ICON: Attractive Valuation, Earnings Growth Driving Future Outperformance

Summary

- One name particularly appealing in the healthcare space is ICON Public Limited Company, a CRO (Contract Research Organization) that has delivered sustained revenue growth.

- While the macroeconomic environment is still unclear, the outlook for ICON seems fairly stable, with EBITDA margin expanding and EPS seen to grow at a solid pace in 2023.

- Despite the outperformance in 2023, ICON's valuation is still much lower compared to the historical average, and the discount relative to its peers has widened since the market peak.

ipopba/iStock via Getty Images

The year 2023 has been marked by a modest recovery in stock prices, with the S&P 500 (SP500) up roughly 6% this year. Shares of ICON Public Limited Company (NASDAQ:ICLR) have climbed 20% year-to-date, though, handily outperforming the broader market and offsetting steep losses over the last 12 months.

Nonetheless, ICON's valuation is still much lower compared to its historical average and the discount relative to its peers has widened since the market peak in December 2021.

In contrast, ICON's top line and margins continue to expand, underscored by a solid backlog and positive market trends, and earnings are expected to grow in the range of mid-single to low-double digits in 2023. This creates an opportunity for investors with a longer-term horizon, looking for attractive risk-reward opportunities in the healthcare sector.

Business Environment Remains Healthy for ICON

While many economies in the world are currently under a slowing-down process, driven by central banks' rate hikes to combat inflation, some sectors are usually more resilient, such as healthcare, for example.

In the healthcare space, in my view, one name particularly appealing is ICON, a CRO (Contract Research Organization). It has delivered sustained revenue growth, underscored by clinical development services, notably coming from mid and large biopharma companies.

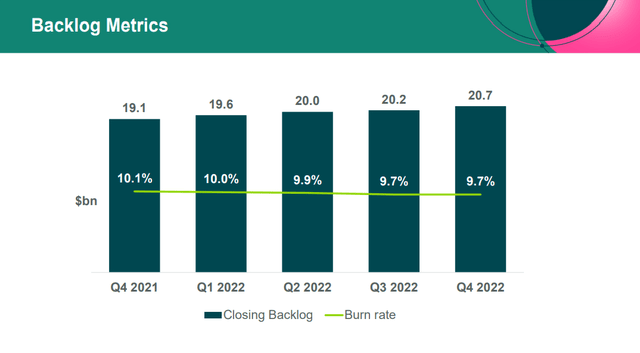

The recent trajectory of ICON's backlog is an important contributor to its revenue predictability. As we can see below, its backlog has been fairly stable over the past quarters. It reached $20.7 billion at the end of the year 2022, logging a growth of 8.7% over the previous year, after new project awards and solid demand from mid and large pharma customers.

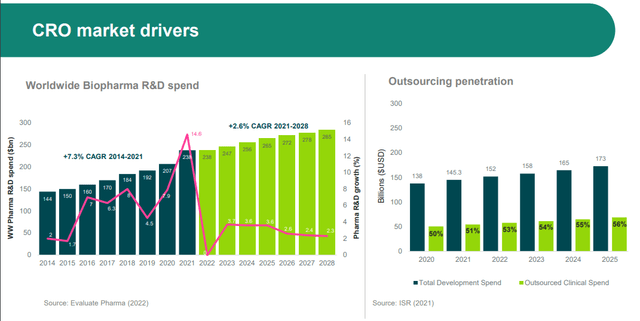

Going forward, with the biopharma R&D spend increasing at a moderate pace over the coming years, as illustrated below, underlying demand should remain healthy. On top of that, the ongoing trend toward outsourcing is an additional tailwind favoring CROs.

To some extent, this has been driven by the increasing clinical trials complexity, as more studies have been in therapeutic areas like oncology and rare diseases, which is leading to additional challenges for the pharma industry, whether relative to the lengthening of studies duration, technical capabilities, patient recruitment, or cost pressures. The flip side of it is that all these difficulties are boosting the demand for a global provider like ICON, with recognized full service, customization, integration capabilities, and international footprint.

Q4 2022 Earnings Highlights

The ICON Q4 2022 earnings report was generally in line with expectations, as quarterly revenue came in at $1.96 billion, with 4.3% year-on-year growth, while full year 2022 revenue was $7.74 billion, with a huge increase of 41% over the previous year, reflecting ICON and PRA Health consolidated operation, following PRA Health Sciences acquisition on July 1, 2021.

