Hims & Hers Health: Proposed Telemedicine Regulation Could Materially Impact Sales

Summary

- I previously rated HIMS as a buy and also mentioned the idiosyncratic regulatory risk the company is facing as a telemedicine operator.

- This has now come to fruition, with a new regulatory framework put on the table as of last Friday 2/24/23.

- Reviewing the proposal in detail, I believe that elements of the new regulatory framework could very well be negative factors for this business.

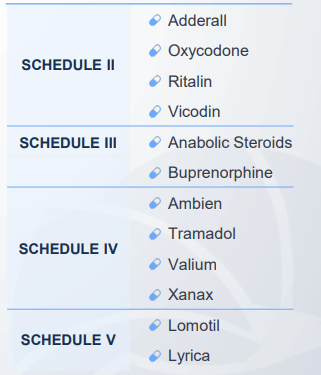

- These headwinds, along with the fact that the company is not profitable, have made me shift my rating to Hold for this security; profit-taking is also advisable for investors that agree with my view.

PAVEL IARUNICHEV/iStock via Getty Images

Overview

I previously covered Hims & Hers Health (NYSE:HIMS) stock and rated it a buy, outlining the company's traction on revenue growth as well as its progress towards generating an operating profit. Within that article I also mentioned the regulatory risk the company is facing. The legal context around telemedicine was previously set during the pandemic era and is technically not statutory. This means that the laws permitting telemedicine operators are temporary and not guaranteed to exist in their current form going forward.

This idiosyncratic risk is now coming to fruition. As of this past Friday, February 24 2023, the Federal government here in the US released a new proposal for telemedicine regulation. The new proposal outlines several drugs that would no longer be viable for prescription via video call, as well as creating a separate class of drugs that can be prescribed for a 1-month span before a patient has to see a medical professional in person. This article will review these changes in more detail.

Shifting Regulatory Framework

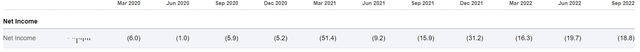

As mentioned, the new regulation is set to ban certain classes of drugs from being prescribed digitally outright. This includes best-sellers such as Adderall & Ritalin, while also clamping down on opiate prescription through digital channels. Additionally, ever-popular anti-anxiety drugs such as Ambien and Xanax are now set to be restricted as well.

Drug Enforcement Agency 2.26.23

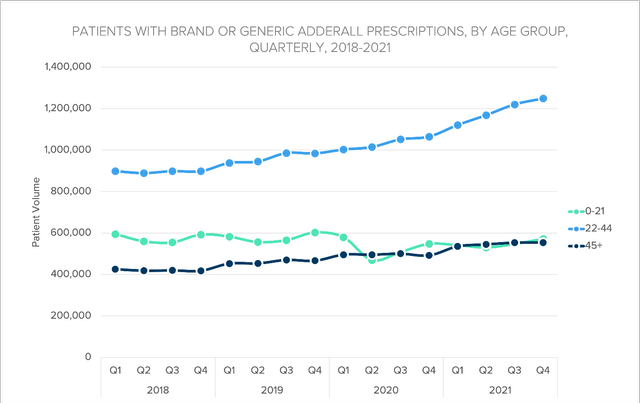

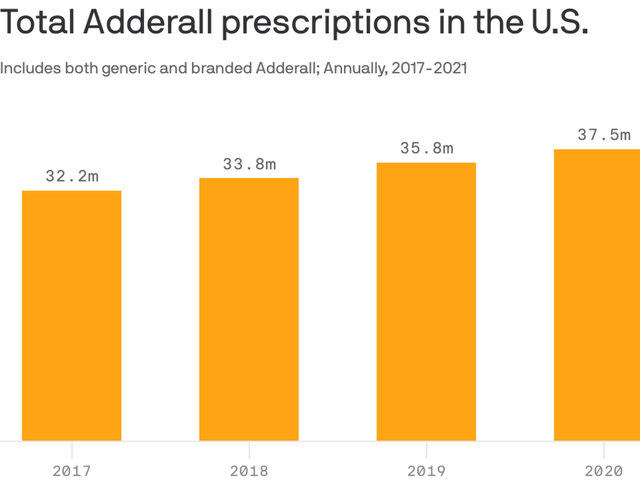

Adderall is one of the most popular prescription drugs in the USA and saw an appreciable increase in sales throughout the pandemic period, rising nearly 50% above pre-pandemic baseline as per the chart below.

