Espey Manufacturing: Only Fairly Valued, Not An Opportunity

Summary

- Espey Manufacturing manufactures power systems (transformers, converters) for vehicles, particularly defense vehicles.

- The company's revenues and margins have historically correlated with the U.S. defense budget. With current geopolitical tension on the rise, the company is posed to do more business.

- However, the company does not enjoy a particular technological moat, so the competition will continue threatening the company's margins.

- Despite its industry's tailwinds, I believe ESP stock is not an opportunity because its share price already discounts all positive developments.

- Purchasing at these prices, the shareholder receives a fair value if the company grows (probable) but a loss if the company does not grow. This is not an asymmetric opportunity for the investor.

guvendemir

Espey Manufacturing & Electronics Corp. (NYSE:ESP) is a maker of power supplies, converters, transformers, and related products, used particularly in defense vehicles and railroads.

The company has been growing recently, in line with higher spending on U.S. defense. Coupled with cost efficiencies, the company's profits have soared.

However, current stock prices imply significant growth and further margin improvements. Although the company's revenues provide some future visibility because of backlogs and their close correlation with defense spending, growth is risky because the market is very competitive.

Most importantly, the company is priced for growth, meaning that if it grows, the investor is left with an adequate return, but not if it does not grow. This is not an asymmetric bet and therefore does not represent an opportunity.

Note: Unless otherwise stated, all information has been obtained from ESP's filings with the SEC.

Business description

Power systems for defense vehicles: ESP designs and manufactures power components (converters, transformers, supplies, UPS) used mostly in military vehicles. The company also sells to the railway industry and does not disclose segment figures, but a revision of its products reveals that the enormous majority is related to military applications.

Small defense contractors are not a great industry to participate in. The sales cycle is long and requires significant design investments before obtaining a design win. Prices are negotiated in a bid system, with established cost plus margin requirements.

Competitors, therefore, cannot build a significant margin based on brand or moat unless their products are truly unique. That is not the case with ESP's relatively simple power system products. The company does not mention any patents and recognizes that it does not control a significant share in any of its end markets.

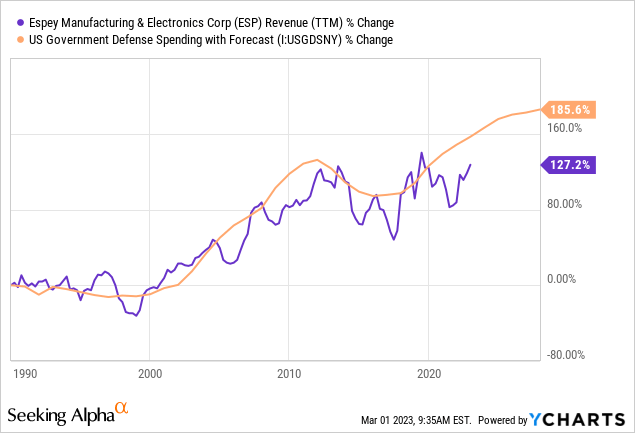

Good correlation with defense spending: The company's revenues have followed the U.S. defense budget closely, albeit the gap is a little wider now than before.

The chart below, which includes forecasts for future defense spending, also signals the recent competitive dynamics of a market where the defense budget was reduced. With the recent geopolitical tension, the higher spending forecasts seem very plausible.

