Wynn Resorts: Trend Toward 'Premium Customer Focus' Is Decades-Long Skill Set

Summary

- The WSJ recently reported on a fast-moving trend in many sectors to stress marketing effort and spend toward premium customers. This is old news for Wynn Resorts, Limited.

- Managements are telling investors they are pivoting away from chasing low-profit demos and stressing smaller but more lucrative customers.

- As we have noted on Seeking Alpha before, Pareto's Law has governed Wynn Resorts, Limited's business model for decades.

- I do much more than just articles at The House Edge: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Ethan Miller/Getty Images News

“Quality is not an act, it’s a habit…” Aristotle.

Followers of my space have long known why I have been a fan of Wynn Resorts, Limited (NASDAQ:WYNN) stock for decades. Standing atop that rationale was the presence of former founder/CEO Steven A. Wynn, a certified genius without peer in our business. As far back as the 1980s, in my conversations with Steve both as a publisher and later as a direct competitor at Caesars Entertainment, Inc. (CZR), his mantra was at times tested, shaken, not stirred (Thank you, James Bond). Yet it always ended up with market shares and earnings that blew away competitors on a customer-for-customer basis.

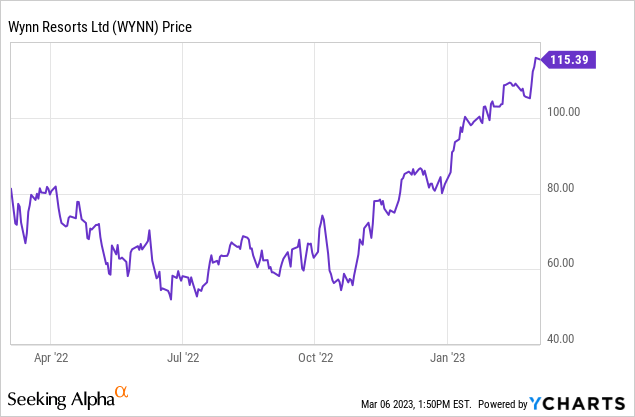

My last article on Wynn appeared in Seeking Alpha on November 3, 2022. The stock closed that day at $66.25, though I had been guiding a strong buy well before that against a lot of bearish sentiment. As of this writing, Wynn is trading at $114 and, in my view, heading even higher.

Clearly, the 6.2% buy in by billionaire gaming and restaurant entrepreneur Tillman Fertitta was a powerful tailwind all by itself. He was probably in at ~$58, so he is sitting very pretty at the moment. He knew a great bargain when he saw one. Below: Tillman Fertitta has made a bundle on his move into Wynn shares last November.

Wynn archives

Yet, at the time, some analysts, saw sharp declines in the stock ahead and in the company’s prospects. Their rationales in many cases had merit. You had a flailing premium and VIP segment, you had a burgeoning debt profile. And mostly, you did not have Steve, who’d been gone since 2018.

Steve, in brief, was a prime practitioner of Pareto’s Law. For those unfamiliar with it, Vilfredo Pareto (1848-1923) was a brilliant polymath who studied economic forces. His research produced the maxim that 80% of consequence come from 20% of causes. It’s been proven accurate over time across many areas of human endeavor. And, usually right in business.

At any given time, 80% of your sales will come from 20% of your customers. The Wynn focus on premium level of customers as the prime marketing target of his properties has paid off over time. Mr. Market, almost always valuing Wynn shares above competitive peers, has been correct. The key principal was his building properties that were demonstrably superior in overall quality of execution than peers.

Underlying it was the understanding that, in gaming, the old "birds of a feather flock together" adage rang true. You assumed that an upscale product will attract a disproportionate amount of upscale, fatter-budgeted play and spend. And upscale people at the tables, the restaurants, the show—name it—attract other upscale people who drop in casually.

I competed with Wynn head to head in AC and Vegas. And Caesars was hardly seen as a home for budget visitors. Steve’s smaller casinos with fewer tables and slots out-won many larger competitors. He once told me, “I’m going to welcome the 25c slot players with a warm hello. But the one buck slot players get as much of the TLC as we can give them.”

In AC, his crap game gondolas were smaller than ours. That was a consequence not only of a smaller casino, but because he knew that a certain kind of whoopee intimacy envelopes the psychology of craps shooters that is best brought out by closer physical contact.

So, the average room rate, the average dining costs, the average gaming budget, and average cost of a show ticket or prices at the nightclubs for Wynn have always ticked higher. Their database on average has a customer profit with a larger potential win and spend. This does not mean neglect of the mass play, As Steve once told me: “The average guy comes to me as walk-in free business. He comes to gawk. Gawking is a form of entertainment.”

