GOF: Failing To Sustain Distribution Internally And Too Expensive

Summary

- Investors today are in need of income due to the rising prices that have dominated the economy over the past year.

- Guggenheim Strategic Opportunities Fund invests in a portfolio that consists mostly of high-yield bonds and similar assets to deliver a very high yield to its investors.

- The closed end fund's portfolio is extremely well-diversified across sectors, and credit quality, and should be able to provide protection against company-specific risk.

- The fund is relying on money from new investors to maintain its distribution, which is very concerning as this is not sustainable long term.

- The GOF fund is trading for a ridiculously expensive price today.

- Looking for more investing ideas like this one? Get them exclusively at Energy Profits in Dividends. Learn More »

arsenisspyros

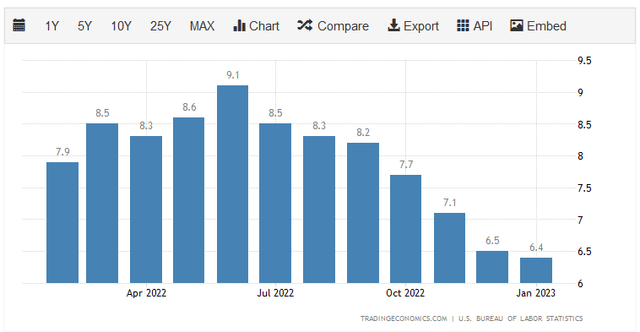

One of the biggest challenges for Americans over the past year or so has been the incredibly high rate of inflation that has dominated the economy. In fact, over the past twelve months, we have not seen a single month in which the consumer price was not at least 6.4% higher than in the prior year quarter:

This inflation has most affected the necessities of food and energy, so it has had a very significant impact on those of lesser means. This is likely one of the biggest reasons why a recent Prudential Pulse survey stated that about 81% of Generation Z members and 77% of Millennials have either entered the gig economy or are considering doing so in order to complement the income from their regular jobs because they need the extra money to keep their bills paid and themselves fed. Thus, clearly, people are being forced to resort to extraordinary means to handle the incredibly high inflation rate.

Fortunately, as investors, we do not need to resort to such tactics to earn an extra income because we can put our money to work for us. We have certainly not been immune to inflation either, so we naturally still need the extra income as much as anyone else. One of the best ways to obtain this extra income is to purchase shares in a closed-end fund that specializes in providing investors with a high level of income. These funds are not especially well followed by many investors, but they are very attractive entities. This is because closed-end funds ("CEFs") provide easy access to a diversified portfolio of assets that can usually produce a higher yield than any of the underlying assets possesses.

In this article, we will discuss one of the most popular income-focused closed-end funds, the Guggenheim Strategic Opportunities Fund (NYSE:GOF). This fund currently yields 12.74%, which is certain to turn the head of anyone looking for income. However, anything with a double-digit yield deserves some close scrutiny as that is a sign that the market believes that its distribution is about to be cut. I have discussed this fund on this site before, but a few months have passed since that time, so a few things have changed. In particular, the fund has released a more recent financial report that will provide us with more insight into how well it has handled the rising interest rate environment that has affected the economy over the past few months. This article will focus specifically on that financial report as well as provide us with

About The Fund

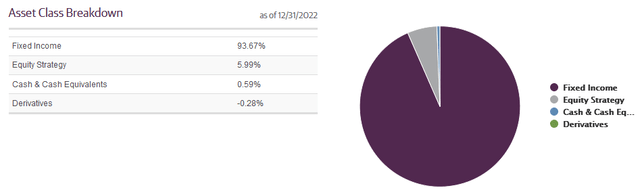

According to the fund’s webpage, the Guggenheim Strategic Opportunities Fund has the stated objective of providing its investors with a high level of total return through current income and capital appreciation. This is a strange objective for a fixed-income fund, which the fund appears to be as 93.67% of its assets are invested in bonds:

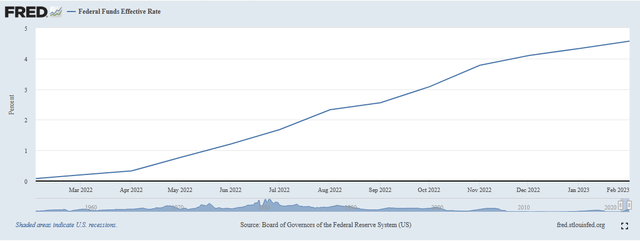

The reason why this is a strange objective is that bonds are not particularly well-known for delivering capital gains. This is because they have no inherent connection to the cash flows and growth of the issuing company. After all, a company will not increase the interest rate that it pays to its bondholders just because its profit goes up. Rather, bonds are priced based on interest rates. In short, when interest rates increase, bond prices go down and vice versa. As everyone reading this is no doubt aware, interest rates have been raising since last March in response to a series of Federal Reserve decisions that are intended to combat the high inflation rate in the economy:

Federal Reserve Bank of St. Louis

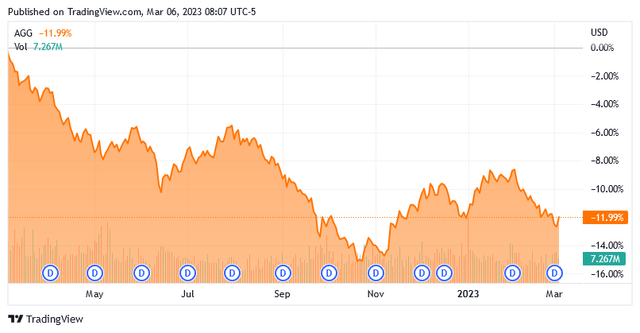

As of the time of writing, the effective federal funds rate stands at 4.57%. It was at 0.08% in February of 2022. In fact, the current federal funds rate is the highest that it has been in more than a decade. This has had a significant impact on the bond market, as the Bloomberg U.S. Aggregate Bond Index (AGG) is down 11.99% year-over-year:

Investors should not really expect any sort of improvement here as inflation remains high and recent comments from the Federal Reserve suggest that it will continue raising interest rates until inflation has finally fallen to its target level. It is questionable how resolute the Federal Reserve will be in this goal as it will eventually run into a situation where the Federal Government begins having trouble paying the interest on the national debt, but that situation has not happened yet.

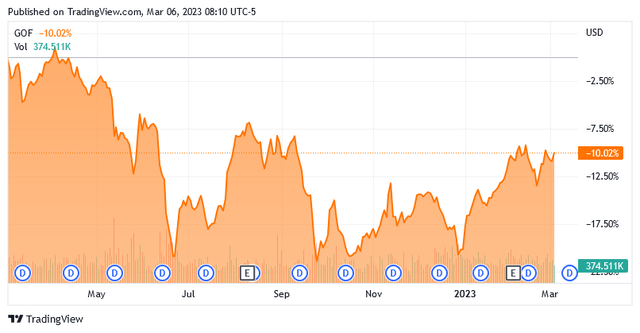

This has had an impact on the Guggenheim Strategic Opportunities Fund as well. As of the time of writing, the fund is down 10.02% over the trailing twelve-month period:

While the fund has certainly outperformed the index, the point is that it will likely struggle to achieve much in the way of capital gains until the Federal Reserve’s interest rate policy changes. That may be a long way off. With that said though, the fund’s incredibly high yield and strong performance do mean that this appears to be a better choice for an income investor than the bond index.

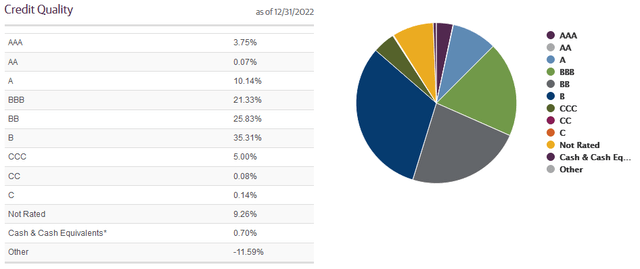

As was noted in my previous articles on this fund, the Guggenheim Strategic Opportunities Fund’s portfolio is heavily skewed toward high-yield bonds (colloquially called “junk bonds”). This remains true, which we can see by looking at the credit ratings of the bonds in the portfolio. Here they are:

An investment-grade bond is a bond that has a rating of BBB or above. As we can clearly see here, that is only 35.29% of the fund’s bond portfolio. The remainder of the securities here are junk bonds. This is something that may concern more risk-averse investors as we have all heard stories about the high risk of losses due to default possessed by these securities. However, we can see that 61.14% of the bonds carry a BB or B rating, which are the two highest ratings possessed by high-yield bonds. According to the official bond ratings scale, companies whose securities possess these ratings have sufficient balance sheet strength to “weather through short-term economic shocks.” These companies also have the sufficient financial capacity to carry their existing debts. Thus, these bonds probably do not have a much higher default risk than investment-grade bonds. As well over three-fourths of the fund’s bond portfolio is rated B or above, the risk here is probably not as big as may be feared.

