ReWalk Robotics: The Next Phase Hinges On Medicare

Summary

- The court process in Germany came to a resolution in ReWalk's favor in the fall of 2022 without an actual court decision, as the insurer dropped the appeal.

- Sales were slowed down in 2022, but growth is anticipated for 2023 from German insurance payments and US Veterans' Affairs, with expanded geographical coverage for training at VA centers.

- The first Medicare claim has been filed, and the next phase is clarity on the benefit category from the Centers for Medicare and Medicaid Services (CMS).

Marilyn Nieves

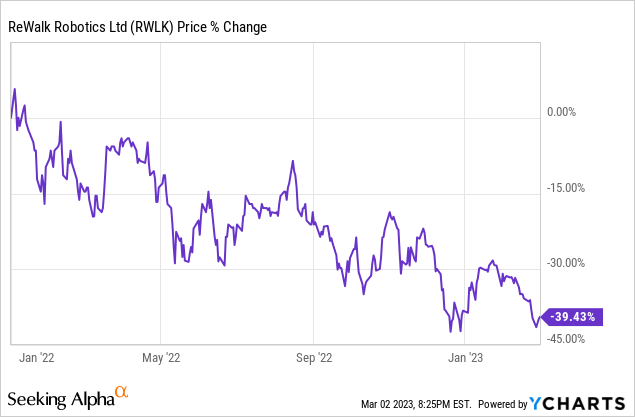

ReWalk Robotics (NASDAQ:RWLK), the microcap Israeli company behind the ReWalk 6.0 robotic exoskeleton that can assist those who have suffered a spinal cord injury, recently reported its full year 2022 results. At the same time, management also provided a view on other key goals for 2023. By traditional financial metrics, 2022 was not a great year for ReWalk - sales lagged 2021's results, cash burn continued to be significant, and the share price failed to create value for the shareholders.

2022 In Review

Despite the appearance as a year of regression, 2022 was an important year in the company's development, from lifting one major cloud of uncertainty in Germany, to submitting its first Medicare claim. I will go through the highlights since my last article (now a year old).

The outcome of the German Federal court case is the most pertinent in the short-term. The Federal court appeal by a major German insurer, Barmer, had been hanging over ReWalk for years, and was headed towards a final court date in early November. However, at the last moment, the insurer dropped its appeal and accepted the lower court's ruling that ReWalk's exoskeleton device is a direct disability compensation, meaning essentially anyone with a spinal cord injury and the insurance can make a claim for coverage. While in some ways a definitive court ruling on the matter could have been preferable, this is essentially a close second best outcome by removing the possibility of the court ruling against ReWalk.

The other significant milestone for 2022 was the progress made with the Centers for Medicare and Medicaid (otherwise known as CMS). This work stretches back years, such as getting the HCPCS ("Healthcare Common Procedure Code") assigned in 2020 that is necessary for filing claims with Medicare. That was a good first step, but did not resolve the issue of what kind of benefit the ReWalk product should be considered - the fundamental question comes down something like "Is the ReWalk device a very fancy leg brace, or does it replace the human legs and function as an prosthetic?"

ReWalk made their case to CMS that they should be considered as a prosthetic in hearings held in June (see page 93 in the linked document for details), and for now the assignment of a benefit category by Medicare is still up in the air. This means the final determination on how well ReWalk is reimbursed for its systems by Medicare remains unresolved. In September the company announced that Medicare was allowing for interim claims submissions to begin even though a final determination on benefits determination had not been made. A first claim was filed in 2022, and there is still much work to do in terms of getting over the hump with Medicare coverage, but there is optimism that this process is closer to the end than the beginning.

As it stands, 2022 was not a good year for revenues. Originally, management guidance for the year had been to expect more than the $6 million in sales seen in 2021. When second quarter results were released, revenue at the halfway point was only $2.4 million, but management still reaffirmed that sales were expected to see growth over the prior year. However, it is fair to say that the third quarter results put that goal out of reach, with revenue a paltry $0.89 million, bringing year to date sales in 2022 to just $3.3 million. Thankfully, Q4 results brought things back to a reasonable if less than satisfying conclusion for the year, with $2.2 million for the quarter, and ending the year at $5.5 million, almost a miraculous recovery to be down only 10% over the prior year.

Sales come primarily from the ReWalk 6.0 system, accounting for ~$4.5 million of the total sales. ReWalk has distribution rights for the Myolyn "MyoCycle," and it has been generating a nice amount of sort of supplemental revenue, $0.25 million in the third quarter and doubled to $0.50 million in the fourth quarter. As a side note, I consider it a concern that management has not spoken directly to the sales of the ReStore product line. This product was hopefully to be a revenue source for use in therapy for stroke recovery, but it was released shortly before Covid-19 came on the scene, and management has been pretty silent on it in the earnings calls throughout 2022. The annual report states " As of December 31, 2022, and December 31, 2021, we had placed 33 and 30 ReStore units, respectively," which is a sore disappointment for what had seemed a promising avenue for sales growth.

