ADT Inc.: Secure Or Not? It Depends

Summary

- Google and State Farm partnerships show ADT Inc. is ready to move out of its comfort zone.

- Dividend looks safe based on FCF and EPS, while Debt remains elevated.

- ADT Inc.'s business and fundamental outlook look reasonable.

- The stock is richly valued relative to growth prospects, and I suggest waiting for a meaningful pullback.

JHVEPhoto

It is a bit of an irony that I am evaluating the dividend security of a security services company in this article. ADT Inc. (NYSE:ADT) showed up on my Seeking Alpha watchlist page with a warning about its dividend safety as shown below.

ADT Warning (Seekingalpha.com)

ADT SA Scorecard (Seekingalpha.com)

Being the dividend nut that I am (and an active ADT Inc. customer), this obviously prompted me to get into the details. I am analyzing ADT's dividend safety using Free Cash Flow, Earnings, and Debt/Cash situation. I conclude the article with an outlook for the business and the stock. Let us get into the details.

Free Cash Flow Strength

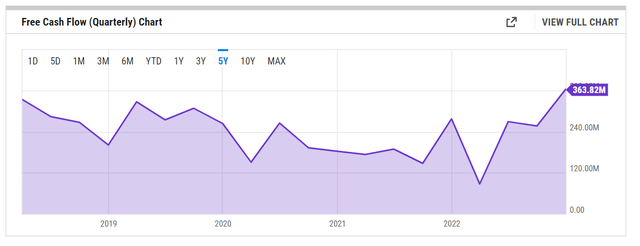

Readers of my articles know that I prefer using Free Cash Flow ("FCF") over Earnings Per Share ("EPS") due to FCF's robustness as a metric. Let's see how "secure" ADT's FCF coverage looks right now.

- Total shares outstanding: 917 Million

- Current quarterly dividend: 3.5 cents/share

- Quarterly FCF needed to cover dividends: $32 Million (that is, 917 Million shares times 3.5 cents per share)

- Average Quarterly Free Cash Flow (Trailing Twelve Months): $243 Million.

- Payout Ratio using TTM FCF: 13%

Based on the last 4 quarters' Free Cash Flow, dividend coverage looks extremely strong. But it is possible that recent events have contributed to this strength, and it may not be an indication of perpetual strength. Hence, let's dig a bit deeper. Spoiler alert! The numbers look good here too.

- ADT's average quarterly FCF over the last five years stands at $240 Million, which once again gives a payout ratio of 13%.

- Even the lowest quarterly FCF of $87 Million (March 2022) covers the dividend commitment almost three times over.

- Finally, ADT's FCF has been fairly consistent over the last five years, as shown below. Of course, there are peaks and troughs, but not to the extent seen in companies of this size. This shows consistent ability to pull money in.

In addition, based on ADT's forward EPS of 44 cents per share, EPS based payout ratio works out to a comfortable 32%. The company recently guided between 30 and 40 cents per share for FY 2023 and based on that, the payout ratio works out between 35% and 46%. In short, dividend coverage looks good based on EPS as well.

ADT FCF (YCharts.Com)

Debt and Cash

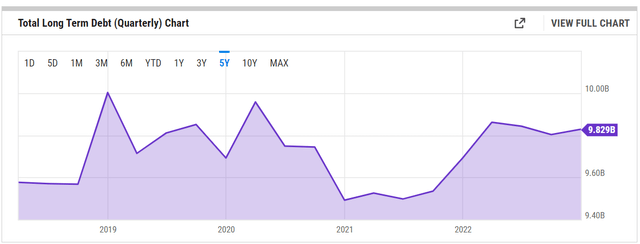

Now this is where things get interesting for the readers and downward for ADT. The company has a monstrous debt load of nearly $10 B as shown below. But the debt load has stayed consistent over the last 5 years, ranging between $9.49 Billion and $10 Billion throughout this time period. Almost every company has debt, so that by and of itself is not a problem until you factor in the following:

- The company has a market cap of $7 Billion as of this writing.

- If any of these loans are due for refinancing, it will take a bigger chunk out of ADT's FCF due to the ballooning interest rates.

ADT Debt (YCharts.com)

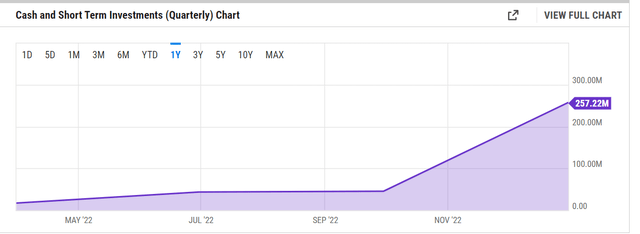

Some companies maintained a huge cash reserve and used debt for its operations when rates were low. That doesn't seem to be the case with ADT, as the cash and short-term investment reserves are nowhere close to comforting.

In short, the strength in FCF and EPS are balanced by the red flags in Debt and Cash reserves.

ADT Cash (YCharts.com)

Outlook

- The company recently reported its Q4 and full year results with EPS falling short and revenue beating, as Seeking Alpha has covered here. Key items from this report and the company's recent investor day event are the following:

- The record-high customer retention rate augurs well for ADT's recurring revenue going forward.

- ADT's partnership with State Farm and Google (GOOG) are still in early stages of bearing fruits but are already showing promise. The Google partnership, in particular, was called out in the investor day event as something that will help ADT provide innovative offerings combined with unrivaled safety and premium experience.

- As a result of favorable factors like the above, ADT is targeting an annual revenue of $10 Billion by 2025, which represents a 15% compounded annual growth.

- Last and perhaps the most important, the company is well aware of its debt levels and plans to reduce it by $1 Billion by 2025.

- The six analysts covering ADT have a median price target of $10.50, which represents an upside of nearly 40% including dividends.

- Finally, I've been an ADT Inc. customer for nearly a decade at this point. I have little to no concerns about the quality of services as well as how they treat me as a customer. While as a consumer I appreciate the fact that their rate has not gone up much over the years, as a potential investor that is both comforting and concerning. It is comforting if you look at their ability to bring consistent money (as affirmed by the FCF section above). It is concerning that they know they cannot be too aggressive with prices (AKA growth prospects are questionable).

Conclusion

The dividend, as is, looks fairly safe to me based on both FCF and EPS. High debt is a concern, but it looks like ADT has operated that way for a while now. If they are making interest payments on time, the debt by and of itself should not be an issue.

A forward multiple of 17 combined with an expected earnings growth rate of about 4%/yr over the next five years gives the stock a price-earnings/growth ratio in excess of 4. Being a fan of Peter Lynch, I am torn between his recommendation to "buy what you know and use" vs using the PEG metric. But then, I tend to err on the side of caution and hence rate the stock a Hold at this time. I suggest waiting for a meaningful pullback before initiating a position in the stock.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.