Is The Sprott Uranium Miners ETF Worth Pursuing?

Summary

- URNM is pricier and more volatile than other alternatives in this space.

- URNM juggles its risk profile very well, and the reward-to-risk equation on the charts looks promising.

- The underlying fundamentals in the uranium market look very attractive for Uranium miners.

abadonian/iStock via Getty Images

ETF Snapshot

The Sprott Uranium Miners ETF (NYSEARCA:URNM) is a financial product that focuses on businesses that devote at least half their assets to the uranium mining industry. Typically, 82.5% of the portfolio comprises of explorers, miners, developers, and producers of uranium, whilst the rest of the portfolio is linked to businesses that hold the physical metal or generate uranium royalties. Do consider that the bulk of the stocks in URNM are domiciled in Canada (56%), and more than half the portfolio consists of small-cap stocks (market cap of less than $2bn). Also note that access to URNM does not come cheap, with an expense ratio of 0.85%, considerably higher than the 0.6-0.7% range seen with other alternatives.

The Underlying Fundamentals Look Promising

IEA

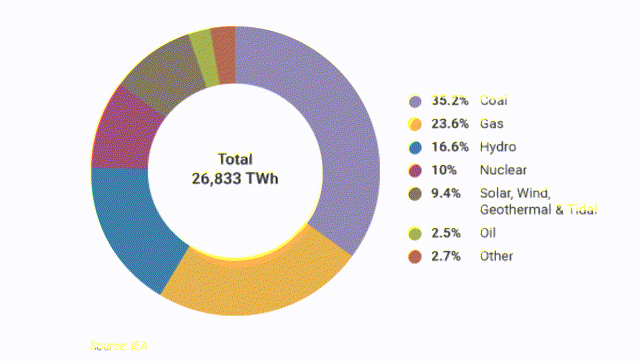

Nuclear energy may currently only account for a modest share of global electricity production, but it would be foolhardy to think that it would continue to persist at the 10% levels when federal authorities across the world have recently been pushing nuclear policies with greater alacrity.

Net zero pledges now cover vast swathes of the globe, and in an environment such as this, nuclear will likely have plenty of takers when you consider the relatively low carbon footprint (15-50gCO2/KWh) of a nuclear plant, versus gas (450gCO2/KWh) or coal (1050GCO2/KWh) alternatives.

Sprott

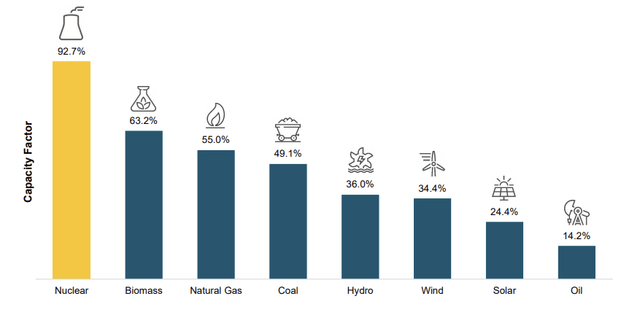

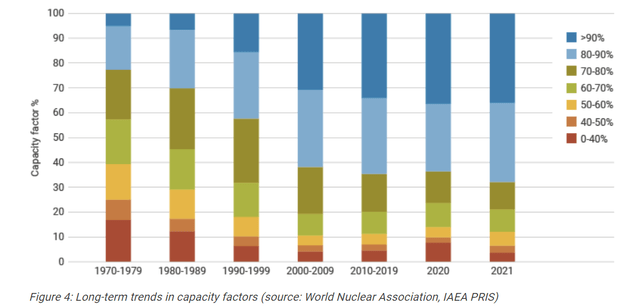

In a world that is increasingly looking for efficient solutions, it also helps that utilization levels of nuclear infrastructure typically tend to be substantially higher than other energy alternatives. Besides, this is something that has continued to improve over time; over 50 years back, less than 30% of nuclear reactors had a capacity factor of over 80%; these days, over two-thirds of the nuclear generators produce well over those 80% levels.

World Nuclear Association

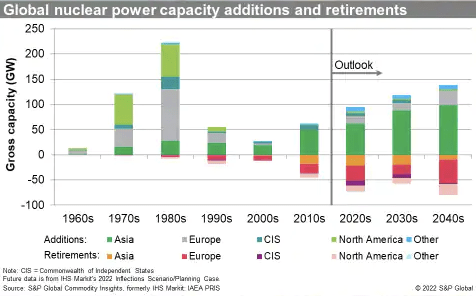

When you consider all these factors, it is hard to argue against higher adoption of nuclear power. Indeed IHS Markit now believes that new nuclear capacity between 2022 and 2050 could be 2.5x the addition rate of the previous three decades.

IHS Markit

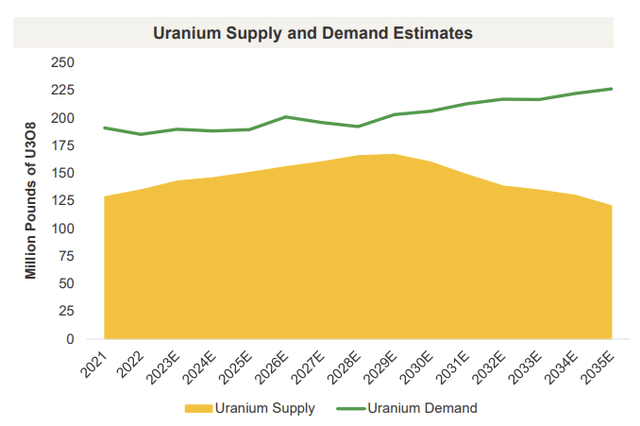

With such gargantuan levels of infrastructure due to come on board, think about what this could do for the prospects of Uranium miners who are already feeling a lot more invigorated after the price rise in Uranium (up 9% YoY) after years of going nowhere. Even though a lot of idle uranium mines around the globe are coming back into the network, it is highly questionable if it this will ameliorate the supply/demand deficit meaningfully. The recent Russian-Ukraine conflict has also shown the perils of neglecting energy security, and this could hasten purchasing habits of utilities as they scramble to lock in long-term supply contracts. This will only put further pressure on the demand-supply mismatch in the market, which is likely to be a recurring theme over the next 10-15 years.

