TerraVest Industries: Compounder With Impressive Growth And Decent Yield

Summary

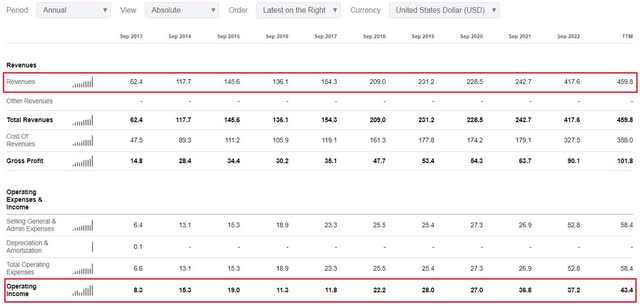

- TerraVest Industries' revenues have soared by over 800% since FY13 and the operating revenue income has almost matched this growth rate.

- TerraVest has grown mainly through M&A as it acquired 14 companies for over $169 million between FY14 and FY22.

- The balance sheet is strong, and I think the company could double its revenues and EBITDA over the next decade.

- TerraVest has repurchased about 3.2 million shares over the past five years and its dividend yield stands at 1.96%.

- Forsaken Value and Yield members get exclusive access to our real-world portfolio. See all our investments here »

Galeanu Mihai

Introduction

As I mentioned in my article about Supremex (OTCPK:SUMXF, SXP:CA) here, I've been looking for value stock investment opportunities in Canada lately. Today, I want to talk about TerraVest Industries (OTCPK:TRRVF) (TSX:TVK:CA). It's a compounder focused on buying up manufacturing businesses that has grown at an impressive pace. Also, the yield looks decent and its recent financial results have benefited from high energy prices. Let's review.

Overview of the business and financials

TerraVest was founded in 2004 and it owns several niche manufacturing and energy services businesses with facilities close to the US border. Revenues are split almost in the middle between Canada and the USA. The business is comprised of 24 subsidiary companies and more than 1,650 employees and is split into four operating segments, namely HVAC Equipment, Compressed Gas Equipment, Processing Equipment Processing, and Service. The HVAC Equipment segment manufactures commercial and residential refined fuel tanks, furnaces, boilers, air conditioning equipment and controls. The Compressed Gas Equipment unit focuses on engineered products for the storage, distribution and dispensing of compressed gases such as liquid propane gas, natural gas liquids, liquified natural gas, anhydrous ammonia, and carbon dioxide. The products include bulk storage vessels, transport trailers, delivery units, dispensers as well as commercial and residential storage tanks. Processing Equipment Processing arm specializes in the manufacturing of wellhead processing equipment and tanks, desanding equipment, biogas production equipment, water treatment equipment and various other custom process equipment. Its main clients include oil and gas companies, utilities, municipalities and engineering companies. Finally, the Service segment is involved in the provision of services to the energy sector including fluid hauling, water management, environmental solutions, heating, rentals and well servicing. As you may have noticed, the Processing Equipment and Services segments are highly dependent on the fortunes of the oil and gas sector. There is seasonality in the business of the group and the first and fourth quarters of the fiscal year are usually the strongest. The Processing Equipment and Service segments usually generate higher sales in the first and second quarters of the fiscal year as this is the period when the majority of the drilling season in the oil sector in Western Canada takes place.

Turning our attention to the financial performance of TerraVest over the past decade, we can see that revenues have soared by over 800% since FY13 to $459.8 million for the last 12 months. Operating income has almost matched this growth rate.

The main way TerraVest has been growing at such a rapid pace is M&A. Over the past five years, it has spent only around C$45 million ($33.1 million) on organic growth initiatives. Yet, the group bought a total of 14 companies for over C$230 million ($169.1 million) between FY14 and FY22 and it has often paid low single digit EBITDA multiples. TerraVest has been looking for synergies and the target companies usually include businesses without a succession plan or that are in distress. According to Fairway Research, the group can generally achieve returns of investment of around 17% on purchases (check pages 13 and 14 here). Half of those 14 acquired companies operate in the HVAC Equipment, and Compressed Gas Equipment segments, which currently account for almost half of revenues.

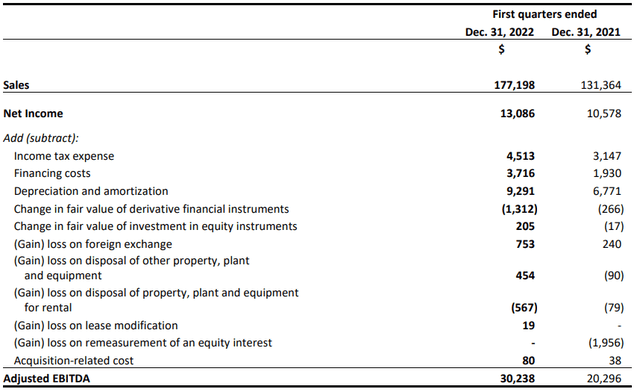

Turning our attention to the latest available financial results of TerraVest, we can see that Q1 FY23 revenues and EBITDA rose by 34.9% and 49% to C$177.2 million ($130.3 million) and C$30.2 million ($22.2 million), respectively.