My 30 years in the business always generated a gawkers crowd around the baccarat rail and people who crane their necks at the craps table where players are making lay downs of $5,000 a roll. And, in the course of the visit, they’ll try the buffet, grab a snack, see a show, drop a few fistfuls of coins in the slots. Again, Steve: “The marketing begins with and ends in the walls and the customer facing employees who impart that sense of pride in working for a quality leader, that ends in great service.”

Here comes “premiumization”

Wynn archives

Above: A typical VIP suite in a Wynn hotel. Yes, all competitors have them. And yes, they are all great. But they are stars, Wynn suites super stars.

We’ll start with a creaky old cliché most of us know:

Reporter to legendary bank robber Willie Sutton “Willie, why do you rob banks?”

Willie: Because that’s where the money is….”

That, in essence, plus Pareto’s Law, is the foundational thinking many late-to-the-party c-suite managements are now pivoting to in this crazed early post-pandemic world of insane challenges. A recent WSJ article found that a rapidly growing number of companies in many sectors are shifting marketing focus from a frontal assault on the masses, chasing eyeballs and thinned-out wallets, and moving toward maximizing the TLC of their best, premium customers.

We hear it from the entertainment and media people suddenly discovering Pareto and Wynn from their long slumbers in their reckless spending chase of anyone breathing. It has also begun to infuse the thinking in manufacturing, services businesses, and finance. The forces that have shaken c-suites from their decades-long delusions. They have sprung in the main from what appears to be unabated inflation in costs, rising cost of debt, and the spillover of so many old truisms broken by the pandemic. It’s all old news to Wynn, a company that has pursued the premium customer from day one. And that is where we begin to make the case that despite the recent run up of WYNN shares, we believe there is lots of runway ahead.

Wynn: Simultaneous engines now firing at once

Las Vegas: Bears have pointed out that the surging recovery on the strip from which Wynn has been a huge beneficiary is not all tied to the late-stage pandemic. They believe, not without merit, that the boom in average spend and footfall was nursed along mightily by the free-money D.C. giveaways during the worst of the pandemic. As soon as the masks began to be dumped into your neighborhood garbage cans, they aver, all that delightful free, discretionary spend filled the town.

There was a clear pent-up demand factor here. We join in pointing to it as a strong contributor. But also in the “Wynn column,” as it were, was and is, the bursting string of firecracker events that drew the masses who might otherwise have not shown up. Our view: More to come as the events calendar for 2023 is even more enticing as it begins to include a strong tide of convention and meeting arrivals.

Wynn properties have rolled up top Revpar numbers. They rank among the best on the strip because, as noted, their marketing focus on higher average spend customers pays off big time. What many analysts and observers often miss, in my view, is the value of the walk-in business for properties like Wynn and Encore. This is often referred to as non-rated play. But that’s too narrow. From my perspective as an industry veteran, take it for what it’s worth, walk-in business for Wynn properties has long been a secret marketing, and critically, free, marketing outcome.

Wynn properties exude what in the eyes of tourists amount to “class.” Many such footfall arrivers may not be willing to pay the room rates for Wynn hotels, or gag at looking at menu prices (even these inflated days) or gulping at the $2,500 alligator pair of stilettos in the shops, But they are customers for the snack bars and fast food outlets, gift shop, t-shirts, and A-list shows presented in beautiful arena settings. But mostly in Wynn properties more than many others, you get the electricity of a Vegas visit at a higher wattage.

My takeaway: We will see Las Vegas in general, and Wynn properties specifically, benefit from a continuing record-breaking revenue stream in the quarters ahead. A word about recession: Clearly if a full-blown recession rains on the Vegas parade, there will be damage. The last time around, Vegas took over a 10% hit on revenues between 2008/9. It did not show real recovery until 2010/ll.

But think of this: Who does a recession hurt the most? It surely is the segment of customers not only battling inflation check-to-check, but on top of that, those with limited discretionary dollars to feed their casino desires. Conversely, upper segment customers, not immune to recession, tend to trim, not eliminate, gaming budgets in my experience. This, in our view, is reason why we see less of a potential hit to earnings than many other players in the space.

Macau: Leading the recovery for Asian gaming leaders is the burst of visitation and average monthly win since China finally dropped the zero-tolerance policy. Again, we note that the bears saw ongoing disaster for Wynn and its peers in Macau around the time of the Communist Party Congress last fall. It appeared that top officials doubled down on zero covid, sending the sector down again.

