Cavco Industries: Delivering Strong Earnings Amidst Tough Market Conditions

Summary

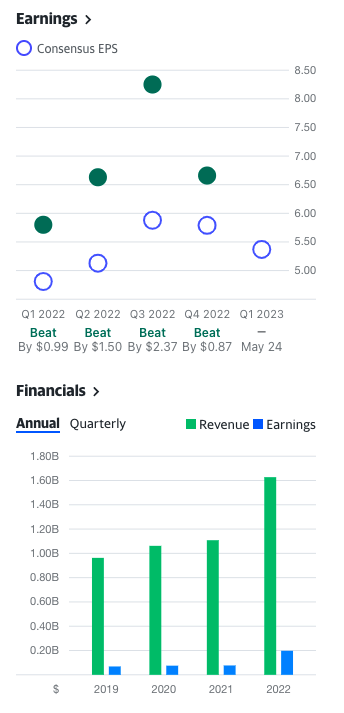

- Cavco Industries beats EPS expectations for the last four consecutive quarters, posting an EPS of $6.66 in Q3 2023 benefiting from diverse revenue business model.

- Strong financials, increased manufacturing capacity, declining cancellation rate and a growing number of quote requests going into the new year.

- Cautious of challenging housing market conditions and declining backlog.

zimmytws

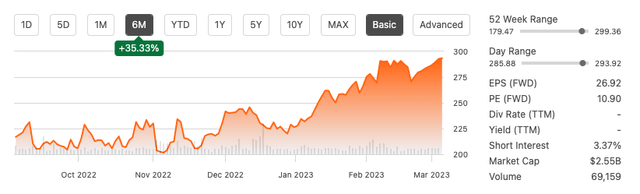

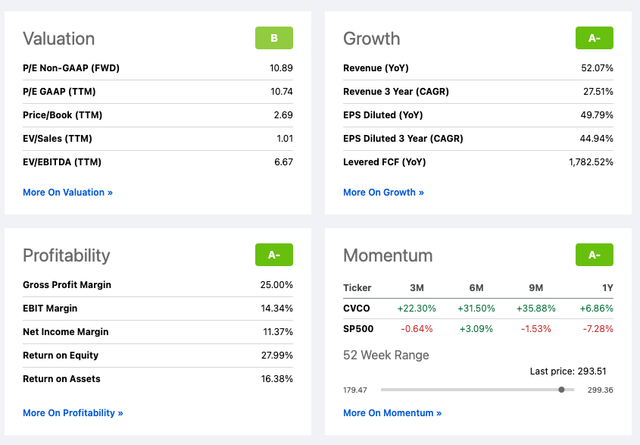

Alternative house building small-cap stock Cavco Industries, Inc (NASDAQ:CVCO) has beaten EPS expectations for the last four consecutive quarters and indicated optimism regarding a declining rate of cancellations and an increase in quote requests. It is currently ranked as the second-highest home building stock on Seeking Alpha with a Quant rating of 4.81, year-on-year revenue growth of 52.07%, an EPS of $6.66 and a low FWD price-to-earnings ratio of 10.74. It has rewarded investors with returns of 35.33% over the last six months.

Six-month stock trend (SeekingAlpha.com)

Although the housing market faces significant challenges, CVCO is not immune if we look at the backlog down 34% in Q3 2023. In the longer term, CVCO will probably play a key role in solving the affordable housing crisis as more people and communities are open to high-quality factory-manufactured or modular home solutions. There are a growing number of federal and state incentives, loosing of zoning restrictions, and better financing options for non-traditional house builds. CVCO is a long-standing leader in building much cheaper, quicker and more sustainable innovative factory-built housing solutions for diverse businesses and individuals. Therefore, I remain bullish on the stock.

Overview

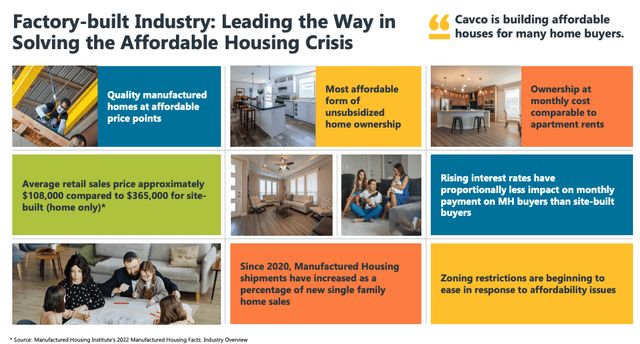

In my previous article, I give an in-depth overview of what the business does. CVCO aims to provide individuals and companies with high-quality, affordable factory-built homes and RVs and offers add-on financial and insurance services. It has a strong pitch, in which the average home retail sales price is $108,000 (without land costs) compared to $365,000 for traditional site-built homes.

The cheapest alternative (Investor Presentation 2023)

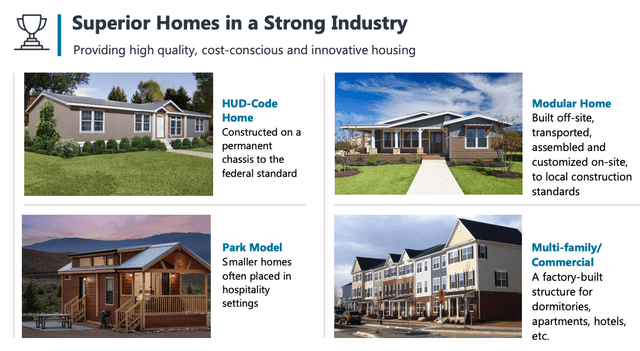

Although manufactured and modular homes have existed for many years, there is still much uncertainty, negative sentiment and confusion around these types of homes. An essential update since the 1970s is that all homes need to meet minimum property standards known as the HUD code, which continues to develop and make improvements. Modular homes often exceed the standards of traditional homes due to advancements in technological capabilities incorporated into the houses.

