Aviva: 2022 Earnings Preview

Summary

- Aviva is going to report its 2022 annual results next Thursday.

- Its operating performance is not expected to surprise much, a key catalyst for a higher share price will be the size of its share buyback program.

- Aviva remains attractive to income investors due to its 7% dividend yield and relatively low valuation.

anyaberkut

Aviva (OTCPK:AIVAF) is set to report earnings in the next few days, and the size of its expected share buyback program will be key for its share price reaction.

As I’ve covered previously, I see Aviva as a good income play within the European insurance sector, due to its high-dividend yield that seems to be sustainable over the long term, supported by its strong fundamentals, excess capital position, and good cash position at the holding company.

Considering that Aviva will report its annual earnings related to 2022 Thursday March 9, 2023, I think now is a good time to update its investment case and see what is expected regarding its 2022 financial figures.

Background & Earnings Preview

For investors who aren’t aware of Aviva’s business profile and investment case I suggest a reading of my previous coverage here, but nonetheless, Aviva is a composite insurance company that has made a significant business restructuring over the past decade, being now focused on three core geographies (the U.K., Ireland, and Canada).

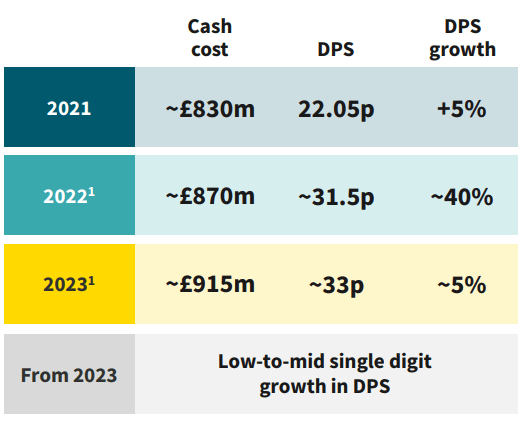

As the company’s growth prospects aren’t particularly impressive, its investment case is now geared to profitability and income, through a high dividend that is currently leading to a forward yield of around 7%, based on dividend estimates related to 2022 earnings of £0.31 per share. Investors should note that Aviva has already paid an interim dividend of £0.10 per share, thus the final dividend is estimated to be £0.21, expected to be announced together with the company’s annual earnings, and probably paid in May after its Annual General Meeting.

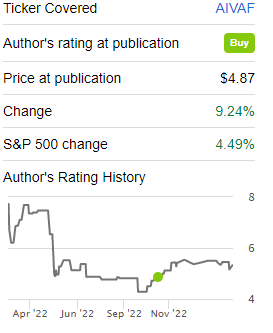

This dividend yield is quite attractive to income investors, and is higher than the average of the European insurance sector (about 5.4%), showing that Aviva is clearly committed to provide an attractive shareholder remuneration policy and also that its shares are somewhat undervalued. Indeed, Aviva is still trading below book value, which seems to be undemanding considering its fundamentals, which explain to some extent its outperformance compared to the market since my article at the end of October.

Performance (Seeking Alpha)

Despite the recent stock performance, Aviva is still trading at 0.9x book value, which compares well to some of its closest peers that trade, on average, at about 1.2x book value. I see its upcoming annual results as a potential catalyst for a higher valuation, if the company was able to maintain positive operating momentum in the last three months of the year.

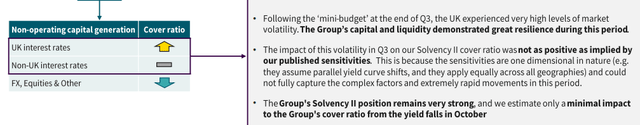

Investors should note that the last quarter was more challenging from a macroeconomic perspective and the U.K. bond market was more volatile than usual, due to U.K. ‘mini-budget’ issue that spooked investors and led to higher sovereign bond yields.

Indeed, as shown in the next graph, the market reaction last September was very strong with the 10-year Gilt yield up by more than 150 basis points in the month to a peak rate of about 4.5%. This increased market volatility was a key reason why Aviva’s capital position was weaker than expected at the end of September, given that its Solvency II ratio was 215% at the end of September, which was well above its 180% target, but declined from 234% at the end of June 2022.

10Y Gilt Yield (Bloomberg)

This effect was to some extent unexpected, considering that Aviva’s published capital sensitivities were for an increase in surplus capital from higher interest rates, due to higher duration of liabilities compared to assets, but the net effect was negative for capital during this period as the company’s economic sensitivities were not capable of fully capturing the complex market moves experienced at the end of Q3 2022.

Sensitivities (Aviva)

However, most of the tax measures were reversed by the new government in October, and the Gilt market experienced a more ‘normal’ behavior during the last three months of the year, with the 10-year Gilt yield ending the year at around 3.6%. Theoretically, this decrease in interest rates should have a negative impact on Aviva’s capital position, but this is a factor that analysts and investors will certainly be careful to estimate, as prior economic sensitivities were not very helpful in predicting capital movements.

Nevertheless, I expect Aviva to report a capital position that is well in excess of its internal target of 180%, which means it will be able to distribute a total dividend of £0.31 per share as it has guided previously, and also announce a new share buyback program. The size of share repurchases can also be a catalyst for a higher share price, as the company’s centre liquidity of around £1.9 billion at the end of October 2022 was more than enough to finance its final dividend payment of about £570 million and perform a share buyback of at least £250 million.

This represents close to 2% of Aviva’s current market value, and I think a share buyback program that is lower than this will not be well received by the market. On the other hand, if cash generation remained strong in the last few months of 2022, Aviva may be more aggressive and perform a larger share buyback program, even though usually the company has a conservative approach and a sizable program is not very likely.

Regarding its operating performance, Aviva is likely to report some mixed trends, as the market backdrop was somewhat challenging in the last quarter of the year. Considering that capital markets remained weak during Q4, Aviva’s volumes related to annuities and its asset management unit are expected to be weak, while on the other hand it should report better trends related to health and protection insurance products.

As the company has been more focused on profitability rather than growth in recent quarters, its operating profit for the year is expected to be about £1.8 billion, up by 12% YoY, supported by higher business margins in its life segment that should be able to offset some weakness in its asset management segment and higher costs from reinsurance.

Its adjusted net income is expected to be around £1.4 billion and report earnings per share of £0.41, which means its dividend payout ratio related to 2022 earnings should be around 75%. This is a higher payout ratio than desirable, but acceptable for a mature company like Aviva, and is well covered by the company’s centre liquidity and excess capital position.

Therefore, I think Aviva is very well capable of delivering on its dividend guidance, with the major unknown factor being the size of its share buyback program. It’s not very likely that Aviva will deliver a shareholder remuneration below market expectations, as the company has flagged its intentions in recent months, thus a potential positive share price reaction should come from a share buyback program above current expectations of around £250 million.

Dividend guidance (Aviva)

Conclusion

Aviva is a good income play within the European insurance sector due to its high-dividend yield, plus its expected share buyback program will enhance even further its appeal to investors. As I don’t expect earnings to beat current expectations by a high margin, the major factor for a higher valuation in the short term is the size of its share repurchase program, if the company decides to be more aggressive and returns a good part of its excess cash through share buybacks.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.