Reata Pharmaceuticals: The Silver Bullet For Friedreich's Ataxia

Summary

- Reata Pharmaceuticals, Inc. recently enjoyed a robust rally due to the FDA approval of its lead drug, omaveloxolone (Oma) for Friedreich's ataxia.

- The label for omaveloxolone is clean without a boxed warning or any other contraindications.

- As it's entering a monopoly market for a deadly condition, omaveloxolone is poised to become a blockbuster.

- I do much more than just articles at Integrated BioSci Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

janiecbros/E+ via Getty Images Reata

Price is what you pay. Value is what you get. - Warren Buffett

In biotech investing, it's crucial that you correctly forecast binary events (i.e., either a drug approval or a big data release) for your stock. In other words, the stock usually (but not always) rallies robustly following approval. Oftentimes, the stock can run up toward approval. In contrast, the shares nearly always tumbled amid a failed event. While you won't get all your forecasts right, betting when the odds are in your favor will deliver robust profits for you in the long haul.

That being said, I recently forecasted the FDA approval of omaveloxolone for Friedreich's ataxia. Contrary to the market's negative expectations, Reata Pharmaceuticals, Inc. (NASDAQ:RETA) shares rallied over 198% in one single trading session following approval. Despite the tremendous gains, there are more catalysts to power further upsides. In this research, I'll feature a fundamental analysis of Reata and share with you my expectations of this intriguing growth equity.

Figure 1: Reata stock chart.

About The Company

As usual, I'll deliver a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. Headquartered in Plano Texas, Reata dedicated its efforts to the innovation and commercialization of medicines to serve the unmet needs of life-threatening orphan (i.e., rare) conditions. I previously noted,

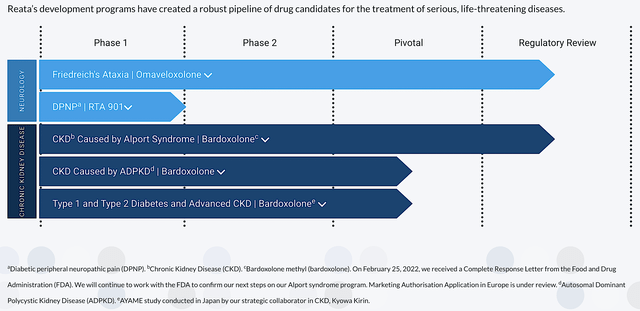

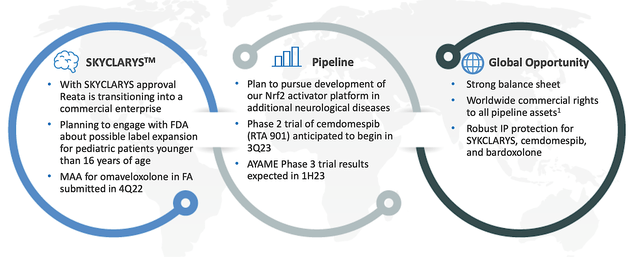

Most orphan diseases manifest symptoms of metabolic abnormality. Hence, it's strategic that Reata's technology targets the molecular pathways involving cellular metabolism and inflammation to address those abnormalities. As shown below, Reata’s pipeline is embodied by beauty and ingenuity because it is stacked by two advanced medicines - bardoxolone (Bardo) and omaveloxolone (Oma). By activating the crux transcription factor dubbed Nrf2, Bardo and Oma aroused a cascade of physiologic effects. This includes inflammatory and oxidative stress reduction as well as mitochondrial functional enhancement.

Figure 2: Therapeutic pipeline.

Friedreich's Ataxia

Shifting gears, let us discuss Friedreich's ataxia. As an ultra-rare, genetic, and neurodegenerative disorder, Friedreich's ataxia (i.e., FA) is caused by the silencing of the FXN gene that codes for the protein frataxin that resides in the powerhouse of the cell (i.e., mitochondria). Consequently, the mutation causes defective mitochondrial functioning and suppresses Nrf2 expression which leads to impaired energy production inside the cell.

As a ramification, patients afflicted by FA suffer from damages relating to their central nervous system (i.e., brain and spinal cord). The particular part of the brain that is hit hard is the cerebellum which controls bodily movement. As such, patients would experience a loss of sensation and an unsteady/awkward bodily movement that manifested early in life.

