Metalla Royalty & Streaming: Patience Required

Summary

- Metalla continues to be one of the worst-performing precious metals stocks, declining 30% last year after already suffering a more than 40% decline in 2021.

- While this is certainly disappointing for shareholders, the underperformance was to be expected, given the 2021 overvaluation and the need for the excess to be wrung out of the stock.

- The good news is that Metalla is finally becoming more reasonably valued, and we've seen positive developments across its portfolio for key assets (Wasamac, Tocantinzinho, and others).

- That said, while I see Metalla as one of the better junior royalty and streaming companies, I don't see a low-risk buying opportunity just yet.

Falcor

2022 was a tough year for the Gold Miners Index (GDX) and although several names rallied to finish the year, we've seen a sharp retracement since the highs. The poor performance on a trailing two-year basis for gold producers isn't that surprising, given that most of the margin benefit from a $400/oz increase in the gold price ($1,800/oz vs. $1,400/oz) was eroded by inflationary pressures (fuel, electricity, labor, steel, cyanide, etc.) with minimal margin improvement and higher share counts for many companies because of share-based acquisitions and or capital raises to fund growth projects.

Some investors have argued that the Gold Miners Index has no business trading below $35.00 when it traded as high as $45.00 in July 2020 with the gold price trading just $150/oz lower. However, I see this as a superficial argument when we have seen meaningful share dilution among producers (and even some royalty/streaming companies) and margins compressed materially. In fact, AISC margins sector-wide declined 30% from FY2020 levels and that is despite a slightly higher average realized gold price reported sector-wide. So, while one might believe gold producers should trade higher if the gold price is at higher levels, this argument is only valid if that benefit actually flowed through to their bottom line (which it didn't).

Gold Producers - Cash Costs, Gold Price, AISC, AISC Margins (Company Filings, Author's Chart)

Fortunately, the royalty/streaming companies were insulated from this severe margin compression, benefiting from a high-margin business model that isn't hurt by rising operating costs, increased costs to sustain operations, or capex blowouts at growth projects. However, despite this distinction, some have underperformed their producer peers, with Metalla Royalty & Streaming (NYSE:MTA) being one example, down ~30% last year vs. a 10% decline in the GDX. In this update, we'll look at recent developments, what the cause might be for the recent underperformance and whether this has provided a buying opportunity.

2022 Underperformance

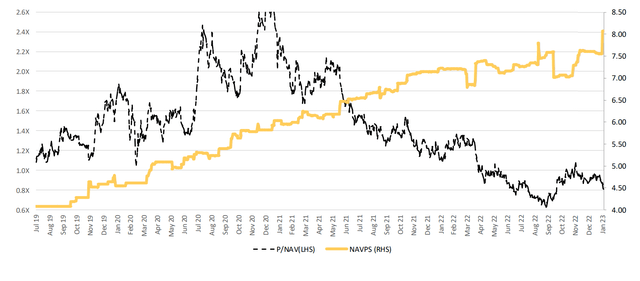

Metalla Royalty & Streaming has been one of the worst-performing stocks on a trailing-two-year basis since I noted that the stock was trading at a frothy valuation in January 2021, at well over 2.0x P/NAV and over 100x sales. Although P/NAV is obviously a better way to value early-stage royalty/streaming companies with maturing development pipelines, there comes a price when a valuation simply can't be justified, and this wasn't certainly the case for Metalla as it entered 2021. Unfortunately, despite some solid transactions, the stock has dropped like a stone since then, suffering a 70% drawdown from its highs, and currently sitting ~66% from its highs despite its bounce off its lows.

MTA - January 2021 Article (Seeking Alpha Premium)

One might assume that this severe underperformance relative to peers and protracted downtrend has something to do with the business model and that this is a cause for concern. However, it's important to note that underperformance of this magnitude is not unusual at all after a ~500% return in just three years for Metalla following its IPO debut and a move to stratospheric levels of over-valuation. In fact, we saw something similar for K92 Mining (OTCQX:KNTNF) after years of outperformance and this is despite the company setting itself up to be the #2 growth story sector-wide with an operation that could produce ~350,000+ gold-equivalent ounces at sub $800/oz all-in sustaining costs later this decade.

