ITA: Why It Deserves Its Valuations

Summary

- The world is getting more militarized as the U.S. and its allies attempt to contain the threat posed by Russia and China.

- To profit from this process, there is the iShares U.S. Aerospace & Defense ETF (ITA) which has more than 50% of its exposure to the big five.

- This exposure to giants should be particularly helpful to help it compete against smaller European defense plays as they scale up to satisfy greater demand for military equipment.

- Also, based on a comparison with equal-weighted XAR and market opportunities, I have a buy rating.

- There are also risk factors to consider as the Fed grapples with high inflation.

Michael Ciaglo/Getty Images News

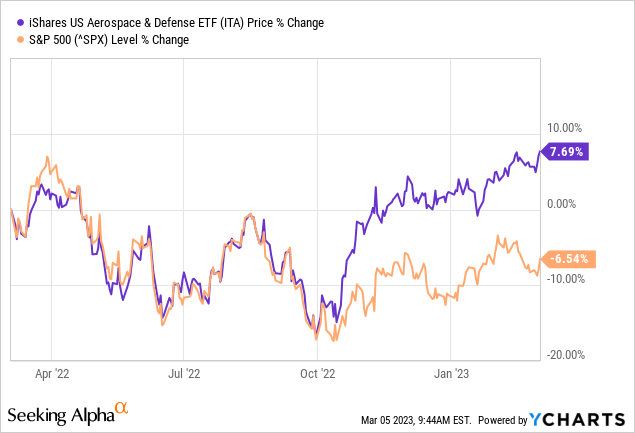

In a context of rising geopolitical tensions, namely with Russia-Ukraine and China-Taiwan while not forgetting North Korea, it is no wonder that aerospace and defense stocks are rising, with the iShares U.S. Aerospace & Defense ETF (BATS:ITA) delivering a 7.7% gain during the last year. This contrasts sharply with the S&P 500's 6.54% loss as shown in the orange chart below.

My objective with this thesis is to assess whether, after such a performance, the ETF can deliver an upside in 2023 as in addition to the demand for weapons, defense companies also face supply chain pressures as well as higher costs of doing business brought by high inflation. Also, with the increased militarization of Europe, the old continent's defense plays are also scaling up.

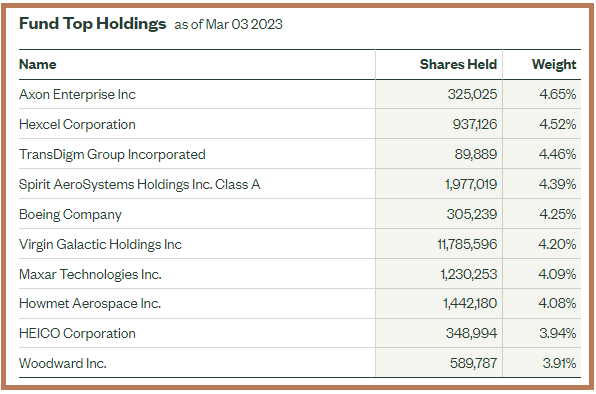

I start with exploring the holdings.

ITA's Holdings and Competition from Europe

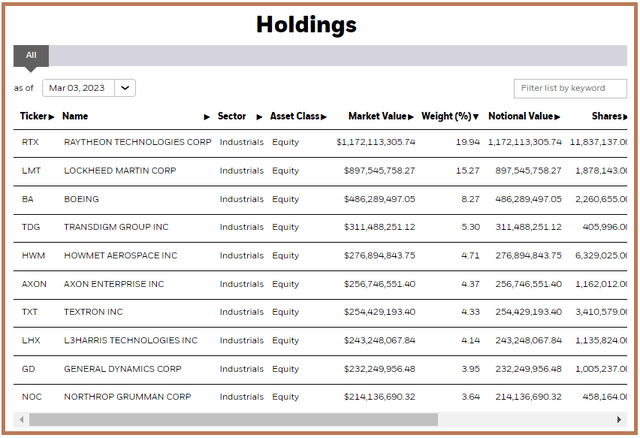

ITA provides exposure to U.S. companies that manufacture both military and commercial aircraft as well as other defense equipment. Looking deeper, its holdings include stocks of giants like Raytheon (RTX), Lockheed Martin (LMT), Boeing (BA), General Dynamics (GD), and Northrop Grumman (NOC) as pictured below. These are typically referred to as the big five as they top the list of major weapon manufacturers, and I will further elaborate on them later.

