Equity CEFs: Are Cornerstone's CLM And CRF Funds Cheap Now?

Summary

- The Cornerstone funds (CLM) and (CRF) tend to trade at some of the highest market price premiums of all CEFs, generally from +10% to as high as +60% historically.

- The reasons for the premium valuations have to do with their incredibly high market yields, currently around 18% as well as during their Rights Offerings, when the premiums can rise and fall precipitously.

- After their latest Rights Offering in June of 2022, valuations dropped to about 10%, which is about average, but since then, the funds have only recovered to about 20% market premiums.

- Compare that to some CEFs that trade at over 30% premiums with not-near the market yields of CLM and CRF and not-near the NAV performances, and you wonder if maybe CLM and CRF are, dare I say it, cheap?

- Well, throw in the reinvestment at NAV option, something that none of these other CEFs offer their shareholders, and all of a sudden, that 20% premium becomes even cheaper.

- Looking for a helping hand in the market? Members of CEFs: Income + Opportunity get exclusive ideas and guidance to navigate any climate. Learn More »

sefa ozel/iStock via Getty Images

Cheap is not a word you want to use when buying most things in life, but for CEFs, the key is to find funds that may be "cheap" even if they trade at a market price premium since we know that not all funds that trade at a discount are necessarily "cheap" and that they can get even cheaper.

And this is where this analysis comes in since there are a group of equity based CEFs that trade at rare-air premiums of +20% all the way up to +100% market price premiums over their NAVs. The question - are any of them worth it and are any of them "cheaper" than they appear?

You can easily go to CEFconnect.com and sort through the hundreds of equity CEFs available to investors and there you will find only six funds that have at least $100 million in managed assets trading at 20% or more premiums as of March 3, 2023.

They're listed in descending order in the first table below and include the Gabelli Utility Trust (GUT), trading at a mindboggling 99% market price premium, the Gabelli Multimedia fund (GGT), trading at a 35.9% premium, the Guggenheim Strategic Opportunity fund (GOF), trading at a 33.7% premium, the DNP Select Income fund (DNP), trading at a 32.4% premium, the Cornerstone Strategic Value Fund (NYSE:CLM), at a 20.5% premium and the Cornerstone Total Return Fund (NYSE:CRF), trading at an 18.6% premium (CRF was over 20% as recently as last Friday).

The market price premiums over NAV are highlighted in red in the far-right column since, in my analysis, any CEF that has an NAV yield over 12% needs to show how they intend to cover that high NAV yield.

In terms of income strategy, four of the funds use leverage (shown in blue below), which is a popular way to increase dividend and interest income, while the Cornerstone funds (shown in yellow) use other high-income CEFs as well as Rights Offerings to help bolster their NAVs.

I'm not going to go into detail of how Rights Offerings play into the strategy of these funds but just know that it's not just the Cornerstone funds that use them. The Gabelli funds, GUT and GGT in particular, have also undertaken Rights Offerings in the past couple years to help bolster their NAVs (since the Rights are typically priced over NAV but at a discount to MKT) and they're more likely to use them again this year.

I also should note that the funds are going to rely on portfolio appreciation to one degree or another, particularly GGT, to help cover their high NAV yields.

Data is as of 3/3/2023:

| Fund Family | Ticker | Income Strategy | Portfolio Description | Current Mkt Price | Current NAV Price | Premium |

| Gabelli | GUT | 22% Leverage | Utility stocks | $6.96 | $3.50 | 98.9% |

| Gabelli | GGT | 40% Leverage | Multimedia & Growth stocks | $6.02 | $4.43 | 35.9% |

| Guggenheim | GOF | 23.4% Leverage | Multi-Sector Bonds, Stock ETFs | $17.15 | $12.83 | 33.7% |

| Duff & Phelps | DNP | 26.4% Leverage | Utility stocks, Bonds, MLPs | $11.48 | $8.67 | 32.4% |

| Cornerstone | CLM | 6.9% Other CEFs | S&P 500 Large Cap Growth stocks | $8.10 | $6.72 | 20.5% |

| Cornerstone | CRF | 11.4% Other CEFs | S&P 500 Large Cap Growth stocks | $7.66 | $6.46 | 18.6% |

Though one could argue that none of these funds is actually "cheap" based on valuations, everything is relative and if some funds can rise to 100% market price premiums, then what should other funds be trading at if their income and appreciation strategy is underappreciated?

I'm going to go over fourcriteria to make my argument that the Cornerstone funds are significantly "cheaper" than they appear when you line them up next to these other highly valued CEFs that trade at 30% premiums or higher.

Determining What Is 'Cheaper' Than It Appears

Criteria #1

The first criteria has to do with MKT yield, and more significantly, the MKT yield to NAV yield ratio. It's clear that the Cornerstone funds offer the highest current MKT yields with CRF at 18.4% and CLM at 18.2%. That's well above the next fund down, GGT at 14.6%, and in fact, the Cornerstone funds have the highest MKT yields of all equity CEFs.

But what's even more important than just a high market yield is the ratio to its NAV yield. And because the Cornerstone funds trade at the lowest premiums of the group, they have the highest MKT/NAV yield ratio too.