At the same time as revenues declined, expenses and other uses of cash have been mounting. While ReWalk is debt free, it has burned through some $20.5 million in cash over the last twelve months, from elevated SG&A costs, specifically spending on some one-time consulting related to its process seeking Medicare coverage. Other uses of cash include a stock buyback of $2.5 million (now up to $3.3 million according to CFO Mike Lawless, or 6% of shares as of the date of the earnings call), and ongoing research & development initiatives. As of December 31, 2022, ReWalk had $67.9 million in cash and no debt, still a healthy balance sheet for a company with a $45.2 million market cap, but definitely another year with a relatively high cash burn rate.

New Opportunities - Outlook for 2023 and Beyond

Though management did not put a number to it, there is a definite expectation that 2023 will see a return to sales growth, and those expectations appear well justified.

CEO Larry Jasinski was asked about the impact on lead generation in Germany on the earnings call, and he indicated leads had been tough through the Covid period, but did not quantify the benefit of the insurance decision for 2023 (edited for length):

that is a lot of our early focus, to get those leads going and get these cases back into the insurers at much higher numbers. . . to build back to the lead levels we saw pre-pandemic then those would translate into things that are more easily processed through the insurers with the acceptance of direct supply. So the impact is going to be there, but it's going to be there more later this year, our cycle time for most of these patients still remains you know 6 to 12 months. . . so that building of leads this year will be an important measurement. It will affect sales some this year, [but] . . . more in the out years.

I think pre-pandemic levels should be considered a minimum threshold, but this recognizes that the legal outcome is not a panacea - sales growth won't happen automatically.

In addition to pathway now available in Germany, there is at least one other source in the near term that can positively impact sales. The US Veterans Affairs department has long been the sole payer willing to cover the ReWalk device for qualified patients in its care, however it has had a narrow geographic footprint of training centers for getting patients walking with the ReWalk device. There are only three VA-run locations in the country providing the training, making access impractical for many veterans, and even serving as potential bottleneck for those who could get themselves to one of the centers. The goal for 2023 is to expand that number to nine, which if accomplished should help move VA cases through the pipeline more quickly.

The biggest variable for 2023 is likely to be the success of Medicare benefit determination. Getting final clarity from Medicare, especially if designated as a prosthetic device, is a key building block towards eventually gaining broader private insurance coverage in the United States. I am not aware of a specific timeline for a final determination from CMS, but it is reasonable to look for one before 2023 is concluded. ReWalk hopes to submit at least 35 claims in 2023 for Medicare reimbursement, and perhaps as many as 50. For a sense of scale, ReWalk ended 2022 with about 65 total cases pending between Germany and the US, so this sort of expansion is clearly material to their results.

If 2022's $5.5 million in sales was achievable, and there is solid grounds for expecting growth, then bumping the low bar up to match 2021's sales of $6.0 million is a fair place to start and still be conservative. Assuming cost of revenue at 65% leaves around $2.1 million in gross profit for the year, and ~$19 million in operating expenses (assuming $3 million for R & D, $16 million for SG & A), leaves an operating loss of on the order of $16.9 million. There is some non-cash expense built into that, but for the sake of simplicity without knowing the changes in working capital etc., I'll take that loss as a rough approximation for cash used in operations. Cash used in investment and in financing in 2022 came to about $3 million ($0.5 in capex, and $2.5 in share repurchases), so I am using the same in 2023. The result is taking around another $20 million from the cash balance by the end of this year, implying around $48 million in cash 10 months from now, still just a bit higher than its current market cap of $45 million.

So from a cash usage standpoint, a worst-case scenario is essentially a repeat of 2022. However, I was caught off-guard when management raised the possibility of pursuing M & A. As Mr. Jasinski laid out his seven priorities for 2023, number four was a statement of looking to acquire complementary technologies that were not developed in-house, and the company has a banking partner assisting. Importantly for investors, he made clear the caveat that any such goal would be pursued in such a way that did not take away from a goal to become break-even with the current capital on hand. That is a direct statement that no additional capital raise is under consideration, and he doesn't think they should need to one in order to get to break-even profitability, a point he reiterated three times on the call.

Mr. Jasinski has said it would not be another spinal cord injury exoskeleton technology, but rather something more complementary to their existing portfolio of technology. Currently, ReWalk has two products on the market of its own, the personal ReWalk 6.0 that is intended for long-term individual use to support independent living, and the ReStore soft-suit that can be used in a rehab context. There is a small pipeline of additional products in the works at assorted stages of development. The furthest along is the ReBoot, an at-home soft boot that will be intended for at-home use in stroke rehab; this technology has received an FDA "Breakthrough Device" recognition, and management is currently working out the details of how to code claims for this device. Other areas of focus are on continuing to improve the functionality of the ReWalk 6.0, making it better suited for curves and stairs, and these improvements are actively being implemented.

