The market extended gains for the second consecutive day on March 6; however, some profit-booking was witnessed at higher levels. This resulted into a loss of around 90 points on the Nifty50 from its day's high of 17,800, thus leading to a Shooting Star kind of formation on the daily charts.

This is generally a bearish reversal pattern but needs a confirmation in coming sessions. The Nifty50 jumped 117 points to 17,712, while the BSE Sensex climbed 415 points to settle at 60,224, after losing 270 points from day's high.

The broader markets managed to outperform benchmark indices on positive breadth. The Nifty Midcap 100 index gained 0.85 percent and Smallcap 100 index rose 1.12 percent.

"A small positive candle was formed on the daily chart with long upper shadow. Technically, this pattern indicates an emergence of selling pressure from near the overhead resistance of 17,800 levels (opening downside gap of February 22 and weekly 10 and 20 period EMA - exponential moving average)," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

Hence, the analyst feels a decisive move above 17,800 levels is likely to bring more strength in the upside momentum of the Nifty.

But below 17,800, "there is a possibility of further consolidation or minor downward correction in the short term, before showing further upmove. Immediate support is placed at 17,600 levels," the expert said.

The market was shut on March 7 for Holi.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the Nifty has support at 17,679, followed by 17,649 and 17,600. If the index moves up, the key resistance levels to watch out for are 17,777, followed by 17,807 and 17,856.

We have not seen major participation from banks as Nifty Bank rose 99 points to 41,350, and formed small bodied bearish candle with long upper shadow on the daily charts, but there was a continuation of higher highs formation for seventh consecutive session.

"Nifty Bank index witnessed some selling pressure from higher levels but the broader trend remains bullish and one should keep a buy-on-dip approach," Kunal Shah, Senior Technical Analyst at LKP Securities said.

He said the index lower-end support is expected at 41,000 where the highest open interest is built up on the Put side and the upside resistance is at 42,000. The index is likely to trade in this range for the next couple of trading sessions, he feels.

The important pivot level, which will act as a support, is at 41,269, followed by 41,172 and 41,015. On the upside, key resistance levels are 41,584, followed by 41,682, and 41,839.

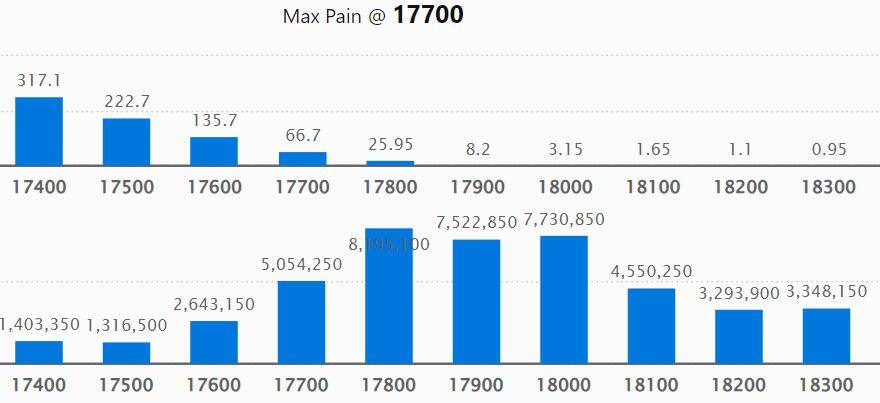

On a weekly basis, the maximum Call open interest (OI) was seen at 17,800 strike, with 81.95 lakh contracts, which may remain a crucial resistance level for the Nifty in the coming sessions.

This is followed by a 18,000 strike, comprising 77.30 lakh contracts, and a 17,900 strike, where there are more than 75.22 lakh contracts.

Call writing was seen at 17,800 strike, which added 33.29 lakh contracts, followed by 18,100 strike, which have addition of 18.25 lakh contracts, and 18,300 strike which saw 18.15 lakh contracts addition.

We have seen Call unwinding at 17,600 strike, which shed 23.18 lakh contracts, followed by 18,500 strike which shed 18.71 lakh contracts, and 17,500 strike which shed 18.01 lakh contracts.

