Squarespace: Surprisingly Positive Guidance

Summary

- Squarespace, Inc. delivered Q1 guidance that shows there's still more torque left in the company.

- Squarespace's capital allocation priorities are less than optimal.

- Given that Squarespace's share price hasn't really gone anywhere in a year, I believe sentiment is relatively muted.

- Altogether, this looks worthwhile considering.

- Looking for a helping hand in the market? Members of Deep Value Returns get exclusive ideas and guidance to navigate any climate. Learn More »

everythingpossible/iStock via Getty Images

Investment Thesis

Squarespace, Inc. (NYSE:SQSP) positively surprised investors with its strong guidance for fiscal Q1 2023.

The one main blemish to SQSP is management's use of capital is undisciplined. After repurchasing $120 million worth of stock in the past year, SQSP remains intent on highlighting its $80 million remaining under its authorization.

But that aside, there are plenty of positive considerations to get involved in this name, despite the premarket jump.

What's Next for this Once Hot Name?

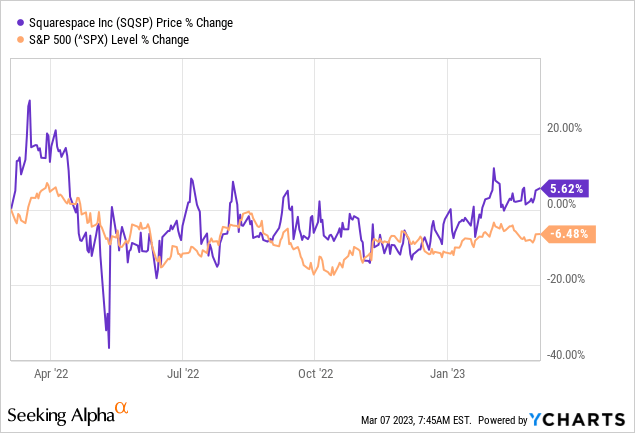

The graphic above reminds investors of the level of disenchantment with Squarespace, Inc.'s prospects. Indeed, in the past year, up until this a.m., the share price had moved up by less than 10%.

Recall, at one point, this was a highly coveted stock. And today, this stock is down more than 50% from its highs.

Before we discuss some positive considerations, allow me to first note some of the aspects that I don't like about SQSP.

Poor Capital Allocators

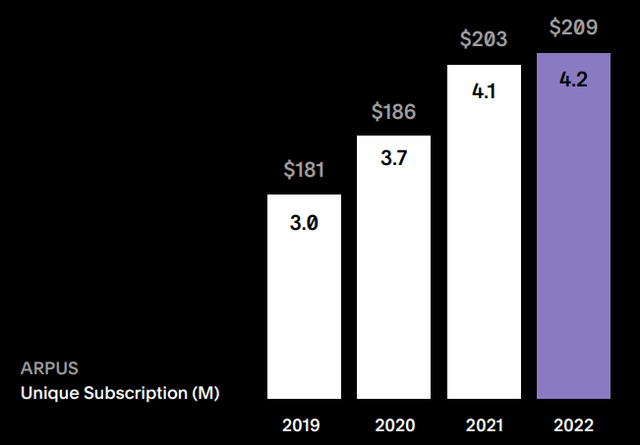

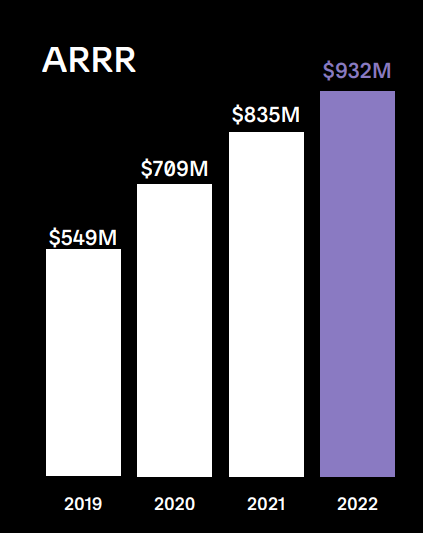

This is a business that's likely to report less than $1 billion of revenues in the coming year, and its growth rates are already faltering. For all the narrative about SQSP ''scaling operations,'' what follows is the unique subscription growth.

SQSP Q4 2022 shareholder letter

As you can see here, unique subscriptions were up 3.3%. Hardly commensurate with a growth business.

Consequently, when management is deploying $120 million to repurchase shares at $21.28 on the open market, that's not the best use of capital.