Home offerings (Investor presentation 2023)

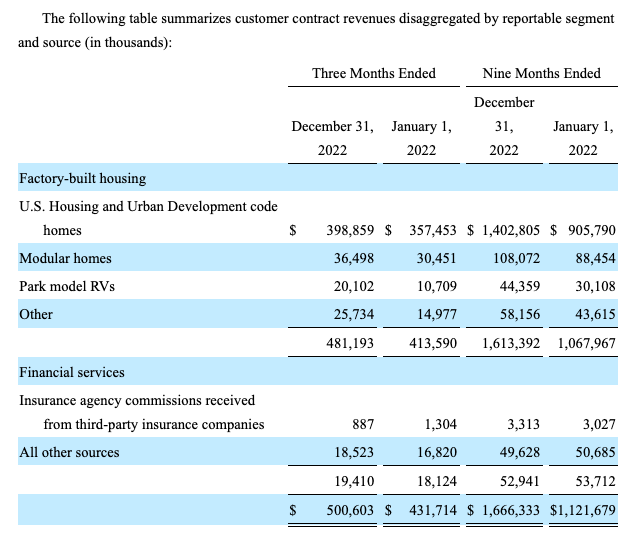

Financials by segment

We can see that CVCOs revenue is broken down into factory-built housing and financial services. In Q3 2023, we see a year-on-year increase across all segments except for insurance commissions received from third-party insurance companies, which were reduced to $887,000. HUD code homes make up most of the business, with $399 million for Q3 2023.

Q3 2023 segment overview (sec.gov)

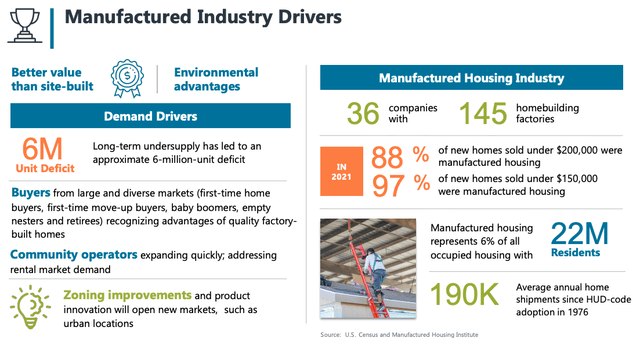

Growth drivers

CVCO has several growth catalysts, including its financial strength allowing the company to invest and take on strategic acquisitions, increased manufacturing facilities, a long history of innovation, such as customisable homes with new products and technologies, its established brand strength, an expanding customer base for which it has recently launched a new website connecting customers to its 1,500 retailers and communities. Furthermore, the USA is experiencing a pressing affordable housing shortage, with experts predicting the number to be well into the millions. This has led to organisations promoting the benefits of factory-built homes, improving zoning restrictions and increasing knowledge of the different housing solutions.

Growth drivers (Investor presentation 2023)

Financial results and valuation

CVCO has seen significant top and bottom-line growth over the last three years, with annual EPS growing by 53% and its EBIT margins increasing from 9.9% to 14% in the previous twelve months. In Q3 2023, net revenue increased by 16% YoY to $501 million, and net income increased by 29% to $76 million before income tax. This was due to an increase in average selling price and a gross margin improvement of 26.4% rather than an increase in the number of units sold. CVCO's backlog has reduced dramatically, as is seen across the housing industry. It declined by 34% to $427 million in Q3 2023.

Top and bottom line overview (Finance.Yahoo.com)

CVCO has a very healthy balance sheet with total cash of $392.76 million and total debt of $26.69 million with a current ratio of 2.99 and a quick ratio of 1.75, indicating that the company has enough short-term liquidity to pay off short-term liabilities. It has a positive free-levered cash flow of $147.88 million TTM. This has allowed for consistent capital allocation, investing in manufacturing facilities, share repurchases of $73 million YTD and strategic acquisitions for growth, such as Solitaire Homes for $39 million in cash.

If we look at CVCO's grading according to Seeking Alpha's Quant ranking, the stock is ranked as the second-highest home-building company. It has a market cap of $2.52 billion and an attractive FWD price-to-earnings ratio of 10.89 with double-digit growth and profitability numbers. The stock has performed better in the short and long term than the SP500 index.

Quant Grading (SeekingAlpha.com)

Final thoughts

CVCO is financially in an excellent position with a healthy balance sheet and strong cash flow. One of the biggest concerns is the decrease in the backlog by 34% due to unfavourable housing market conditions. However, on the Q3 2023 earnings call, the management team were optimistic about the increase in quote requests and the slowing rate of cancellations. CVCO has increased its manufacturing facilities and launched a website connecting potential customers to 1,500 retailers and communities. Furthermore, we see tailwinds from states incentivising factory-built homes, and CVCO is still well under its one-year stock target estimate of $358.33. Therefore, I remain bullish on this stock.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.