Metalla - P/NAV and NAV Per Share Growth (Company Presentation)

To provide evidence of Metalla's progress since its 2021 peak, we can see that it has consistently grown net asset value per share by completing several attractive deals, and its share price and net asset value per share have actually traded somewhat inversely. Given the proof that the company has not been eroding shareholder value and has actually been relatively disciplined compared to some of its peers that have paid up for growth or transacted on tired/riskier assets, I believe investors should be careful not to miss the forest for the trees and realize that this underperformance in MTA is likely attributed to the froth needing to come out of the stock, and not developments related to the business. Let's dig into recent developments:

Recent Developments

Last year was another positive one for Metalla with a new asset coming online in Q3 2022 (El Realito), the start of construction at the Tocantinzinho Project in Brazil (first production in 2024), and another upgrade for Wasamac, which has gone from being held by a ~$300 million company to a ~$5.0 billion company to a ~$22 billion company since Metalla added this royalty asset. Although this steady changing of hands and independent work having to be done by new operators has slowed down the initial production date, the production profile has increased materially, with the contemplated mining rate increasing from ~5,000 tonnes per day, and the production profile potentially increasing to closer to ~180,000 ounces over the life of mine vs. ~140,000 ounces under Monarch.

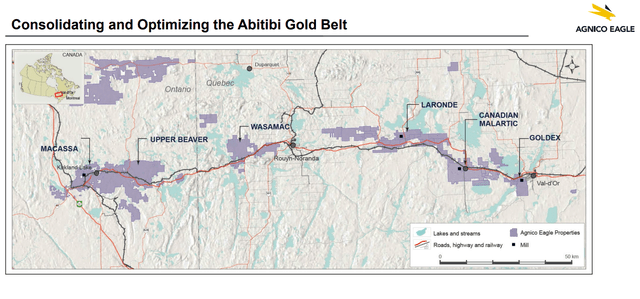

Abitibi Gold Belt Optimization (AEM Presentation)

The major recent development at this asset, though, is that with Yamana's Canadian assets changing hands to being owned by Agnico Eagle (AEM), Agnico is looking at utilizing the 40,000 tonnes per day of excess capacity that will be available in 2029 at the Canadian Malartic Mill to process ore from other mines. One of these opportunities is Wasamac, which lies less than 100 kilometers west of the Canadian Malartic Mill and has the grades to support hauling the ore over this distance. Given that Agnico is the most aggressive driller sector-wide, it is great to see this asset in the hands of an even more well-capitalized operator.

Canadian Malartic Partnership - 2020 Mine Plan (Technical Report)

That said, I continue to believe that Q1 2028 is a more conservative timeline for commercial production vs. 2026/2027 proposed by Yamana, and with this appearing to be a spoke along the Abitibi Gold Belt vs. a stand-alone, I don't see any reason Agnico would rush to put Wasamac into production before H1 2026. This is because the Canadian Malartic Mill should still run near capacity in 2025/2026 before the real scale down occurs in 2026/2027, and Agnico will spend this year confirming this is the right move for the asset before construction would begin in 2025 earliest.

In summary, while Wasamac will certainly provide a massive boost for Metalla (~$3.6 million in revenue per annum for the first few years), we're still up to five years away from the start of commercial production. However, from a big picture standpoint, this regional competitive advantage with considerable mill capacity at Canadian Malartic post-2027 means that Agnico is likely to drill Wasamac and Camflo (where Metalla also holds a royalty) quite aggressively given that the hurdle for defining economic ounces is much lower when there's a hungry mill sitting nearby that needs feed from spokes (satellite mines). So, while Monarch had defined an 11-year mine life, I wouldn't be shocked if this asset was producing well into the late 2040s under Agnico, which certainly benefits Metalla and provides visibility into future cash flow.