Sprott

Closing Thoughts- Is URNM a BUY, SELL or HOLD?

Besides the core investment thesis discussed above, there are some other impressive aspects that buttresses one's confidence in this product.

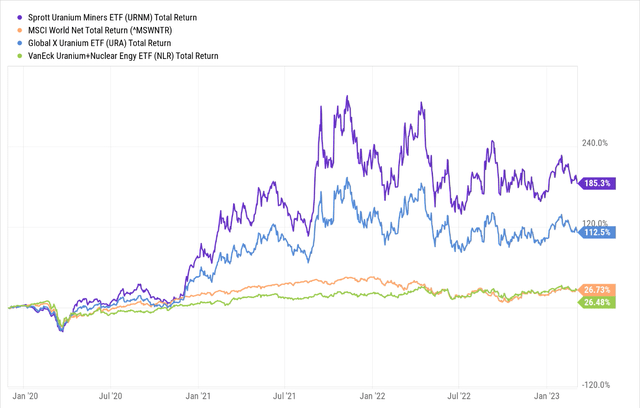

Since its inception, URNM has proven to be an outstanding source of alpha outperforming the MSCI World Index by nearly 7x! Meanwhile, the return differential with two other competing products in the Uranium mining space has been commendable as well, particularly when you consider the variance with VanEck Uranium + Nuclear ETF (NLR).

YCharts

Granted, past performance is no guarantee of future results, but it’s also quite improbable to witness an overnight shift in the texture of URNM’s risk-adjusted return profile, relative to its peers.

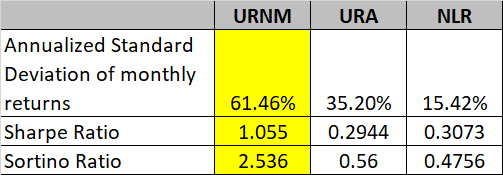

What the table below tells us is that inherently, URNM is quite a volatile product, with the standard deviation of its monthly returns coming in at almost 4x that of NLR, and 1.74x that of the Global X Uranium ETF (URA)! With such an elevated standard deviation profile, one would have thought that it would be challenging for URNM to deliver ample enough excess returns (returns over the risk-free rate) that would justify the level of risk taken. However, note that amongst the three competing ETFs, only URNM generates a Sharpe Ratio over 1.0, highlighting the quality of stock picking on offer here.

YCharts

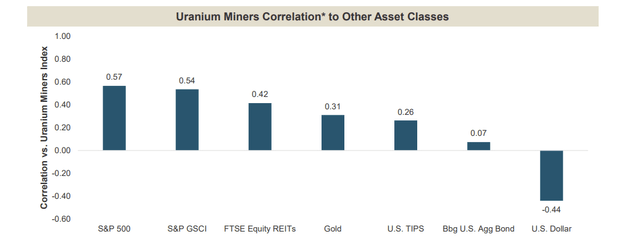

Also note that URNM performs exceedingly well in trouncing harmful volatility, as exemplified by a Sortino ratio of 2.5x. Both the other ETF options fail to generate ample excess returns when faced with downside deviation. This quality of handling downside deviation over time makes it a fine portfolio pick. URNM's portfolio credentials are also enhanced by the fact that Uranium miners only have low-to-moderate correlations with other asset classes.

Sprott

Finally, it’s also worth highlighting the attractive risk-reward potential on both the standalone charts as well as the relative strength charts.

If one looks at the weekly chart of URNM we can see that after peaking at the $52 level, URNM has been witnessing a downtrend that looks like flattening out. Whilst the degree of pullbacks was quite pronounced during the first half of 2022, with large shaped weekly candles (notice that the 14-period ATR indicator had hit levels of 5) every now and then, things have sort of eased off in recent weeks. Even the ATR indicator has now dropped to its more normalized range of less than 2.5x reiterating the level of volatility contraction.

It is preferable to take positions in a product when volatility ebbs, and the buy case here is further validated by the attractive risk-reward on offer. If one considers the gap between the current price of URNM, the downward-sloping resistance, and the upward-sloping support, the reward-to-risk equation works out to an attractive 1.87x.

Investing

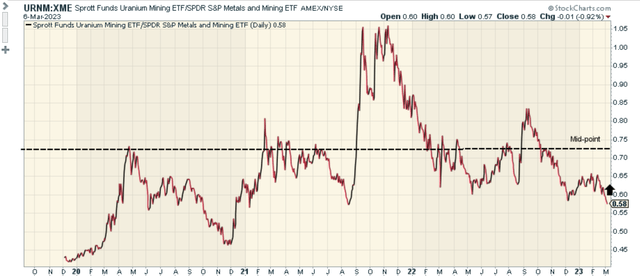

The chart below also highlights how attractively poised Uranium miners look, relative to an ETF covering a more diversified basket of metal miners. The current relative strength ratio is roughly 20% off the mid-point of its range, offering some scope for mean-reversion in favor of URNM.

Stockcharts

To conclude, URNM is a BUY

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.