 0.34x as of the end of 2022.

The company plans to reduce operations, maintenance, and insurance casualty costs in the near term by adding a new fleet. To improve profitability in this business, the company is focusing on optimizing its customer mix and operating an efficient fleet. The company plans to order more tractors in 2023 than in 2022 to increase the average age of its fleet, which is currently 2.1 years old. The operation and maintenance costs should decrease as the average age of the fleet increases. However, in 2023, I believe the company’s operating ratio should increase due to the lower volumes, partially offset by the benefits of the new fleet.

CVLG’s Brokerage and Warehousing Businesses

The company’s Managed Freight segment contributes 26% to the total revenue, whereas its Warehousing business contributes 6% to the total revenue. The Managed Freight business includes brokerage services and a Transportation Management System (TMS). The brokerage services provide logistics capacity by outsourcing third-party freight for customers’ freight, and the TMS provides logistics services on a contractual basis to its customers who prefer to outsource their logistics needs. The Warehousing segment provides day-to-day warehouse management services to customers who want to outsource this function.

The Managed Freight segment has been experiencing declining revenues over the past two quarters, with a 13% decline in Q3 FY22 and a 30% decline YoY in Q4 FY22. This decline is attributed to reduced volumes, which can be traced back to the absence of excess volume from both the Expedited and Dedicated segments, which were present in 2021. On the other hand, the Warehousing segment's freight revenue increased 31% YoY in Q4 FY22, which is a positive development. This increase is due to the addition of four new customers in 2022, the largest of which became operational in December 2022.

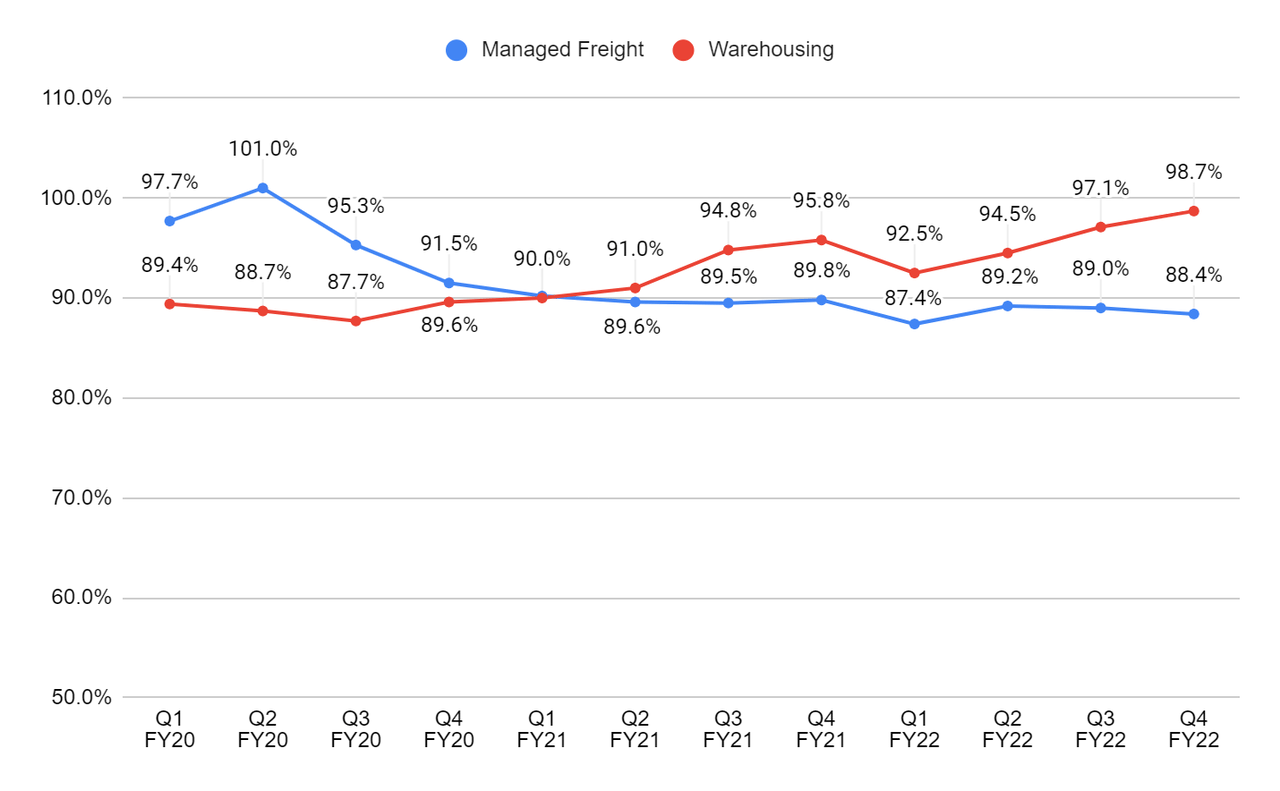

Managed Freight segment and Warehousing segment adjusted operating ratio (Created by DzD Analysis by taking data from CVLG)

The Managed Freight segment’s adjusted operating ratio has improved over the last few quarters due to the increased freight rates. On the other hand, the Warehousing segment's adjusted operating ratio has deteriorated in 2022. This is primarily due to the investments made in warehouse capacities and the costs associated with new customer additions. While this may be a concern, it is important to recognize that these investments are necessary for the segment's growth and expansion.

Looking forward to 2023, I believe the Managed Freight segment should face challenges due to the decrease in demand from end markets, which should result in lower volumes and revenues. On the other hand, the Warehousing segment should see positive revenue growth in 2023. This is due to CVLG's customers' focus on cost savings and improving efficiency at their facilities, which could result in increased demand for warehousing services. CVLG can capitalize on this trend and offer tailored solutions to meet the evolving needs of its customers.

I believe CVLG's Managed Freight segment should face stiff competitive pressures in 2023 due to declining volumes, resulting in a potential reduction in profitability. With many competitors offering lower freight rates to attract customers, CVLG will likely have to reduce its rates to remain competitive. On the other hand, the Warehousing segment should see improvements in profitability in 2023 as the company plans to utilize labor more effectively and increase prices.

Risks

I'm anticipating margins to decline slightly due to the benefits of the addition of new tractors. If the impact of volume deleveraging on the company is significant, profitability should suffer significantly.

Valuation

DCF valuation (Created by DzD Analysis using Alpha Spread)

In my DCF analysis, I assumed revenue would be negative in 2023 due to the weak demand in the end markets and should grow between low and mid-single digits beyond 2023. The capital expenditure should increase in the coming years as the company plans to invest in adding new tractors to its fleet. I used a discount rate of 9% and arrived at a fair value of $46.58 for KAI.

If we use relative valuation, the stock is currently trading at a forward P/E of 9.75x, which is at a significant discount when compared to its five-year average forward P/E of 14.70x.

My final view

To summarize, in 2023, Covenant Logistics should experience a decline in revenue due to ongoing inventory destocking across most of its end markets. However, the company plans to leverage this situation to acquire other companies and gain market share, which should benefit the company in the long run. The company's profitability in 2023 should be impacted due to volume deleverage, partially offset by the cost savings resulting from adding new tractors to its fleet. The stock is currently trading at a discount based on DCF calculations and relative valuation. However, given the challenging near-term conditions and other better companies in the transportation industry, I would prefer to hold the stock for the time being.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.