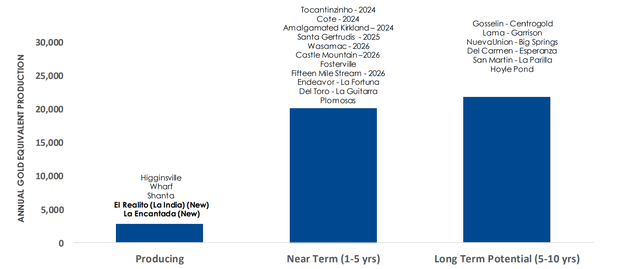

Metalla - Annual GEO Production Potential (Company Presentation)

From a potential negative standpoint for royalties held on Agnico's assets by Metalla, Agnico may plan to spend $7.3 million on the Santa Gertrudis Project this year, but the project has been removed from recent presentations, and a 2025 start date certainly doesn't look likely (which is what Metalla has noted in its most recent presentation). In fact, given the upgrade in Agnico's portfolio with the ability to leverage off existing infrastructure and somewhat of an urgency to start development on Wasamac/Upper Beaver by H2 2026 to ensure there's adequate feed to fill the Canadian Malartic Mill starting in 2029, we could see Santa Gertrudis pushed out to a later date or just see Agnico sit on it for the time being.

The other negative would be a divestment or Santa Gertrudis sitting idle given that for a 3.5 million-ounce producer like Agnico, it's not clear whether Santa Gertrudis fits the portfolio any more, even if it is a very robust project (it was expected to produce 150,000 ounces of gold at the high end of soft guidance). This would be a tiny operation for a company of Agnico's size, and regarding Mexico, the company's next focus appears to be San Nicolas, which should be higher-margin and much larger, which would justify it staying in the region despite having tiny operations at Pinos Altos and La India. Hence, while Metalla believes Santa Gertrudis is near term (2025), I'm much less optimistic about this proposed timeline (Metalla Presentation).

Elsewhere, Metalla picked up royalty ground just outside the Fosterville Mine boundary for a song (~0.60x P/NAV) in 2020, but because of operating constraints related to low frequency noise (below the level of human hearing) which is being emitted by primary surface fans at Fosterville, production from the mine will be lower this year. This obviously doesn't affect Metalla's revenue and cash flow, given that this is not a producing asset. However, if the EPA of the Victorian Government continues to make things difficult for Agnico (these fans cannot operate from midnight to 06:00 AM, making it difficult to support previous mining rates, it would not be shocking if Agnico sold the mine.

As it stands, I do not see an asset sale as likely, but it certainly looks more likely than it did two years ago when Metalla scooped up this royalty that it hoped might pay off down the road, which at the time was the #1 asset for Kirkland Lake and has now dropped to a top-6 asset for Agnico from a priority standpoint. Unfortunately, the EPA playing hard ball when the high-grade reserves are already exhausted creates a greater hurdle for maintaining low-cost production given that if it's mining less than half the grades and it's now losing one-fourth of the operating hours because of operating constraints with little basis for this enforcement, this certainly doesn't help the production profile and ability to maintain economies of scale.

Finally, on the positive side, Cote will begin production next year, which will provide a minor contribution once mining heads onto its royalty ground. Meanwhile, there looks to be a high probability that Amalgamated Kirkland will head into production next year, with plans to process material at the LZ5 Mill circuit at the LaRonde Complex as part of Agnico's Abitibi Gold Belt Optimization plans (utilizing excess mill capacity in the region). So, although Metalla will only see a slight bump in attributable gold-equivalent ounce production this year as no contribution from COSE will partially offset El Realito, we should see a step up in production and annual revenue in 2024 (Cote, AK, Tocantinzinho).

Valuation

Based on ~54 million fully diluted shares and a share price of US$4.70, Metalla trades at a market cap of ~$254 million and an enterprise value of ~$260 million. This compares favorably to an estimated net asset value of ~$300 million, with Metalla trading at approximately 0.85x P/NAV based on this estimate. Although this figure is well below many of Metalla's largest peers and the average P/NAV multiple for the royalty/streaming space, this multiple is not that unusual relative to more relevant peers such as Elemental Altus (OTCQX:ELEMF), Gold Royalty Corporation (GROY), and EMX Royalty (EMX) which all trade well below 1.0x P/NAV. So, on a relative standpoint, I don't see this disconnect as that abnormal, and using a conservative multiple of 1.0x P/NAV and an estimated 56 million fully diluted shares at year-end, I see a fair value for MTA of US$5.35.

