Digital Turbine: A Pivot Is In Sight

Summary

- Digital Turbine, Inc.'s misfortunes are about to pivot, providing ad spending reverts to its average growth trajectory.

- The company has a novel business model. Moreover, constant expansion by integrating growth ideas such as a Shopify-esque platform could yield substantial financial benefits.

- Although constant R&D is required, Digital Turbine's costs are primarily variable, protecting its bottom line from severe economic events.

- Digital Turbine stock is relatively undervalued and nearly oversold.

- Looking for a helping hand in the market? Members of The Factor Investing Hub get exclusive ideas and guidance to navigate any climate. Learn More »

Sauliakas/iStock via Getty Images

Digital Turbine, Inc. (NASDAQ:APPS) stock has suffered from a trying time during the past year, conveyed by its more than 70% year-over-year drawdown. Recouping those losses may seem like an arduous task; however, our analysis tells us that APPS stock might be set for a pivot.

Based on a combination of fundamental and company-specific aspects, we believe consumers and investors alike have overreacted during the past twelve months amid fears of an economic catastrophe. Although coy about the global economy, we believe industry outliers such as Digital Turbine are undervalued and might recover in the coming quarters, lending investors lucrative tactical investment opportunities.

Let's commence with a more detailed discussion.

APPS Stock's Realized Return (Seeking Alpha)

Fundamental Analysis

The Bad

I don't quite buy into the secular growth trend argument, as highly volatile companies and stocks will generally have an exponential trajectory compared to the broader market. And Digital Turbine's Q3 earnings report showed just that, as the company's year-over-year quarterly revenue slipped by 25% amid growing systemic headwinds.

Much of the firm's recent misfortunes resulted from lower macroeconomic confidence among consumers, and pandemic re-openings also played a part. Collectively these features resulted in lower advertising spending and ancillary service demand from enterprises, leading to a crash in Digital Turbine's growth pattern.

On-Device Offerings

Starting with ad spending, Digital Turbine's CEO, Bill Stone, claims that Ad pricing has decreased by 10% to 30% over the past year. We anticipate this to be due to the aforementioned reasons.

Furthermore, device shipments were 10% to 12% slower in the U.S. in 2022. Again, macroeconomic headwinds played a significant role, reducing both personal and enterprise spending. Although Digital Turbine's on-device business expanded by 10% year-over-year, a continued trend of device deliveries will impact the firm at some stage.

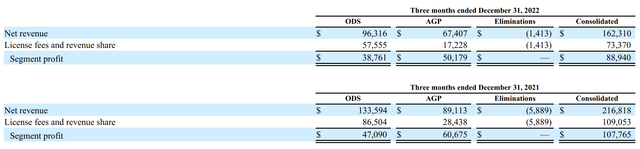

App Growth Platform

As visible in the diagram below, Digital Turbine's App Growth Platform also suffered a year-over-year hit in sales and profit. The segment, which allows mobile app publishers and developers to monetize their active users by display features, fell during the past twelve months for the same reasons as On Device Solutions.

The Good (I Mean Exceptional)

Digital Turbine's strength is linked to its novelty. The company adds value to advertising by delivering uniform solutions that span from small entrepreneurs to large enterprises.

Future Growth Drivers

Solutions like SingleTap and AdColony have added tremendous zest to Digital Turbine's business model.

However, more scope exists.

The company plans on investing significant resources in developing a type of Shopify (SHOP) offering, which would allow its partners to port their apps across platforms, manage payments, install new apps, and curate their offerings with the help of a dynamic marketplace. In fact, Digital Turbine recently acquired an equity position in an app called Aptoide, taking its first leap toward achieving its integrated vision.

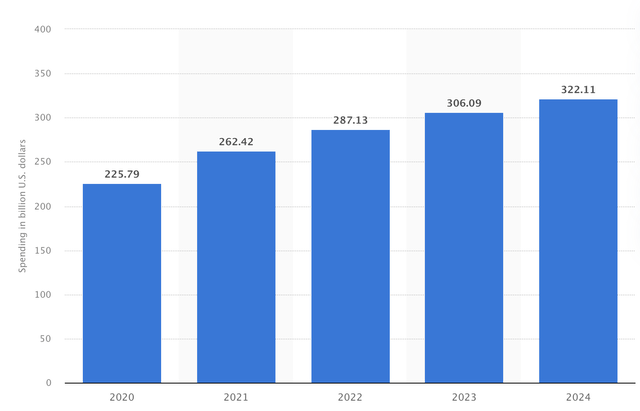

Ad Spending Prospects

Although ad spending suffered a temporary drawdown in 2022, the general consensus is that digital ad spending will grow exponentially in the coming years as businesses and entrepreneurs pivot toward a digitalized world.