Due to its progressive nature (and the lack of treatment options), patients' lives are being robbed prematurely in their 30s. As it activates Nrf2, Oma is lifesaving for patients because it reverses the disease course.

Skyclarys Approval

As you know, the FDA recently approved omaveloxolone (Skyclarys) for treating FA in patients 16 years or older. Since there was no prior approval, this marked a historic decision for patients afflicted by this devastating disease. In the efforts to deliver Skyclarys to younger patients, Reta planned to engage with the FDA for a potential label expansion soon. Commenting on the stellar development, the CEO (Warren Huff) remarked,

The approval of Skyclarys, the first therapy specifically indicated for the treatment of Friedreich’s ataxia, is an important milestone for patients affected by this disease as well as their families and caregivers. We are grateful to Friedreich’s ataxia patients, investigators, U.S. regulators, and our scientists and employees who made this approval possible. As a company, this is a transformative milestone that highlights our commitment to developing and commercializing novel therapies for patients with severe diseases with few or no approved therapies. We look forward to delivering Skyclarys to eligible patients as quickly as possible.

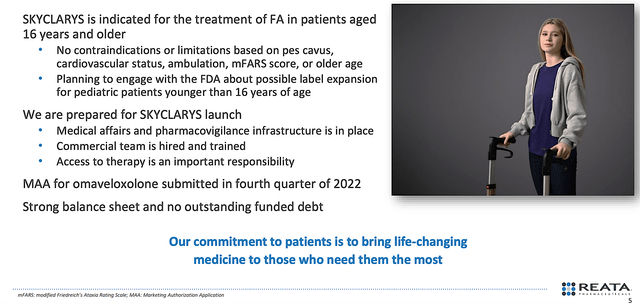

Figure 3: Skyclarys approval for FA.

Contrary to the negativity on Wall Street, the label is extremely clean. There were neither contraindications nor limitations based on pes cavus (i.e., curved foot), cardiovascular status, ambulation, mFARS score (i.e., functional assessment of FA), and older age. Moreover, the approval came without a boxed warning. Free from such restrictions, you can bet that Skyclarys would generate robust sales.

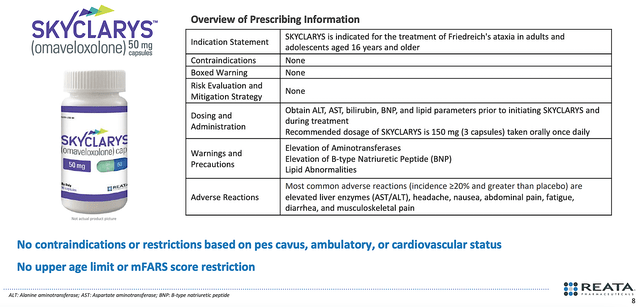

Figure 4: Skyclarys clean label.

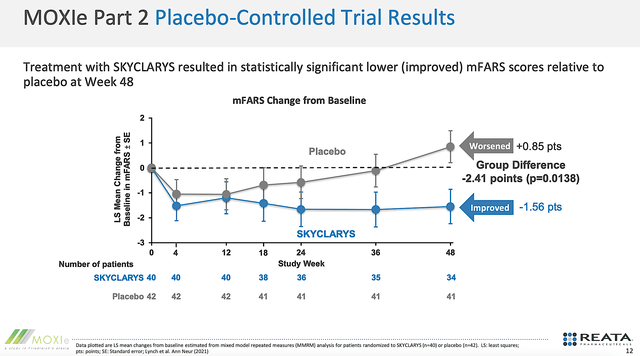

As you can appreciate, Skyclarys was approved based on one single high-quality Phase 3 data and other supporting evidence. As shown below, patients on Skyclarys enjoyed robust, clinically meaningful, and statistically significant improvement in their mFARS score.

As you know, the mFARS score is a measure of the patient's functional status which reflects their FA disease progression. At Week 48, there was a 2.41 points difference. Riding that trajectory, you can expect the difference to widen over time. The wider the difference, the more efficacious Skyclarys.

Figure 5: Robust efficacy.

