March is an important month for liquid funds. And if you have some short-term surplus cash to park for a few weeks to even a month or two, then these are for you.

As we enter March, liquidity in the financial system starts to go down and short-term rates look up. This is good news for liquid funds. Here’s why.

Attractive yields

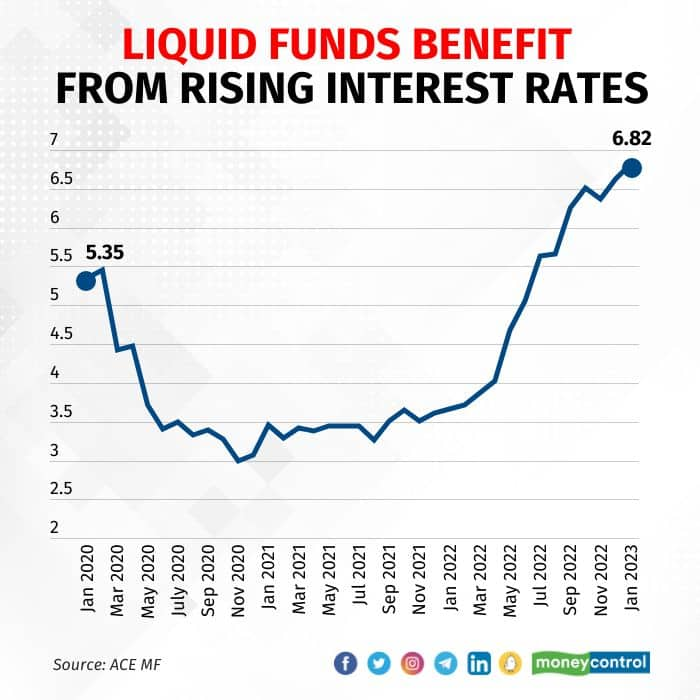

Yield-To-Maturity (YTM) of liquid schemes have gone up over last one year. According to ACE MF, the average yield to maturity of liquid funds was 6.82 percent as of January 31, 2023 compared to 3.67 percent a year ago. These yields, after being adjusted for the expense ratio, offer an idea of expected returns to the investor. Higher the number better it is, other things remaining the same.

For beginners, liquid funds invest in money market securities that will mature in less than 91 days. This ensures that the portfolio keeps maturing frequently and the fund manager redeploys it at then prevailing yields. If interest rates are moving up, liquid funds tend to do well, as they did in recent times of rising interest rates. Since May 2022, the Reserve Bank of India (RBI) has hiked the repo rate by 250 basis points to 6.5 percent. One basis point is one-hundredth of a percentage point

Liquid funds’ YTM has followed this upward movement in policy rates.

Superior returns and low risk

Liquid funds are used by investors to park money for the short term. Many times, investors leave money in savings bank accounts, which fetches them an average 3 percent return. Current expectations of earning more than 6 percent annualised returns from liquid funds makes them attractive.

Banks have not yet hiked the very short-term FD interest rates or interest rates payable on saving bank account balances in line with the increase in yields available on liquid funds.

Mahendra Kumar Jajoo, Chief Investment Officer, Fixed Income, Mirae Asset Investment Managers (India), says: “Liquid funds’ yields are expected to stay strong for some time as the central bankers are still indicating upward movements in interest rates. Even if the policy interest rates do not move up from here, they will take some time to come down, which in turn will reward investors in liquid funds.”

Experts also point out that investors should not forget the financial year-end. And traditionally we see a liquidity crunch around this time.

Joydeep Sen, Corporate Trainer –Debt, says: “Given the surplus liquidity in the financial system, the short-term rates were not meaningfully going up in March till last year. However, this year, though the liquidity is surplus, the surplus has been going down and rates are likely to go up in March.”

Though liquid funds are offering relatively higher returns than other comparable investment avenues, investors are not exposed to high risk. Most liquid funds invest in commercial paper, certificates of deposit and other money market instruments with a high credit rating. The focus of the fund manager is to maintain liquidity of the portfolio.

Priyadarshini Mulye, an investment advisor registered by the Securities and Exchange Board of India (SEBI) and founder of arthafinplan.com, is of the opinion that liquid funds are relatively less risky due to low interest rate risk.

“Returns on liquid funds are attractive and they make a very good money parking space,” she adds. She recommends liquid funds if an individual wants to park money for one to three months.

Should you invest?

Though the returns offered by liquid funds can be attractive, do not put all your money in these schemes just because other debt schemes have been offering relatively low returns in the last one year.

In a rising interest rate scenario, liquid funds, overnight funds and ultra-short duration funds may look promising. However, they at the best can be short-term parking spaces and won’t make long-term investments. When interest rates start going down, yields on these liquid funds will also follow. For investors who are prepared to withstand some volatility and have a long time frame, there could be better options.

“If you have long enough view of say three to five years and you can sit tight in case of volatility in debt markets, then consider some allocation to short-duration funds. Do not go aggressively after long-duration funds as of now,” Jajoo says.

If you are looking at liquid funds as a short-term parking space for your money, then do not blindly go with one that offered the highest returns in the recent past. Well- managed liquid funds can also be used to save contingency funds.

Sen says: “Always check the credit quality of the portfolio of liquid funds. I have a slight preference for liquid schemes of a large size as they ensure corpus size stability.”

Liquid funds have a statutory graded exit load until the seventh day from the date of allotment of the units. If you are going to use a liquid fund as a source scheme for starting a Systematic Transfer Plan, then start the STP after seven days from the date of allotment of units.

Capital gains booked on liquid fund units held for less than three years are taxed as short-term capital gains in line with the slab rate of the investor.