Top Holdings of ITA (www.ishares.com)

These are the companies that have been benefiting from increased militarization, both as a result of heightened geopolitical tensions in Eastern Europe and East Asia, as well as the U.S. spending more to modernize its air and ground forces.

Also, ITA's top holding, as I recently pointed out in another article, has backlogs or advanced orders which stood at 2.5 times FY-2022 revenues. Additionally, its supply chain problems seem to be easing, but with high inflation likely to be sustained in 2023, I will assess whether profitability could be impacted.

Moreover, there is likely to be more competition ahead namely for more defense-oriented and threat detection equipment like radars where French Defense and Aeronautics play Thales (OTCPK:THLEF) has obtained key wins for its Ground Master 200 multi-mission radar to be deployed in the war theater in Ukraine.

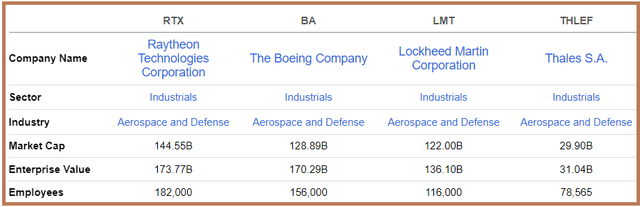

In this respect, one of the factors which have greatly helped American defense plays attain their massive scale of over $100 billion in market cap as pictured below, is the U.S. having the world's highest military spending, in front of China. Hence, to meet growing demand, its companies have to continuously expand production facilities.

Comparison with Peers (seekingalpha.com)

Now, European countries which depended for a large part on America to defend their borders against aggression as part of the North Atlantic Treaty Organization had to rethink their strategy after the invasion of Ukraine. Hence, they are likely to boost defense spending themselves to contain the threat coming from the East, and, as such, French Thales Systems with a market cap nearing $30 billion is likely to obtain more contracts.

At the same time, European defense companies are also diversified in commercial activities, including aeronautics. Therefore, depending on geopolitical factors, as well as the degree of willingness of governments to support their local champions in terms of research, we can expect more competition as defense plays scale up to meet up with Europe's needs. To have an idea of the competition, one can view the Boeing-Airbus (OTCPK:EADSY) decade-old rivalry for passenger planes.

Diversification and Profitability of the Big Five

However, staying within the realms of the commercial domain, U.S. defense plays are also diversified into aeronautics, including space activities. Now, with the pickup in travel in China and the rising middle class in emerging economies like India and Brazil, there should be more demand for passenger planes. At the same time, with Apple's (AAPL) direct-to-satellite iPhone 14 and more telecom companies like T-Mobile (TMUS) considering satellites as a means to circumvent costly ground-based antennas for their mobile networks, space business should see more traction.

Pursuing further, American companies' larger sizes confer them better bargaining power when negotiating with suppliers while the sophisticated weaponry they manufacture is synonymous with better pricing power. This ultimately means that they can generate higher revenues and maintain profit margins. For this matter, one key factor which is helping them obtain more contracts is the bipartisanship that prevails between Democrats and Republicans when it comes to increasing the defense budgets, which has resulted in the President's expectations even being exceeded.

Coming back to the Javelin missile, its joint development by Raytheon and Lockheed Martin is an example of how the big five companies can coordinate and share research costs. Now sharing costs, and co-development of advanced weapons systems in the rather restrictive U.S. defense market as ITA has only 35 holdings, hints at the idea of an oligopoly, or a market structure where there is little competition.

