GOOG Vs. GOOGL Stock: 2 Ways To Buy Alphabet, One Of Them Is Always Better

Summary

- The confusion around Alphabet's stock tickers never seems to end, but we shall put an end to this debate once and for all through this note.

- Alphabet has three share classes (A, B, C), and we will discuss each of them in detail to understand the difference between GOOG and GOOGL.

- Furthermore, I will share the better class of stock for retail investors looking to buy into Alphabet on this dip.

- We're currently running a sale at my private investing ideas service, The Quantamental Investor, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

vzphotos/iStock Editorial via Getty Images

Introduction

In my recent article on Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL), we discussed Google's lose-lose situation in relation to Microsoft's attack on its "Search" market share with a better mouse trap, i.e., OpenAI's ChatGPT. Despite facing the prospect of a declining market share (revenue growth slowdown) and/or contracting margins, Alphabet's reasonably-valued stock is currently offering an attractive risk/reward for long-term investors. This is why I rate Alphabet's stock a "Buy" in the low $90s.

Now, Alphabet has had multiple publicly-listed share classes since 2014; however, some investors are still seemingly confused about GOOG and GOOGL (different tickers for the same company) as evidenced by this comment on one of my articles:

Alphabet Stock: Is Google's Search Engine Dominance Impacted By Microsoft's New AI-Powered Bing? (Seeking Alpha)

In today's note, I plan to discuss Alphabet's different share classes and explain their similarities and differences. Additionally, I will share my thoughts on the ever-existent spread between GOOG and GOOGL. Lastly, I will delineate the better buy among Alphabet's different share classes. Without further ado, let's get started!

What Are The Different Share Class Structures?

Initially, when Google became a public company in 2004, it issued Class A shares with 1 vote per share to the public, while the founders retained the Class B shares with 10 votes per share to maintain control of the company. However, the issuance of more Class A shares over time diluted the founders' control, which prompted a stock split in 2014.

As part of the split, existing Class A and Class B shareholders received a new Class C (non-voting) share for every existing share held. These non-voting shares allowed Alphabet's management to issue additional shares or liquidate existing shares without affecting the founders' control (voting power). Despite widespread investor criticism at the time, the market has accepted this three-Class share structure, with the Class A and Class C shares trading more or less in sync with each other, and the non-voting Class C shares sometimes trading at a premium. Please note that Alphabet's Class B shares are not publicly-traded.

What Are The Similarities And Differences Between GOOG and GOOGL?

Alphabet Inc., the parent company of Google, has two types of shares represented by the ticker symbols GOOG and GOOGL. GOOG denotes Class C shares, whereas GOOGL represents Class A shares.

| Classes | Economic Interests | Voting Power |

| Class A shares (GOOGL) | Same as other classes | 1 Vote |

| Class B shares | Same as other classes | 10 Votes |

| Class C shares (GOOG) | Same as other classes | No Voting Power |

As we noted earlier, Class A shares have voting rights, whereas Class C shares have no voting rights. So, GOOGL has one vote per share, GOOG has no voting power. All three classes of Alphabet shares have equal economic interests in the company, i.e., Alphabet's earnings are equally attributable to each Alphabet share regardless of its Class (A, B, or C).

Do Voting Rights Make A Difference For Investors?

Voting rights can be valuable for shareholders as they provide them with a voice in the company's decision-making process. Shareholders who hold voting shares have the ability to vote on important matters such as the election of board members, the approval of mergers and acquisitions, and other significant business decisions.

Furthermore, voting rights empower shareholders to influence the company's direction and hold management accountable for their actions. By expressing their views and voting for proposals that align with their values and interests, shareholders can make their voices heard.

However, it's worth noting that in some cases, a company's management may hold a majority of the voting shares, giving them significant control over the company's decisions. This is the case with Alphabet, but we will look into this matter in the next section.

Now, some shareholders may not wish to exercise their voting rights or may not have enough shares to make a significant impact on the company's decisions.

Ultimately, the value of voting rights depends on the investor's individual objectives and priorities, as well as the specific circumstances of the company in question.

Is GOOG or GOOGL A Better Investment?

From an economic standpoint, there is no difference between GOOG (Class C) and GOOGL (Class A) shares as they both represent an equally valuable piece of Alphabet in relation to its financial performance and earnings. The only difference is in the voting rights that come with Class A shares, which in theory, gives an investor more control over the company's decisions. Since voting rights are valuable to certain investors, they may be willing to pay a premium to own GOOGL shares over GOOG shares.

While this is theoretically correct, I think paying a premium for GOOGL is pointless. Why? Let's find out -

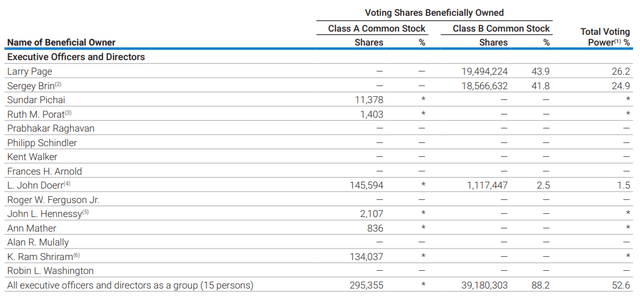

As we noted earlier, Alphabet's Class B stock is not publicly listed, and these shares are held by company insiders, including Alphabet's founders, management team, and some board of directors. Now, this Class of stock represents only a small percentage of the total outstanding shares of Alphabet; however, each Class B share has 10 votes, and cumulatively, they give their holders significant control over the company's decisions.