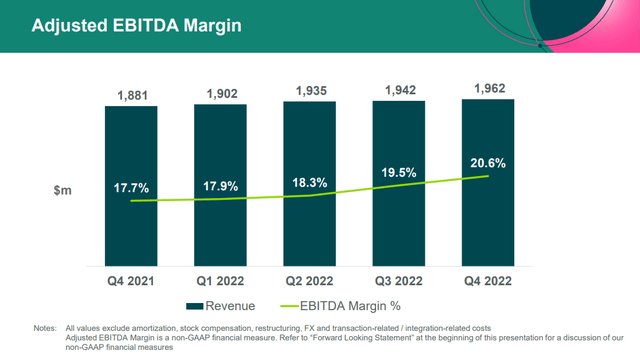

Full year gross margin was 28.9%, led by direct fee revenue growth and resource utilization optimization in Q4, and Adjusted EBITDA margin was 19.1%, with 140 bps expansion compared with 17.7% recorded in 2021.

We have seen margins expanding on a sequential basis as well, as shown below, with quarterly Adjusted EBITDA expanded from 17.7% to 20.6% over the last five quarters, all of them already considering ICON and PRA Health consolidated businesses.

Meanwhile, the management team reaffirmed the guidance for 2023. That reflects a positive outlook for the coming quarters, with revenue growth in the range of 2.6%-7.7%. This forecast seems a bit conservative, but, in my view, it is appropriate until there are clear signs of improvement in the funding environment in the biotech sector, which can drive recovery in spending over the course of the year.

On the earnings side, ICON is projecting Adjusted EPS in the range of $12.40-$13.05, with growth of 5.5% to 11.1% on a yearly basis. This looks well-supported by EBITDA margin expansion, led by cost synergies and operation efficiencies, including resource allocation and integration of artificial intelligence tools in the business.

Attractive Valuation

ICON has largely outperformed this year, with a rally of 20% so far, outpacing the average gain of nearly 8% from peers of Life Sciences Tools & Services industry.

The selection criteria for the peer group was a market cap above $10B, resulting in the following stocks list: TMO, DHR, A, IQV, MTD, WAT, ICLR, WST, PKI, AVTR, TECH, CRL, BIO, QGEN, BRKR, ILMN, and RGEN were excluded from the list due to too high valuations on a relative basis in order to avoid distortions in the peer group average.

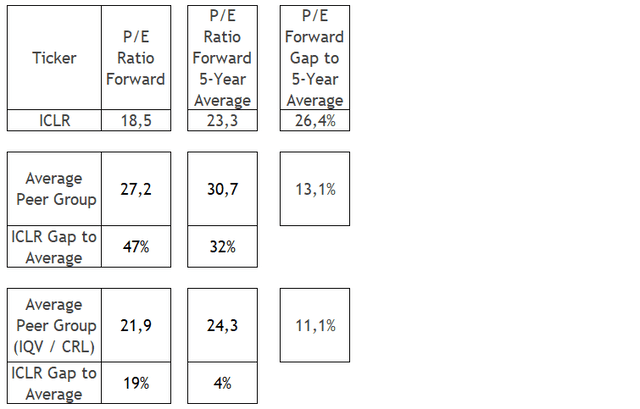

Despite this outperformance in 2023, ICON's valuation is still attractive. As we can see below, with a P/E Forward of 18.5, ICON is trading at a large discount relative to the peer group, as the P/E Forward of the group is 27.25 on average. The same goes for its closest peers engaged in the CRO business, IQV and CRL, whose P/E Forward is 21.9 on average.

The situation is no different from a historical perspective. ICON's current P/E Forward is 26.4% lower than its 5-Year average of 23.3. Meanwhile, the current P/E Forward of the peer group is roughly 11-13% below their 5-Year average. This gives ICON a higher upside when the stock market eventually recovers and valuations return near to historical levels.

Data from Seeking Alpha, consolidated by the author

While the macroeconomic environment is still unclear, the outlook for ICON Public Limited Company seems fairly stable, with EBITDA margin expanding and EPS seen to grow at a solid pace in 2023, according to the company's forecast.

That said, keeping an overweight position in names with more predictable earnings and lower valuation like ICON Public Limited Company sounds to me like a smart move at the time being. And even if we see more volatility in the short term, investors should be rewarded by starting to build new positions in the stock looking to outperform the broader market over time.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.