In other words, even though the Cornerstone funds have the highest NAV yields as well, a current buyer would capture a higher percent of that in the market yield.

So looking at the table below sorted by the MKT Yield/NAV Yield Ratio, you can see how much more yield capture you get with CRF and CLM at 84% and 83% compared to say GUT at 50%.

Yes, the higher the NAV yield, the more difficult it is to cover, but the offset here is that a current buyer of the Cornerstone funds gets a significantly higher market yield than the other funds even while three of these other funds, i.e. GGT, GOF and GUT, do not have significantly lower NAV yields.

| CEF | Current MKT Yield | Current NAV Yield | MKT Yield/NAV Yield Ratio |

CRF | 18.4% | 21.8% | 84.4% |

| CLM | 18.2% | 21.9% | 83.1% |

| DNP | 6.8% | 9.0% | 75.5% |

| GOF | 12.7% | 17.0% | 74.7% |

| GGT | 14.6% | 20.0% | 73.4% |

| GUT | 8.6% | 17.1% | 50.3% |

This helps makes the Cornerstone funds that much more attractive.

Criteria #2

Criteria #2 has to do with the make-up of the fund's distributions and for funds that use a leveraged strategy, which are all of the funds other than the Cornerstone funds (see Income Strategy in table at top), the vast majority of these fund's distributions are going to be made up of portfolio dividends and interest and are thus taxable in a taxable account, even if the fund lost significant value during the year.

The Cornerstone funds, on the other hand, have distributions that are made up of mostly Return of Capital, and that makes CLM's 18.2% market yield & CRF's 18.4% market yield tax-deferred until you sell the fund.

In other words, the tax-equivalent yield of the Cornerstone funds in a taxable account could actually be higher than their roughly 22% NAV yields, thus pushing the ratio to over 100%.

None of these other funds are going to come even close to that and compared to GUT, in which a current buyer would barely receive half of the 17.1% NAV yield GUT has to pay, all of which has been taxable income historically, and the yield advantage to the Cornerstone funds is so off the charts, that you would almost have to call the Cornerstone funds "cheap" by comparison.

Note: I recently wrote an article called Equity CEFs: The Best Return Of Capital funds for 2023, which included CLM as one of the best funds to buy

Criteria #3

Next, let's look at the performance figures from last year and year-to-date this year since this also presents an interesting analysis of what's over-priced vs what might be considered cheap:

Here's the table I will be referring to based on MKT and NAV total return performances as of 3/3/2023:

| CEF | MKT Price | NAV Price | YTD 2023 MKT Performance | YTD 2023 NAV performance | 2022 MKT Performance | 2022 NAV performance |

| CLM | $6.72 | $8.10 | 13.2% | 7.5% | -33.2% | -15.4% |

| CRF | $6.46 | $7.66 | 11.2% | 7.3% | -33.2% | -15.8% |

| GUT | $6.96 | $3.50 | -6.0% | -1.4% | -1.6% | -2.3% |

| GGT | $4.43 | $6.02 | 12.5% | 13.9% | -28.2% | -42.2% |

| GOF | $17.15 | $12.83 | 15.1% | 4.4% | -5.0% | -11.5% |

| DNP | $11.48 | $8.67 | 3.2% | -1.8% | 10.7% | -1.3% |

The Cornerstone funds obviously had a horrible year last year losing -33.2% at market price despite their NAV performances, -15.4% for CLM and -15.8% for CRF, outperforming their benchmark S&P 500 (SPY), which was down -18.2%, including all dividends.

So why did CLM and CRF drop so much at market price when a fund like GGT held up better, down -28.2%, despite a -42.2% drop in its NAV last year? That represents the second worst NAV performance of all the funds I followed, and yet somehow, GGT gained premium valuation when most all other technology and growth CEFs fell to wide discounts.

As near as I can tell, it probably had to do with the fact that the Cornerstone funds cut their distributions in November while GGT and indeed, all these other funds did not.

Of course, none of this should have been a surprise since the Cornerstone funds use a 21% NAV distribution policy, applied each year to the fund's ending NAV in October. So due to the bear market in 2022, this meant that 2023's distributions were going to be a cut significantly and the -32% cut that resulted for each fund ($0.1808/month to $0.1228/month for CLM and $0.1734/month to $0.1173/month for CRF) probably contributed a lot to the fund's poor market price performance.

Note: GGT also should have cut its distribution even more dramatically than the Cornerstone funds last year according to its 10% NAV distribution policy. But GAMCO chose not to. That was the basis for this article last December

What occurred last year is over and in many ways, gives the Cornerstone funds the upper hand with their depressed market prices and lower distributions. And already this year, the Cornerstone funds are off to a very good start in 2023 with their NAVs up 7.5% for CLM and 7.3% for CRF. Once again, that is better than their S&P 500 benchmark and already over 1/3 of the way to their 21% NAV nut for the year.

Compare that to the leveraged utility focused CEFs, GUT and DNP, which are down -1.4% and -1.8% YTD at NAV (see table above), and which funds would you rather own right now? The S&P 500 focused CLM and CRF at a 20% premium or the utility sector focused GUT and DNP at 30% and 99% premiums?