Trilliant Health 2.26.23 Axios 2.26.23

Given the overall trendline, it is sensible to believe that HIMS has been a core beneficiary of this trend throughout the last several years. This will now be put to a halt, or at least significantly restricted, in light of the new regulation. As such I believe it will constitute a material negative impact on the company's top line.

The aforementioned restrictions on popular anti-anxiety medicates Ambien & Xanax should also have a material negative impact in my view. As can be seen, Anxiety & Depression is a top category on the HIMS website and can be seen on the front page - certainly an indicator that the company both generates sales in this category and is looking to continue doing so.

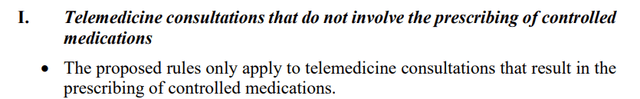

Reviewing the regulatory proposal in more detail, we can note that telemedicine beyond the context of actual prescriptions is not set to be affected. This means that the HIMS business model is, at least, not facing wholesale destruction.

Additionally, telemedicine prescriptions can still be valid if a doctor has previously met with a patient in-person. This opens the door to physicians leveraging the HIMS platform for ongoing relationships with patients that they have previously met. I consider this a bright spot in what is otherwise a significantly negative factor for the company's business is concerned.

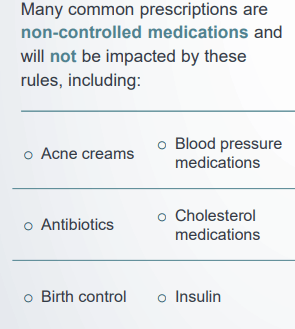

Several classes of drugs are not set to be regulated under the proposed law. This includes things such as acne creams, antibiotics, insulin, and birth control. Since each of these is also popular amongst the population, there will still be room for the company to continue generating sales across each of these.

DEA.gov 2.26.23

Conclusion

In sum, I think that this regulation will indeed negatively impact the HIMS business model and its top-line metrics throughout 2023. Nonetheless, there is still room in the market for the firm to continue growing in light of the nuances of the regulations that I outlined above - albeit at a slower rate. We must also note that this proposal is not yet law, although I would not bet against it becoming law.

Additionally, it could also indicate the beginning of more significant telemedicine regulations being put on the table in the near future. Investors should assume that these proposed regulations will become law, and they are set to do so after the conclusion of the pandemic health emergency on May 11th 2023.

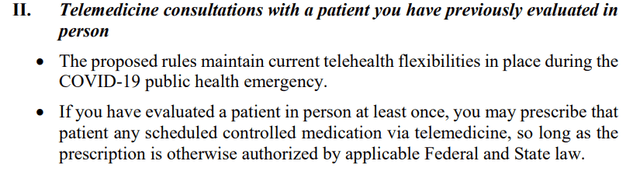

Furthermore it is worth remembering that this company is not profitable. These regulatory headwinds will make it that much more difficult for it to achieve profitability.

Even though the company posted a beat across both EPS and revenue on its latest earnings report, the impact of this regulation will start to become apparent in two quarters out. This will then provide us with a quantified view as to exactly how serious this really is. Since the regulation is set to come into being in May of this year (Q2), it will be about 5 months before we have the first relevant points.

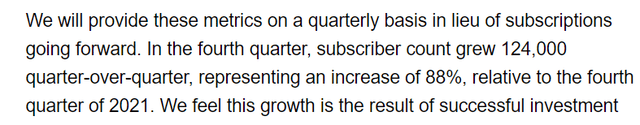

The leading metrics that investors should pay attention to would be new user acquisition as well as ARPU (average revenue per user). To benchmark where things stand at present, we can see that HIMS acquired 124K new subscribers in Q4 2022 at an 88% YoY increase.

SeekingAlpha.com HIMS Q4 2022 Earnings Transcript 3.6.23

Monthly ARPU came in at $55 per month. An additional metric of interest here is the share of subscribers with a multi-month subscription - something the company has also seen improve in its most recent quarter.

SeekingAlpha.com HIMS Q4 2022 Earnings Transcript 3.6.23

Given the specifics of the new regulatory framework, I believe that it is these variables that will be the canary in the goldmine for this stock. If they drop off precipitously that will be a strong indicator that the rest of the company's financials will be impacted negatively; if not, then perhaps we will be in the clear.

In light of these changes and the associated increase in uncertainty, I am now going to shift my position to a hold on this security. I will continue watching the specific metrics outlined above to see how these changes are affecting the company's business over the next several quarters.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.