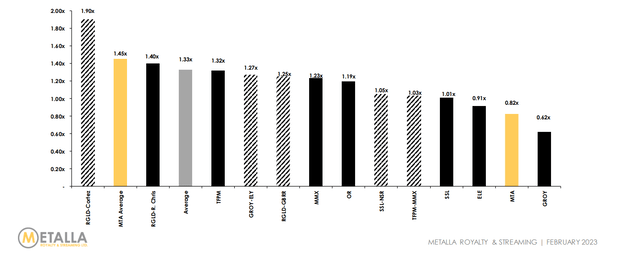

Metalla Royalty - Valuation vs. Other Companies/Asset Sales (Company Presentation)

Some investors might look at the above chart and conclude that Metalla is undervalued compared to where we have seen transactions occur over the past couple of years if looking at deals like Gold Royalty Corporation's (GRC) acquisition of Ely Gold Royalties, acquisitions of royalties on Great Bear, Red Chris, and Cortez by Royal Gold (RGLD). However, I would argue that GRC's acquisition of Ely using expensive currency following its IPO was an anomaly with the benefit of using overpriced shares to add cash flow to the portfolio. Meanwhile, though Royal Gold paid a handsome price to lock up royalties on Red Chris, Cortez, and Dixie, these are Tier-1 jurisdiction assets with 350,000 GEO per annum potential (or ~1.0 million ounces with the Cortez Complex), meaning that RGLD to pay a large premium to net asset value.

Assuming Metalla's portfolio comprised solely Tier-1 jurisdiction assets owned by top-5 operators with 350,000+ GEO per annum potential, one could certainly make a case for Metalla to trade at above 1.50x P/NAV. However, this is obviously not the case, and the only obvious asset that comes close to fitting these criteria is Wasamac (but it doesn't meet the 350,000+ GEO per annum profile), or Lama in Chile, but it's not yet clear on the scale of this asset. So, although Metalla has a solid portfolio compared to its peer group in the junior space, I don't think investors should anchor themselves against prices paid in the acquisitions of other Tier-1 jurisdiction royalties held by top operators to derive a fair value for Metalla's stock.

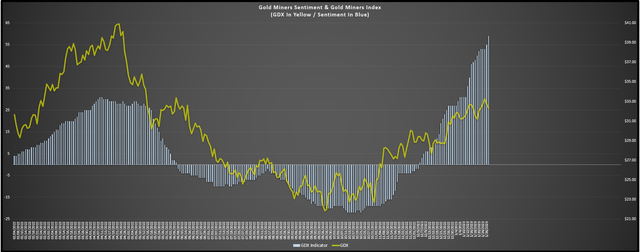

While a fair value of US$5.35 for MTA points to a 14% upside from current levels, I do not believe in buying at any price for growth stories, and I require a minimum 35% discount to fair value to justify starting new positions in small-cap names and ideally 40%. If we apply this discount to Metalla and use the lower end of the range, the stock would need to decline below US$3.50 to offer an adequate margin of safety. This would line up with a re-test of the stock's September 2022 lows, which can't be entirely ruled out, given that sentiment sector-wide is yet to be washed out to levels where I would consider further downside as unlikely (such as September 2022 when downside looked to be minimal because of extreme pessimism for mining shares).

Gold Miners Sentiment as of January 26th, 2023 (Author's Data & Chart)

Summary

Metalla Royalty has been one of the most active companies in the royalty/streaming space and has done a solid job of paying the right price for most royalty assets despite being active in a competitive period when many others were over-paying for growth. Based on developments over the past 18 months, the fruit of this labor is finally becoming more visible, with obvious examples of winning deals being Wasamac, Tocantinzinho, Cote, and potentially Fifteen Mile Stream. That said, investing in micro-cap names is very risky even if they have attractive business models, and especially when that business model comprises being a price-taker, even if Metalla benefits from insulation from inflation. So, while I see MTA as a solid buy-the-dip candidate, I see the ideal buy zone being US$3.55 or lower.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of AEM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.