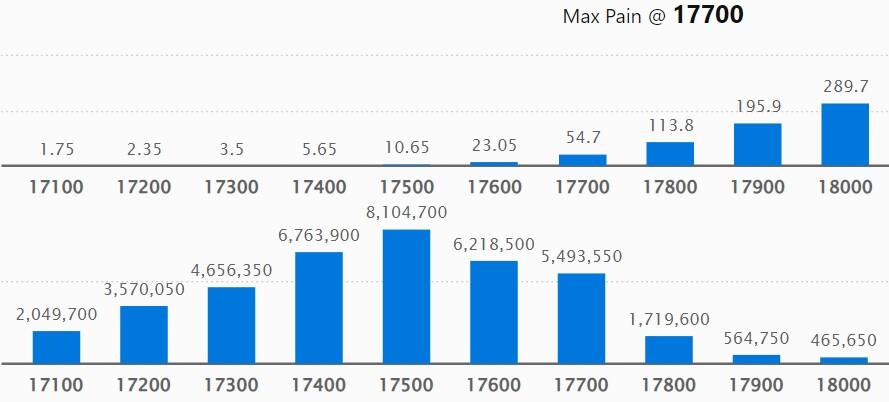

On a weekly basis, we have seen the maximum Put OI at 17,500 strike, with 81.04 lakh contracts, which is expected to act as a crucial support zone for the Nifty50 in coming sessions.

This is followed by the 17,400 strike, comprising 67.63 lakh contracts, and the 17,600 strike, where we have 62.18 lakh contracts.

Put writing was seen at 17,700 strike, which added 43.21 lakh contracts, followed by 17,800 strike with 12.46 lakh contracts, and 17,600 strike with 9.75 lakh contracts.

We have seen Put unwinding at 17,100 strike, which shed 10.14 lakh contracts, followed by 17,000 strike which shed 9.97 lakh contracts, and 17,200 strike which shed 8.35 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Hindustan Unilever, Bharti Airtel, HDFC, Nestle India, and Can Fin Homes, among others.

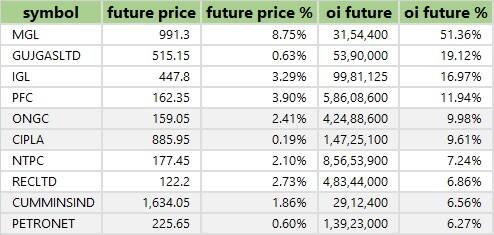

An increase in open interest (OI) and an increase in price mostly indicate a build-up of long positions. Based on the OI percentage, 68 stocks including Mahanagar Gas, Gujarat Gas, Indraprastha Gas, Power Finance Corporation, and ONGC, witnessed a long build-up.

A decline in OI and a decrease in price, in most cases, indicate long unwinding. Based on the OI percentage, 21 stocks including RBL Bank, Britannia Industries, Dixon Technologies, Atul, and Jindal Steel & Power, witnessed a long unwinding.

26 stocks see a short build-up

An increase in OI accompanied by a decrease in price mostly indicate a build-up of short positions. Based on the OI percentage, 26 stocks including Ramco Cements, L&T Technology Services, Punjab National Bank, HDFC AMC, and Dr Lal PathLabs, saw a short build-up.

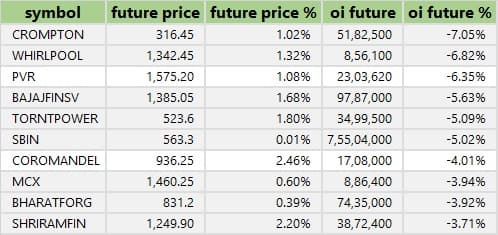

A decrease in OI along with an increase in price is an indication of short-covering. Based on the OI percentage, 78 stocks were on the short-covering list. These included Crompton Greaves Consumer Electricals, Whirlpool, PVR, Bajaj Finserv, and Torrent Power.

