The Korea Fund: A Good Addition To Any Investment Portfolio

Summary

- The Korea Fund has geographic and industry diversification.

- Its performance track record is better than most Korean focused ETFs but investors are paying a slightly higher management expense ratio.

- KF provides exposure to South Korean blue chip companies that most North American investors may not have access to.

Mlenny/E+ via Getty Images

It's hard to dismiss South Korea as an economic powerhouse. The country's brands, companies, and even its K-pop groups have been making headlines:

- The South Korean band, BTS, reportedly brings in ~$5 billion alone to the South Korean economy.

- Hyundai Motor Co. (OTCPK:HYMLF) is becoming a stronger electric vehicle manufacturer

- NAVER Corp (OTCPK:NHNCF) recently closed on its acquisition of Poshmark

Each of the above are powerhouses in its own right and it speaks to the business acumen of South Korean companies.

There are only a few investments out there with a focus on South Korean firms and one of them is The Korea Fund (NYSE:KF). The Korea Fund is a $136.6MM fund focusing on equity securities with long term growth potential, that are listed on the Korean Stock Exchange. KF was first launched in 1984 and it is one of the oldest funds with a focus on South Korean stocks.

Historically, The Korea Fund has been performing better than its peers and makes a good diversification play for risk adverse investors in my view.

KF Track Has a Descent Track Record

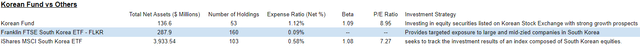

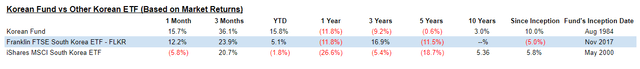

There are two other investments that share a similar investment thesis as the KF: Franklin FTSE South Korea ETF (FLKR) and iShares MSCI South Korea ETF (EWY). Both are ETFs (Exchange Traded Funds) with a focus on well-established Korean companies listed on the Korean stock exchange:

The Korean Fund vs Other Investments (Various investor websites)

(Source: Korea Fund / Franklin / iShares)

Historically, KF returns consistently outperforms the other two ETFs. The only exception is in years 3 where KF's loss of 9.2% is more than iShares MSCI South Korea ETF of -5.2%.

The Korean Fund vs Other Investments (Various Website)

(Source: Korean Fund / Franklin / iShares)

I believe there are a few reasons why the performance at KF has been consistently better. KF only holds 53 companies in its portfolio and has less assets under management than the other 2 ETFs (see above). I believe this allows investment managers at KF to be nimble and be more focused on individual companies.

The 2 ETFs takes a more passive trading approach and try to track closely to the FTSE South Korea Capped Index. KF does bottom-up fundamental research on the companies it invests in, and utilizes a research firm to help with its investment thesis. This explains why the management fees at KF are substantially higher than Franklin's and iShares fees. KF has an expense ratio of 1.12% while Franklin FTS South Korea ETF charges 0.09% and iShares MSCI South Korea ETF charges 0.58%. This is not a bad price to pay: KF has higher management fees but investors tend to receive better returns.

KF Has Diversification Across Industries and Geography

The KF invests in well-established South Korean companies that are competing near the top of its respective industries. Predominantly these companies are blue chip companies that are well financed with strong balance sheets. Below shows the top 10 holdings at KF and its respective EPS:

Korean Fund Top 10 Holdings (The Korean Fund Website)

The top 10 companies KF holds in its portfolio had earned a minimum of $4.92 USD per share. Collectively these companies make up 58.1% of the total assets under management.

A look at the industry breakdown shows how diversified KF is across different industries:

Korean Fund Sector Breakdown (The Korean Fund Website)

(Source: The Korea Fund Fact Sheet)

Only Information Technology make up 33.3% and that is from a 22.5% investment in Samsung Electronics Co. (OTCPK:SSNLF) or (OTCPK:SSNNF). More on this down below.