Estimated Market

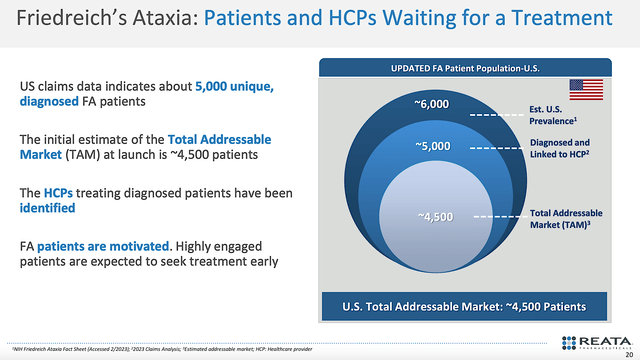

Viewing the figure below, the estimated U.S. prevalence for FA is 6.0K patients. Of that figure, 5.0K patients are diagnosed and being cared for by a doc. As such, you can see that leaves the total addressable market (i.e., TAM) to be around 4.5K patients.

In my previous article, I showed that the estimated FA market would grow to $2.0B by 2030. Now, you might be wondering, how can such a small total addressable market, or TAM, generate such a robust market size. As you know, FA is an ultra-rare disease. On average, an orphan drug gets reimbursed at $140K annually.

The premium reimbursement offsets the lengthy and low success rate of the innovation process. Due to the premium payments, you'd only need to sell your drug to a few patients to generate meaningful revenue.

Figure 6: Estimated market.

Now, Reata stated that the company would price Skyclarys at $370K annually. In running a few calculations (as shown below), you can clearly see how sales could be substantial. That is to say, if Skyclarys reaches only 1K patients, it can deliver $370M in revenues. At 3K patients, the drug would become a blockbuster.

Given the deadly nature of this disease without a drug (and the fact that Skyclarys is operating in a monopoly market), chances are that it could easily reach at least 3K patients. After all, patients tend to die in their 30s without treatment. As such, it would be foolish not to take a highly efficacious drug.

| Patients reach | Revenue |

| 10 | $3.7M |

| 100 | $37M |

| 1K | $370M |

| 2K | $740M |

| 3K | $1.1B |

| 4K | $1.4B |

| 4.5K | $1.6B |

Figure 7: Estimated Skyclarys revenues.

Launch Preparation

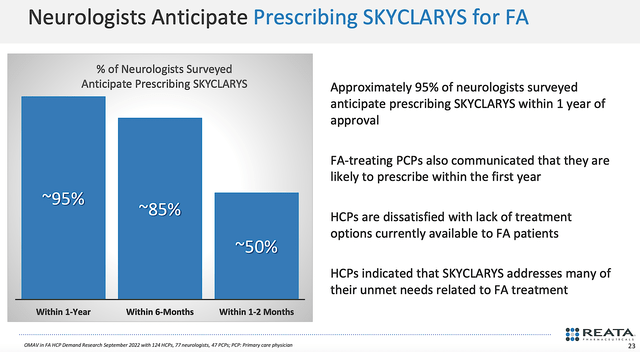

In its launch process, Reata already ran surveys of neurologists (docs specializing in treating nervous system conditions). Notably, the consensus showed that roughly 95% of the docs would prescribe Skyclarys within a year. Moreover, as much as 50% of physicians would prescribe the drug within 1-2 months. You can see that those are overwhelming statistics favoring a robust Skyclarys prescription growth.

Figure 8: Neurologists' survey.

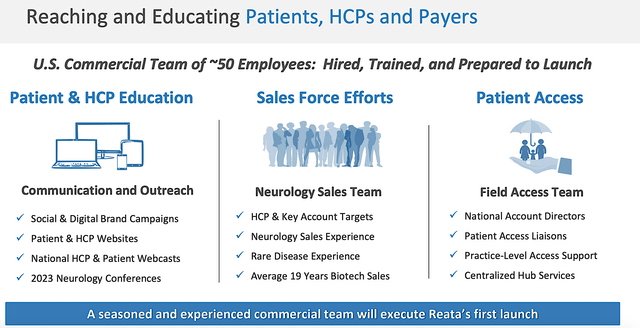

In readying for a launch, Reata will leverage both the traditional shoes/leather approach as well as the digital revolution. As such, the company would implement sales/marketing campaigns on various social media while sending their highly experienced reps to the physician's office.

Figure 9: Various launch strategies.

