Cameco: 2023 To Be A Rewarding Year

Summary

- Cameco Corporation put out a very strong 2023 outlook that I believe investors are not fully appreciating.

- Crucially, I believe that, in 2023, we'll see utilities come to the market to contract for significant uranium pounds.

- And Cameco, as one of the biggest uranium companies in the world, will be ready to serve utilities' uranium demand.

- Looking for more investing ideas like this one? Get them exclusively at Deep Value Returns. Learn More »

Antoine2K

Investment Thesis

Cameco Corporation (NYSE:CCJ) is expected to be moderately profitable in 2023 and even more profitable in 2024. But that isn't the whole story. Or better said, that's not the only reason to be bullish on this stock. This investment is for investors that are bullish on uranium but don't want sleepless nights.

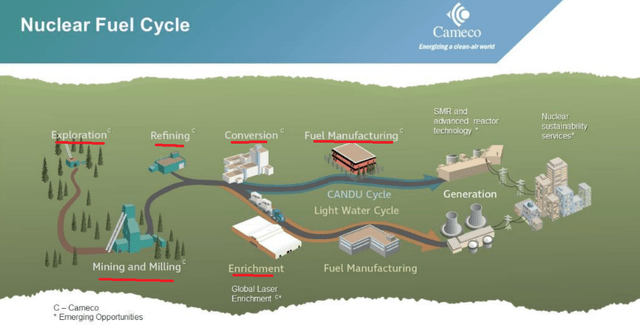

Red lines are Cameco's operations

Cameco is one of the largest uranium producers around the world. And through its 49% Westinghouse Electric acquisition, Cameco is now an integrated uranium company.

Here, I describe how investors should think about Cameco in 2023.

The Key Uncertainty Facing Uranium, When?

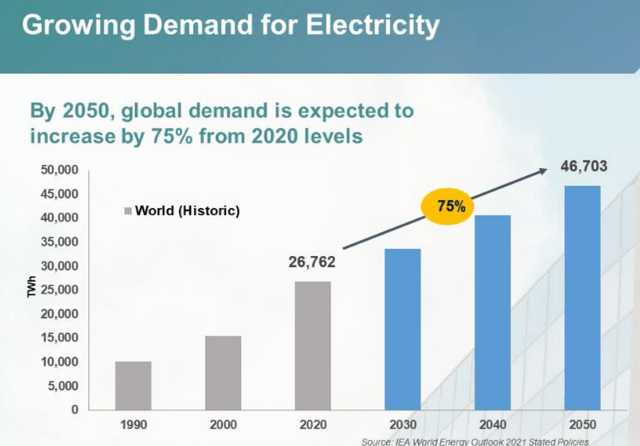

Demand for nuclear is going in one direction, and that is up.

Not only driven by climate-change advocates looking for zero-emission carbon energy supplies, but also through a growing government impetus to secure one's country's energy demand.

Today, energy security is no longer just a buzzword. The geopolitical events of 2022 have made this a very real energy supply contemplation.

At the margins, there's a tide change in public and political thinking, regarding their stance toward nuclear energy.

Slowly, this has started to lead to a deficit between underlying supply and demand.

But here's the real crux of the problem for bulls. The supply side remains largely unknown. Even if there are ample discussions about inventory supplies drying up, that same argument has been in place for several years, including most intensely in 2022. And thus far, besides a compelling narrative, the uranium spot price remains stubbornly stuck at $50 per pound.

That being said, this doesn't mean that the bull thesis is wrong. It simply means that investors are having to remain a little more patient for a little while longer.

And alas, therein lies the problem! Investors don't like the uncertainty of not knowing ''when'' the fundamentals will arrive to support this highly alluring narrative.

All that being said, there are some interesting green shoots that are starting to emerge.

Nuclear Power, the Driver of Future Energy

Here are the facts: we demand clean, secure, and affordable energy as we never have before.

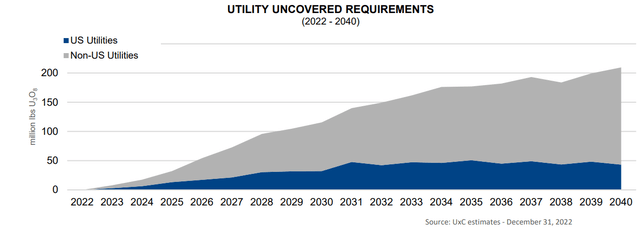

In fact, Cameco declares that right now, ''utilities are now approaching replacement rate contracting for the first time in over a decade.''

This means that for the first time in 10 long years, utilities are seeking to contract uranium supply to match their demands. This is a massive change in a thesis that hasn't gained much traction for years.

Previously, utilities would have simply purchased up their uranium supplies for a few years ahead, as they'd know that there was ample supply in the spot market. But right now, for the first time in years, this dynamic has changed.

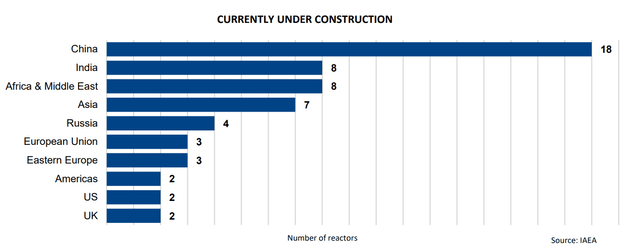

Moreover, as you can see from the graphic above, this is a global movement. This is not only about the direction that North America is heading in. This is a global trend to increase the demand for nuclear energy.

And Cameco is extremely well-positioned to be a reliable provider of uranium volumes.

The Bottom Line

For 2023, Cameco is very well set up, with strong uranium contracting in its portfolio.

But the real driver for Cameco Corporation stock will be when utilities return to uranium producers to contract for uranium volumes, rather than being able to get their volumes from the spot market.

In fact, as the graphic above shows, starting with 2023, there's a rapidly rising need for uranium by utilities. And that shortfall is only expected to increase with time.

Essentially, rather than getting caught up in trying to figure out whether paying 7x forward sales for Cameco Corporation is a compelling risk-reward, I suggest that readers look instead to the fundamental opportunity that's now available in this stock.

If the uranium thesis starts to finally gain some traction in 2023, whether an investor pays 7x or 8x or even 10x forward sales for Cameco Corporation will make little difference.

Because once uranium prices start to move toward $60 per pound, everything that we are discussing here will become a reality. And at that point, Cameco Corporation's valuation won't be at less than CAD$20 billion market cap, but significantly higher.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.