GARP: Stability Amid Style Storms

Summary

- When the market first bottomed in the spring of 2020, the initial rally was driven by technology and growth companies.

- While a slower economy and a less hostile rate environment favor growth, the value differential still tilts toward value.

- For investors looking to reconcile a favorable growth backdrop with less than compelling valuations, one solution is ‘growth at a reasonable price’ or GARP.

Hiroshi Watanabe

The English philosopher Thomas Hobbes is perhaps best known for describing life in its natural state as "nasty, brutish, and short." The same description could be applied to post-pandemic style investing.

When the market first bottomed in the spring of 2020, the initial rally was driven by technology and growth companies. Later, in the fall of 2020, investors abruptly pivoted to value stocks as news of effective vaccines favored cheap cyclicals poised to benefit from an economic recovery.

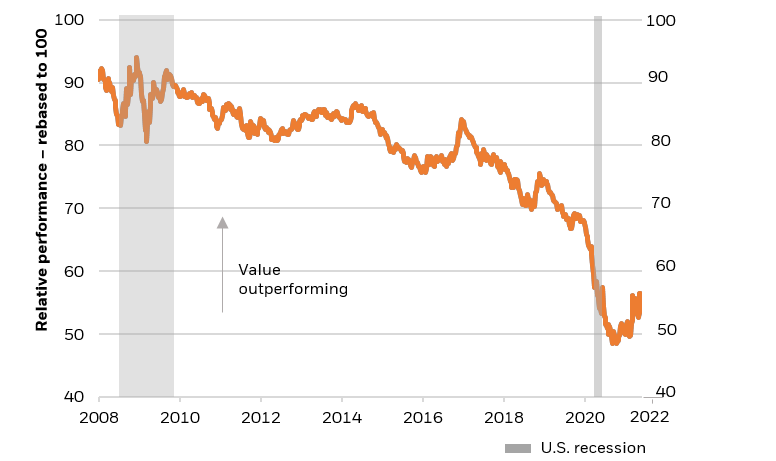

And this tug-of-war between growth and value has continued, with frequent reversals, for the past two years. Most recently, growth has come back into vogue. Since the start of the year, U.S. large-cap growth stocks have gained roughly 11%, more than twice the gains for value stocks (see Chart 1).

Equity performance - year to date

Source: Refinitiv Datastream and MSCI, chart by BlackRock Investment Institute. Jun 06, 2022. Notes: The line shows the relative performance of the MSCI World Value Index versus the MSCI World Growth index. An increase in the index level means value is outperforming growth. The index is rebased to 100.

Where to next? While a slower economy and a less hostile rate environment favor growth, the value differential still tilts toward value. My take: Split the difference and stick with growth at a reasonable price, i.e., GARP.

Macro vs valuations

Slower economic growth puts a premium on growth companies. An average of economic expectations by Bloomberg suggests real U.S. GDP growth of approximately 0.5% in 2023. Back in February of 2022, the consensus was 2.5%. While the U.S. is likely to avoid a recession, the lagged impact of monetary tightening, higher inflation, and fading stimulus still suggest an economic slowdown. As I've discussed in previous blogs, slower economic growth puts a premium on companies able to generate organic earnings growth.

Peak rates would remove a growth headwind. Growth stocks, particularly 'early' growth names with no near-term earnings prospects, were disproportionately hit by last year's surge in interest rates. While rates can climb from here, inflation is decelerating, and the Federal Reserve is nearing the end of its tightening cycle. Going forward, interest rates are likely to prove less of a headwind for growth stocks.

Growth valuations remain elevated. Using a simple ratio of price-to-earnings, U.S. large-cap growth stocks trade at approximately a 70% premium to their value cousins. This ratio is well below the late 2020 peak of 105%, but still meaningfully above the long-term average of 45%. Last year's meltdown negated growth's 'pandemic premium' but growth valuations remain elevated, at least when compared to value.

Growth at a reasonable price

For investors looking to reconcile a favorable growth backdrop with less than compelling valuations, one solution is 'growth at a reasonable price' or GARP. I have advocated for this style before. GARP tends to be an effective 'all-weather' tilt. More importantly for today's environment, GARP has historically performed particularly well when the economy is slowing but not contracting. GARP may also provide some protection against the nasty consequences of being on the wrong side of the post-pandemic growth/value divide.

This post originally appeared on the iShares Market Insights.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by