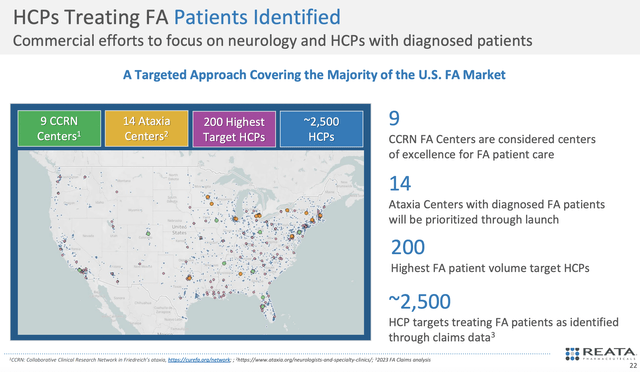

As if all the ducks lined up in a row for Reata, you can see that the firm already identified all the healthcare providers (i.e., HCPs) caring for 2.5K patients (i.e., half of the TAM). Using roughly 50-60 reps with over 19 years of biotech sales experience, the company is poised to target 2.5K HCPs and 14 ataxia centers, and 9 FA CCRN Centers.

While you can argue that Reata's small sales/marketing team is not adequate to penetrate this market, I believe that the limited number of patients would boost Skyclarys' chances of marketing success. After all, there aren't that many patients for the reps to reach. With few patients, you could imagine that there is less of a need for a robust sales/marketing team.

Figure 10: Skyclarys launch preparations.

Upcoming Catalyst: Skyclarys Sales & Label Expansion

As you can appreciate, catalysts are the fuel that drives a biotech share price. In my view, the upcoming launch and sales growth of Skyclarys would be the most important catalyst for Reata. Moreover, additional labels as well as the penetration into additional markets would deliver leaping sales growth.

In reaching other markets, Reata already filed a Marketing Authorization Application (i.e., MAA) with the European Union in Q4 last year. As such, you can expect a European approval sometimes in Q3. Moreover, Reata is eager to work with the FDA to expand Skyclarys' label for pediatrics (i.e., kids younger than 16 years old). Given the stellar data (excellent safety and robust efficacy), you can see that Skyclarys should easily clear that regulatory hurdle.

Figure 11: Growth catalysts.

Financial Assessment

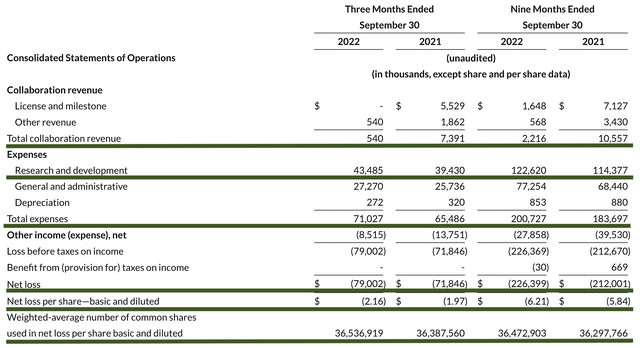

Just as you would get an annual physical for your well-being, it's important to check the financial health of your stock. For instance, your health is affected by "blood flow" as your stock's viability is dependent on the "cash flow." With that in mind, I'll assess the 3Q2022 earnings report for the period that ended on September 30.

As follows, Reata procured $540K in collaboration revenue compared to $7.3M for the same period a year prior. Since Reata just transitioned into a commercialization-stage operator, it's normal to see little to no revenue at this point. Give the company a couple of years, and you should see robust sales growth.

That aside, the research and development (i.e., R&D) for the respective period registered at $43.4M and $39.4M. I viewed the 10.1% R&D increase positively because the capital invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $79.0M ($2.16 per share) net losses compared to $71.8M ($1.97 per share) net declines for the same comparison. The widened bottom line depreciation made sense because Reata is now investing in more R&D for a future payoff.

Figure 12: Key financial metrics.

About the balance sheet, there were $387.5M in cash, equivalents, and investments. Against the $71.0M quarterly OpEx, there should be adequate capital to fund operations into 1Q2024. Simply put, the cash position is adequate relative to the burn rate.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with a thesis regardless of its fundamental strengths. More importantly, the risks are growth-cycle dependent. At this point in its growth cycle, the main concern for Reata is whether the company can quickly ramp up Skyclarys' sales.