According to Alphabet's 2022 proxy statement, insiders collectively held roughly 52.6% of the voting power in the company. While Google's founders - Larry Page and Sergey Brin - do not own a majority stake in Alphabet, they have majority voting power in the company with their Class B common stock holdings, i.e., they effectively control Alphabet.

Alphabet 2022 Proxy Statement

Since the majority voting power is firmly in the hands of Alphabet's founders, the voting power in GOOGL (Class A stock) is pointless. Hence, as a long-term-oriented retail investor, I see absolutely no difference between GOOG (Class C) and GOOGL (Class A) shares.

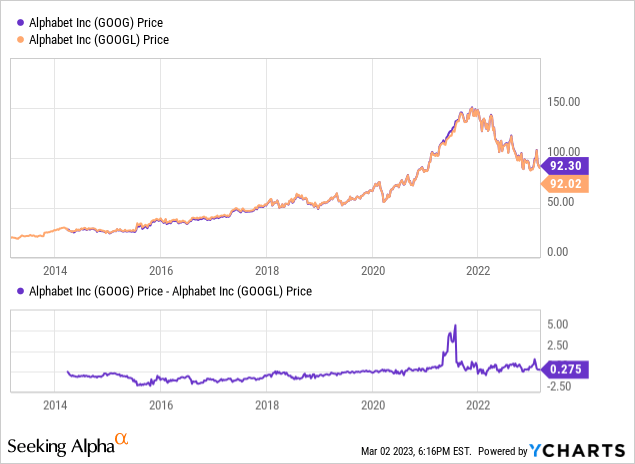

Historically, the spread between GOOG and GOOGL shares has been minimal; and that makes logical sense because the voting power of Class A shares is not valuable in Alphabet's case. That said, GOOGL shares did command a premium of $1-$2 for the first few years since the creation of Alphabet's multi-class stock structure.

In recent years, the relationship has flipped, and GOOG shares now command a small premium to GOOGL. While many factors could impact stock prices, I think Alphabet's capital return programs being focused on its GOOG (Class C) shares have been the primary drivers of the positive spread between GOOG and GOOGL.

Since 2014, Alphabet has executed multiple share repurchase programs, but as the size of these buybacks grew, the impact on Class C shares became more evident (the spread expanded to 4% in 2021). In response, Alphabet's management included Class A shares in its buyback authorizations in mid-2021. Naturally, this change has led to a narrower spread between GOOG (Class C) and GOOGL (Class A) shares.

Now, in my view, the spread between GOOG and GOOGL should be zero. And any investor looking to buy Alphabet's publicly-listed shares should just simply buy the cheaper stock among GOOG and GOOGL.

Bottom Line

Google is under attack on multiple fronts amid a challenging macro environment, and so, the business and the stock could remain under pressure in 2023. That said, Alphabet offers a lucrative risk/reward for long-term investors coming in at current levels. Hence, I continue to rate Alphabet a "Buy" in the low $90s. Due to a precarious technical setup and unsupportive quant factor grades, I strongly prefer staggered buying via a 6-12 month DCA plan.

Source: Alphabet Stock: Is Google's Search Engine Dominance Impacted By Microsoft's New AI-Powered Bing?

In today's note, we learned about different classes of Alphabet stock, and the moral of the story is -

Key Takeaway: At any given point in time, buying the cheaper one among GOOG and GOOGL is the right thing to do for long-term investors.

Thanks for reading, and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our marketplace service - "The Quantamental Investor" - to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

We have recently reduced our subscription prices to make our community more accessible. TQI's annual membership now costs only $480 (or $50 per month). New users can also avail of special introductory pricing!

JOIN THE QUANTAMENTAL INVESTOR NOW

This article was written by

I am the Author and Chief Financial Engineer at "The Quantamental Investor" - a community pursuing bold, active investing with proactive risk management. At TQI, our mission is to help retail investors build generational wealth in equity markets. To do so, we share robust model portfolios that cater to investor needs across different stages of the investor lifecycle. All of our investment ideas are thoroughly vetted through TQI's Quantamental Analysis process, which uses a mix of fundamental, quantitative, technical, and valuation analysis. If you're interested in learning more about our marketplace service, visit: The Quantamental Investor

If you're interested in reviewing my performance, feel free to view this tracker: Performance tracker for my SA research.

To learn more about our company and services, visit: The Quantamental Investment Group LLC's website - TQIG | Home

Prior to joining The Quantamental Investment Group LLC, I served as the Head of Equity Research at LASI's SA Marketplace service - Beating The Market, for two years. In the past, I have worked as an Associate Fellow with Jacmel Growth Partners, a middle-market private equity firm in New York. My resume also includes a stint at Capgemini as a software engineer. With regards to academia, I hold a Master of Quantitative Finance degree from Rutgers Business School and a Bachelor of Technology degree in Electronics and Communication Engineering, whilst I am also pursuing the CFA certification (Level 2 candidate).

If you would like to connect with me, please feel free to send me a direct message on SA or leave a comment on one of my articles!

Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.