Another way that the fund can protect itself against default losses is by having a substantial number of positions. The Guggenheim Strategic Opportunities Fund certainly meets this requirement as it has 1,326 current positions. This is a slight increase over the 1,310 positions that the fund had when we last looked at it, which could be a sign that the fund is trying to reduce its risks of loss as we have seen a few companies deteriorate financially in the last few months. However, the increase in position count is relatively small in percentage terms so this could also simply be a case of the fund’s management trying to maintain a certain number of positions within a set range to accommodate normal changes in market conditions. Either way, we can see that the fund has such a large number of positions that any default should have minimal impact on the fund’s overall portfolio value.

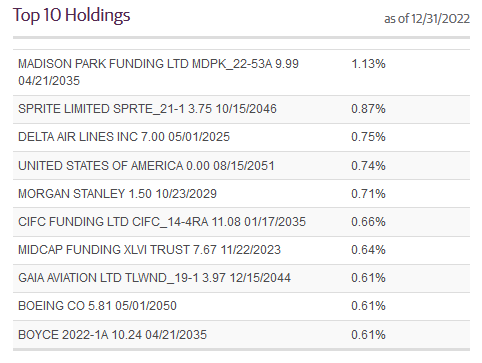

As a result of a large number of positions, we might expect that no single position would account for a significant weighting in the portfolio. This is certainly true, which we can see by looking at the largest positions in the fund:

Guggenheim

This is largely what we expected to see as no single position accounts for more than 1.13% of the overall portfolio. That is very nice because of the protection that it provides us against idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk that any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification, but if any asset accounts for more than 5% of the portfolio then the risk may not be completely eliminated. Thus, the concern is that some event will occur that causes the price of a given asset to decline when the market does not, and if that asset accounts for too much of the portfolio, then it may end up dragging the entire fund down with it. This does not appear to be something that we need to worry about here though as no single asset accounts for too much of the portfolio. Thus, this fund appears to be sufficiently diversified in order to protect us against the risk that any of these companies may pose individually.

Leverage

In the introduction to this article, I stated that closed-end funds like the Guggenheim Strategic Opportunities Fund have the ability to use certain strategies that allow them to boost their yields above that of any of the individual assets in the portfolio. One of the most common strategies to accomplish that, which is also employed by this fund, is the use of leverage. Basically, the fund borrows money and uses the borrowed money to purchase high-yield bonds and similar assets. As long as the interest rate that the fund has to pay on the borrowed money is lower than the yield of the purchased securities, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is able to borrow money at institutional rates, which are significantly lower than retail rates, this will usually be the case.

However, the use of debt in this manner is a double-edged sword because leverage boosts both gains and losses. Thus, when the market price of the purchased bonds declines, the fund will suffer larger unrealized gains than it would have in the absence of leverage. This is something that could be a major consideration today as it seems likely that the interest rate pressure on bond prices will continue for a while, which will push down the market value of the bonds in the fund’s portfolio. As such, we want to ensure that the fund is not employing too much leverage as that would expose us to too much risk. I do not generally like to see a fund’s leverage exceed a third of its assets for this reason. As of the time of writing, the Guggenheim Strategic Opportunities Fund’s levered assets comprise 24.45% of its portfolio so it appears to be satisfying that requirement. Overall, this fund appears to be striking a pretty reasonable balance between risk and reward.