A better use of capital would be for management to reinvest back into business so that SQSP can figure out some way to drive down its cost structure and lower its average revenue per subscriber.

SQSP Q4 2022 shareholder letter

Because, at the end of the day, you can only increase prices so far before customers churn out. A better, long-term growth strategy is to work on reducing prices for customers. Essentially, following Amazon's (AMZN) playbook.

Revenue Growth Rates Reaccelerate

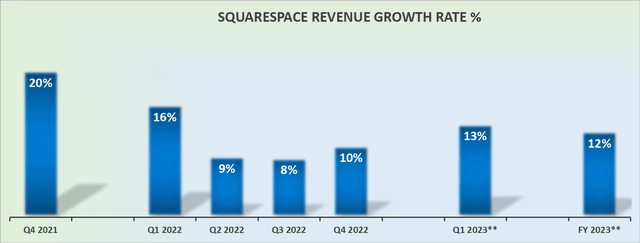

SQSP revenue growth rates, GAAP figures

Squarespace, Inc.'s guidance has several aspects that investors welcomed. The first, and perhaps most important aspect, is that despite the challenging comparables with fiscal Q1 2022, SQSP is still able to post respectable growth rates of 13% y/y.

But what the market got particularly excited about is that the outlook for Q1 is expected to come in around 2% above the consensus analysts' estimate.

Or better said, assuming that SQSP left some room to positively impress investors when it ultimately reports fiscal Q1 2023, it's entirely possible that its fiscal Q1 2023 could end up growing by 14% y/y.

In sum, its revenue guidance implies that this company is still able to post some topline growth. But the real icing on the cake from the Q4 earnings report is the progress that SQSP has made on its profitability.

Profitability Profile is Rapidly Improving

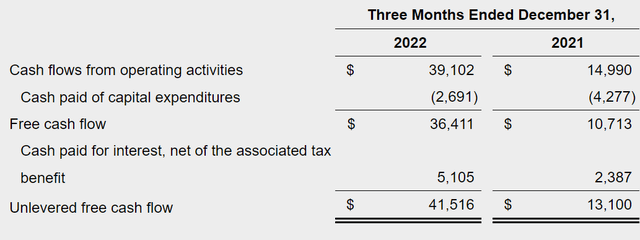

SQSP Q4 2022 shareholder letter

The table above demonstrates that Squarespace, Inc. got investors' memo. Investors are more than willing to buy into management's vision, provided that management is able to prove to investors that there's a viable business in SQSP.

Furthermore, not shown in the table, but the outlook for fiscal 2023 points towards the free cash flow line growing by 20% y/y.

All of a sudden, this means that the business is no longer "just a growth story," but that SQSP is seriously interested in becoming self-sufficient.

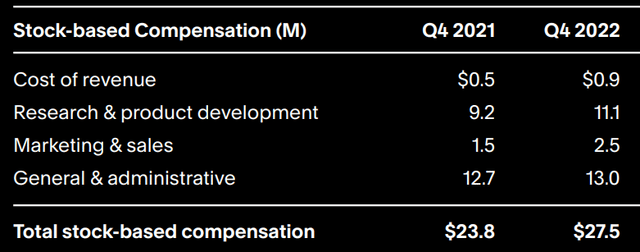

That being said, we could spend some time discussing that SQSP's stock-based compensation ("SBC") continues to raise at a rapid rate.

SQSP Q4 2022 shareholder letter

More specifically, fiscal Q4 2022 saw SBC climb by 15% y/y, which is faster than the business' revenue growth rates.

On the other hand, given that Squarespace, Inc. shares haven't gone anywhere fast in the past year, not reacting to anything that wasn't truly bad news, the stock was coiled and primed to move higher on good news.

SQSP Stock Valuation -- 20x Forward Free Cash Flow

The one thing to keep in mind about Squarespace, Inc. is that the business carries a fair amount of debt. As of fiscal Q4 2022, SQSP has approximately $285 million of net debt.

So when Squarespace describes its improvements in ''unlevered'' free cash flow, we have to keep in mind that with rising interest rates, this will impact its future interest rates once it refinances its debt.

Nevertheless, the stock is priced at 20x ''clean'' forward free cash flow, including the premarket bump. This doesn't strike me as exorbitant, particularly if the business is able to reignite its growth trajectory.

The Bottom Line

Squarespace, Inc. is finally showing some promise. SQSP stock is reasonably valued. There are some minor blemishes in this report, but overall, given that the stock hasn't gone anywhere in 1 year, I believe investors will be keen to send Squarespace, Inc. share prices higher.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.