InterContinental Hotels: RevPAR Growth Impressive, But Inflationary Pressures Continue

Summary

- InterContinental Hotels Group has continued to see significant RevPAR growth.

- However, growth in average daily rates appears to be outpacing that of RevPAR.

- I take the view that Intercontinental Hotels Group will need to demonstrate significant growth across Greater China to justify further upside.

onurdongel

Investment Thesis: I take the view that Intercontinental Hotels Group will need to demonstrate significant growth across Greater China and continued evidence that RevPAR growth can keep up with ADR in order to see further upside in the stock from here.

In a previous article back in January, I made the argument for a long-term bullish view on Intercontinental Hotels Group (NYSE:IHG), given that the company has shown impressive growth in RevPAR (revenue per available room) in spite of inflationary pressures.

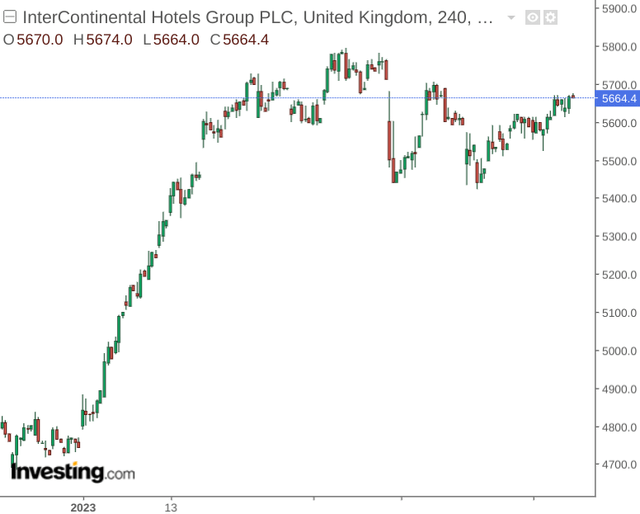

Since my last article, the stock is up by just over 7%:

The purpose of this article is to assess whether such upside can be sustained - particularly in light of recently released full-year 2022 results.

Performance

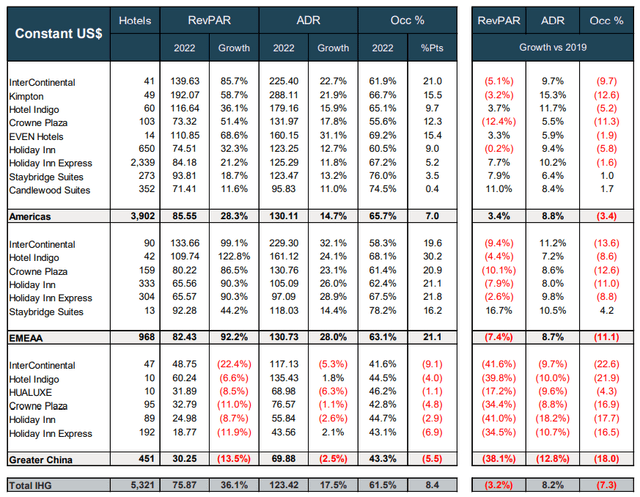

When looking at growth in comparable RevPAR for the full year 2022 as compared to the previous year, we can see that while that of the Americas and EMEAA have continued to see strong growth on a percentage basis as compared to that of last year - all hotel brands across Greater China have seen negative growth as compared to that of last year.

IHG Supplementary Information - Q4 2022

Given that COVID restrictions have only recently been lifted in China and restrictions were resumed in big cities such as Shanghai in 2022 - it is likely that this significantly lowered RevPAR growth potential across the Greater China region.

With that being said, investors are likely to expect a significant rebound in RevPAR across Greater China in order to justify further growth in overall RevPAR going forward. We can see that while RevPAR growth for EMEAA was very strong at 92.2% - the Americas encompass the majority of the IHG hotel portfolio - which saw more modest growth of 28.3% in the past year.

As such, investors may reasonably expect that RevPAR growth across EMEAA could start to moderate from here - with a rebound in growth across Greater China accounting for a larger portion of overall RevPAR growth going forward.