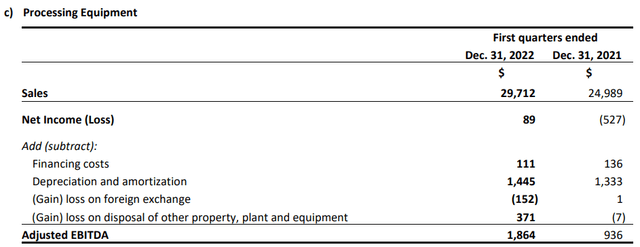

A lot of the revenue growth came from the acquisition of Mississippi Tank and Manufacturing Company (March 2022), T.S.X. Transport (October 2022), and Green Energy Services (November 2021). Excluding these three purchases, Q1 FY23 sales increased by 9.7% to C$133.4 million ($98.1 million). Most of the organic growth in sales and EBITDA came from the Processing Equipment segment thanks to strong demand for energy processing equipment in Western Canada as a result of high oil prices.

High energy prices also provided a boost to the Services business as the revenues of this unit excluding Green Energy Services grew by 27.6% to C$5.2 million ($3.8 million) in Q1 FY23.

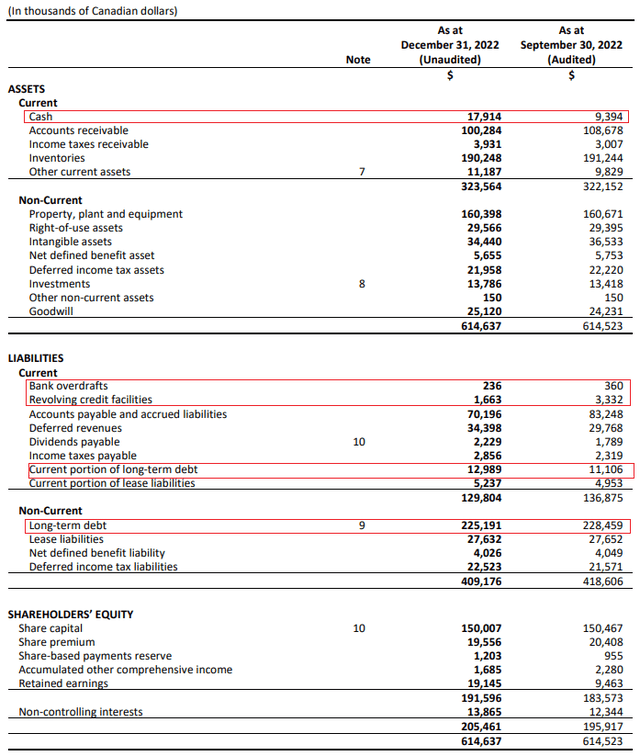

Turning our attention to the balance sheet, I think that TerraVest is in a strong position as its net debt stood at just C$222.2 million ($163.3 million) as of December despite the various acquisitions over the past few years.

Turning our attention to the valuation, TerraVest has an enterprise value of C$677.4 million ($498 million) as of the time of writing and is trading at an EV/EBIT ratio of 11.5x. In my view, this ratio could increase in the near future as falling oil prices will likely put pressure on the financial performance of the Processing Equipment and Service segments. However, I think that the company is undervalued at the moment due to its track record. In my view, the disciplined M&A strategy of TerraVest could enable the it to more than double its revenue and EBITDA over the next decade. I also like the fact that the company has a decent yield. Over the past three years, TerraVest has repurchased about 3.2 million shares. In addition, the company has a quarterly dividend of C$0.125 ($0.092). This translates into a dividend yield of 1.96% as of the time of writing.

Looking at the risks for the bull case, I think that there are two major ones. First, rising interest rates could lead to lower energy prices which will negatively impact the financial performance of the Processing Equipment and Services segments. Second, the daily trading volume rarely exceeds 10,000 shares which means that there could be significant share price volatility. In my view, it could be dangerous to start a large position as it would be challenging to exit without putting pressure on the share price.

Investor takeaway

TerraVest looks expensive based on fundamentals at first glance, but the company has a compelling track record of growing revenues and EBITDA over the past decade, even during periods of weak oil prices. In my view, the balance sheet is strong, and the company is able to continue growing at a rapid pace through M&A. I wouldn't be surprised if revenues and EBITDA doubled over the next decade. However, it seems dangerous to open a large position due to the low trading volume.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

I have been investing in stocks since 2007. I have no preference for sectors or countries - I'm as comfortable owning a part of a cement miner in Peru as holding shares in a wheat farming firm in Bulgaria. If it's a value stock - great. If the dividend or share buyback yield is high - even better.

- Disclosure: I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.