Instead, what we have now is a highly pressured China, throwing aside its crazed zero-tolerance policies in the wake of an economic tsunami and ending the travel bans. Initially, Macau officials were estimating Chinese New Year arrivals at ~200,00. When all were counted, they found over 600,000 people had come for the holiday heavily contributing to the huge spike in monthly win to $1.3b. Again, the skeptics assigned the rise to pent-up demand. We agree, but we also saw green shoots quickly turning into blossoming flowers as, for a second month in a row, gaming win rose above $1.2b.

There has been widespread sentiment among many analysts that the death of the junket VIP segment foretells much stormy weather for Wynn, which is overly dependent on that demo. It will hurt, of course. But more critical to investors here is the fact that Wynn also leads in premium mass—on average a higher-budget player than its peers.

2023 annual forecasts Macau gross gaming revenues

Macau official : $9b

Analyst consensus: $16b

Our forecast: $18b

Morgan Stanley estimate pre-zero end: $16b

Morgan revised forecast raised to $22b with 2024 arriving at the baseline 2019 win of $37.7b.

Our forecast: By early 3Q23, Macau will be hitting monthly revenue numbers equal to baseline 2019. After discussions with our industry colleagues there, we are raising our 2024 win number to $39.4b.

Sports betting: Wynn is a passenger on the sports betting jet plane. It yet has the heft or the inclination to chase this very expensive customer acquisition melee. Despite the fact that marketing expenses are falling and gross handles and wins are increasing in the space, we don’t see WynnBet as a major competition for share leadership. We do see it either settling in as a profitable also ran, second tier site or as a candidate for sale when its revenue stream and customer base exhibits a real value to attract a buyer.

Boston: After a halting start complicated by the pandemic and underperforming slot business, the property has revived and moved into market leadership by a strong percentage. The sale of its realty to a REIT was a sound move taken to relieve some pressure on the heavy debt burden.

Conclusion

The corporate bandwagons toward marketing pivots to far more intense concentration on the upper segments of customer bases are getting more crowded every day. Wynn has been at the forefront of this marketing strategy for decades, and as a result has built a database of customers as well as a highly profitable, unrated, low cost walk-in business. We see the current analyst consensus price target of $117 as way below what the bullish scenario suggests.

Our PT: Assuming recession as a wild card, we still see the shares moving to $140 to $190 territory by 2Q23.

For in-depth and deep dive research on the casino and gaming sector, subscribe to The House Edge. New: Free excerpts from our book in progress "The Smartest ever Guide to Gaming Stocks" - free to existing members and new subscribers.

This article was written by

For 30 years I held senior vp and exec VP positions in major casino hotel operations among them Caesars, Ballys, Trump Taj Mahal and have done extensive consulting assignments for many others in the US, including the native American property Mohegan Sun, in Connecticut. I have also done special projects for Caesars Palace in Las Vegas. I was the founder and publisher of Gaming Business Magazine, first ever publication covering the gaming industry and have written extensively about the industry.

MY INVESTMENT STRATEGY: Due to the necessities of my casino consulting business which encompasses many top gaming companies, I have placed my own gaming portfolio into a blind trust over ten years ago. At that time I instructed my money manager(who is a former industry colleague herself as well as a corporate lawyer and money manager) to follow my gaming investment strategy along these lines.

1. I am a value investor first. Knowing the industry in depth I am able to plumb opportunities and problems others cannot see. Mostly I like to identify price ranges over given periods where I believe the market is asleep and I can buy in at the lowest possible risk. 2. I am a strong believer in management quality. Knowing so many top people in the industry allows me to evaluate which ones I believe have the "right stuff" to move a stock and which are populated by corporate drones. 3. I have instructed my manager never to trade on sugar high spikes in earnings or news per se but use the "string theory" I have developed which in brief, follows a skein of news and earnings releases over set periods of time for each stock and then move in or out. 4. I have instructed her to keep the portfolio diverse with holdings in four basic areas: Casino stocks in Las Vegas, Macau and the regionals, gaming tech stocks with real moats not just cute apps.

I am pleased to announce that as of September 1, 2022 I am expanding my coverage to include entertainment stocks, a sector undergoing a massive revolution on many fronts. This has sprung loose many investment ideas in the space I expect to share with members. The coverage is added at no extra cost.

I have been involved in the entertainment sector as well for decades involved in overseeing show and events in my properties as well as independent productions. I currently sit on the board of privately held Atlas Media Corporation, one of America;s premium non-fiction producers of tv and film programming.

Overall I have done immensely well and share my views with SA readers and more specifically with strong recommendations and gaming stock strategy analysis based on my network of industry contacts for subscribers to my SA Premium Site: THE HOUSE EDGE.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.