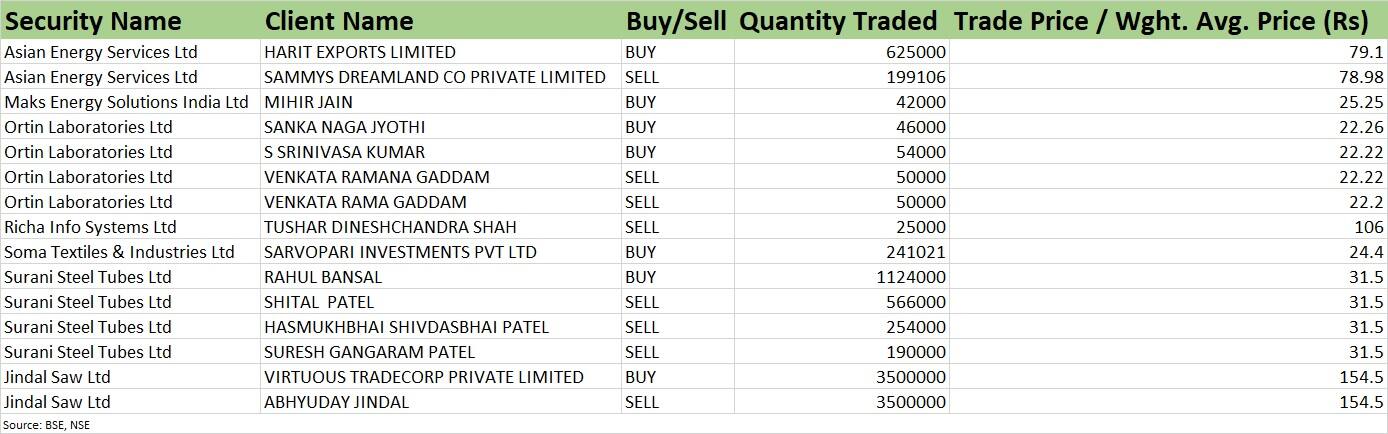

(For more bulk deals, click here)

Investors' meetings on March 8

Asian Paints: Company's officials will be meeting with Capital World Investors.

Tata Communications: Officials of the company will participate in ICICI Securities Corporate Roadshow in US.

Titan Company: Company's officials will interact with Marshall Wace, and McInroy and Wood Ltd.

Five-Star Business Finance: Officials of the company will interact with Baroda BNP.

Tube Investments of India: Company's officials will meet WhiteOak Capital.

Stocks in the news

Allcargo Logistics: Allcargo Logistics has received board approval for acquisition of 38.87 percent stake from its partners in contract logistics business, at an enterprise value of Rs 373 crore. With the acquisition, Allcargo Logistics will take its stake to 100 percent in the contract logistics business. The acquisition reflects the group's vision for robust growth by creating an effective synergy between contract logistics and express distribution. The board also approved sale of smaller non-core customs clearance business, wherein Allcargo will sell its 61.13 percent stake for an enterprise value of Rs 42 crore. Further, the company declared an interim dividend of Rs 3.25 per equity share for FY23.

Indraprastha Gas: The company has signed joint venture agreement with Genesis Gas Solutions (subsidiary of Vikas Lifecare) to set up India's smart meter manufacturing plant with capital expenditure of Rs 110 crore. Initially this plant will have installed capacity to manufacture 1 million meters annually, and is planned to be operational by April 2024.

Ajanta Pharma: The meeting of the board of directors of the company is scheduled be held on March 10 to consider the proposal for buyback of the equity shares.

KPI Green Energy: The company has signed a 20-year Hybrid Power Purchase Agreement (PPA) for 1.845 MWAC capacity with Garrison Engineer-based in Jamnagar under its independent power producer segment.

NBCC India: The company has received three construction and development projects worth Rs 541 crore including development of new industrial estate in union territory of Jammu & Kashmir worth Rs 217.27 crore, and construction of Institute of Chemical Technology in Bhubaneswar worth Rs 300 crore.

Lumax Auto Technologies: The company has received board approval for investment of up to Rs 225 crore in subsidiary Lumax Integrated Ventures, and extension of corporate guarantee in favour of Kotak Mahindra Investments for securing credit facilities or debt of up to Rs 250 crore to be availed by Lumax Integrated Ventures.

Sun Pharmaceutical Industries: The company has completed acquisition of biopharmaceutical company Concert Pharmaceuticals. Concert is developing deuruxolitinib, a novel, deuterated, oral JAK1/2 inhibitor, for potential treatment of adult patients with moderate to severe alopecia areata.

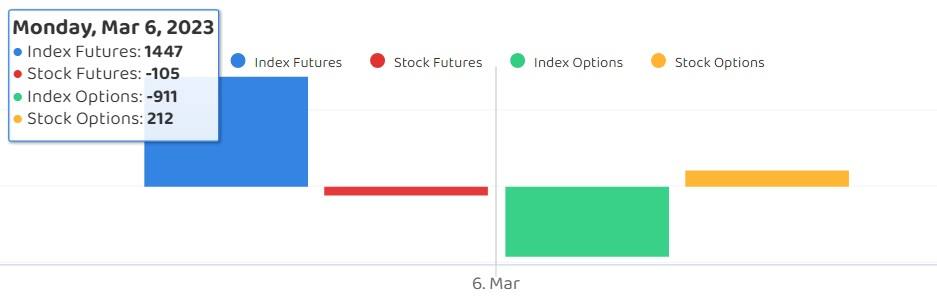

Fund Flow

Foreign institutional investors (FII) bought shares worth Rs 721.37 crore, while domestic institutional investors (DII) purchased shares worth Rs 757.23 crore on March 6, the National Stock Exchange's provisional data showed.

Stocks under F&O ban on NSE

We don't have any stock in the F&O ban list for March 8. In fact, the National Stock Exchange has not added a single stock in its F&O ban list since the start of March series. Securities banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.