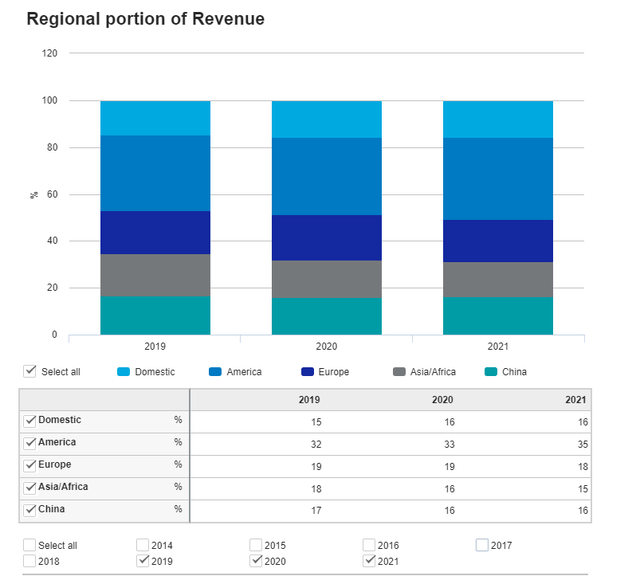

While all these companies are traded on the Korean stock exchange, these companies have significant operations overseas and do not rely solely on the South Korean market. Using Samsung as an example (since KF invested a sizeable amount here), more than 80% of Samsung Electronics Co's revenues are overseas:

Samsung's Revenue by Region (Samsung Electronics Co website)

(Source: Samsung Regional Portion of Revenue)

This means that KF has a diversification across industries and geography, while also being profitable year after year.

Risk: Overexposure to Samsung Electronics Co. and a Beta of close to 1

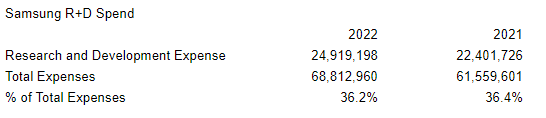

KF has over $136MM of assets under management and 22.5% of it is invested in Samsung Electronics Co., this approximates to $30.6MM. Although KF has diversification there is still an over exposure to Samsung Electronics, which saw its EPS rise in each of the last three years - so this definitely provided a boost to KF's performance. But another factor to consider is Samsung Electronics Co. must always be at the leading edge of the latest technology. It spends more than 36% of its total expenses on research and development every year:

Samsung Research and Development Costs (Samsung Website)

(Source: Samsung Electronics 2022 Annual Report)

Technology is always changing so it is difficult to say if Samsung Electronics Co. can maintain its competitive edge in the near future.

Beta measures a stock or fund's sensitivity to the overall stock market. A beta of 1.00 implies a stock / fund is perfectly correlated to the overall stock market's movement. KF has a beta of 1.09 so it is slightly more volatile than the markets. What this could mean is although the investment managers at KF are doing a decent job managing the fund, they might not be doing that much better than how the overall market is performing.

To put it in another way, if there is a stock market crash tomorrow, KF is likely going to go through the same shocks.

Conclusion: A Buy if you are looking for access to the Asian Market

Let's be clear, KF is not a fund that is going to explode in value overnight. Rather, investors who are choosing this investment are probably looking for exposure to the blue chip stocks in Asia.

What is appealing about KF are its investment holdings. There are different investments here that can appeal to wide range of investors:

- KF has shares in JYP Entertainment Corp, a company that produces KPOP music and manages several well-known KPOP groups

- ~6% of KF's holdings are in the automotive industry and it appears Hyundai Motor Co. (a company KF has shares in) could be a juggernaut in the electric vehicle space.

- The semi-conductor industry is anticipated to grow to $3.34 billion USD by 2028 from $2.01 billon USD in 2020. KF has invested 6.9% of its assets in SK Hynix, the world's 3rd largest semiconductor company.

- NCSoft is a gaming company known for its online role-playing games such as Lineage and Guild Wars. KF's portfolio has ~2.6% of its portfolio invested in it.

This list can go on.

Another benefit for investors is its diversification component. Besides being exposed to Samsung Electronics Co., KF is diversified across geography and across various industry sectors. This protects KF if there is ever a slowdown in any one industry or company.

Finally, more than 58% of KF's holdings are in companies with positive earnings per share. Almost all of these companies are safe and the risk of bankruptcy is low in my opinion.

Investors who typically can't access the South Korean stock exchange should take a look at KF. There are companies here that most North American investors may not have access to. Overall, I believe KF is a good addition to investors looking to gain a bit of protection in their overall investment portfolio. I recommend The Korea Fund.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.