Distribution Analysis

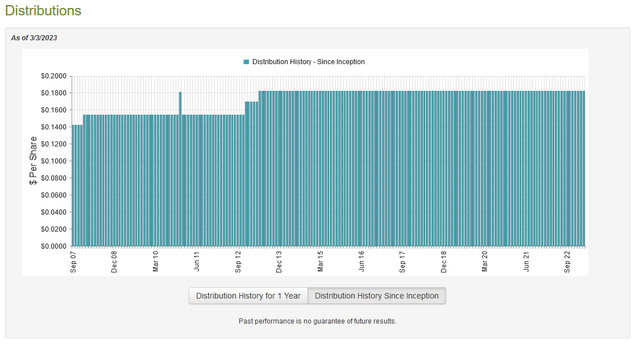

As mentioned earlier in this article, the primary objective of the Guggenheim Strategic Opportunities Fund is to provide its investors with a high total return primarily through current income and current gains. In order to accomplish this objective, the fund invests in a portfolio of bonds, particularly high-yield bonds. As bonds primarily deliver their return in the form of direct payments to investors, this results in the fund receiving a great deal of income. It then applies leverage to boost the income that it receives. The fund then pays its income out to its investors, so we can expect it to boast a fairly high yield. This is certainly the case as the fund currently pays out a monthly distribution of $0.1821 per share ($2.1852 per share annually), which gives it a whopping 12.74% yield at the current price. The fund has been remarkably consistent about its distribution over time as it has never reduced it:

This is without a doubt one of the best track records of any bond fund, which may explain the double-digit yield. The market probably expects that this fund will be forced to cut its distribution as many other bond closed-end funds have done. The track record also explains this fund’s appeal among many investors as it has provided a consistent and secure source of income for many years. As such, the most important thing for us today is how well the fund can sustain this distribution. After all, we do not want to find ourselves the victims of a distribution cut since that would reduce our incomes and likely cause the fund’s stock price to decline.

Fortunately, we have a very current document that we can consult for the purpose of analyzing the distribution. The fund’s most recent financial report corresponds to the six-month period that ended on November 30, 2022. This is a much newer report than we had the last time that we looked at the fund, which is good because it should give us a good idea of how well the fund weathered the rising interest rate environment that dominated the economy in 2022. That is critical for the fund’s ability to maintain its distribution. During the six-month period, the Guggenheim Strategic Opportunities Fund received a total of $52,566,505 in interest and $5,080,428 in dividends from the assets in its portfolio. This gives the fund a total income of $57,646,933 during the period. The fund paid its expenses out of this amount, leaving it with $40,804,844 available for shareholders. That was, unfortunately, not nearly enough to cover the $117,933,588 that it actually paid out during the period. At first glance, this will certainly be concerning as the fund is failing to generate sufficient income to cover its distribution, by quite a lot.

However, the fund does have other ways through which it can earn the money that it needs to cover its distribution. Chief among these is capital gains, but as might be expected from the bond-heavy portfolio in a rising rate environment, the fund was not particularly successful at this during the period. It did manage to achieve net realized gains of $2,676,070 during the period, but this was offset by the $96,445,983 net unrealized losses that the fund suffered during the period. The fund did manage to raise $127,590,271 through the issuance of new shares during the period but its assets still declined by $43,308,386 during the period after accounting for all inflows and outflows. In short, the fund only managed to maintain its distribution by bringing in new investor money. That is not sustainable over any sort of extended period. Overall, it appears that the market’s caution is warranted here as the fund appears unable to sustain its distribution through its actual operations.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Guggenheim Strategic Opportunities Fund, the usual way to value it is by looking at the fund’s net asset value. A fund’s net asset value is the total current market value of its assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are purchasing the fund’s assets for less than they are actually worth. Unfortunately, that is not the case with this fund today. As of March 3, 2023 (the most recent date for which data is available as of the time of writing), the fund had a net asset value of $12.83 per share but the shares actually trade for $17.17 per share. That gives the shares a rich 33.83% premium to the net asset value at the current price. That is relatively in line with the 33.41% premium that the shares have had on average over the past month, but that is still an incredibly high premium to pay for any fund. This fund looks very overpriced today, especially considering that it is relying on money from new investors to maintain that distribution.

Conclusion

In conclusion, the Guggenheim Strategic Opportunities Fund is a popular fund among many investors due to its long history of paying out its distribution reliably. The fund does have a very good fixed-income portfolio that adds somewhat to its appeal. However, it falls short in two aspects. In particular, the fund cannot maintain its distribution through its own operations and is dependent on new investors injecting money into it. That is not sustainable over any sort of extended period. In addition, the fund is ludicrously expensive for a fund that is struggling to maintain its distribution. It would be best to avoid Guggenheim Strategic Opportunities Fund until the distribution is cut, or the share price drops to a more reasonable valuation.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!

This article was written by

Traditionally, we have not always responded to comments but in order to improve the quality of our research, comments will be reviewed and we will respond to issues regarding errors or omissions. This does not include our premium service, "Energy Profits In Dividends" which is available from the Seeking Alpha Marketplace. This service does include detailed discussions with our team both on the reports themselves and in a private forum.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.