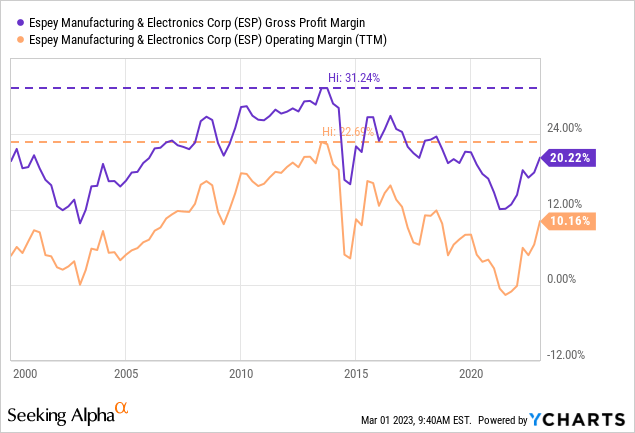

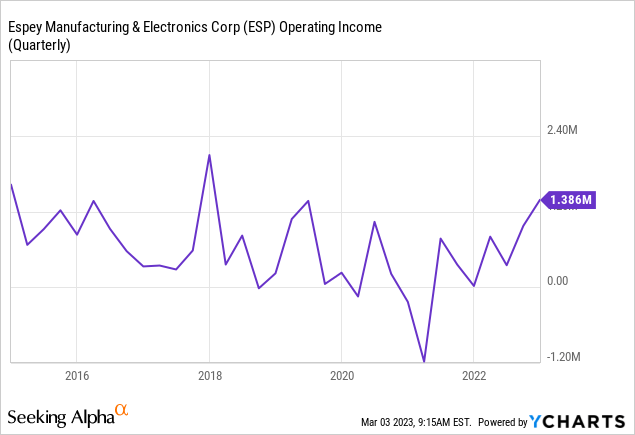

Margins follow revenues: High levels of business were also coincident with higher margins for the company. This is understandable, given that ESP has significant sales costs from its long sales cycle, and overhead costs from its manufacturing operations, that are best diluted across more volume.

But competition does its part: It is also true that the company's products probably faced higher competition in the past decade, on top of decreasing revenues, given that they are not technologically differentiated.

The problem of backlog and capitalized costs: ESP capitalizes a significant portion of its overhead costs, concentrated at the beginning of its long-term manufacturing contracts, to accrue those costs across the expected revenue generated by the contract.

This dynamic requires significant estimations from management, affects gross margins substantially, and is prone to reversions. Particularly, the defense department contracts do not provide for specific levels of revenues, which have to be estimated based on budget information.

A detailed review of this accounting system (which is mandated, not an aggressive accounting decision by management) was presented for CPI Aerostructures (CVU).

As of 2Q23 (December 2022), ESP has capitalized $16.5 million in overhead costs as part of its inventories. These capitalized costs (pure accounting representation, as they are not materialized in an object that can be resold) represent 90% of inventories and 60% of TTM CoGS.

The risk is that a reduction in defense spending, generally or in specific projects, would make management reduce its expectations of future revenues, requiring the company to accelerate the recognition of those expenses.

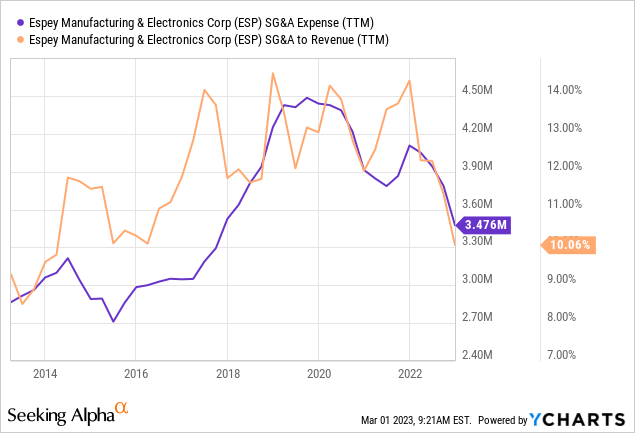

Controlling SG&A costs: The Achilles' heel of many low-margin companies is an elevated SG&A cost level, particularly if that level permanently decouples from revenues and gross margins.

That was the case with ESP for some years, between 2014 and 2020 at least. As seen before, the company's revenues and gross margins fell. However, the chart below shows that during the same period, SG&A expenses grew, both in absolute terms and as a portion of revenues, further contributing to the fall in profitability.

The opposite has happened in 2022, with SG&A costs decreasing significantly at the same time as revenues and gross profits grow, multiplying the effect on bottom-line profitability.

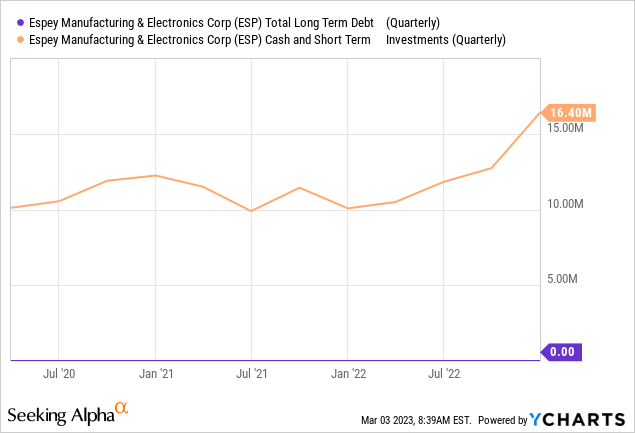

Financially strong: The company has no debts and carries $16.5 million in cash and short-term securities as of 3Q22.

