Nippon Yusen Shows Cracks In Global Economy With Weak Christmas Season

Summary

- Shipping is a dangerous market right now because we're clearly at the top of the cycle.

- The profit resilience in NYK is all coming from bulk, which is benefiting from longer-duration engagements and will already decay next quarter.

- Volatility in earnings is high in the shipping industry. While there might be an angle with NYK due to its low PE, the whole sector is too economy-levered.

- With prices at all-time highs, it's best to stay away from NYK. Who knows how sentiment will turn on them.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

shaunl

Nippon Yusen Kabushiki Kaisha (OTCPK:NPNYY) is a shipping and logistics operator. They do dry bulk and container shipping, but mostly containerships. The PE is very low, but the profit pressures are clear, already visible in their Q3 data. Moreover, cycles in shipping are awful for investors, and the risks are currently quite high here, with a lot of scope for earnings contraction as congestion improves and demand falls. We are underweight shipping, there are too many cheap and safe opportunities on markets to ignore compared to shipping which is so levered to the global economy.

A Q3 Look

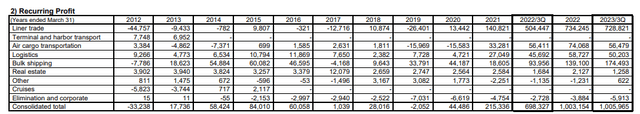

The Q3 results can be looked at here, below are the long-term results:

Historical Results (NYK Fact Book)

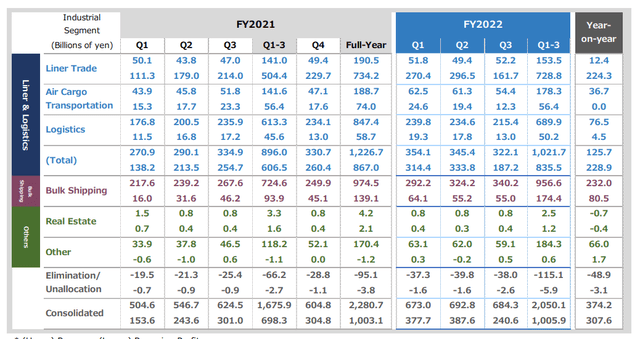

Container shipping has seen reductions in volumes, despite Q3 being a usually really strong season due to Christmas and other holiday volumes and trade. These reductions are only YoY and not MoM, due to seasonality assuring some amount of sequential growth. The situation is the same across the industry: Spot rates are falling and this is beginning to have an impact on shipowners. The 3-month results show declines in the operating profit in the liner trade segment by about 20%. Volumes were also a problem in the air cargo transportation segment, which declined YoY but also alarmingly MoM, as well as logistics and operating leverage meant a serious hit to profits, on top of declines in these businesses' rates. Sequential declines in air cargo transport are worrisome, and absolutely out of the ordinary.

Segment Results (Q3 2022 Pres)

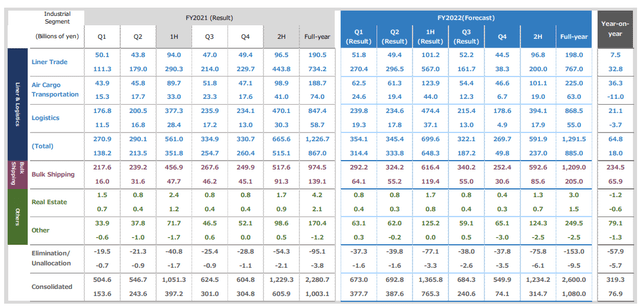

The bulk shipping division, which includes automotive transportation, benefited from pent-up demand in automotive markets due to the previous semiconductor shortages. The bulk shipping business itself saw a market environment with lower spots, but longer-term operating contracts that were signed in Q1 were still carrying over into this quarter at excellent rates. This segment is ultimately dominated by dry bulk, so worse market conditions will come to grip this segment as well too, and severe declines of upwards of 20% are being shown in the forecasts as that hurt gets deferred by duration.

Segment Forecasts (Q3 2022 Pres)

Bottom Line

A weak Christmas season gives a lot of information on the state of logistics and shipping markets. With congestion at ports easing, the issue is now global demand, which also means the cycle has come to an end. The issue is that the performance of shipping businesses can be extremely volatile. In down cycles, negative operating profits come about as contracts aren't being secured at high enough rates to cover fixed costs. While certain indicators of global demand like employment still show some strength, the softening environment may only continue to deteriorate as major trade flows slow into Europe and the US. Supply chain issues are going to be in the rearview, and then we'll be left with demand questions, which is much more of a concern. The 1.86x PE is very low on the forecast results, waiting just for the Q4, so the earnings yield is superb, but of course, there's a guarantee of declines in earnings for 2023. When the direction is clearly bad, it is difficult to call. The price is almost at all-time highs, and with earnings being extremely levered to economic conditions in shipping, we're staying away.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Valkyrie Trading Society seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.