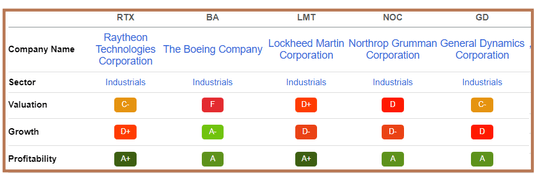

This structure has been made possible through consolidations, with one example being the formation of Raytheon Technologies following a merger between Raytheon Company and United Technologies Corporation in 2020. This idea of limited competition in this industry is supported by the high profitability grade of A- to A+, or all green for the big five, as pictured below.

Comparison of peers (seekingalpha.com)

However, the valuation scores above, which vary from C and F, seem not to be currently favorable for those who want to position themselves with these stocks at this stage.

Valuing Military-Grade ITA

The fact that its holdings are richly valued has translated into ITA bearing a price-to-earnings multiple of 23.03x compared to only 21.72x for the SPDR S&P 500 ETF (SPY). However, ITA is undervalued compared to the SPDR S&P Aerospace & Defense ETF's (XAR) 24.85x. Thus, to bring ITA's share price more at par with XAR, it has to be adjusted to $126.6 (117.33 x 24.85/23.03).

Now, XAR is more of an equal-weighted ETF with 33 holdings, whose top ones are pictured below.

XAR Aerospace and Defense ETF (www.ssga.com)

This SPDR ETF tracks the S&P Aerospace & Defense Select Industry Index which dedicates only 4.25% of its overall weight to Boeing, one of the big five, as I elaborated upon earlier. On the other hand, ITA tracks the Dow Jones U.S. Select Aerospace & Defense Index which is heavily weighted towards the big five, which together constituted 51.07% of the underlying fund's overall assets as of March 3.

Now, while this concentration in the big defense names may appear to be risky from the stock volatility point of view, in current circumstances, it is advantageous for the following reasons. First, competition from European plays will most likely impact smaller U.S. defense plays to which XAR dedicates a higher percentage of its assets, as contrarily to the big five, these companies do not have the R&D budgets nor the manufacturing clout to build sophisticated weapons like missiles in large quantities. Second, with increasing militarization as part of the new Global Cold War, the big five are the ones that should benefit the most as their percentages of defense sales to overall revenues (from 56% to 96%) are already the highest in the world.

Third, as exemplified by Raytheon which has a semiconductor foundry as part of its operations, the big five are more likely to exhibit that degree of vertical integration which can help to mitigate supply chain issues in the future.

Concluding with Caution

Therefore, with the U.S. military spending on track to reach its highest level (after adjusting for inflation) since the Iraq/Afghanistan wars in the 2008-2011 period, plus America's allies also buying more defense equipment to contain threats from China and Russia, the global market is expected to reach $577.19 billion in 2023, after growing at a CAGR of 7.9% from last year. Thus, by incrementing ITA's current share price of $117.33 by 7.9%, I obtain a target of $126.6, which is the exact same figure I obtained earlier when comparing with XAR.

However, investors are advised that market conditions are likely to stay volatile, with the main reason for this being the Federal Reserve having to deal with inflation being stickier than anticipated. Also, some of the latest economic indicators for CPI (Consumer Price Index) and PPI (Producer Price Index) were on the high side in January. Another indicator of U.S. economic resiliency is lower jobless claims. Now, with different high-ranking Fed officials supporting Chairman Powell in raising interest rates to tame inflation as I had pointed out in a recent thesis, equities, in general, should suffer and be contagious to ITA. At the same time, investors are reminded that any peace agreement between Russia and Ukraine or a reduction of the belligerency between the U.S. and China is bad for defense stocks.

Finally, looking beyond potential fiery episodes of volatility and based on purely military opportunities, ITA deserves its target of $126.6, which, by the way, remains on the moderate side as it does not include opportunities in the civilian commercial sector.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.