Valuation

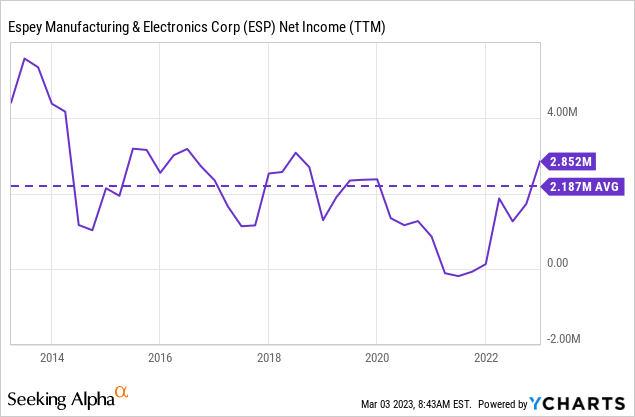

Historical, recent, and future profitability: If evaluated based on the latest defense budgeting cycle initiated after 2014, ESP generated an average of $2.2 million in net income. A $56 million market cap seems excessive from a historical standpoint.

However, several things have changed. The company has improved its cost management, reducing SG&A. It has also increased revenues, improving gross margins as well. Finally, and most importantly, the war in Ukraine and the tense geopolitical context imply higher defense spending in the coming decade.

For example, taking 2Q23 (December 2022) as a basis, the company would generate $5.5 million in operating income, translating to approximately $4.5 million in net income (considering 21% federal corporate income taxes).

Capturing the defense budget: The first issue is whether or not ESP will capture the expected increase in the defense budget. This will depend on winning more contracts and the DoD increasing the budget for vehicles to which ESP already supplies components.

I answer this aspect affirmatively because changing a vehicle is a lengthy process, and more spending will probably be directed toward existing programs.

Better margins in the future? I do not believe ESP margins will improve much more than today for a few reasons. First, the company does not have a technological moat. It has to compete based on price for the most part. Second, current margins are already close to long-term 20+ year averages. Third, today's margins already incorporate expectations for future demand because higher expected demand decreases the amount of overhead recognized over today's products.

The accounting risk: Recent revenue and margins have been affected by expectations of future demand. For example, revenue recognized by units delivered grew 10% between 2Q23 and 2Q22 or 6M23 and 6M22. However, revenue recognized over milestones (accrual, expectations-based accounting) increased by 55% during the same period. This implies that most revenue growth comes from expectation changes, not more deliveries.

The company's funded backlog is $78 million as of 2Q23, representing approximately two years of revenue. Funded implies that current DoD budgets approved by Congress already include funding for projects (vehicles in this case) from which ESP derives revenue. It is not 100% certain revenue, but it is pretty solid.

Still, the risk of a change in future expectations exists and should be discounted in the company's quality considerations.

Multiples, growth, and quality: For the above reasons, I assign more probabilities to the company maintaining and growing current profitability than to the negative scenario where it returns to the 2014-2021 levels.

In my opinion, the company does not qualify for an earnings multiple premia because it has accounting and contract risk, does not have a moat, and depends on an industry where rivalry is high, and profitability is low. True, its industry benefits from geopolitical tailwinds, but the pros and cons even out.

Still, the company trades at a P/E ratio of 12.5x to annualized 2Q23 earnings (second highest quarterly operating income since 2015). A 12.5x ratio implies a premium on company quality, which I believe the company does not deserve.

What this indicates, in my belief, is that the company is fairly valued but does not represent an opportunity. If the company can maintain profitability and grow even more (the base scenario), it will return the average return for a company of its quality. However, if it does not, the investor may face lower earnings yield and further capital losses as the multiple adjusts to the new reality.

Conclusions

ESP is growing revenues, improving profitability, and benefits from industry tailwinds that will probably last years.

However, the company carries accounting risk, does not have a moat, and its industry is competitive, where profitability is threatened.

The company trades at a premium multiple on historically high annualized earnings. That premium is not justified by the company's quality but will probably be closed by profitability growth (the base case scenario given the geopolitical context).

Still, there is nothing to be won at current prices, only the possibility (strong, true, but still a possibility and not a reality) of regular returns.

For that reason, I believe ESP stock is not an opportunity.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.