Conagra Brands: Improved Earnings Outlook, High Yield Make It Attractive

Summary

- Conagra Brands has the highest dividend yield compared with its peer set and has grown its payout by 9.2% in the past 5 years.

- CAG is also the cheapest in its peer set despite its improved earnings outlook, signaling possible upside.

- Although margins have come under pressure in recent years due to inflation, they have improved in the most recent quarter and are near pre-covid levels.

- CAG is steadily reducing its net leverage, which is good for the dividend going forward.

- CAG stock is an attractive buy for investors looking to build a defensive portfolio to counter the effect of interest rates staying higher for longer amid stubborn inflation.

Katrina Wittkamp

Conagra Brands (NYSE:CAG) is a Chicago based consumer packaged goods company that produces a wide range of branded and customized staple food products for sale primarily in the US. Its product portfolio spans categories such as frozen foods, groceries and snacks and includes dozens of renowned brands such as Healthy Choice, Birds Eye and Slim Jim among others. These brands are sold to major retailers across the US, including Walmart (WMT), CAG’s largest customer as per its latest 10-Q, accounting for 28% of consolidated net sales in the first half of fiscal 2023 (fiscal year ends in May).

CAG is an archetypal consumer staples stock — it has stable non-cyclical revenues, pays consistent dividends and has low volatility. CAG produces essential items and therefore enjoys stable revenues, including during times of economic uncertainty. Tellingly, its revenues came in at $11.05 billion in fiscal year 2020, $11.18 billion in 2021 and $11.53 billion in 2022. This is despite headwinds such as Covid-19, geopolitical conflict, inflation, and interest rate hikes over this period. CAG also pays consistent dividends, with more than 30 consecutive years of dividend payments. Its stock price is also not volatile, with a 52 week range of $30.06 - $41.30.

Best income play compared with peers

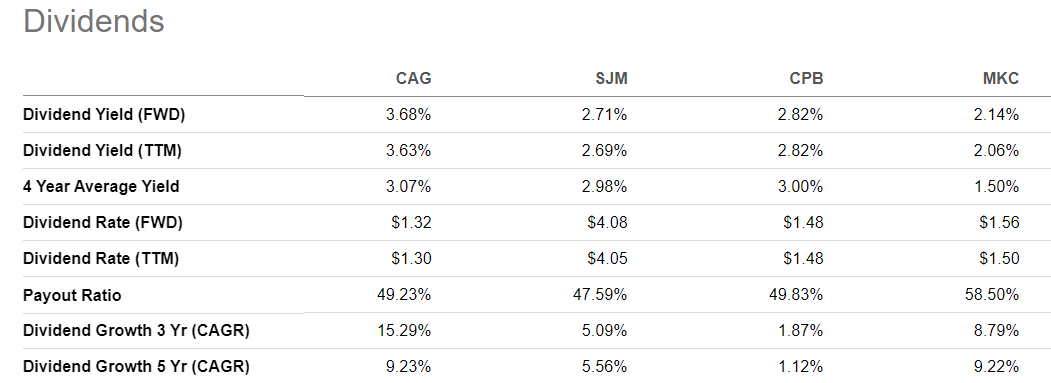

CAG’s peers include food companies such as J. M. Smucker Company (SJM), McCormick & Company (MKC) and Campbell Soup Company (CPB). All of them pay dividends but CAG has the highest yield as the table below shows.

Seeking Alpha

Importantly, CAG has been growing its payout at a healthy pace in recent years. CAG’s 5 year dividend growth rate of 9.23% is the highest in its peer set. MKC’s yield is similarly high but the company is facing its own unique challenges, including softer guidance and high multiples, that have weighed on the stock price. It has a sell rating from the Seeking Alpha Quant rating system and is at risk of performing badly. Stocks rated Sell or worse by the Seeking Alpha Quant rating system have massively underperformed the S&P 500.