The company can also burn excessive cash as they ramp up commercialization efforts. Moreover, there is a small risk that Skyclarys might not gain EMA approval. Furthermore, Bardo's H1 AYAME data release could be negative.

Conclusion

In all, I maintained my buy recommendation on Reata Pharmaceuticals, Inc. with a 4.7/5 stars rating. As it has come a long way, Reata Pharmaceuticals is now a commercialization-stage operator with the recent Skyclarys approval for FA. Operating in a monopoly market where the demand for any solution is extremely robust, Skyclarys has tremendous prospects. The label was very clean, and commercialization efforts are underway. As such, you can bet that Skyclarys would become a blockbuster. To fully unlock Skyclarys' value, Reata already filed an MAA with the EMA. Meanwhile, the other molecule (Bardo) is advancing in its development. The future is looking much brighter for Reata. And, the Sky is the limit for Skyclarys as it delivers hope to patients (first in the U.S. and then worldwide).

Thanks for reading! To read the full article, CLICK HERE. To get the latest articles, please hit the orange “Follow” button on top.

Be sure to check out our private investment research community, Integrated BioSci Investing.

Dr. Tran's analyses are the best in the biotech sphere, well worth the price of subscription.

Very professional, extremely knowledgeable and very honest … I would highly recommend this service and his stock picks have been very profitable.

Simply put, this is worth every penny. Just earlier today, one of the companies recommended by Dr. Tran got acquired for a nice 50% premium.

Click here for a FREE TRIAL.

This article was written by

Founded by Dr. Harvey Tran MD, MS, CNPR, (in collaboration with other PhDs), Integrated BioSci Investing LLC (“IBI) is a growing community of experts and everyday investors who help one another to invest better.

We bring to you a NEW investment philosophy called “Integrated BioSci Investing.” It's a distillation of value/growth investing wisdom from gurus such as Warren Buffett, Buffet's mentors (Ben Graham and Phil Fischer), and Sir John Templeton that are adapted specifically for biotech stocks.

IBI's analytical research is powered by the integration of (medical, scientific, and market) expertise to deliver unprecedented accuracy in clinical trial forecasting that, in and of itself, is one of the requisites to finding alpha bioscience investment.

Ultimately, our tireless due diligence and the wisdom of IBI members translate into strong returns for you. To name a couple of winners, Crispr Therapeutics (CRSP), CryoPort (CYRX), and Guardant Health (GH), correspondingly delivered 679.1%, 778.3%, and +435.9% for our subscribers."

As an IBI member, you’ll enjoy the following EXCLUSIVE benefits: daily real-time research articles that are comprehensive and more in-depth than free research articles; access to the chat room with many experts and everyday investors for you to ask your questions live about your favorite stocks (you’re expected to get an answer no later than 24 hours); ability to view our high performing portfolios and their pertinent updates; consulting on strategies to help you set up your own portfolios; Our best ideas and their updates via a research article or chat; potential to have research featured on your favorite companies; ability to reach Dr. Tran via phone call or Skype as you wish.

CLICK the orange FOLLOW button to receive the FREE real-time alerts on our articles and blogs.

CONNECT with Dr. Tran through his LinkedTree https://linktr.ee/DrHarveyTran

READ more on www.drtranbiosci.com (and make sure to register for our mailing list).

LEARN about Dr. Tran’s background in an in-depth article by following this link. http://www.drtranbiosci.com/p/dr-tran.html

"Stellar therapeutics for patients. Differentiated intelligence for investors. Premium valuations for firms."

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: As a medical doctor/market expert, I'm not a registered investment advisor. Despite that I strive to provide the most accurate information, I neither guarantee the accuracy nor timeliness. Past performance does NOT guarantee future results. I reserve the right to make any investment decision for myself and my affiliates pertaining to any security without notification except where it is required by law. I'm also NOT responsible for the action of my affiliates. The thesis that I presented may change anytime due to the changing nature of information itself. Investing in stocks and options can result in a loss of capital. The information presented should NOT be construed as recommendations to buy or sell any form of security. My articles are best utilized as educational and informational materials to assist investors in your own due diligence process. That said, you are expected to perform your own due diligence and take responsibility for your action. You should also consult with your own financial advisor for specific guidance, as financial circumstances are individualized. That aside, I'm not giving you professional medical advice. Before embarking on any health-changing behavior, make sure you consult with your own doctor.