STK: Outperforming The Nasdaq

Summary

- Columbia Seligman Premium Technology Growth Fund is an equity "buy-write" closed-end fund.

- The vehicle is long a portfolio of technology-related companies and writes call options on the Nasdaq 100.

- The CEF employs a dynamic call writing strategy that is dependent on VIX levels.

- STK has outperformed the Nasdaq this year, being up +19% year to date.

- The fund is now trading at the top end of its historic premium range.

Olivier Le Moal

Thesis

Columbia Seligman Premium Technology Growth Fund (NYSE:STK) is an equity "buy-write" closed end fund. The fund is long a portfolio of technology related companies and writes call options on the Nasdaq 100, options which will typically range from 25% to 90% of the underlying value of the fund holdings:

Under normal market conditions, the fund’s investment program will consist primarily of investing in a portfolio of equity securities of technology and technology-related companies as well as writing call options on the NASDAQ 100 Index or its exchange-traded (ETF) fund equivalent on a month-to-month basis. The aggregate notional amount of the call options will typically range from 25% to 90% of the underlying value of the fund’s holdings of common stock. The fund expects to generate current income from premiums received from writing call options on the NASDAQ 100 or its ETF equivalent.

To note that the fund has a slight basis between the holdings (only 66 names in the portfolio currently) and the written calls which are done on the index. We like the fact that the fund is concentrated on a smaller number of names when compared to the index because it allows the portfolio managers to generate alpha for the fund, active management which has proven its worth throughout time via its stellar performance.

We like the fact that the call writing is dynamic and dependent on market conditions. Active management of call writing is the way to go in our opinion. The main flaw of many options systematic strategies is that they fail to adjust notional when the main pricing inputs are too expensive or too cheap. STK has a very straight forward lever when considering the overwritten notional:

In determining the level (i.e., 0% to 90%) of call options to be written on the NASDAQ 100, the Investment Manager’s Rules-based Option Strategy is based on the CBOE NASDAQ-100 Volatility Index (the VXN Index). The VXN Index measures the market’s expectation of 30-day volatility implicit in the prices of near-term NASDAQ 100 Index options. The VXN Index, which is quoted in percentage points (e.g., 19.36), is a leading barometer of investor sentiment and market volatility relating to the NASDAQ 100 Index. In general, the Investment Manager intends to write more call options when market volatility, as represented by the VXN Index, is high (and premiums received for writing the option are high) and write fewer call options when market volatility, as represented by the VXN Index, is low (and premiums for writing the option are low)

Basically the CEF writes options on almost the entire notional when VIX levels are high, and pulls back when VIX is low. Currently the VIX is around roughly 20, and the fund has a 49% overwritten percentage. We like this dynamic approach and we feel this type of lens generates alpha in the long term. To that end STK has outperformed the Nasdaq year to date, being up 19.6% versus 13.3% for the index.

STK is a robust CEF that delivers on transforming Nasdaq returns into dividends. The fund employs a dynamic overwrite strategy that is VIX dependent. The CEF has outperformed the Nasdaq in 2023 but is now trading at the top end of its historic premium range. We are therefore on Hold for this name.

Analytics

- AUM: $0.44 billion.

- Sharpe Ratio: 0.7 (3Y).

- Std. Deviation: 26 (3Y).

- Yield: 6.8%

- Premium/Discount to NAV: 7.14%

- Z-Stat: 0.9

- Leverage Ratio: 0%

Performance

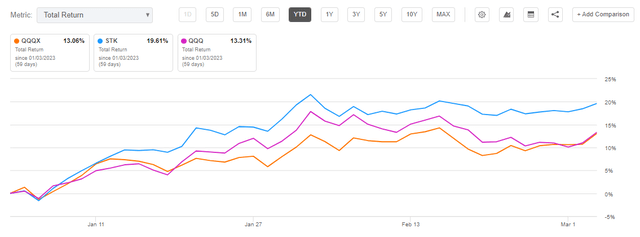

The CEF has healthily outperformed the Nasdaq in 2023:

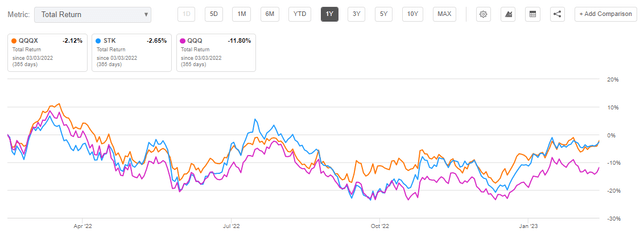

Sell vol strategies as embedded in QQQX and STK have also outperformed the index on a 1-year lookback:

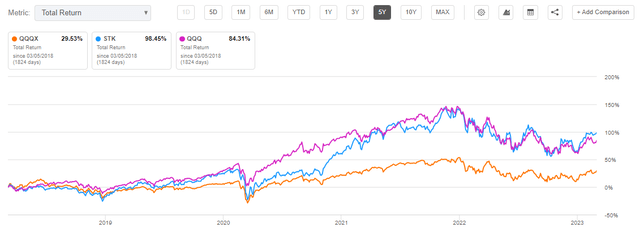

Long term STK is a comparable investment to Nasdaq, while QQQX trails significantly:

Holdings

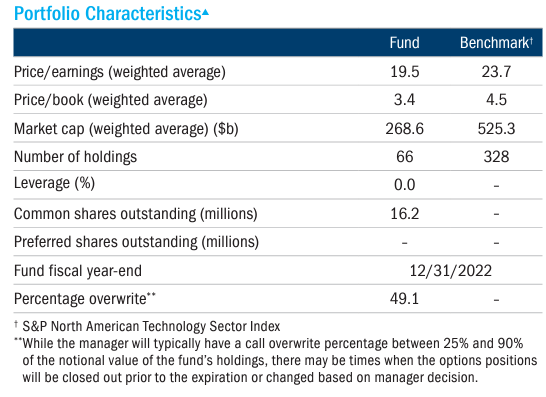

The CEF only holds 66 names in its portfolio:

Portfolio Details (Fund Fact Sheet)

We can see from the above table that the fundamental ratios of the underlying companies compare favorably with the index - i.e. lower P/E ratios and P/B values. This is where the portfolio manager should make a difference.

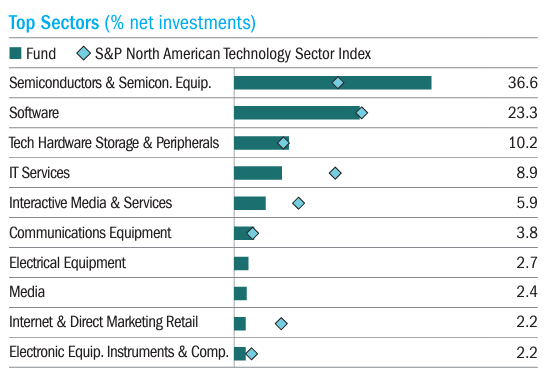

The top sectors in the CEF are semiconductors and software:

Top Sectors (Fund Fact Sheet)

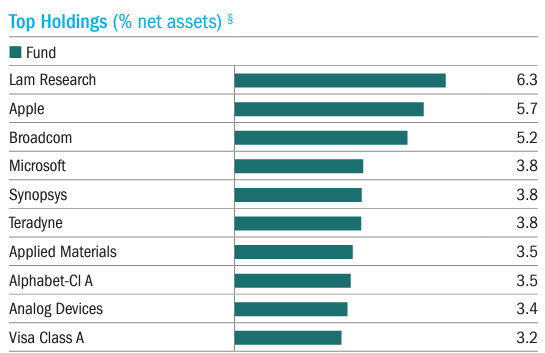

The top holdings are fairly concentrated, with all of the names above a 3% weighting in the fund:

Top Holdings (Fund Fact Sheet)

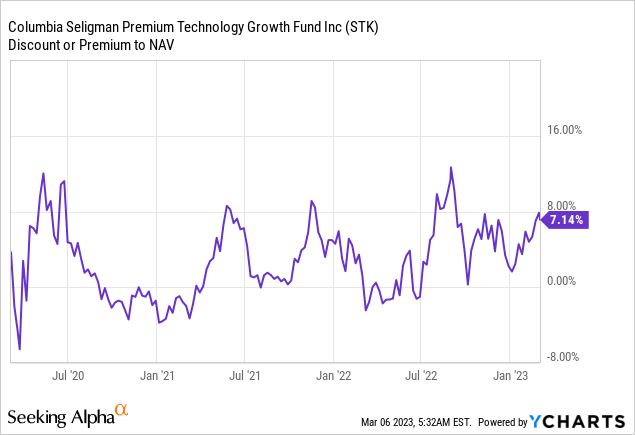

Premium / Discount to NAV

The fund is now trading close to the top range of its historic premium to NAV:

We can see how the fund has high beta to market risk-on / risk-off moves, with the premium contracting to zero during sell-offs. A substantial portion of the outperformance this year in STK is driven by its widening premium to net asset value. We expect the fund to give it up during the next market sell-off leg.

Conclusion

STK is an equity buy-write CEF. The fund holds 66 technology related names and writes call options on the Nasdaq 100 index. The vehicle employs a dynamic call writing strategy that is VIX dependent. The fund covers a higher percentage of the portfolio when the VIX is high and a lower number when the VIX is low. Currently with the VIX in the low 20s the CEF has only 49% of the portfolio overwritten with call options. The vehicle's strategy has been successful, outperforming the Nasdaq in 2023 by 6%. Long term this CEF successfully transforms Nasdaq returns into dividends, exhibiting a total return performance comparable with QQQ. With the CEF now trading at the top end of its historic premium range and with tech equities overvalued in our opinion, we are on Hold with respect to STK CEF.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.