It is very difficult to guess what ReWalk would be willing to pay to acquire a complementary technology that keeps it on a path to break-even profitability within its current capital structure. If it has $48 million to work with after netting out $20 million in total use of cash for 2023, then at that rate it has just over two years cash left. Although they anticipate the cash burn to slow significantly soon if they think break-even is possible on the current capital basis, I would still be surprised to see them go after anything in M & A greater than $10 million. Personally, I don't know whether or not anything attractive is available in that price range, but as it happens, $10 million is what Ekso Bionics (EKSO) is spending to acquire the Indego product from Parker-Hannifin (PH), and I think is the best comparable guide to a transaction in the space out there.

Valuation and Conclusion

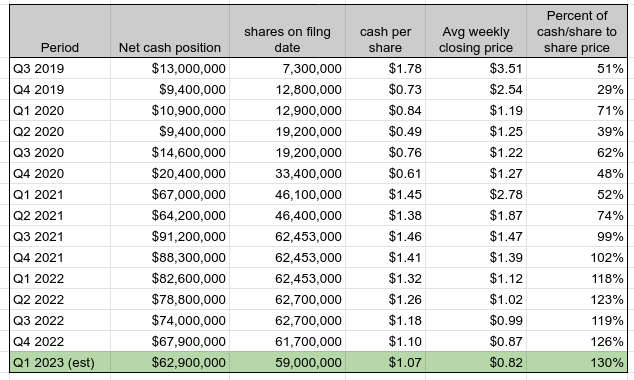

The way I have been going about thinking of ReWalk's value over the last 2 years is essentially by looking at its net cash per share versus its market value. As the cash balance came down I fully expected the share price to follow, which it logically has, knowing that predicting the bottom would be a fool's errand. Against this trend have been the catalysts falling into place one by one, which admittedly have been frustratingly slow to materialize (at one point management thought the German case could be concluded as early as late 2021, so basically a fully year longer than the best case scenario). As the cash has dwindled, the market discount to the cash value per share has widened, though this wasn't always the case - for most of 2021, the market value was greater than just the cash per share. That ended firmly in 2022, and I now expect for Q1 of 2023 that cash per share will be 30% greater than the average market price, based on an average market price of $0.82 per share and assuming a use of cash of $5 million for the quarter (and a slightly smaller share count).

ReWalk Robotics Cash Per Share, Q3 2019 - Q1 2023 (EST) (Author's spreadsheet; historical prices from Marketwatch.com)

I suspect there are multiple reasons for the growing gap - it broadly corresponds to risk-off market sentiment and the impact of rising interest rates on risk-free rates and corresponding discount rates. At the same time, while I am mildly surprised the stock didn't gain any positive momentum from the earnings call with its revelation of up to 50 Medicare claims to file this year, I am reminded there is a constant element for investors of "show-me" actual results, and should be justifiably skeptical. I believe that it will take a quarter with clear and sustainable improvements in German claims and payments, or the announcement of a final Medicare benefit category determination that was favorable for ReWalk, before we start seeing that growing gap between cash per share and market value start to turn around.

On the German claims, I am fairly comfortable that those will materialize over 2023 and in years to come, and by itself could be enough for ReWalk to get by as a private small European-focused med tech company, with $6 million annual sales base. Their ambitions are greater than that, though, and the Medicare decision will either make or break ReWalk's ability to survive as larger endeavor. Without knowing the reimbursement level Medicare would provide it is difficult to predict the revenue. Pricing of the unit has been reported in the range of $70,000 or more, but assuming Medicare would pay less than that, say $60,000 per unit, then assuming they get approval for 30 units from Medicare out of the intended 35-50 submissions this year, would be $1.8 million. The clear implication is that ReWalk is talking about going from less than 100 units placed per year to a few hundred units, all in a matter of about 24 months in order to get to a break-even point.

Whether or not this is feasible is surely playing into the market's valuation, with high skepticism. I share the skepticism on the timeline - it is very aggressive - but I am generally optimistic on the direction, but I realize that it all hangs on the final Medicare decision. Even if they cannot get to the break-even point on the current capital base, demonstrating that getting there is even possible should be all that is necessary to accessing any additional capital when the time comes, boosting the prospects and valuation so long as additional capital is reasonable. For better or worse, those answers should become evident by the end of 2023. I continue to rate it as a speculative buy, understanding that this is investment is the highest risk name in my portfolio, and I will not over-weight my exposure.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of RWLK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.