Improving margins and reduced indebtedness

When a company is paying consistent dividends and increasing payouts at a healthy pace, investors need to ensure that it can afford to continue moving in this direction. One way to make this assessment is to look at margins, particularly for consumer staple companies like CAG that have fairly flat or single digit top line growth.

CAG’s margins have come under pressure in recent years due to inflationary and supply chain headwinds. Its gross margin for the trailing twelve months is 25.54% vs a 5 year average of 27.98%. EBITDA margin is 17.74% vs a 5 year average of 19.55% and net income margin is 5.66% vs a 5 year average of 8.67%. As a result, cash from operations for the trailing twelve months was $1.21 billion, around $100 million less than the 5 year average of $1.33 billion.

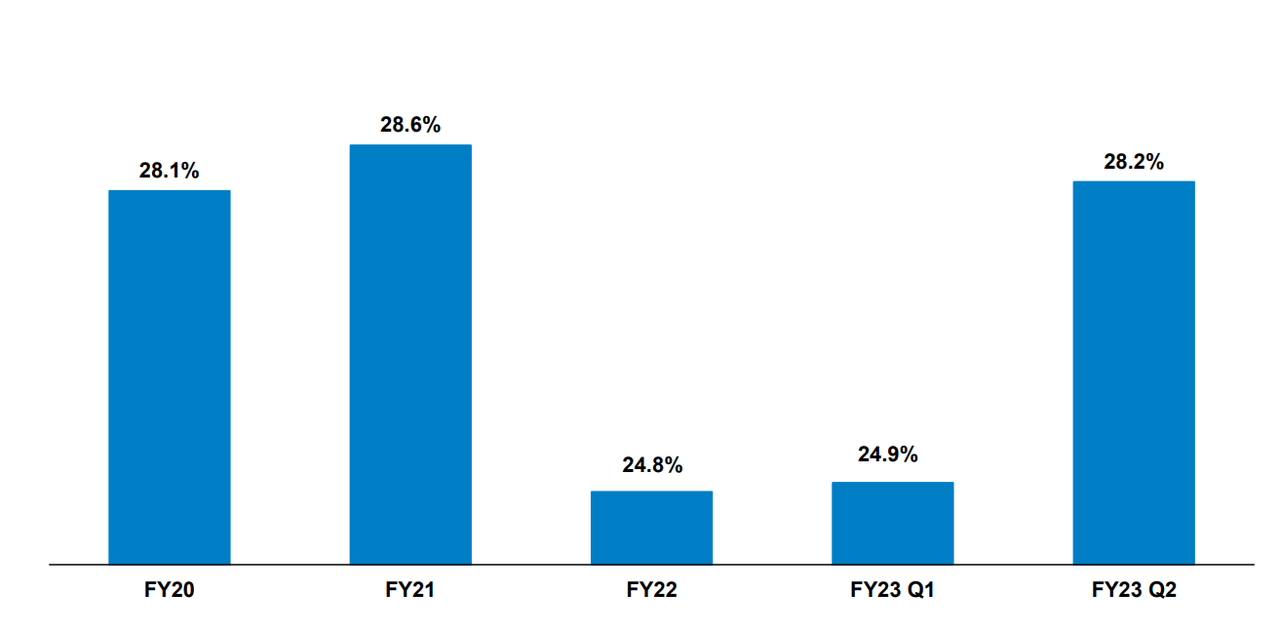

CAG, however, appears to be turning a corner with regard to improving its profitability. Its gross margins, which had fallen sharply after Covid and the inflationary challenges that followed, increased in the most recent quarter ended 11/27/22 (FY2023 Q2) to near pre-covid levels.

CAG's gross margins (CAG earnings presentation)

“Our adjusted gross margin of 28.2% represents a 310 basis point increase over the second quarter of last year. And our adjusted operating margin of 17% represents a 237 basis point increase over that same period,” noted Sean Connolly, CEO, on the earnings call.

