Danone: Winning Where The Company Is

Summary

- China's infant share gains as well as positive data from the US market.

- The company increased its DPS by 3.1% (still lower than pre-COVID-19 levels).

- Portfolio transformation coupled with a margin recovery story. Hold for now.

ProjectB/iStock Unreleased via Getty Images

Last week, Danone (OTCQX:DANOY,OTCQX:GPDNF) reported its Q4 and FY 2022 results. In 2022, we should mention that Danone unveiled a new strategic plan with the intent to connect sustainable profitable growth with value creation. As a reminder, in the year, there was a new CEO appointment and here at the Lab, we do believe that Danone is in better hands nowadays; however, we still struggle to find proof points for an earnings recovery. Before commenting on the quarterly update, our neutral rating was based on the following: 1) a decrease in the volume with hypermarkets disputes and SKU rationalization; 2) its Russian division with a negative one-off of almost €1 billion; and 3) a multiple in line with Danone's historical valuation. Looking at the last two months, the company's stock price increased (as expected) - you can check our article called: A Better Than Feared Quarter; however, in retrospect, with a twelve months basis view, our neutral rating proved to be the right one.

Mare Evidence Lab's previous publication

There are a few pieces of positive news to recap as well as negative key takeaways to report:

- (+) Danone's market share is improving in North America, China, and Oceania. In Europe, results were more mixed, with EDP performance contrasted. There was good and balanced growth in Italy and France, while in the Rest of the World, EDP output declined and was partially offset by Danone's high protein offerings. Water and more importantly, specialized nutrition saw broad-based contributions from medical nutrition and infant medical formula solutions or IMF;

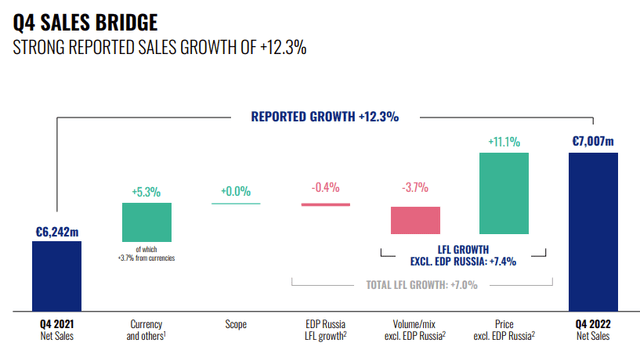

- (+) Looking at the GEO sales, IMF China reported solid growth with a plus 60 basis points of share gains. North America increased by more than 8% in like-for-like turnover with a +0.5% volume/mix and also 20 basis points of market share gains. H1 margins were heavily impacted by raw material inflationary pressure and supply challenges, but H2 sequentially improved with pricing ramping up (and we hope for higher productivity);

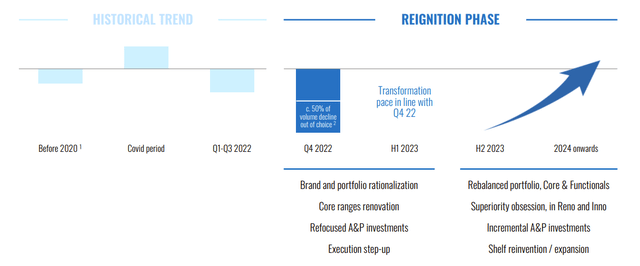

- (+) Danone is streamlining its current portfolio and is impacting its short-term volumes. During the Q&A analyst call, the CEO emphasized that approximately 50% of the decline in European volumes was the company's own decisions (namely SKU rationalization) to reduce and suspend EDP and Waters deliveries. For instance, in Spain where Danone went from 10+ brands to five;

- All the presentation released was based on "WINNING WHERE WE ARE" and we hope that with a clear strategy of portfolio rotation, Danone will be back to a sustainable earnings growth story;

- (-) In the mind time, the margin from operations was down by -159 basis points and the 3.6% EPS growth was mainly led by favorable currency development/other effects;

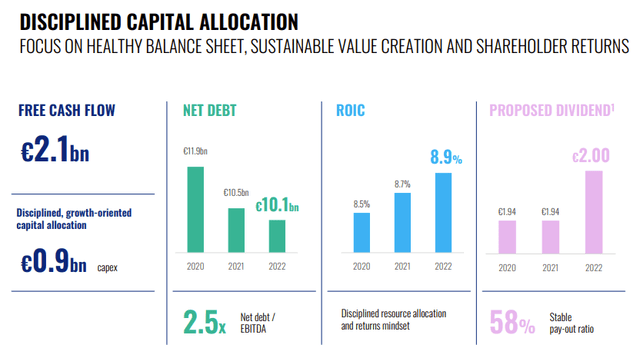

- (-) In 2022, Danone's FCF reached €2.12 billion and was down from €2.48billion on a yearly basis, reflecting a decrease in core operating cash (Fig 1);

- (+) The company's financial debt decreased by €0.4 billion and Danone announced a DPS of €2.00 up by +3.1% compared to last year. Net debt/EBITDA reached 2.5x with a RoIC of 8.9% (Fig 2).

Danone Q4 Financials in a Snap

(Fig 1)

Danone 2023 Financials in a Snap

(Fig 2)

Conclusion and Valuation

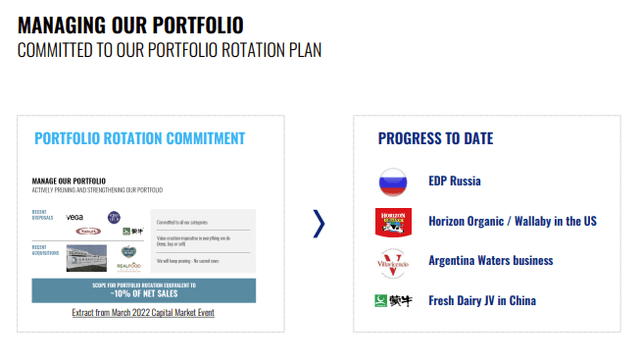

In 2023, starting with the CEO's words, Danone "will pursue its transformation, and further invest in brands, products, and capabilities while delivering in line with the mid-term guidance defined last year". The CEO is positive that the current year will accelerate Danone's transformation to profitable growth. Here at the Lab, we are confident that the company will achieve its upper half of the 3-5% like-for-like top-line sales growth range and on the margin, forecasting a lower inflation rate, the company will benefit from carry-over pricing where necessary. The Danone first semester will probably align with Q4, while H2 is expected to be a sequential improvement (Fig 2). Portfolio rotation is ongoing (Fig 4) and the company will dispose of lower growth areas and margins, which will positively affect the group, while the company is investing in plant-based capabilities and Chinese-specialized nutrition. Regarding the valuation, we believe that Danone is fairly priced in. Valuing the French integrated player with a 16x Price Earning, we derived a €54 stock price ($11 in ADR), and so we confirmed our neutral rating target.

(Fig 3)

(Fig 4)

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of DANOY, GPDNF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.