Digital Turbine's 0.04% market share remains infinitesimal. However, as previously mentioned, the firm has a novel business model, which could see its industry participation grow substantially in the coming years.

A notable risk is that the organization operates in an industry with low switching costs. Moreover, digital advertising is very fragmented. Therefore, Digital Turbine and its investors identically will always need to keep an eye out for rising competition.

Financial Statement Analysis

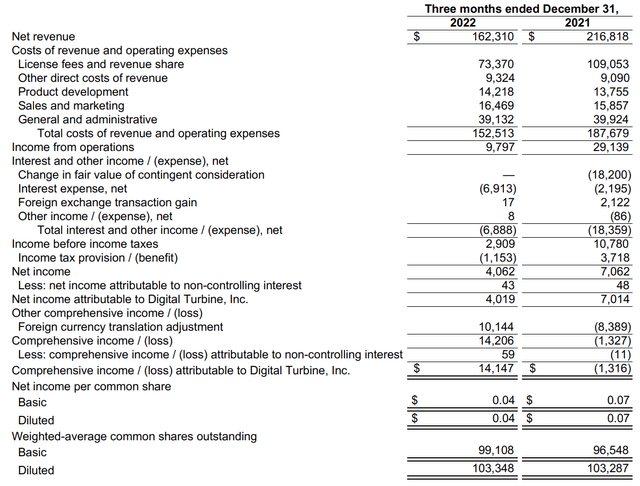

Digital Turbine's costs are primarily variable as the company focuses on a lean business model and prevents itself from overstaffing. For example, its licensing fees line item, which is its most substantial expense, is positively correlated to revenue, conveying a less obligated income statement.

However, like most early-stage companies, Digital Turbine's product development costs and marketing have stayed high during the past year. As a growth-stage firm, Digital Turbine is required to reinvest in innovation and marketing throughout the economic cycle.

Another area of concern is the company's debt load. With a debt-to-equity ratio of 71.27%, Digital Turbine presents its equity investors with significant risk whenever the economy is in a downward spiral, which is unlikely to change until the enterprise enters a more mature phase.

Valuation and Technical Analysis

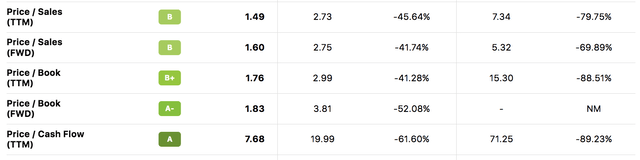

Contrary to what many believe, top-line valuation multiples such as the price-to-sales and price-to-cash flow ratios are helpful when evaluating a stock. That's because tech growth stocks typically exhibit volatile income statements, inconsistent capital structures, and mixed amortization numbers. Therefore, many analysts use P/S and P/CF to draw a consensus.

Digital Turbine's P/S and P/CF ratios are at normalized discounts of 79.95% and 89.23%, respectively, providing investors with a potential value gap.

Another aspect that stacks up favorably is Digital Turbine's technical price level. The stock is trading below its 10-, 50-, 100-, and 200-day moving averages while displaying an RSI of 32.18. Collectively these metrics imply that the stock is oversold and set for a potential mean reversion.

Conclusion

Limitations of the Analysis

The primary limitation of our research report relates to valuation. It is challenging to value Digital Turbine, as it is an early-stage growth firm with a volatile market share and inconsistent cash flow statement. Thus, a parsimonious indication of valuation was used by observing the stock's price multiples relative to their historical averages.

Another limitation of the research report is that it observes Digital Turbine in isolation instead of looking outward and determining whether the stock suits the current stock market environment. Thus, investors should consider whether this article's analysis of Digital Turbine fits into their broad-based market outlook.

Consensus

After its more than 70% year-over-year drawdown, we deem Digital Turbine, Inc. a buy, as we believe the company has reached its cyclical bottom. The continuous growth of Digital Turbine's underlying industry, coupled with its novel business model and expansionary plans, conveys the possibility that its financial results will revert to mean in due course. Moreover, key metrics imply that Digital Turbine, Inc. stock is undervalued and oversold, lending us a premise that it is a lucrative investment.

Looking for structured portfolio ideas? Members of The Factor Investing Hub receive access to advanced asset pricing models. Learn More >>>

This article was written by

Quantitative Fund & Research Firm with a Qualitative Overlay.

Coverage: U.S. & EM Stocks, ETFs, CEFs, and REITs.

Methods: Quantitative modeling, Top-Down, and Street Gossip.

While we encourage debate, we no longer regularly respond to comments on our articles, as direct dialogue is primarily restricted to our marketplace subscribers.

Our articles do not constitute any financial advice.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.