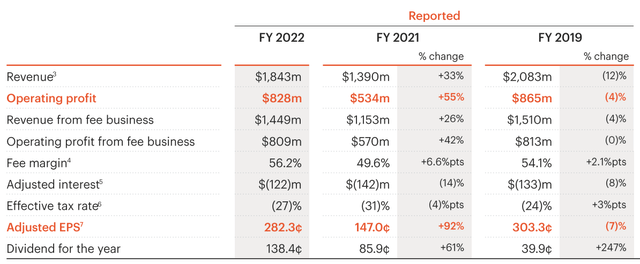

When looking at overall earnings performance, we can see that adjusted EPS is up strongly on that of 2021 by 92%, whereas the same still remains 7% below that of full-year 2019 levels.

IHG Hotels and Resorts: 2022 Full Year Results

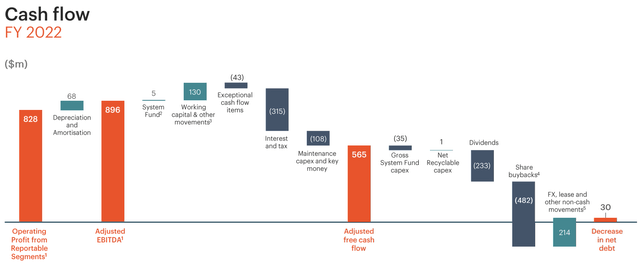

I had previously commended Intercontinental Hotels Group on its capacity to reduce its net debt - having decreased the same by $163 million for the first half of 2022.

IHG Hotels and Resorts: 2022 Full Year Results

On a full-year basis, we can see that this trend has continued - with net debt having decreased by $30 million as compared to last year.

Risks and Looking Forward

Going forward, I take the view that the capacity of Intercontinental Hotels Group to see further growth will hinge significantly on the capacity of growth across the Greater China market, given the lifting of COVID lockdowns earlier this year. As mentioned, with RevPAR growth across the Americas starting to plateau, the Greater China is likely to become increasingly important in sustaining overall RevPAR growth.

Moreover, the risk also remains that inflationary pressures could increasingly affect RevPAR growth - with demand starting to potentially level off in the face of price increases.

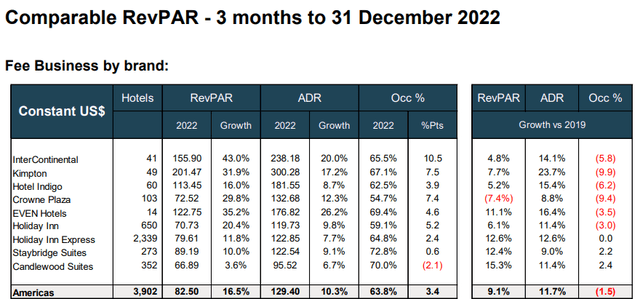

For instance, when looking at the Kimpton brand (which showed the highest RevPAR for Q4 2022), we can see that while ADR (average daily rate) is up by 23.7% on that of 2019 - growth in RevPAR is up by 7.7%, which indicates that revenue growth has not been keeping up with price increases. For the Americas as a whole, RevPAR growth has been 9.1% as compared to 11.7%, and we can see that higher-priced brands by ADR more generally have shown lower RevPAR growth on a percentage basis compared to those with a lower ADR.

IHG Supplementary Information - Q4 2022

From this standpoint, I take the view that inflationary pressures could be a risk factor if we continue to see overall RevPAR fall behind that of ADR growth.

Conclusion

To conclude, Intercontinental Hotels Group has continued to see a strong rebound in earnings growth. However, there are signs that growth across the Americas is starting to plateau, and the gap between growth in RevPAR and ADR is getting wider.

From this standpoint, I take the view that Intercontinental Hotels Group will need to demonstrate significant growth across Greater China and continued evidence that RevPAR growth can keep up with ADR in order to see further upside in the stock from here.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is written on an "as is" basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.