Because if short rates go to 5.5% to 6.0%, that's probably not going to be good for the markets in general, but it will be worse for utilities.

Nobody knows what the rest of the year will bring, but when I look at all six of these funds, I believe it's the Cornerstone funds CLM and CRF that are in the best position to gain a significantly higher premium valuation this year after last year's disappointment.

Criteria #4

There's one more criteria on why the Cornerstone funds are much cheaper than they appear compared to these other high premium funds. And I've saved the best for last.

In Criteria #2, I said that the Cornerstone distributions are almost all Return of Capital, making their 18% market yields as high as 23% tax-equivalent yields for income investors in high tax brackets for Federal and State income taxes.

Well, there's one more feature of the Cornerstone fund's distributions that the other funds don't have and this is probably the greatest contributor to bringing down the Cornerstone fund's valuations to even lower than their current 20% and 18% premiums.

I mentioned it in one of the bullet points at the top of the article and it has to do with Cornerstone's dividend reinvestment policy that allows shareholders to reinvest those ultra-high distributions at NAV no matter what the market price premium is.

I don't think I can quantify in any graphs or tables how much of a difference this can make in overall performance of the Cornerstone funds, but it is massive.

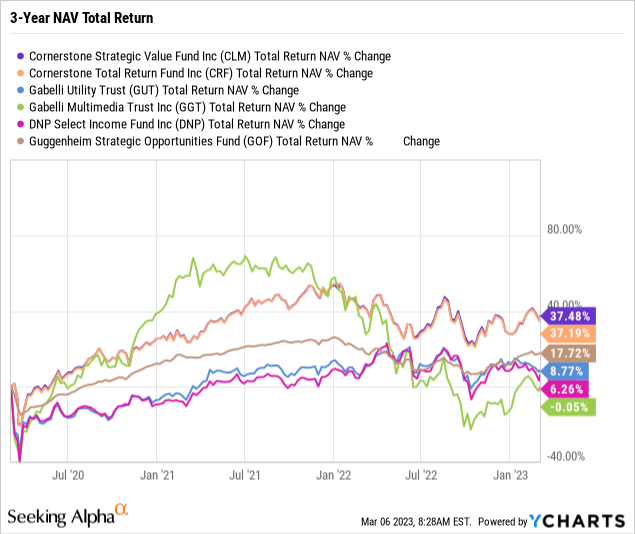

Here is a three-year NAV (not MKT price) total return comparison of the six funds and though I can't say exactly how Y-Charts calculates these percentages (does it include the Rights Offerings or is reinvestment at MKT or NAV?), it does show that the Cornerstone funds, despite last year's bear market, are still crushing the other funds at NAV total return performance.

And that, in my book, is the most important statistic and will ultimately lead the Cornerstone market prices higher.

Y-Charts

The ability to reinvest at NAV when the funds are at high premiums is frankly a game changer in favor of the Cornerstone funds over these other high premium funds that apply a typical 95% of market price for their dividend reinvestment program.

So how much more of a decline in the Cornerstone's premium should one calculate when you can reinvest 21% of your total shares in CLM or CRF each year at the lower NAV price vs 95% of MKT price?

It's hard to say for sure but it's substantial and is the last of the four criteria of why the Cornerstone funds are the "cheapest" of the high premium CEFs to buy.

Conclusion

I wanted to go back to the Rights Offerings one more time since it is a controversial subject for the Cornerstone funds and may be contributing to why the funds are trading at relatively low 18% and 20% premiums right now.

There may be a concern that Cornerstone will undertake another Rights Offering since the last two, in 2022 and 2021, were announced around this time of the year.

2021's Rights Offering at 107% of NAV was a huge success and though 2022's was also successful at an even higher 112% of NAV, thus helping bolster the NAV even more, we haven't seen the market price recovery like we saw in 2021.

Certainly, the bear market and the large distribution cuts last year are probably having a lot to do with that, but there seems to be some hesitation this year from shareholders to go all in.

For that reason, I doubt if Cornerstone will undertake a Rights Offering right now and it is much more likely that you will see Gabelli cash in on their high premiums and announce more Rights Offerings for say, GUT and/or GGT.

All I know is if CLM's and CRF's NAVs continue to outperform like they have, that should reduce the need for another Rights Offering and should allow the market prices to move back up to the 30% premium levels or even higher, like all of these other high premium funds.

Thank you for reading my article. My goal is to give you observations and actionable ideas in Closed-End funds while educating you on how these unique and opportunistic funds work.

CEFs can be one of the most exhilarating and yet most frustrating security classes to invest in, and it's important that you have someone who can be a level head during up and down periods of the market. I hope to be that voice of calm when necessary. ~ Douglas Albo

If you'd like to learn more about my services, please go to this link:

CEFs: Income +Opportunity

This article was written by

Registered Investment Advisor since 2009. Prior experience includes 12-years as a Vice-President, Financial Advisor at Smith Barney from 1994 to 2001 and Morgan Stanley from 2001 to 2007.

Disclosure: I/we have a beneficial long position in the shares of CLM, CRF, SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.