Another indicator that CAG could potentially sustain its dividend growth is the fact that it is reducing its debt. Its long-term debt peaked at $10.51 billion in 2019, but has been steadily declining ever since, falling to $7.97 billion as of May 2022. CAG’s net leverage ratio fell to 3.9x in the quarter ended November vs 4.3x in the year-ago quarter.

Upside potential

CAG’s not only improved its margins in the most recent quarter, but also other key metrics such as revenues and EPS, both of which came ahead of analysts’ estimates. Revenue of $3.31B (+8.2% Y/Y) beat estimates by $30M while non-GAAP EPS of $0.81 beat estimates by $0.15.

The management raised its full year guidance, citing strong momentum. It further noted that its priority will remain strengthening its balance sheet. “We are raising our fiscal 2023 guidance on all metrics - organic net sales growth, adjusted operating margin, and adjusted earnings per share due to continued positive business momentum and our strong first half performance,” noted Sean.

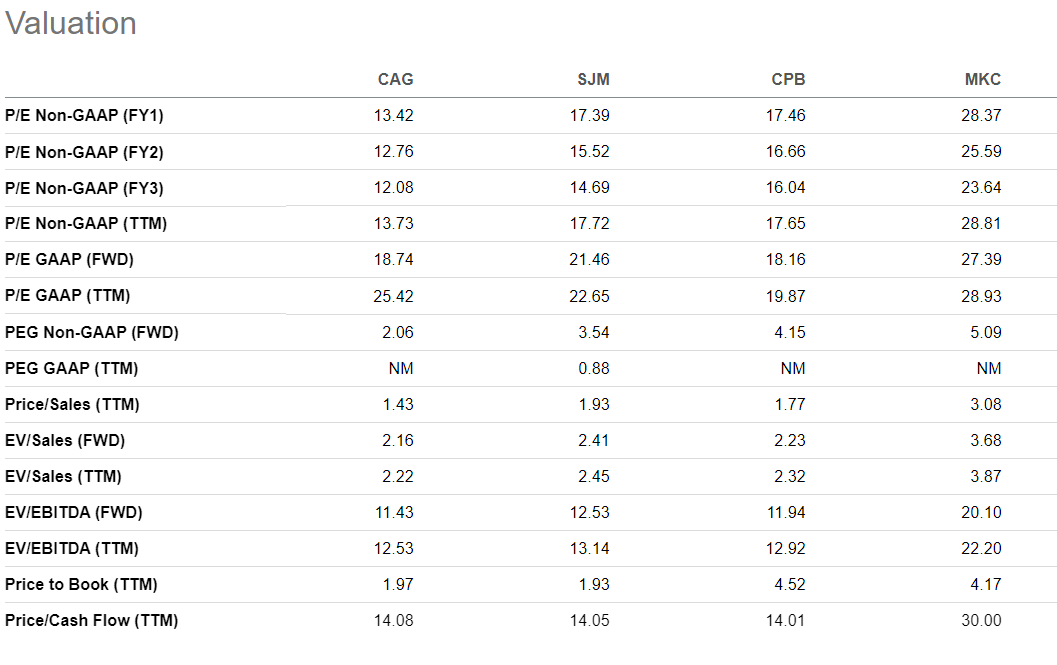

Stifel Analyst Christopher Growe noted that the solid sales momentum and improving bottom line outlook provide support for the shares into the low -$40 range. This represents a 14% upside potential from current levels. I believe this is possible given CAG’s current valuation relative to peers. As the chart below, CAG is the cheapest in its peer set, despite the improving earnings outlook.

Seeking Alpha

Defensive strategy

Despite the upside potential, I wouldn’t buy CAG primarily for growth as there are many better suited alternatives (including undervalued tech stocks) if you are looking for capital gains. Instead, I would buy CAG as part of a defensive investing strategy. CAG provides good income and has low downside risk, which could help counterbalance a growth oriented portfolio in the event inflation persists and interest rates stay higher for longer.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.